Understanding the risk of Coinbase after Circle's successful IPO

The natural conclusion is to long Coinbase after Circle's ~10x since IPO. We help articulate the downside and risks associated with Coinbase at $77B.

Hey Fundamental Investors,

Jon here again from Artemis.

We’ve deep-dived: Strategy, CoreWeave, and Circle. Today, we take a deep-dive into Coinbase, a leading U.S. centralized exchange, in light of recent price action of Circle. Many investors have approached us suggesting a pair trade: long Coinbase, short Circle.

As always, this is not financial advice—just a framework for thinking through potential upside and risk, using data and valuation modeling for Coinbase based on comps.

Let’s dive into Coinbase with our fundamental analyst, Kevin Li.

Executive Summary:

Stablecoin upside capped: Circle’s IPO highlights the promise of stablecoins, but Coinbase captures only a limited share of USDC economics. Under the revenue-sharing agreement, Coinbase receives approximately 60% of total USDC revenue, but retains only a portion of that, as around 43% is passed through to users as yield—leaving Coinbase with roughly 34% of total stablecoin revenue.

Regulatory moat fading: Coinbase benefits from regulatory uncertainty, using its costly compliance infrastructure as a competitive moat. However, in a more regulated and transparent environment, this advantage diminishes as competitors gain viability.

Exchange under pressure: Coinbase’s core trading take rate has fallen from 2.5% to 1.4%, accompanied by a decline in market share from over 58% to approximately 38%, driven by fee compression and growing competition from ETFs, decentralized exchanges (DEXs), and retail-focused TradFi platforms like Robinhood.

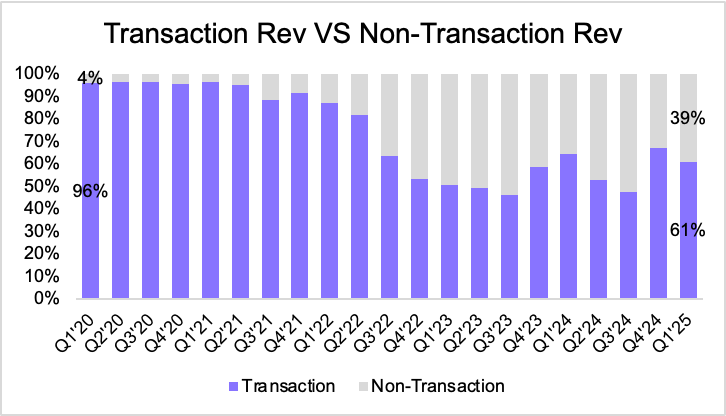

Diversifying revenue base: Coinbase is expanding into subscriptions (Coinbase One), staking, USDC interest income, and derivatives to offset weakening spot volumes. Trading revenue as a percentage of total revenue has declined from over 90% last cycle to ~55% this cycle.

Base is gaining traction: Base, Coinbase’s Ethereum Layer 2, is scaling rapidly in both volume and profitability—now leading all Ethereum L2s in transactions and active addresses—but still trails Solana in overall user activity and adoption momentum.

Derivatives gaining momentum: Volumes have surged past $300 billion per month, but monetization and long-term growth remain constrained by aggressive liquidity incentives and strong competition from ETF-based crypto options.

Valuation appears attractive: A sum-of-the-parts analysis values Coinbase at approximately $95B, but the market is rightly pricing in structural risks to its exchange moat and long-term margins.

Coinbase’s Path to Becoming an Ecosystem giant

To understand the challenges Coinbase faces today—and why it doesn’t serve as a clean proxy for Circle—it’s essential to look at its origins. Coinbase started as a straightforward cryptocurrency exchange, emerging at a time when purchasing Bitcoin was complicated for the average user. By offering an intuitive, easy-to-use platform, it quickly gained widespread adoption. Its early and proactive approach to regulatory compliance gave Coinbase a significant advantage, enabling it to scale across both retail and institutional markets.

This foundation—built on trust, accessibility, and legal clarity—enabled Coinbase to establish a dominant trading business and a loyal user base. With that in place, the company shifted its focus toward expanding monetization opportunities. It launched Coinbase One, a premium subscription service, and introduced staking products that allowed users to earn yield on their assets—both aimed at deepening engagement and diversifying revenue.

As Coinbase’s brand and reach grew, Coinbase co-launched USDC—a stablecoin positioned as a compliant alternative to USDT and BUSD. With stablecoins acting as a key bridge between fiat and crypto, USDC adoption was accelerated by Coinbase’s platform integration and credibility. Rising interest rates—peaking near 5%—further boosted revenue through interest earned on USDC reserves.

To complete its ecosystem, Coinbase introduced Base in 2024, an Ethereum Layer 2 chain. With this, it now controls a full-stack infrastructure: exchange, stablecoin, and blockchain—a vertically integrated crypto ecosystem.

The exchange business and the brand it created have been the engine behind Coinbase’s broader ecosystem. Subsequent product launches weren’t just new features—they were ways to monetize existing core users and trust built from the exchange.

At its core, Coinbase’s business model follows a simple equation:

Revenue = Users × ARPU (Average Revenue Per User)

The company’s strategy has consistently focused on scaling both sides of this equation: expanding its user base through strong distribution and regulatory credibility, and increasing ARPU by introducing new, value-added on-chain products throughout its ecosystem. The core funnel has therefore centered on acquiring users via the exchange and driving higher monetization through a layered product stack.

Why Coinbase Isn't a Clean Bet on Circle or USDC

While the ecosystem strategy is compelling, it complicates the investment thesis. Coinbase’s broad scope means it cannot be viewed as a clean USDC or Circle proxy. Today, USDC-related revenue accounts for just ~15% of Coinbase’s total income—far outweighed by transaction fees from its exchange business. However, that core revenue stream is increasingly under pressure due to rising competition from ETFs, decentralized exchanges (DEXs), and traditional finance platforms like Robinhood. As a result, buying Coinbase as a proxy for Circle or USDC exposure is not a pure play. To respond to the competitive traditional business, Coinbase has sought to diversify away from trading by building a broader, more durable business model. It now operates across four primary segments:

Crypto Exchange Business: This is the core exchange business, where revenue is generated from trading fees.

Subscription and Blockchain Rewards: Including products like Coinbase One and institutional staking/custody — add-on services for exchange business.

USDC and Interest Income: This revenue stream comes from interest earned on USDC reserves and from the interest income generated by cash held on Coinbase’s balance sheet.

Base (Layer 2 Network): Transaction revenue from its Ethereum Layer 2 chain.

USDC’s Rebound: Growing Volumes, Shrinking Edge

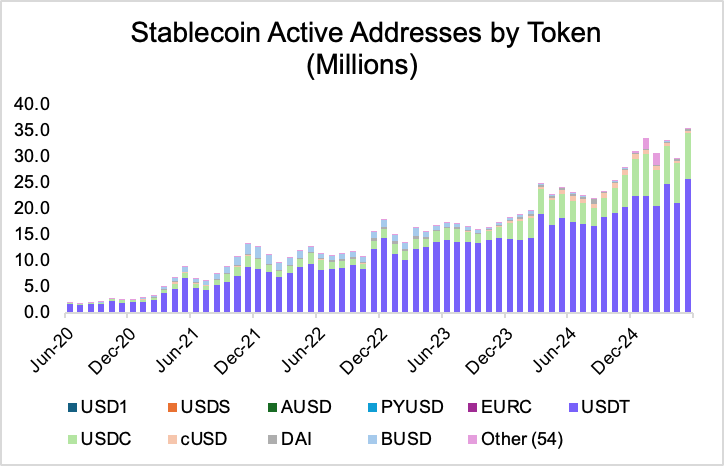

For investors excited by Circle’s IPO, the bullish case for Coinbase often centers on its stablecoin business. USDC adoption is growing: over 8 million of the 30 million active stablecoin addresses use USDC, and weekly transactions now exceed 300 million. This momentum shows no signs of slowing, and a comprehensive report by Artemis provides further insight into the scale and rapid evolution of the stablecoin ecosystem.

Coinbase earns yield on U.S. Treasuries backing USDC and splits revenue with Circle. As USDC's market cap nears record highs, Coinbase’s stablecoin-related income has grown into a $1B annualized stream—around 20% of Coinbase’s total revenue. With Circle successfully completing its IPO at a ~$34B valuation (June 16, 2025), Coinbase—which captures approximately 60% of USDC-related economics—implies a ~$51B stake in the USDC ecosystem, representing roughly 76% of its current market cap.

However that headline number obscures how much value Coinbase actually retains. Around half of stablecoin-related revenue is passed through to users as yield. Coinbase currently offers this pass-through as a marketing strategy to keep users on-platform—but with competitors like Robinhood now offering yield on idle cash, this may no longer be optional. As a result, actual net revenue is closer to $171M per quarter—just 57% of the total.

In addition, USDC has long positioned itself as a regulatory-compliant stablecoin tied closely to the U.S. dollar ecosystem. Many viewed potential U.S. regulatory action against USDT—similar to BUSD—as an asymmetric upside for USDC. But despite expectations of regulatory pressure on USDT, it continues to dominate, capturing ~75% of U.S. stablecoin trading and maintaining a strong global lead. USDC’s post-SVB recovery has been slow, and it underperforms in regions like Canada, Bermuda, and Puerto Rico. Meanwhile, Cantor Fitzgerald’s 5% stake in Tether and management of its $134B in assets under Howard Lutnick suggest diminished regulatory risk—undermining USDC’s perceived compliance edge.

In summary, Coinbase captures only a fraction of USDC’s upside due to its shared economics with Circle. With Tether still dominant, USDC’s potential market share gains remain limited—constraining Coinbase’s exposure as well. While Circle’s stock has gone parabolic, much of this reflects anticipated future growth, particularly in payments. Because Coinbase’s contribution to USDC growth has come primarily through its trading platform, its participation in this next phase of stablecoin-driven upside is limited. As such, a bullish view on Circle is more cleanly expressed by backing Circle directly, rather than through Coinbase. The following sections examine mounting pressures on Coinbase’s other business lines, including its core exchange and on-chain infrastructure.

Exchange Business: ETFs, DEXs, and the Erosion of Coinbase’s Moat

Historically, the exchange business has been supply-side driven. This means users go to the exchanges that list the assets they want. When legal compliance is a non-issue, demand is dictated less by brand loyalty and more by which exchange offers access to the latest hyped or high-returning token. New or trending tokens (especially in speculative or meme categories) often create sudden spikes in user activity, and listing a sought-after asset can significantly increase an exchange’s trading volume and active users.

There are generally three different types of token in the market:

Blue Chip Assets – Highly liquid, trusted, and often considered "safe" (e.g., BTC, ETH, SOL).

Legally Safer / Venture-Backed Tokens – Backed by credible teams or with a degree of regulatory compliance (e.g., ADA, XRP, LINK).

Speculative/Meme Tokens – High risk, high reward; often drive spikes in engagement (e.g., FLOKI, APE, TURBO).

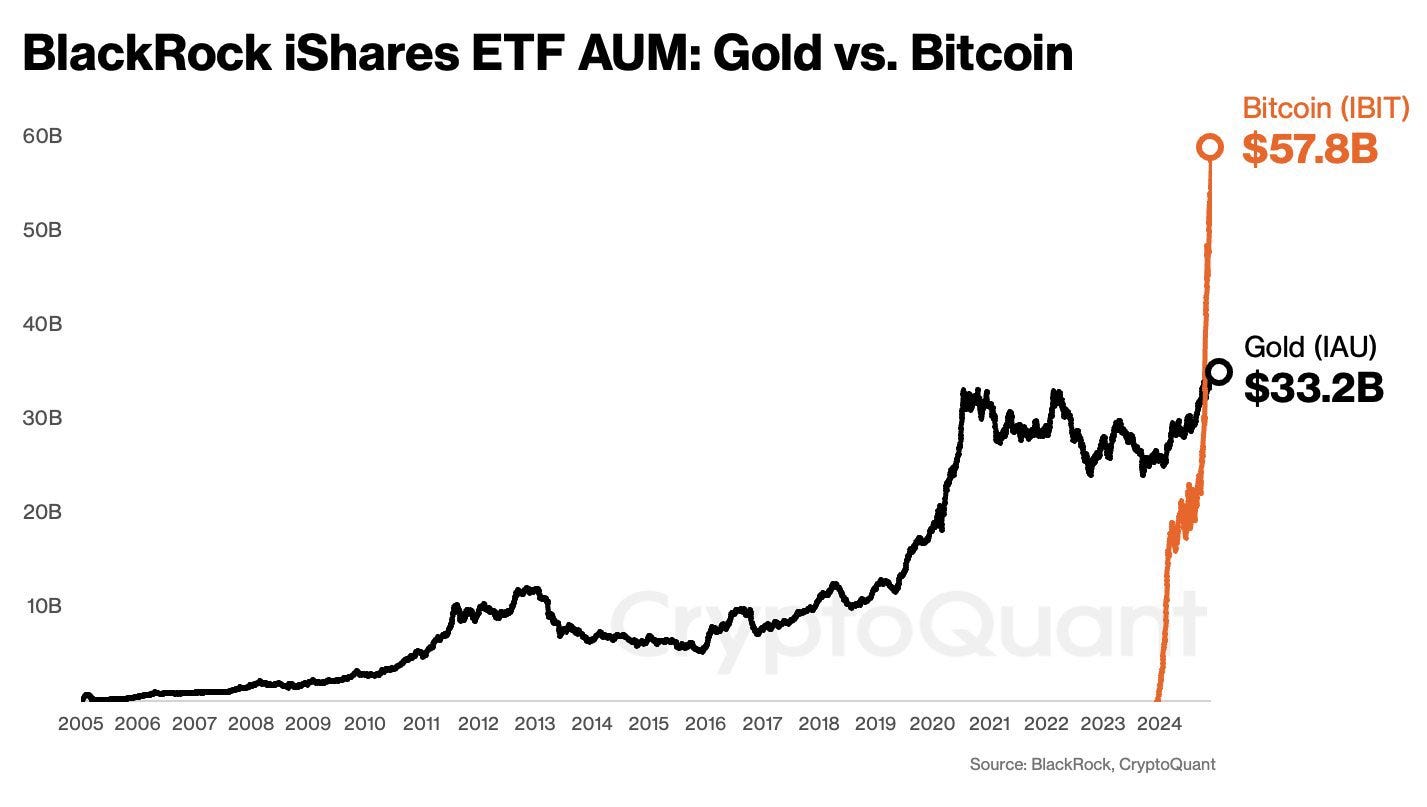

Until this cycle, Coinbase led the U.S. market across all major token categories, thanks to its broad asset listings and diverse trading pairs. However, the exchange landscape has shifted dramatically. Firstly, the rise of crypto ETFs has created a regulated, institution-friendly entry point, accelerating mainstream adoption and allowing traditional capital to enter the space without relying on platforms like Coinbase. Institutional adoption has been strong, with Bitcoin ETFs reaching over $100 billion in AUM within a year. BlackRock’s IBIT ETF, in particular, surpassed the 20-year AUM of its own gold ETF in less than 12 months—highlighting the depth of institutional interest in crypto.

While ETFs have expanded access to blue-chip assets like BTC and ETH, they’ve also eroded a key Coinbase advantage—being the primary compliant platform for U.S. crypto exposure. What was once Coinbase’s exclusive growth opportunity is now shared, and in some cases redirected, toward ETF vehicles. Increasingly, new U.S. investors are entering crypto through ETFs rather than Coinbase, signaling a shift in mainstream access. Though Coinbase earns custody fees from some ETFs, these revenues are modest compared to the higher transaction fees it previously depended on.

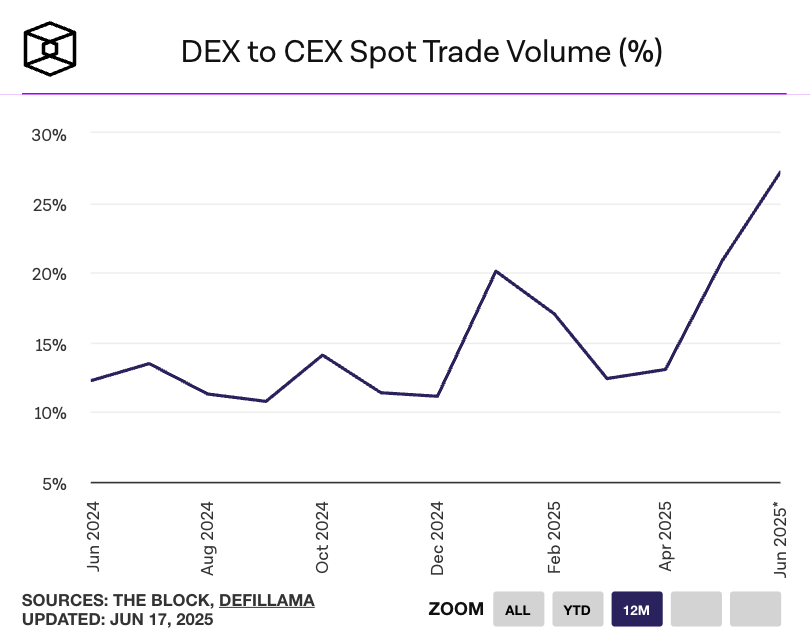

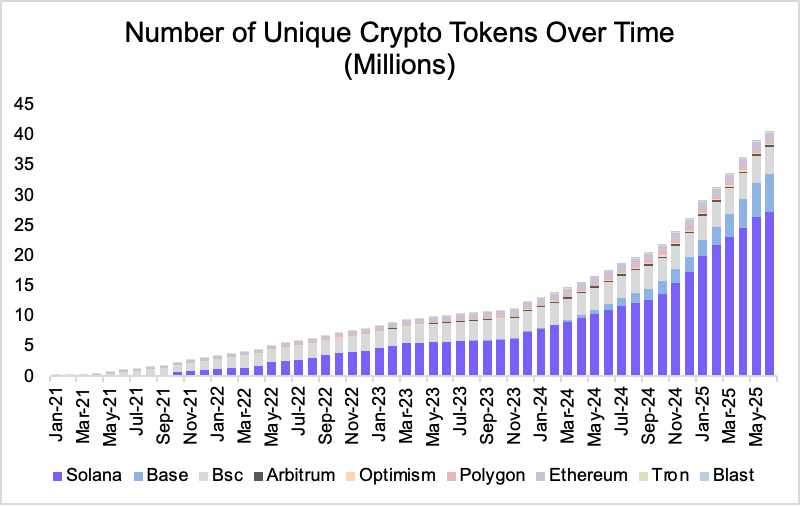

On the other end of the spectrum, the explosion of meme coins has sparked a renewed wave of retail speculation, reinforcing the speculative nature of crypto. Tools like Pump.fun, Raydium, and Jupiter have made it easier than ever to launch a token—leading to an almost 30x increase in the number of tokens since the last cycle.

Due to its strict compliance standards, Coinbase has lagged in listing smaller or meme-based tokens, unable to keep pace with the daily influx of new coins. In contrast, decentralized exchanges (DEXs) have surged in popularity, offering instant liquidity for virtually any token through permissionless, AMM-based trading. This gives DEXs a clear advantage in speed and flexibility—anyone can list, and anyone can trade. For users seeking early-stage, high-risk, high-reward opportunities—especially in meme coins—DEXs are often the only viable option.

Compounding Coinbase’s disadvantage, the platform has had limited integration with the Solana ecosystem—now a hub for meme coin activity. As a result, Coinbase largely missed the Solana meme coin boom, while DEXs like Raydium and Jupiter captured the associated trading volume and user engagement.

In addition to the rise of ETFs and meme coins, the Trump administration has signaled a more crypto-friendly stance, aiming to provide greater regulatory clarity and end the aggressive crackdown on the industry. For example, Trump’s newly appointed SEC chair, Paul Atkins, has moved quickly to roll back Gary Gensler’s enforcement-heavy approach toward platforms like Coinbase and Kraken, which was initiated under the Biden administration.

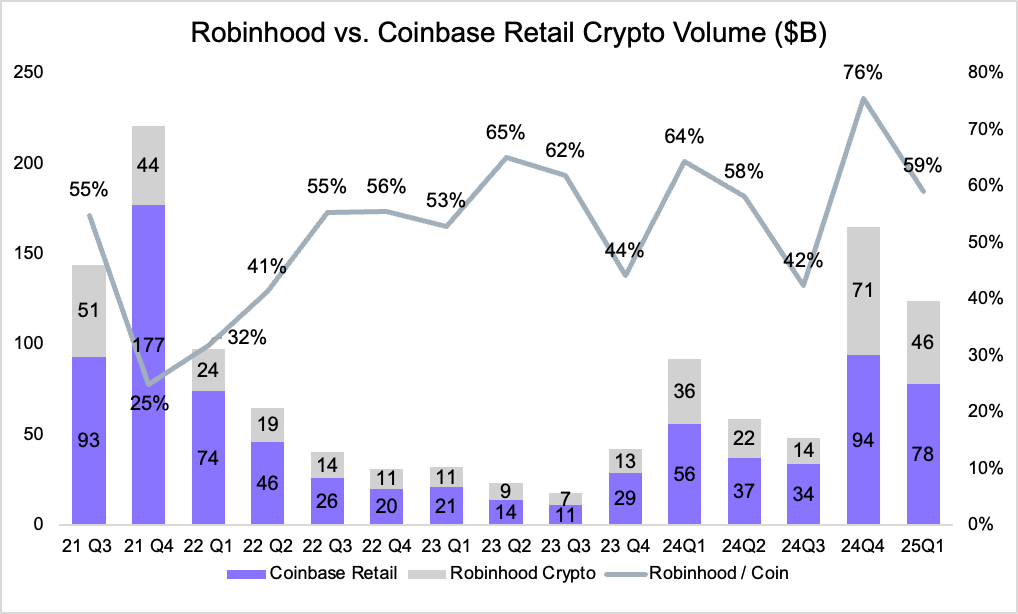

As a result, traditional finance platforms like Robinhood—with strong retail reach—have expanded their token offerings to increase market share. This shift is evident in the data: Robinhood’s retail revenue rose from 32% to 76% of Coinbase’s by Q4 2024, highlighting Coinbase’s loss of market share. While the move toward regulatory clarity may seem beneficial for Coinbase, it also lowers the barrier to entry. Previously, strict compliance favored well-resourced firms like Coinbase; under the new, more lenient regime, smaller exchanges and trad-fi platforms can compete more effectively.

To analyze this competition quantitatively, increased competition across all segments of crypto should give Coinbase more pressure to lower their notoriously high fees or risk losing market share. In fact, Coinbase's share of USD-supported exchange volume has already declined—from a peak of 60% to around 50% today, with a temporary low of 32% during the height of the meme coin season.

More importantly, Coinbase’s take rate on trading volume has dropped significantly in tandem—from 2.5% at its peak to around 1.4%. This decline would be even steeper if not for the recent introduction of derivatives. It's notable that the take rate surged in late 2022, right after FTX’s collapse, when Coinbase briefly enjoyed a near-monopoly in the U.S. market. This trend peaked in Q4 2023, just before the launch of the Bitcoin ETF, which marked the beginning of a more competitive and institutional phase for crypto trading.

As one can see, the competitive landscape for Coinbase has shifted drastically this cycle. At stake is a critical blockage in Coinbase’s core funnel—from exchange to the on-chain economy. As illustrated in the chart above, active users peaked at only 70% of their 2021 high. While the exchange is currently facing huge competition, there are three monetization businesses that could become the core pillar: Derivative Market (Coinbase International), USDC, and Base.

Derivative Market: Futures Without a Future?

Derivatives remain the most profitable segment in crypto trading. In 2024, Coinbase launched a limited set of international derivative products, and adoption was swift. While Q1 2025 results showed strong volume growth, Coinbase noted derivatives are still early-stage but could be a key to monetizing institutional users. However, revenue impact has been limited so far due to ongoing marketing efforts, as rebates and incentives to build liquidity are netted against institutional transaction revenue.

However, the primary goal of launching derivatives in 2024 was to better monetize existing users and also attract new ones. However, international user growth was minimal, aside from a brief spike during the late-2024 meme season. While derivatives contributed to higher transaction revenue, they didn’t drive significant user expansion. Importantly, derivative revenue is embedded within Coinbase’s broader transaction line—without it, the platform’s take rate on trading volume would likely look even weaker.

In 2025, Coinbase began offering derivatives to U.S. users to better monetize its domestic base. However, this rollout coincides with the rapid rise of Bitcoin options tied to ETFs, which could limit upside. With most derivatives concentrated in blue-chip assets like BTC and ETH, Coinbase faces direct competition from ETF-based options—further capping growth potential in this segment.

In conclusion, while derivatives segment is significant revenue driver in the short term, Coinbase’s long-term position remains challenged unless it can grow the top of its funnel—attracting new users in an increasingly crowded and fragmented exchange market.

Base: Coinbase’s Bet on On-Chain Infrastructure

Base, Coinbase’s Ethereum Layer 2 scaling platform, aims to onboard users to the on-chain economy while diversifying Coinbase’s revenue beyond trading. Unlike other L2s, Base uses ETH as its native currency and has no native token. Backed by Coinbase’s brand and support, Base saw rapid adoption—driven by viral apps like Farcaster—becoming the top Ethereum Layer 2 by transaction volume within its first year and a leader in daily users and total value locked.

Coinbase captures substantial value from operating Base’s sequencer, earning transaction fees minus Layer 1 costs. According to Sea Launch and Jhackworth on Dune, Base generates approximately $1 million in weekly gross profit with margins around 90%. Moreover, Base accounts for over 75% of all Layer 2 gross profits, highlighting its efficiency and market dominance. Beyond sequencer fees, Base funnels users into Coinbase’s ecosystem via its wallet and app, generating revenue from crypto purchases, swaps, and Base-native apps. Base also supports Coinbase’s B2B offerings—like Cloud, OnchainKit, and SDKs—and, through its Optimism partnership, Coinbase may receive up to 118 million OP tokens over six years, tied to Base’s growth.

Base’s core limitation lies in being a modular Ethereum Layer 2, which introduces fragmentation across liquidity, users, and developers. Bridging assets from Ethereum adds friction, and limited interoperability between L2s hampers seamless integration. These issues stem from differences in blockchain finality, making cross-chain liquidity transfers slow, costly, and complex. Despite tools like AggLayer and bridges, the modular structure still presents challenges. Although Base has grown rapidly, its adoption—measured by active users and transaction volume—still lags behind more unified, scalable monolithic chains like Solana, which has three times the daily active users and seven times the daily transaction volume.

What Is Coinbase Worth? A Sum-of-Parts Valuation

We will use a sum-of-the-parts valuation approach, segmented into the following components:

Exchange Business – includes transaction revenue, subscriptions & services, and blockchain rewards

Base Revenue – revenue generated from Coinbase’s Layer 2 network, Base

USDC Revenue – Coinbase’s share of revenue from its partnership with Circle

Interest Revenue – income earned from interest on cash and USDC reserves

Fundamentally, Coinbase’s exchange business is both cyclical and increasingly competitive. To value it, we apply the average revenue multiple of traditional brokerage firms, which reflects a more stable and mature market structure.

Applying this multiple, Coinbase’s exchange business is valued at: $5.17B × 15.61 = $80.7B.

As part of the bull thesis for Base, we apply the average MC/Revenue multiple observed between Optimism (OP) and Arbitrum (ARB), which is approximately 270x. Applying this to Base’s annualized revenue of $68.7 million yields an implied market cap of: $68.7M × 270 = $18.5B.

However, our base thesis applies a traditional tech valuation framework. Using a 30x Price-to-Gross Profit multiple and assuming a ~90% gross margin, Base’s implied gross profit would be approximately $61.8 million—yielding a more conservative market capitalization estimate of $61.8 million × 30 = $1.86 billion.

This contrast highlights the significant valuation gap between token-based models and traditional financial frameworks. Given the speculative nature of current token multiples, we base our analysis on the more fundamentals-driven traditional finance model.

Valuing Coinbase’s USDC-related business is relatively straightforward, now that Circle has completed its IPO. Circle is currently valued at approximately ~$34 billion(June 16th, 2025), which reflects its 40% share of USDC revenue. Since Coinbase captures the remaining 60% of USDC revenue, and retains about 57% of that as net income (after passing yield through to users), we can estimate the value of Coinbase’s USDC-related business as follows:

$34B × (6 ÷ 4) × 57% = ~$29.07B

This implies that USDC contributes roughly $29.07 billion in value to Coinbase.

Coinbase earns nearly $300 million annually from interest on its $8 billion in cash reserves. We include this asset value directly in the sum-of-parts calculation as $8.0B.

Our sum-of-the-parts valuation suggests Coinbase could be worth approximately $95.7 billion, implying that the market may be underpricing the company. However, this apparent discount reflects real and material risks.

Conclusion: A Diversified Ecosystem Facing Competition Everywhere

Coinbase’s core exchange business is under sustained pressure from structural forces: ETF-driven disintermediation, fee compression from DEXs, and slowing user acquisition. Meanwhile, newer revenue pillars like Base and USDC, while strategically important, are each contending with intensifying competition in their respective markets. USDC and interest income—key drivers of recent upside—are also sensitive to falling rates and yield pass-through pressures, which limit margin capture.

In short, Coinbase is evolving into a diversified crypto ecosystem, but each leg of the model now faces headwinds. While it may appear undervalued on a purely financial basis, the market's caution reflects a rational pricing-in of diminishing moat, margin pressure, and competitive fragility.

Concluding Remarks

If you found this write-up valuable, please consider liking, sharing, and subscribing to Artemis Substack. You can also follow and connect with me on X—I'd love to discuss Coinbase and hear your perspective. Your support truly means a lot!