The Big Fundamentals in Crypto: Uniswap, Crypto Up ~27%+, GokuStats on Twitter

Artemis on Twitter + Crypto Market update + Uniswap mini-dive

Hey Artemis Friends!

Jon here, one of the co-founders of Artemis.xyz. I wanted to update the community on what’s been going on the last week at Artemis and the big fundamentals in crypto (get ready for my attempt at making memes!).

To start it was really exciting to see Artemis’s first product GokuStats.xyz get shared and tweeted out in the wild on Twitter this past week!

Also it’s been interesting to watch crypto prices grow in the last 30 days.

As always, please read the disclosures at the end of the post as none of this is meant to be investment advice and we do hold certain tokens that we discuss in this post.

Artemis.xyz in the wild on Twitter 😱

It was really cool to see Anatoly, the co-founder of Solana, tweet a GokuStats.xyz table on the number of Solana transactions compared to other major L1s.

We had other folks like @krugermacro share tables from Gokustats.xyz as well 🙏🏼

Market Update 📈

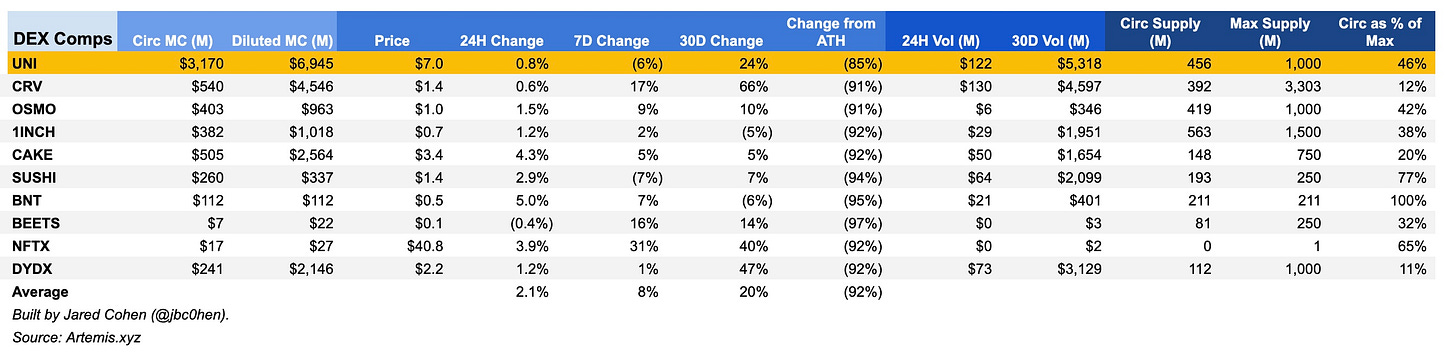

7/24/2022 Artemis Weekly Crypto Comps

👉 If you’d like this Crypto comp table in your inbox daily and customized, sign up for our beta launch here http://artemis.xyz/ and we’ll email you crypto comps!

Some observations 👀

ETH is up nearly 40% in the last 30 days and BTC is up 8%

ETH and BTC are still down ~67% from their ATH as of July ‘22.

Among these major liquid tokens, the average token in our comp set is up broadly 27%

AVAX is up 31%

MATIC is up 57%

Lido (LDO) is up 206%

CRV is up 66%

It begs the question — is it a great time to start deploying?

It would’ve been great for new liquid token funds to deploy in the recent bear market rally — but a key question is how much this will sustain.

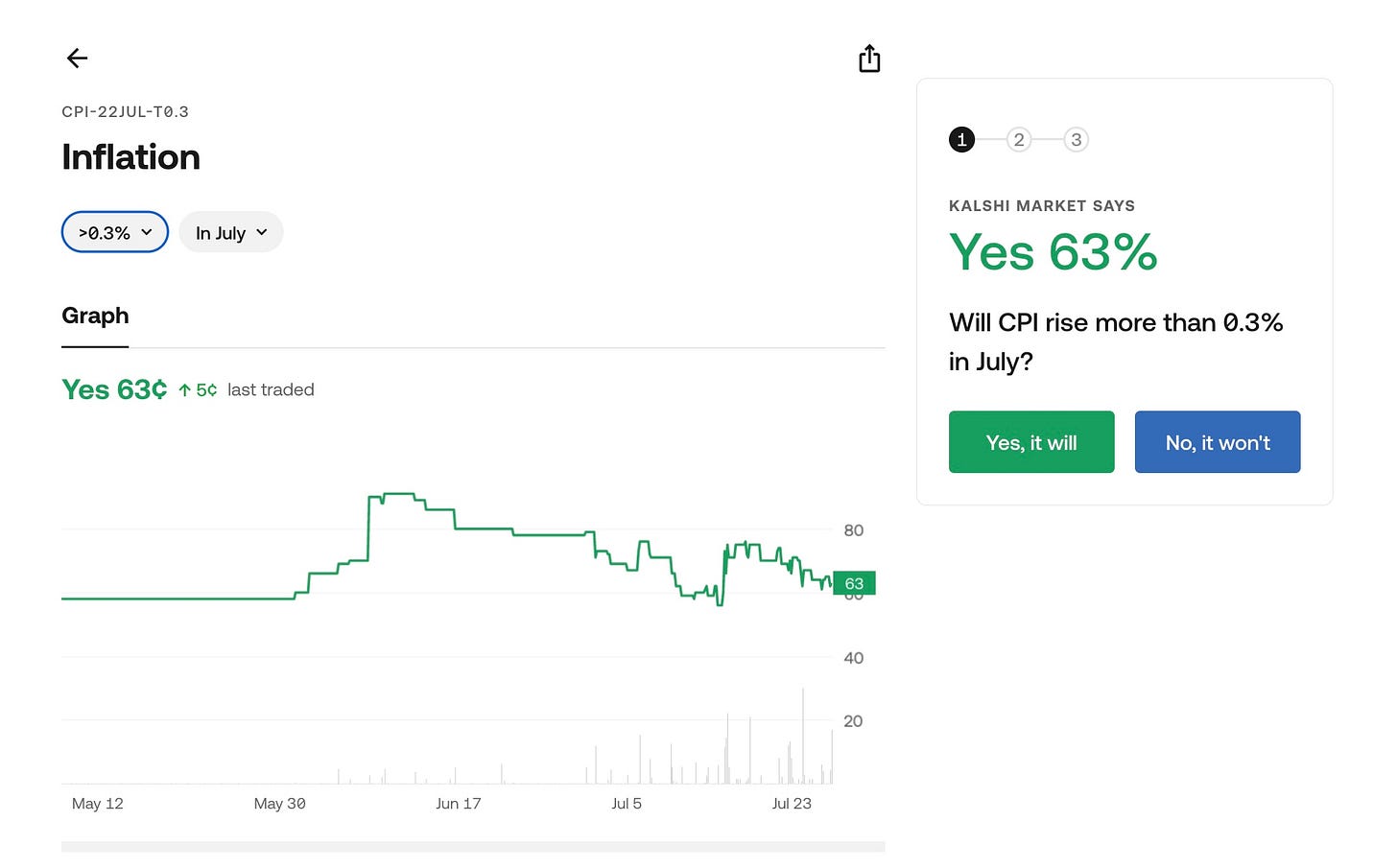

Global Interest Rates (h/t The Tie) are rising

Kalshi (global prediction market) is pricing in a likely >0.3% CPI hike in July ‘22

Trueflation has rates at >10% in July ‘22

→ Inflation and rates really affects crypto and capital allocators decision to move money into risk on assets like crypto or risk off assets like treasuries where a 10 year treasury bond now yields ~ 2.91%.

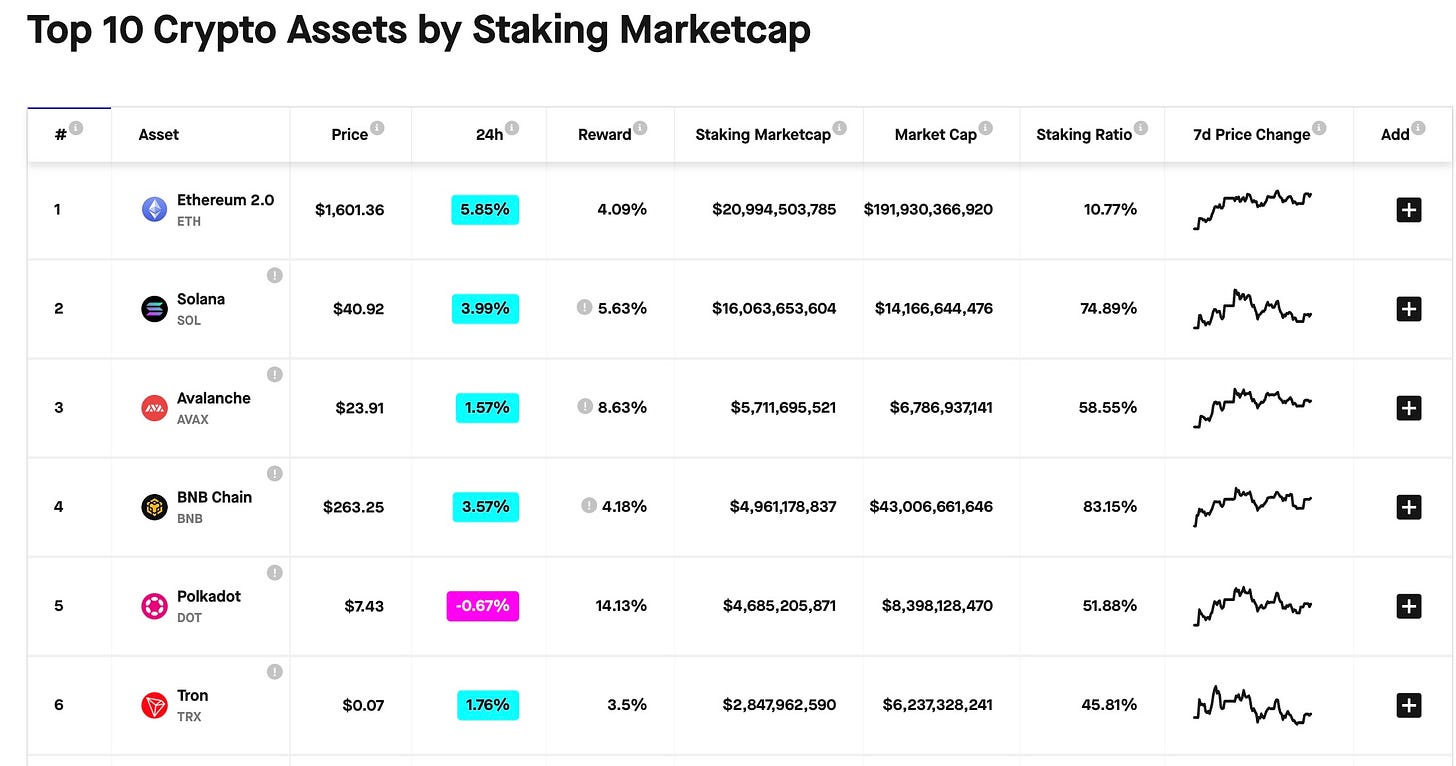

→ Staking ETH right now yields roughly 4.09% in ETH (note on nominal terms) and staking SOL right now yields 5.63%— at what point does it make sense when a risk free asset like bonds can yield ~3% and a capital allocator doesn’t have to take price risk?

The Big Fundamental Update - Uniswap 🦄

For the readers, I’m a huge basketball fan. So if we’re covering fundamentals in crypto, we have to give a shoutout to the one and only Tim Duncan aka the Big Fundamental (our team cringed when I made this meme ).

This week we do a mini-dive into Uniswap ($UNI) Let’s go.

Uniswap 🦄

Price Action: Uniswap’s governance token UNI is ~$6.95 up ~50% from their lows in late June. Some potential drivers of this:

Crypto is up more broadly (see crypto market update above)

Uniswap continues to maintain its dominance at DEX leader

Uniswap daily volume ~ Coinbase (see below)

It’s worth noting that Uniswap Labs team is ~100 employees up 3x YoY and added nearly 21 employees in June ‘22. Clearly they’re adding talent to their team

Uniswap hired Will Rubin (ex-Coinbase senior direct PM) as VP of Product.

Key Metrics

DEX Marketshare: 64% (Source: Dune)

Protocol Revenue: $0 (no fee for token holders or the DAO) (Source: Token Terminal)

LP Revenue: ~$453m annualized revenue (7 day avg fee * 52) (Source: Cryptoinfo)

TVL: $6.16B (up 28% from lows in mid June ‘22) (Source: Defilama)

Volumes (ETH, Polygon, Optimism, Arbitrum): down slightly MoM (partial month as volumes below only show up until July 24th (vs full months for previous months). (Source: Uniswap)

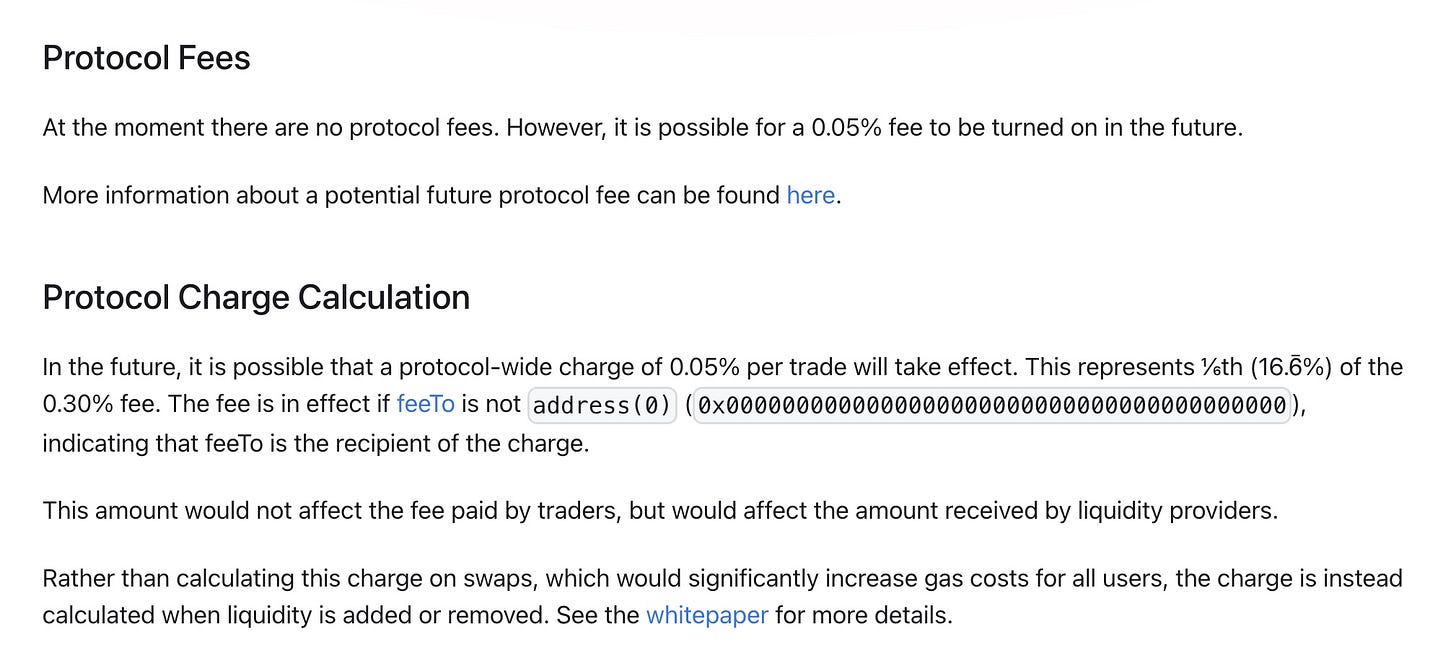

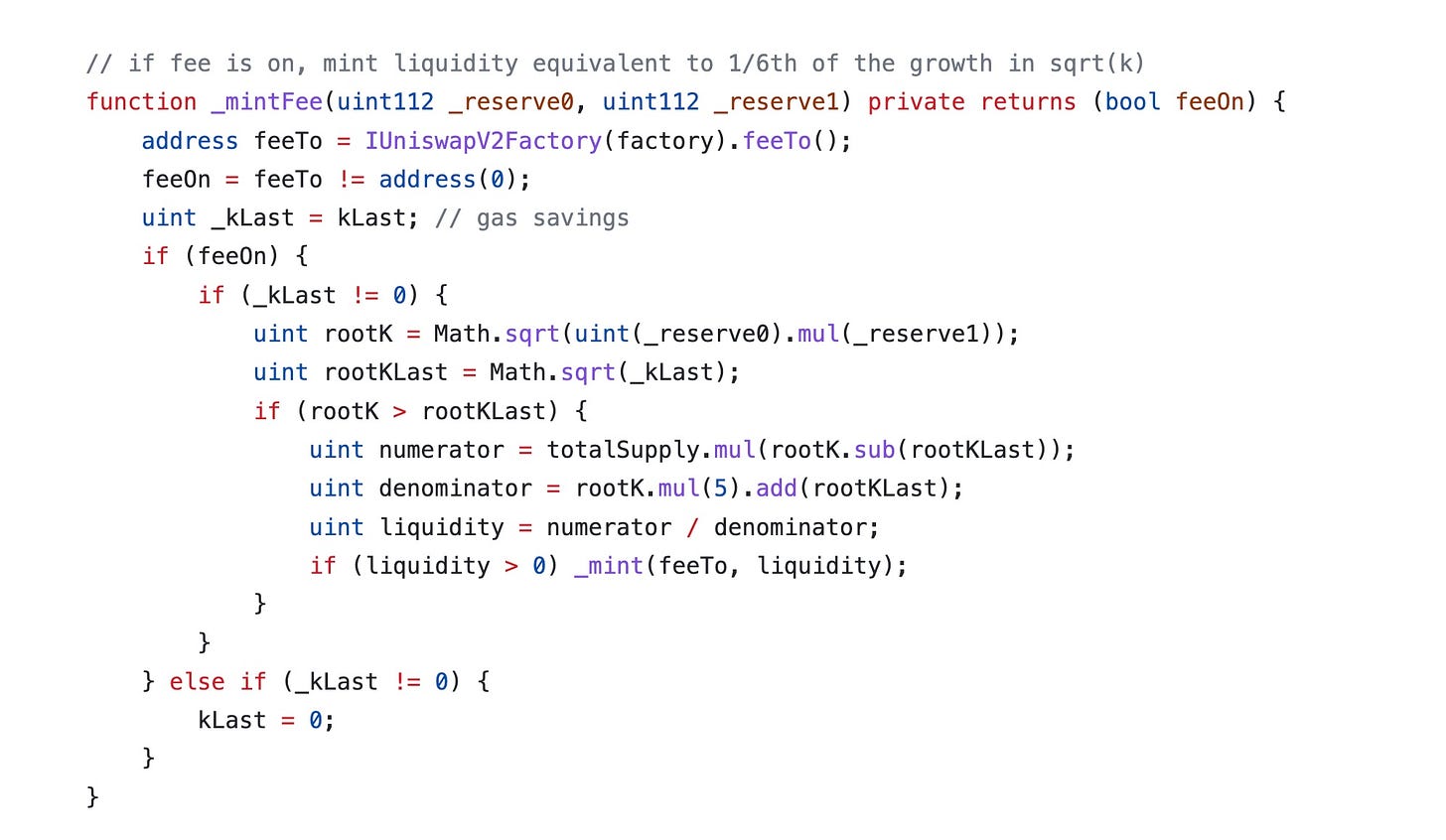

The 80/20: Fee Switch Revenue?

Currently $UNI is a governance token. For $UNI holders to participate in the growth in Uniswap, there has to be some sort of protocol fee that accrues to token holders.

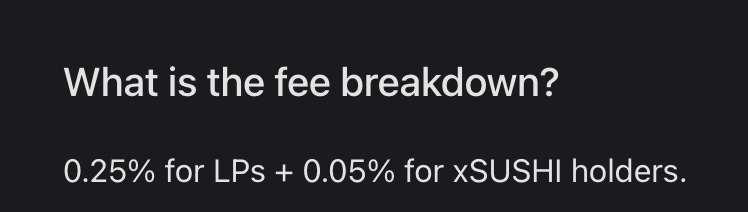

Uniswap governance token currently doesn’t collect a fee for $UNI token holders like Sushi Swap which takes a 0.05% fee for users

Uniswap’s docs state that a 0.05% fee could be turned on in the future, primarily taking 1/6th of the fee that currently go to LPs.

An argument from Leighton that I found interesting was turning on fees for a limited set of pools and experimenting and seeing what the DAO could do with the fees beyond rewarding token holders. Some ideas that were laid out include funding grants and developers, public good funding, etc. The argument is primarily about starting somewhere and collecting data on seeing how LPs react.

Arguments against turning on the “Fee Switch” currently.

Regulatory concerns in the US that could make $UNI tokens look a lot like securities and thus checking the boxes of the The Howey Test.

The existence of an investment contract

The formation of a common enterprise

A promise of profits by the issuer

The use of a third party to promote the offering

LPs potentially moving their liquidity to other pools as their revenue decreases from 30 bps to 25bps

It’s worth noting a temperate check on Snapshot of the proposal resulted in ~100% yes but largely driven by an individual monetsupply.eth with their 3.5m U 0.00%↑ NI.

Product Updates 😎

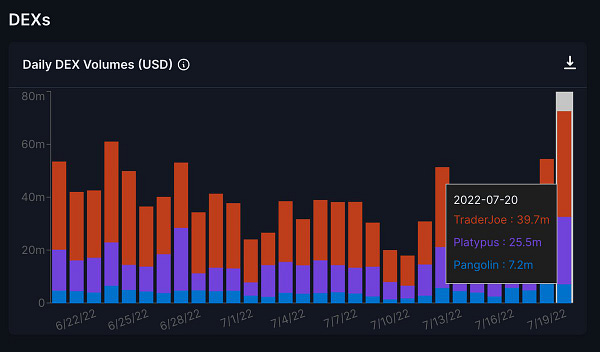

👉 We added Avalanche DEX Volume! Interesting to see TraderJoe continue to dominate the AVAX DEX market with 87%+ market share.

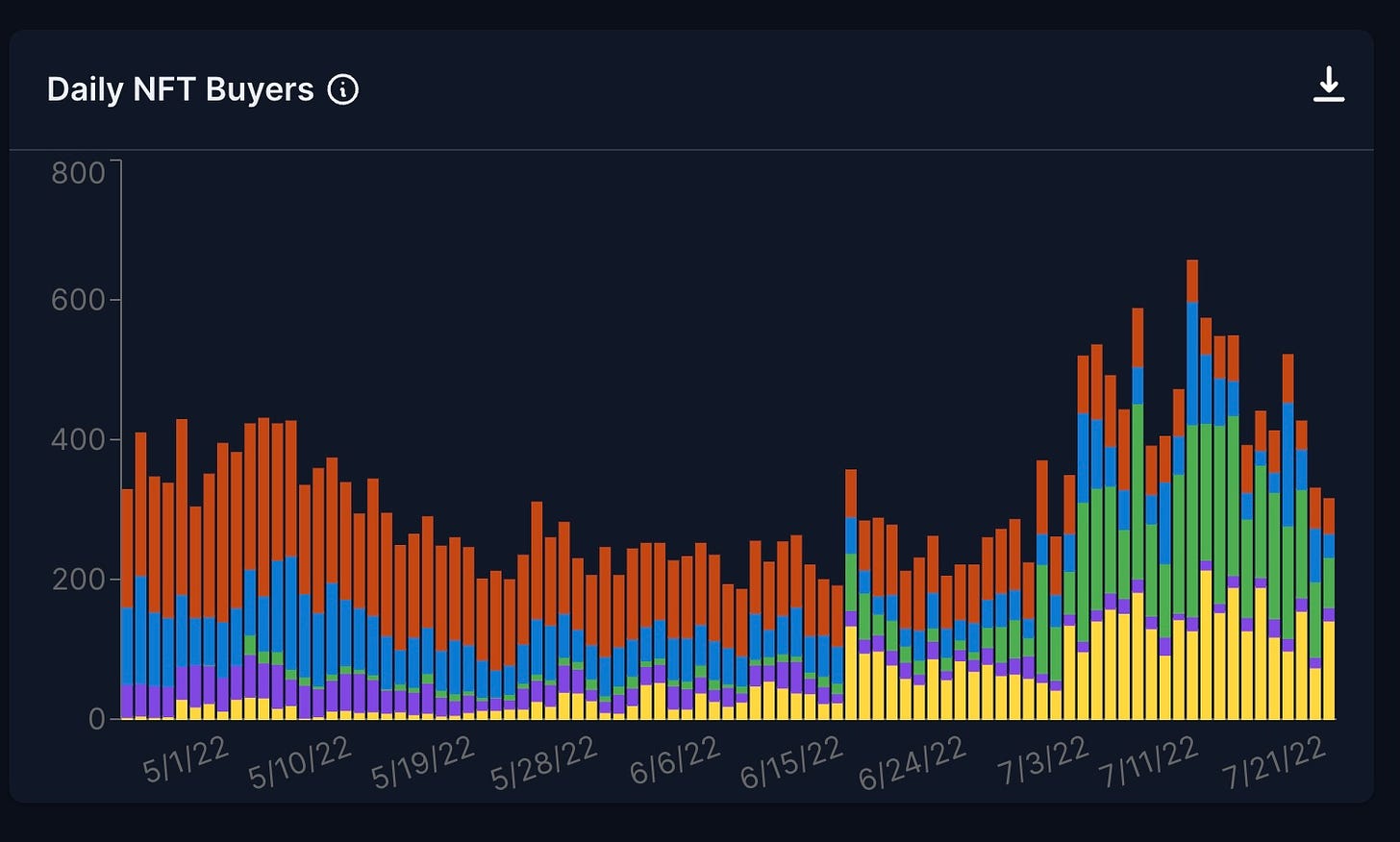

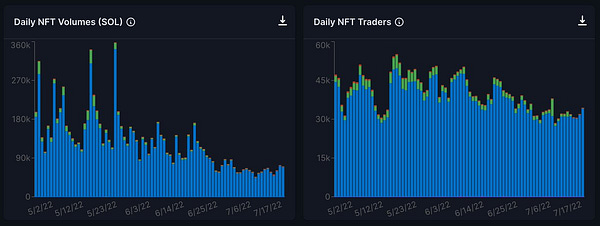

…And NFT Volume/Traders! NFT volumes starting to heat up on AVAX because of https://joepegs.com/. Interesting to watch new daily NFT buyers grow in July ‘22 because of Joepegs.

Thanks for tuning in! See you all next week,

Jon Ma

@jonbma

Disclosures

Author owns $BTC $ETH $SOL $AVAX $DYDX $UNI $MPL and a negligible amount of other tokens.

Views expressed in these emails are ours and ours alone and don’t represent that of previous or current employers. Artemis Analytics provides financial and industry information regarding liquid tokens as part of our dashboard, blog, and emails. Such information is for general informational purposes only and should not be construed as investment advice or other professional advice.