This week, Ripple Labs ordered to pay $125 million in settlement with the SEC (Yahoo Finance), Celsius sues Tether for $2.4 billion (Tether), the SEC subpoenas three crypto VCs (DL News), pump.fun will make creating coins completely free (X/pumpdotfun), and Brazil’s SEC approves the first Solana ETF (Coindesk).

🌞 DeFi remains resilient during major market downturn and volatility

💫 Jupiter governance votes on major tokenomics change

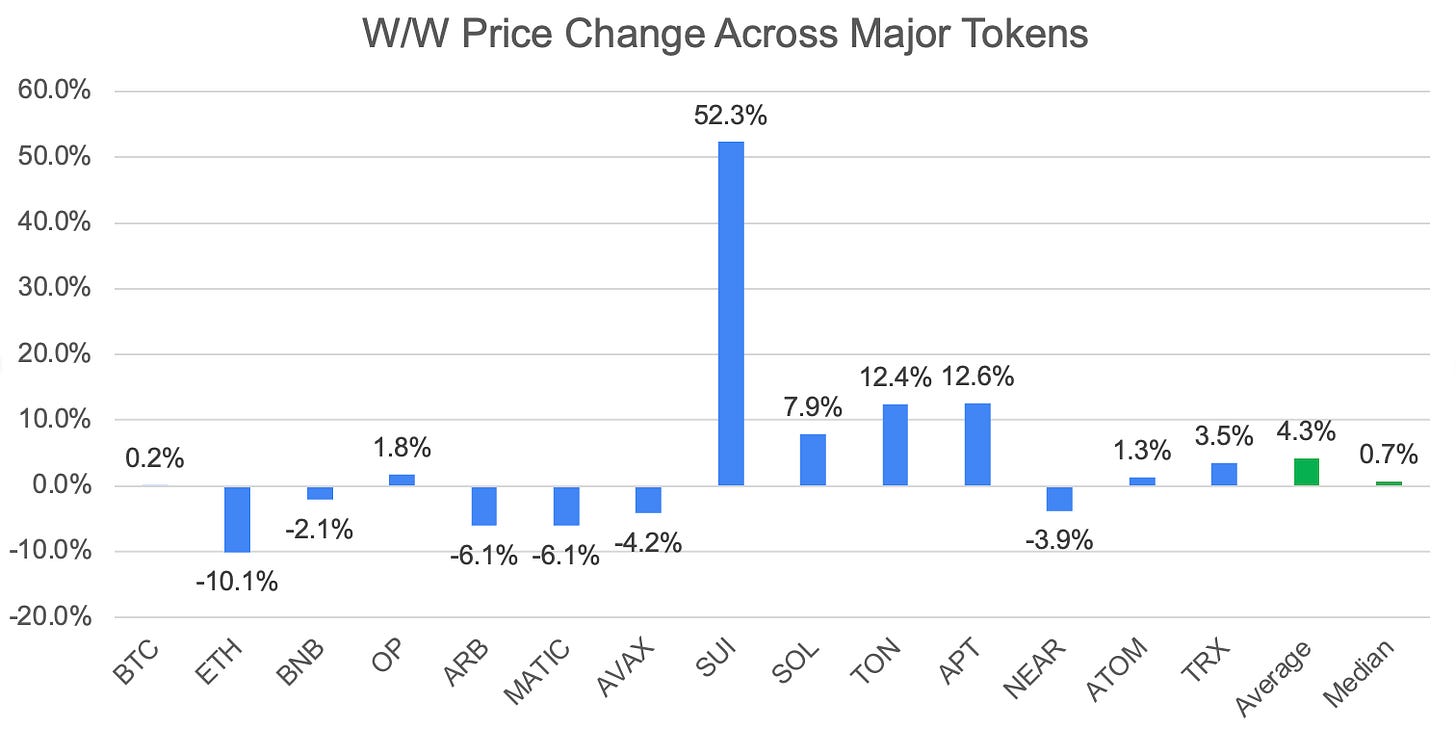

Despite the massive market meltdown early last week, most crypto assets recovered to end the week relatively even. A reminder that two weeks ago, major crypto assets ended the week down an average of 11%. Last Monday, ETH dropped over 20% in value in just a day as broader market fears strongly affected risk assets. According to Coingecko data, the overall crypto market lost nearly $400bn in value going into Monday (CNBC). Surprisingly, most assets recovered quite strongly throughout the rest of the week. Notably, several assets ended the week positive, including SUI which saw a 50% price increase W/W, on news that Grayscale had launched their Sui Trust (X/Grayscale). ETH still ended the week down 10%, struggling to recover the week’s early losses, while BTC recovered fully.

There were several factors at play that led to the crypto market’s nearly 20% selloff.

Macro/Japan: The Bank of Japan decided to raise interest rates for the first time in decades to 0.25%. From 2016 to 2024, Japan actually had negative interest rates. This means that it was really cheap to borrow Japanese Yen, convert it to other currencies and earn yield somewhere else on the cheap, borrowed capital. This is known as the yen carry trade, and has been immensely popular with Japan’s low rate environment, especially when coupled with a weakening yen. However, this changed when the BoJ announced an increase in rates, causing the yen to strengthen, and forcing big leveraged investors to de-leverage and shed other stock and bond holdings. Japan’s Nikkei index saw its worst losses since 1987’s Black Monday, dropping 20% in just a few days. For a more in-depth explainer of the yen carry trade, see this great video.

Macro/USA: As we covered in last week’s newsletter, the US’ jobs report came in much weaker than expected, indicating the US economy is slowing. This triggered recessionary fears as the Sahm Rule was activated. Last Monday, Wall Street’s ‘fear index’ (the VIX) had its greatest single day increase in history, greater than its jumps during the 2008 financial crisis, and 2020 COVID crash.

Other: Jump Crypto appears to be selling out of its crypto positions and exiting the crypto marketmaking business. Kamala Harris is leading in prediction markets, and does not seem to be ‘resetting’ with crypto companeis as expected. The war in the Middle East was showing signs of serious escalation over the weekend.

The combination of all of these factors at play at the same time led to extreme fear in the markets, manifesting itself in the largest selloff of the year.

🌞 DeFi holds strong during major market downturn

Major market downturns make for a great time to see which DeFi protocols are robust and can effectively survive volatily and stress. DeFi’s resilience is often referenced when looking at the drastic market events of 2022, where centralized financial entities, neobanks, exchanges and more collapsed. On the other hand, DeFi protocols remained strong and healthy. In the same way, this week DeFi protocols once again demonstrated their strength and resilience, showing that completely autonomous financial protocols can be robust and reliable, sometimes more so than their centralized counterparts.

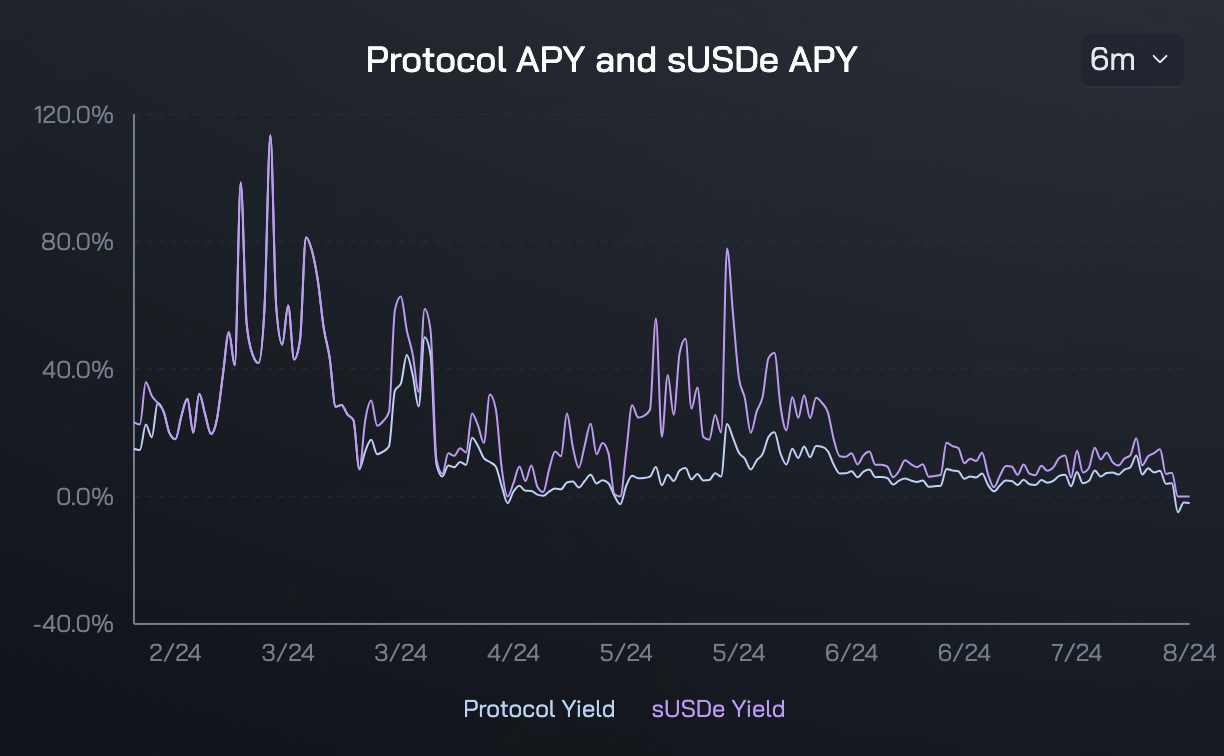

One new DeFi protocol that rose to prominence during 2024 is Ethena, the protocol which mints USDe, a soft dollar-pegged crypto currency marketed as a ‘synthetic dollar’. It popularized a novel way of creating digital dollars by taking ETH deposits, staking half to earn ETH staking yield, and using the other half to short ETH, effectively constructing a delta neutral portfolio. Many people were worried that this strategy might be extra susceptible to market volatility, and that USDe should be considered a high-risk asset akin to Terra’s UST. Ethena experienced its first real stress test this past week. The result was that the protocol maintained its peg, and handled over $50 million in redemptions overnight. Also this week, USDe launched on Solana, and added SOL as a backing asset. USDe supply has been contracting over the past month and a half since reaching a peak supply of 3.6 billion, in line with decreasing sUSDe yield, and a cooling market. The launch of USDe on Solana may reverse this trend.

Another DeFi protocol that shone during the market crash was Aave, DeFi’s leading lending protocol. The Aave protocol experienced its largest single day liquidations ever, with nearly $250 million in collateral liquidated, according to BlockAnalytica. Roughly 80% of the liquidated collateral were ETH based assets, as ETH was hammered during the market crash - the worst out of major tokens.

These liquidations ensured the protocol remained stable and functional. These liquidations led to the second largest daily revenue to the Aave treasury in the protocol’s history, according to data by TokenLogic. These revenue metrics are particularly relevant as it relates to Aave governance’s most recent tokenomics proposal which we wrote about a couple weeks ago.

💫 Jupiter governance votes on major tokenomics change

Jupiter is Solana’s gateway to DeFi: its greatest aggregator, and one of its leading perpetuals exchanges. In fact, Jupiter has consistently ranked in the top 5 perps exchanged by trading volume this year, according to Artemis data.

The JUP token launched with only 13% of total supply in circulation: a market cap of $900m but an FDV of roughly $7bn. There has been a lot of cricism towards projects that have launched tokens with low float/high FDV, with many price charts being down-only since TGE. Jupiter launched its native token JUP back in January in a highly anticipated airdrop, with the goal of having extremely transparent tokenomics. Last weekend a major proposal passed Jupiter governance with flying colors (95% for). The proposal comes partly in response to the narrative that has been so prevalent over the past year.

The proposal aims to reduce the token’s total supply by 30% by burning 3bn tokens that have not yet been released into circulation. The token allocation follows a 50/50 rule, such that 50% of the supply is allocated to the team while the other half is allocated to the community. As such, the 3bn tokens burned will be shared equally by the team and the community. This burn will take place over a period of time, likely several months in the lead up to the annual Jupuary. This is also only the first of 3 JUP related votes that will take place this year.

It would be great to see other projects whose token’s market cap is significantly lower than its fully diluted valuation take steps to ameliorate the difference. Kudos to the Jupiter team for leading the charge!

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 6/12/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

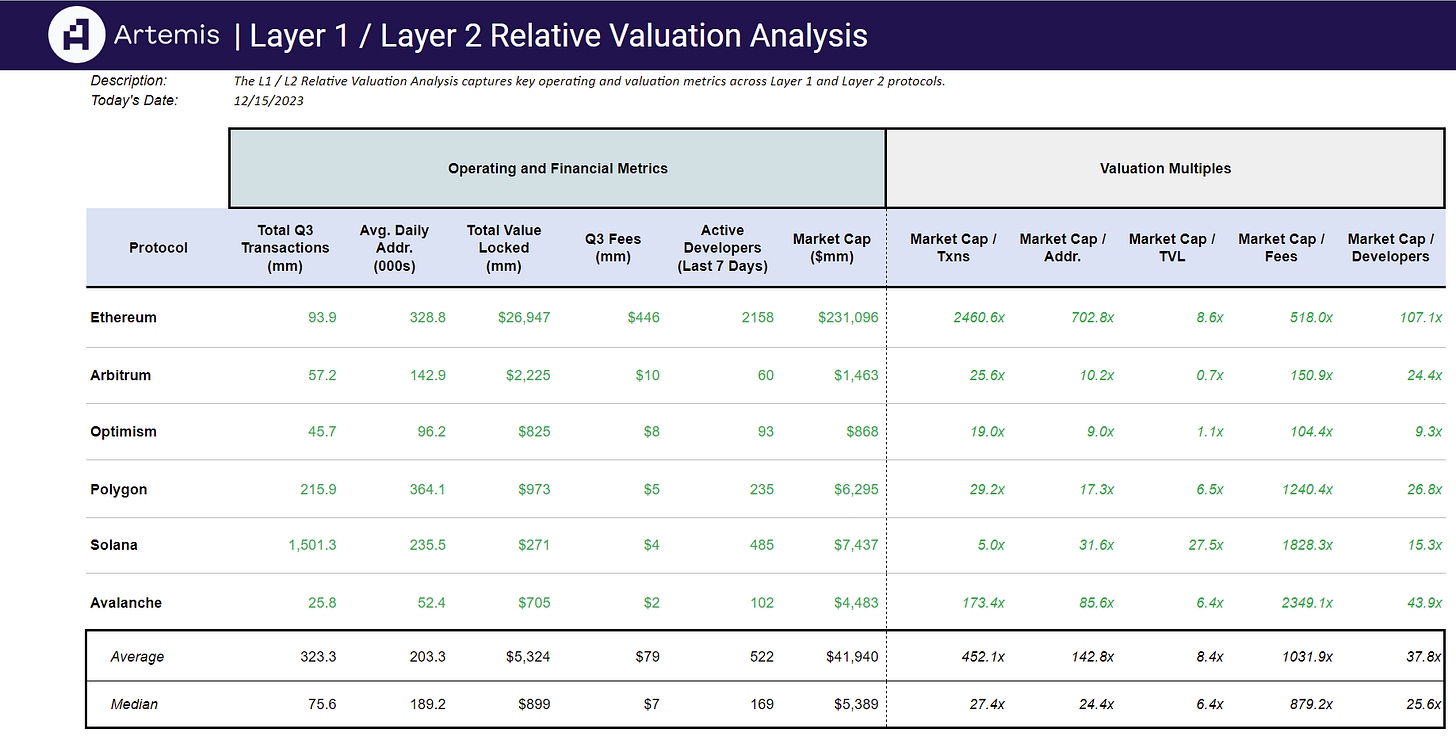

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞