We’re very excited to announce we’ve copublished a case study with Dagster Labs detailing how we leverage Dagster’s data orchestration capabilities to build robust data pipelines to empower crypto analysts, investors and innovators!

This week, Russia passed a bill to legalize crypto to dodge international sanctions (Reuters), Lido launches "Lido Institutional", a middleware solution for enterprise level staking (X/LidoFinance), CEO of Sequoia and a16z-backed BitClout arrested and charged with with wire fraud (WSJ), and Tether reports record $5.2bn in profit for H1 2024 while holding enough US debt to rank 18th among countries (Coindesk).

🌞 Compound Governance attack

💫 Cosmos events turn sentiment hyper bearish

Markets had one of their worst weeks this year, with major assets down an average of 11.4%. The biggest losers were alt L1s SUI and NEAR, closely followed by AVAX and SOL, each losing more than 15% of their market values over the week. Price action was largely mirrored in the equities markets as the major equities indices lost $2.9 trillion in market value partly due to major tech stocks missing on earnings (AMZN down 9% on Friday). The other key driver of the decline was the jobs report released on Friday morning which showed US economic growth slowing as unemployment 5% M/M, and non-farm jobs missed expectations by 35%. This marks the highest US unemployment rate since November 2021. The Japanese stock market also saw its biggest single day loss since 2016.

In other macro news, on Wednesday the Federal Open Markets Committee (FOMC) met for the first time since May to decide interest rates. As was expected by the market, the FOMC chose to keep rates unchanged in July. The next meeting is on September 18th, and, given current market conditions, the fed-funds futures now see an 80% chance of a 50bp cut, a large shift from last week’s 11.5% probability.

During his keynote speech at the Bitcoin conference in Nashville last weekend, former President Donald Trump made a number of big statements about his intended approach to the cryptocurrency industry. He promised to fire SEC Chairman Gary Gensler, stating that “[he] will appoint an SEC chair who will build the future, not block the future”. Perhaps the biggest announcement Trump was his intention to create a Strategic Bitcoin Stockpile, meaning that the US Government would hold on to the bitcoin it has seized instead of selling it at auction as is the norm. In contrast, other speakers at the Bitcoin conference, like presidential hopeful RFK Jr. and Senator Cynthia Lummis, announced their intentions to form a Strategic Bitcoin Reserve meaning the US Government would buy bitcoin, not just hold onto seized coins. The role of crypto in he US elections continues to grow and evolve as Kamala Harris is allegedly looking to get a speaking slot at Permissionless, Blockworks’ major crypto conference.

Today marks the second week of ETH ETFs trading. According to Farside Investors’ data, cumulative net flows have stabilized at -457m, as Grayscale’s ETHE outflows have slowed. When compared to the action of flows in Grayscale’s GTBC, ETHE has actually seen a much faster rate of outflows over the first two weeks.

💫 Compound governance attack

On chain, one of the largest and sophisticated DAOs in the crypto industry experienced a possible governance attack. Compound is a pioneering protocol in the decentralized finance ecosystem. It was the first major lending protocol and the first to hit $10bn in deposits. This was before it was overtaken by Aave, now the king of DeFi lending. Compound was also recently flipped in deposit value by the fledgling Spark protocol built on top of the Maker stablecoin protocol.

Compound has a seasoned and robust governance system, which, just this week, experienced a possible attack. The proposal was to transfer 499,000 COMP to a DeFi strategy managed/ran by GoldenBoys that intended to transfer COMP into goldCOMP to earn yield. Humpy, the person behind it, has been a Defi whale for many years, and was involved in a similar Balancer governance attack a few years ago. On the bright side, Humpy is a big holder of COMP so he may be less incentivized to damage the protocol.

An interesting point noted by The Hivemind Podcast is that many VCs that are big holders of COMP tokens have delegation programs with university blockchain clubs that are now on vacation, and thus not actively voting. Nobody seems to be paying attention and no one really cares about COMP anymore. Compound has not really made any big changes over the past few years, unlike Aave. This could be due to regulatory uncertainty as Compound is already an established protocol and does not want to risk everything by doing an upgrade which might be the subject of an SEC enforcement action down the line. In contrast, Aave is mostly based outside the US, and has made great improvements and upgrades to its protocol including a stablecoin, GHO.

A few interesting stats courtesy of X/DefiIgnas:

The attacker made 3 proposals to governance:

The first two for 92k COMP failed

The third one for 499k COMP passed

57 addresses participated in the vote, more than the usual ~20.

🌞 Cosmos events turn sentiment hyper bearish

This past week there was an increase in bearishness in the Cosmos ecosystem. This may have been a long time coming but was catalyzed most recently by the Terra chain halt due to an exploit in the protocol. This bug had been disclosed back in an April patch but was reintroduced to the Terra protocol in June.

In this same week, Kujira, another Cosmos chain, saw its token drop 55% in one day after several of its treasury positions were liquidated. The Kujira team had poor risk management practices around how it invested its treasury assets, and, on Wednesday, large positions in their treasury were liqudated. According to Coindesk, “The liquidations occurred as loans taken by Kujira from their publicly allocated KUJI tokens became undercollateralized during a period of general market volatility. The liquidations sent KUJI lower, leading to more liquidations, even lower prices and a downward spiral. (Coindesk)”.

These events led to the overall Cosmos sentiment turning quite bearish, with many folks turning to X to vent about the toxicity of the ecosystem - including some nasty and specific stories.

In light of this bearish sentiment, it can be helpful to take a step back and look at Cosmos holistically. Today, 2 out of the three biggest perps protocols in the space are built on Cosmos - dYdX and Hyperliquid - which make up nearly 50% of all perps volume (excluding centralized exchanges).

Additionally, a number of other app-specific chains have sprouted up in the ecosystem, including Celestia which has started to take significant market share from Ethereum in the data availability space. Today, 30% of all data posted for data availability in MiB is posted to Celestia, up 2x from 3 months ago.

There are many more real projects built on Cosmos including Akash and Noble. However, the Cosmos community has been very unaligned, as there is no central token for people to rally behind (like ETH in Etheruem, or SOL on Solana). ATOM was meant to serve this role, but never really did. In a few months, people may look back at this moment as one of growth, as the Cosmos community addresses many of its challenges, dirty laundry is aired, and the community continues to evolve.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

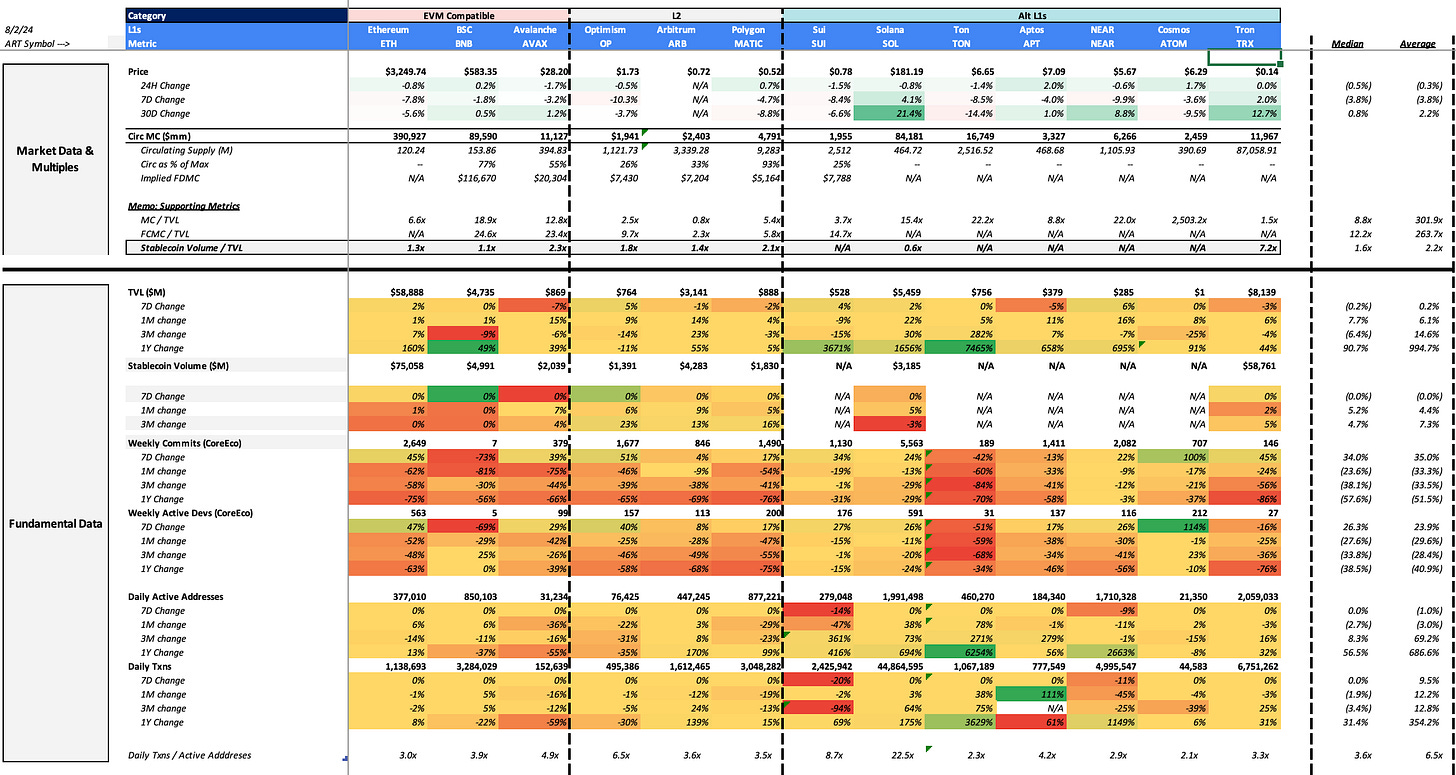

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 6/12/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

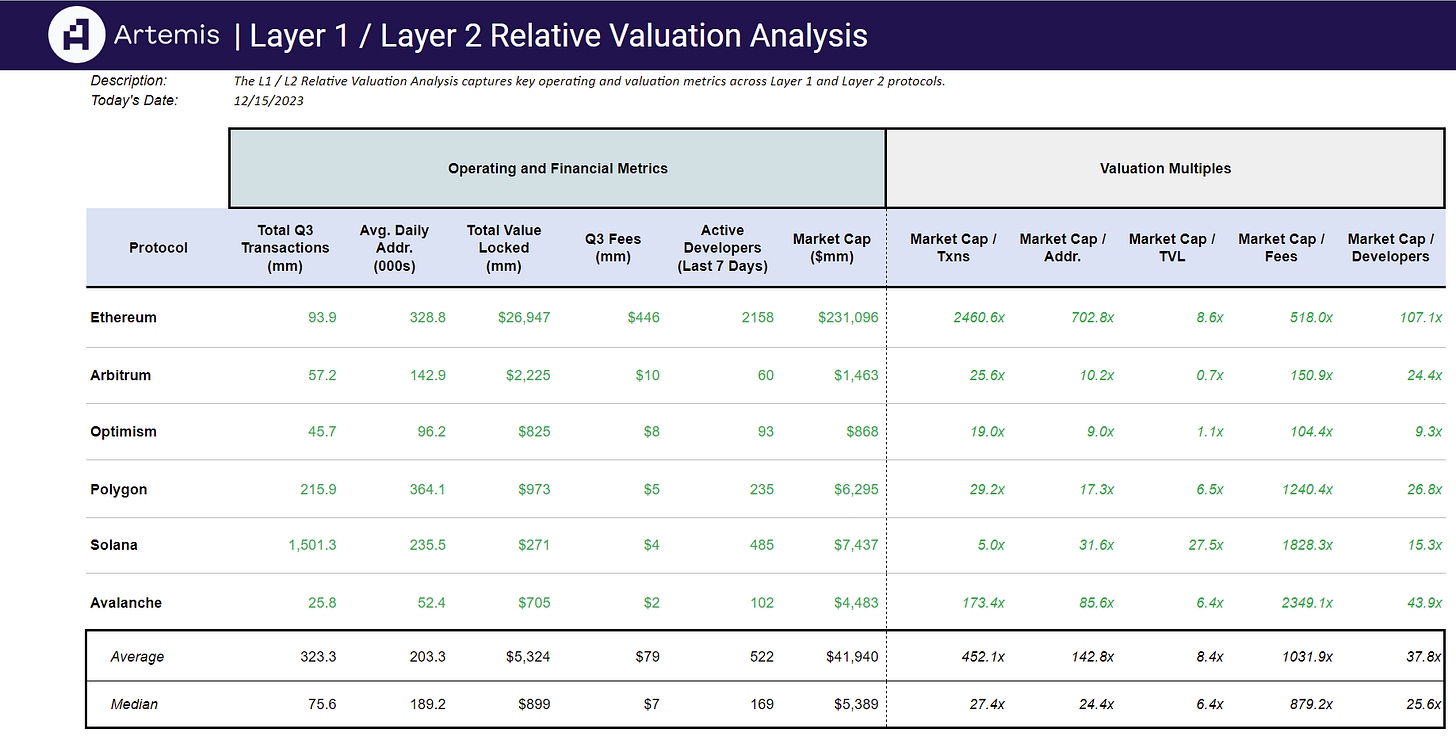

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞