This week, Igloo Inc, company behind Pudgy Penguins, raises 11m in round led by Peter Thiel’s Founders Fund (Axios), Ferrari to start accepting crypto payments in Europe (Ferrari), Avail (Celestia competitor) goes live on mainnet and native AVAIL token starts trading at $1.8b FDV (The Block).

💫 Lending giant Aave reconsiders fee-switch activation

🌞 ETH ETFs begin trading and seeing $1.2bn in inflows

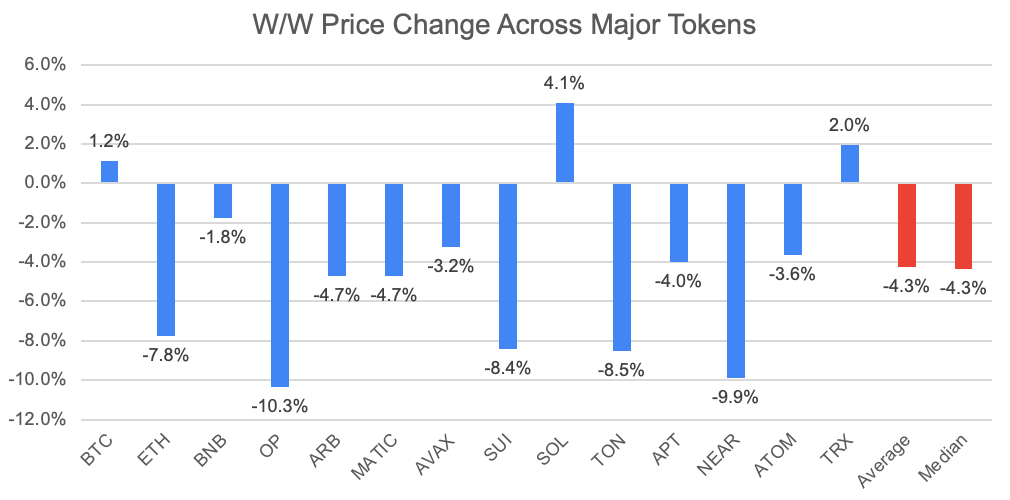

Crypto markets trended down this week, with major tokens down an average of 4.3%, including ETH down 7.8% despite the ETFs launching, and OP and NEAR each down 10%. On the other hand, SOL rebounded to near cycle highs this week, once again surpassing 2021 market cap highs. Much like the broad crypto market, top equity indices like the Nasdaq-100 and SP500 were down, as they have been since they reached all time highs in early mid-July. These losses are caused in part by Tesla and Alphabet earnings announcements to which investors reacted negatively - Tesla posted its worst single-day loss since September 2020.

Next week, the FOMC will convene to decide federal interest rates for the 5th time this year. CME’s FedWatch tool continues to predict a 94% chance that rates remain flat, with a 6% chance of a 25bp cut.

This past Friday, fifteen Democratic congressmen, congresswomen and other politicians sent a letter to the chair of the Democratic National Committee regarding the party’s stance on digital assets. The letter calls on the Democratic party to include pro-digital asset language in the party’s platform, select a VP sophisticated in digital asset policy, select a pro-innovation SEC Chair, and to engage with industry experts. Blockchain, crypto, and digital assets continue to be a central theme in this year’s election cycle, with ex-president and Republican presidential nominee, Donald Trump, set to speak at the Bitcoin 2024 Conference held this week/weekend. Even current VP Kamala Harris was allegedly in talks to speak at the conference following President Biden’s announcement to drop out of the Presidential race, and his subsequent endorsement of Harris for the Democratic nomination.

💫 Lending giant Aave reconsiders fee-switch activation

There was big news in DeFi this week as Marc Zeller, founder of the Aave-Chan Initiative, submitted a Temperature Check to the Aave governance forums proposing a major update to AAVEnomics. This latest proposal introduces a fee switch-like mechanism for the protocol, news that drove the price of AAVE up 20% in 24hrs. The fee switch proposal comes on the heels of a newly designed Safety Module termed Umbrella.

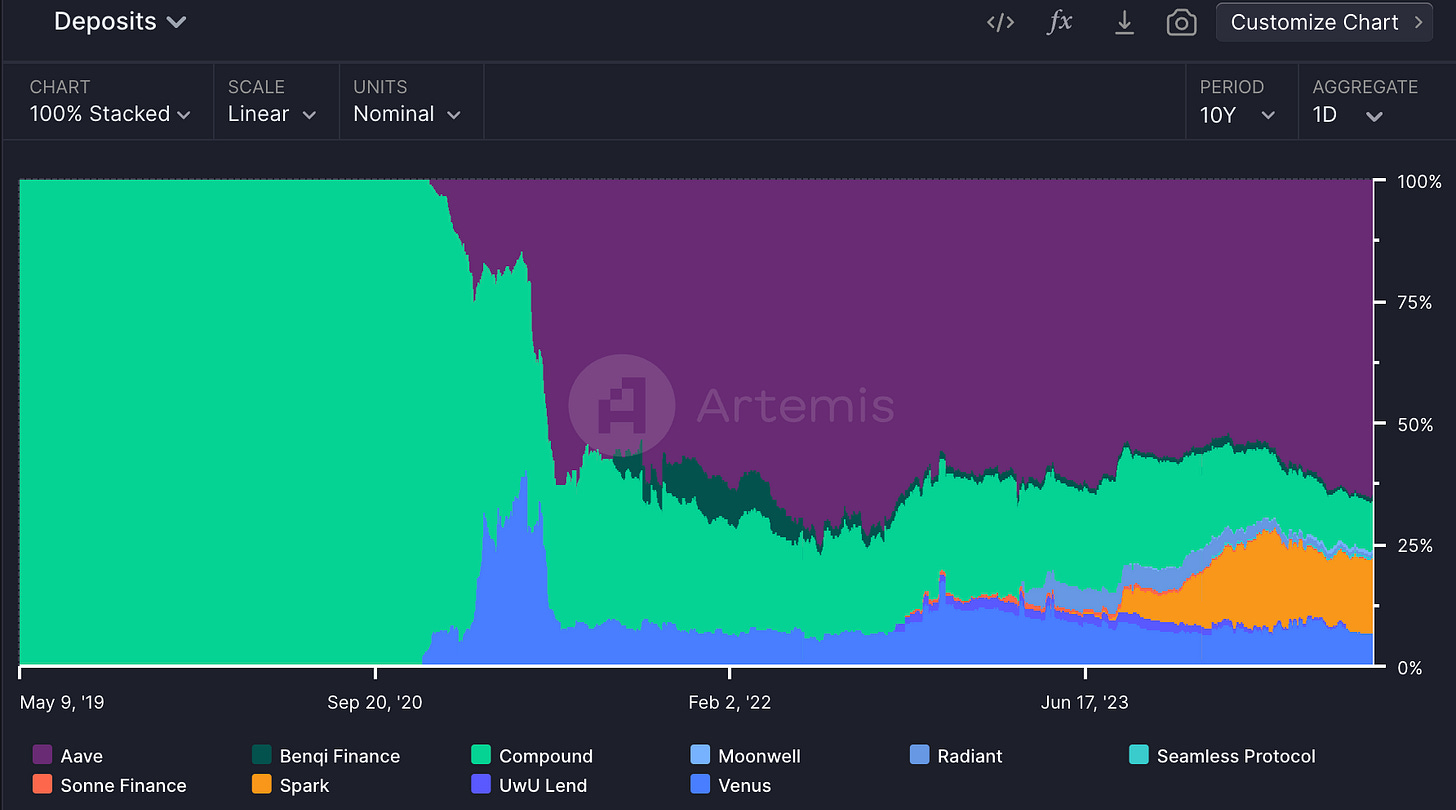

Aave is the historically leading decentralized lending protocol, which has proven its robustness and safety through varying market conditions. One primary mechanism through which this has been achieved is the Safety Module, the Aave protocol’s main defense against bad debt. AAVE token holders can stake their AAVE into the Safety Module in exchange for AAVE rewards from the ecosystem rewards contract. However, these stakers face a risk. If the protocol accrues any bad debt, AAVE that has been staked in the Safety Module will be used to make the protocol whole, and pay back the bad debt.

One of the major changes introduced by Umbrella is the deployment of aToken Safety Modules, where an aToken is the interest-bearing IOU received by a lender in the Aave protocol. This change is expected to bring great efficiency gains to the protocol, resulting in increased protocol revenue and surplus. Thursday’s AAVEnomics update includes a proposal for a “Buy & Distribute” program, whereby AAVE stakers will no longer be compensated through ecosystem rewards. Instead, they will be compensated through AAVE purchased on the open market with funds from protocol revenue.

Aave currently generates roughly $1m in fees every day, of which about $100k on average is retained as revenue by the protocol.

This situation is similar to Uniswap’s governance proposal to activate the fee-switch back in May which caused a 100% price increase within a week. Those gains have since disappeared completely, and the fee-switch discussion has petered out. If Aave’s latest proposal is to go through, it could cause Uniswap to revist the idea, potentially having ripple effects across DeFi.

🌞 ETH ETFs begin trading and seeing $1.2bn in inflows

The Ethereum ETF went live this week. On the first day, Blackrock’s ETHA ETF dominated flows, with over 250m worth of inflows. This was short-lived however, and the second day only saw 17.4m of inflows to ETHA, and an overall outflow of 133.3m. In total during the first week of trading, the new ETH ETFs saw inflows amounting to over $1bn USD. However, this was completely offset by outflows from Grayscale’s ETHE which has seen over -$1.5bn in net flows, roughly 10% of the entire fund. On the whole, Ethereum Spot ETFs cumulative flow is at -$179m, driven by ETHE outflows.

Analysts speculate that a good amount of the inflows to the new ETF products is recycled capital outflowing from ETHE. That said, top ETF analyst Nate Geraci considers the debut to have been highly successful. Senior ETF analyst Eric Balchunas gave the debut a ‘Letter grade: A’ in light of the cumulative $1bn in volume traded on the first day (roughly 25% that of BTC ETFs on their first day).

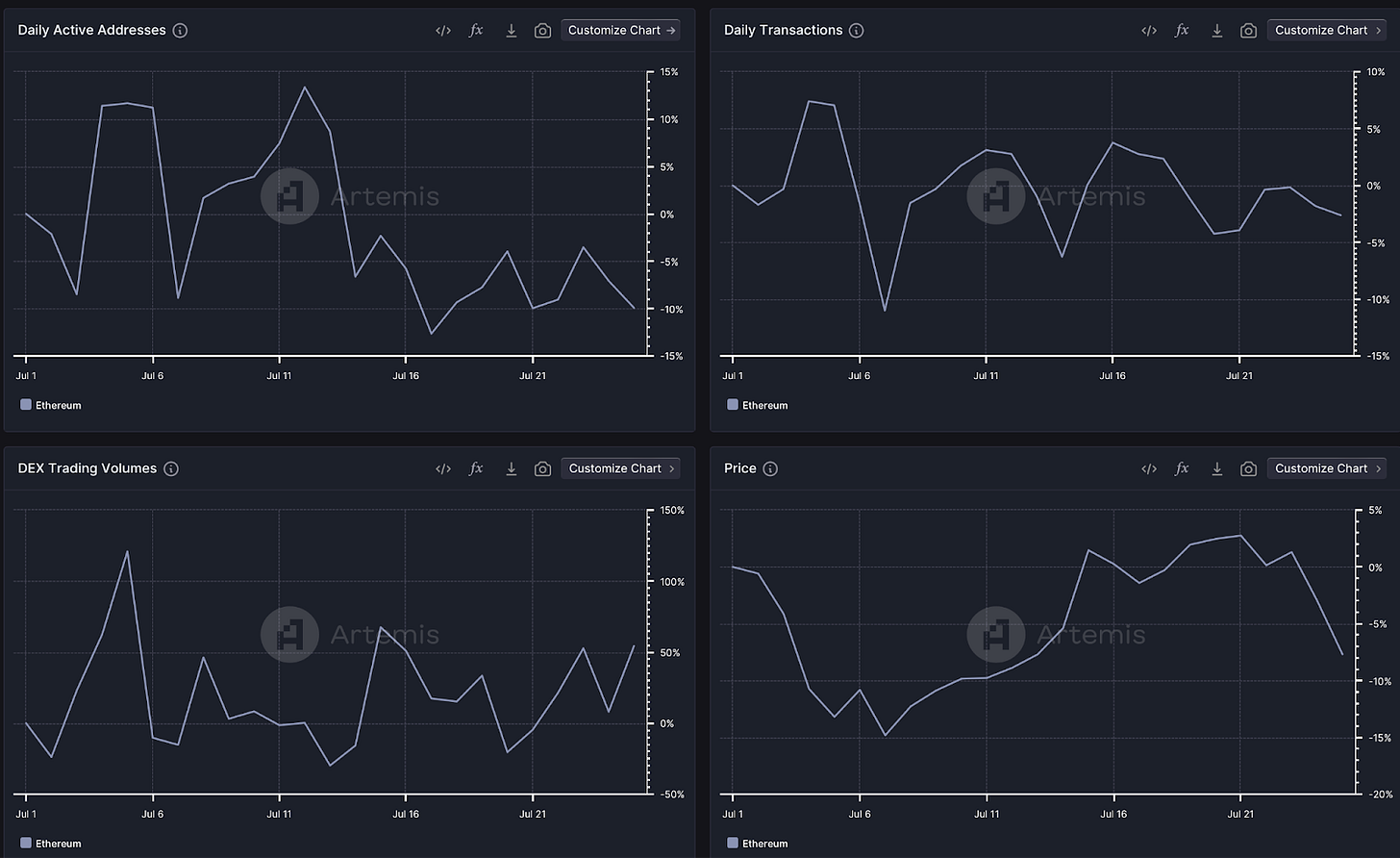

On the Artemis dashboard, we can see how the ETH ETF news preceded a run up in price, which fell off shortly after it was launched. In fact, ETH’s price action following the ETF launch has been eerily similar to BTC’s price action. BTC slumped about 8% during the first weeks of trading, before shooting straight to all-time highs over the following two months.

We are also interested in seeing how onchain metrics reacted to the ETF. In the month of July leading up to the launch, fundamental metrics remained relatively stable over the period, signifying that the ETH ETF has had little to no bearing on the onchain ecosystem.

And amongst all major De-Fi protocols, there has been no substantial price increase despite many calling for a “re-pricing of De-Fi” ; this looks to be a thesis that will take some time to play out.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 6/12/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

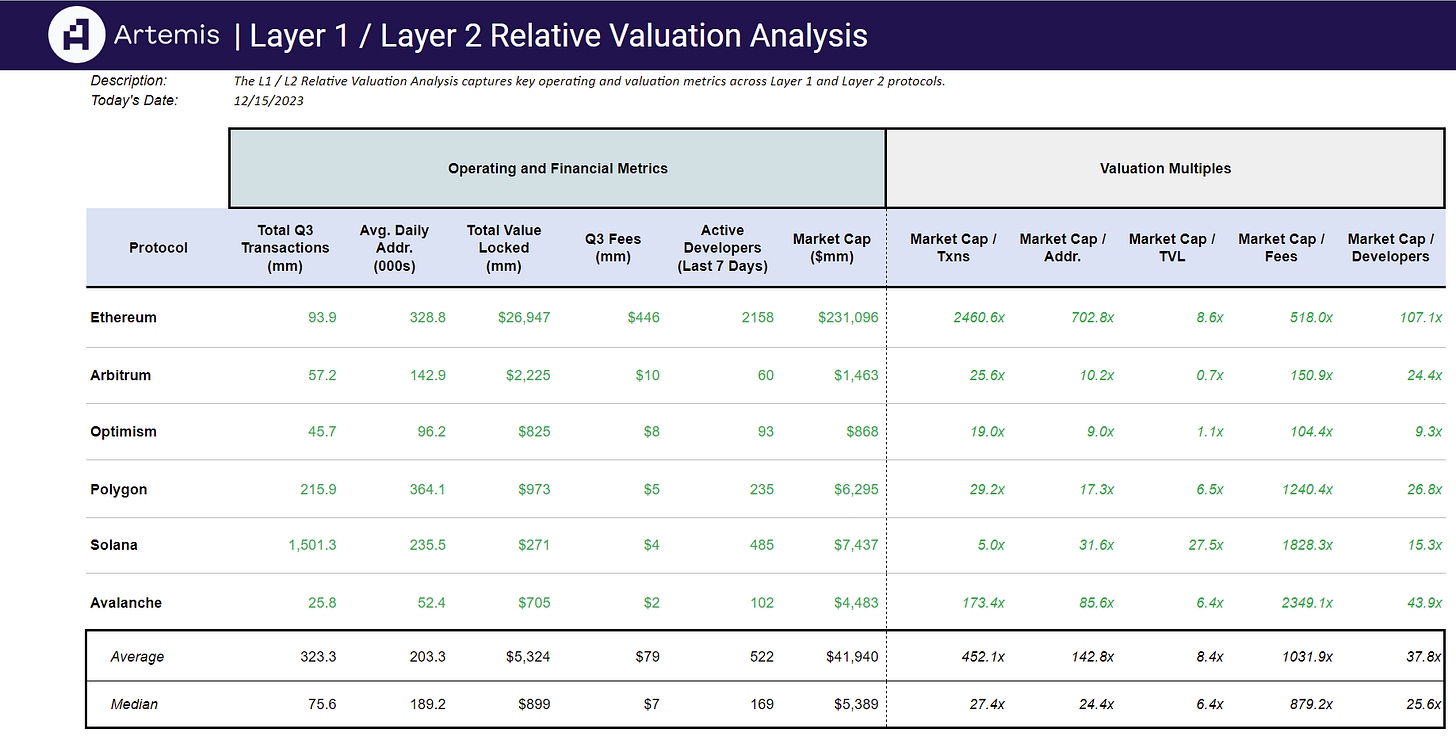

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞