The Big Fundamental: Big Three L1 Deep Dive (Ethereum🏔, BSC🏞 and Solana🌋)

a deep dive into the application verticals developing on the largest monolithic blockchains

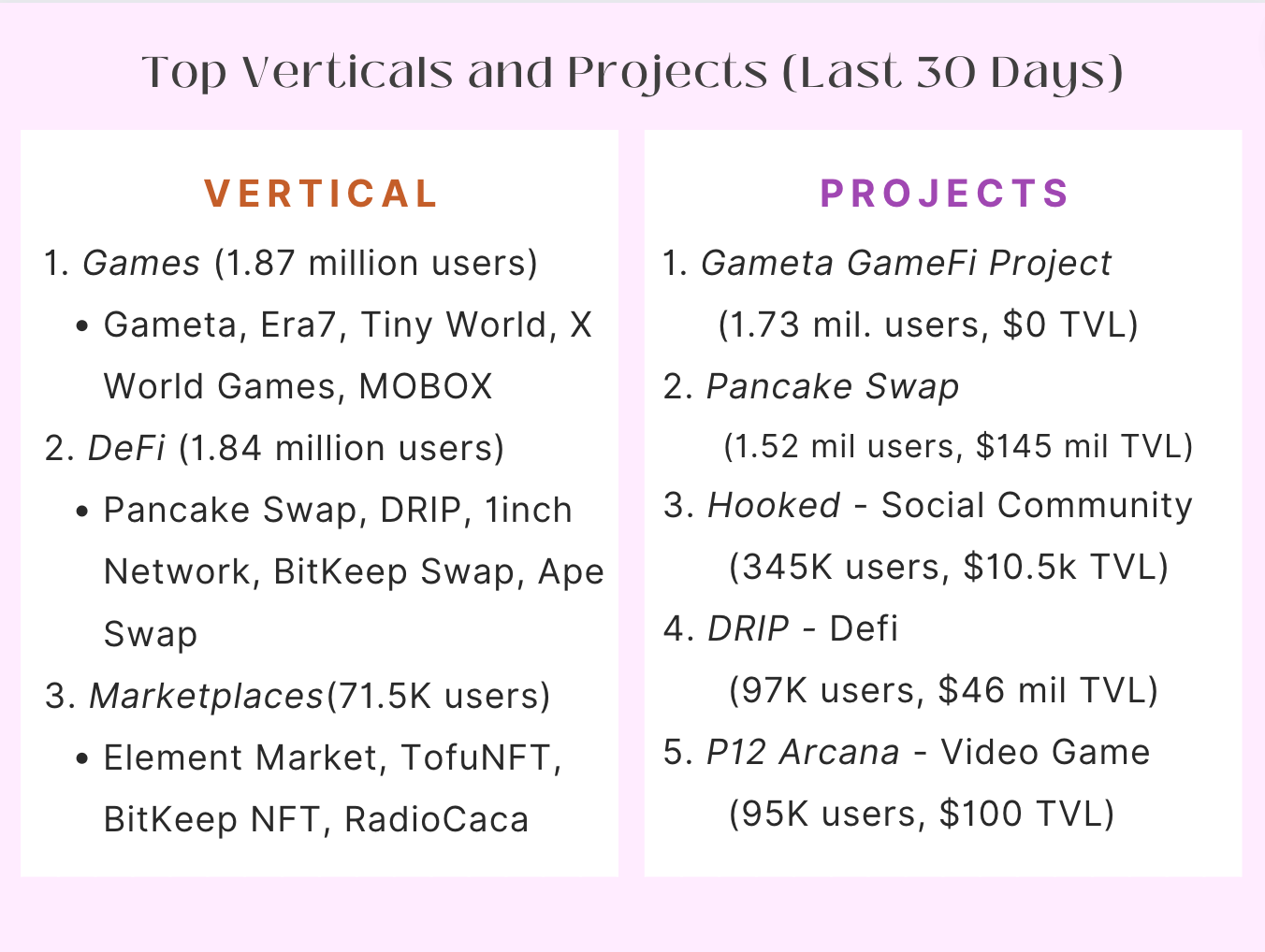

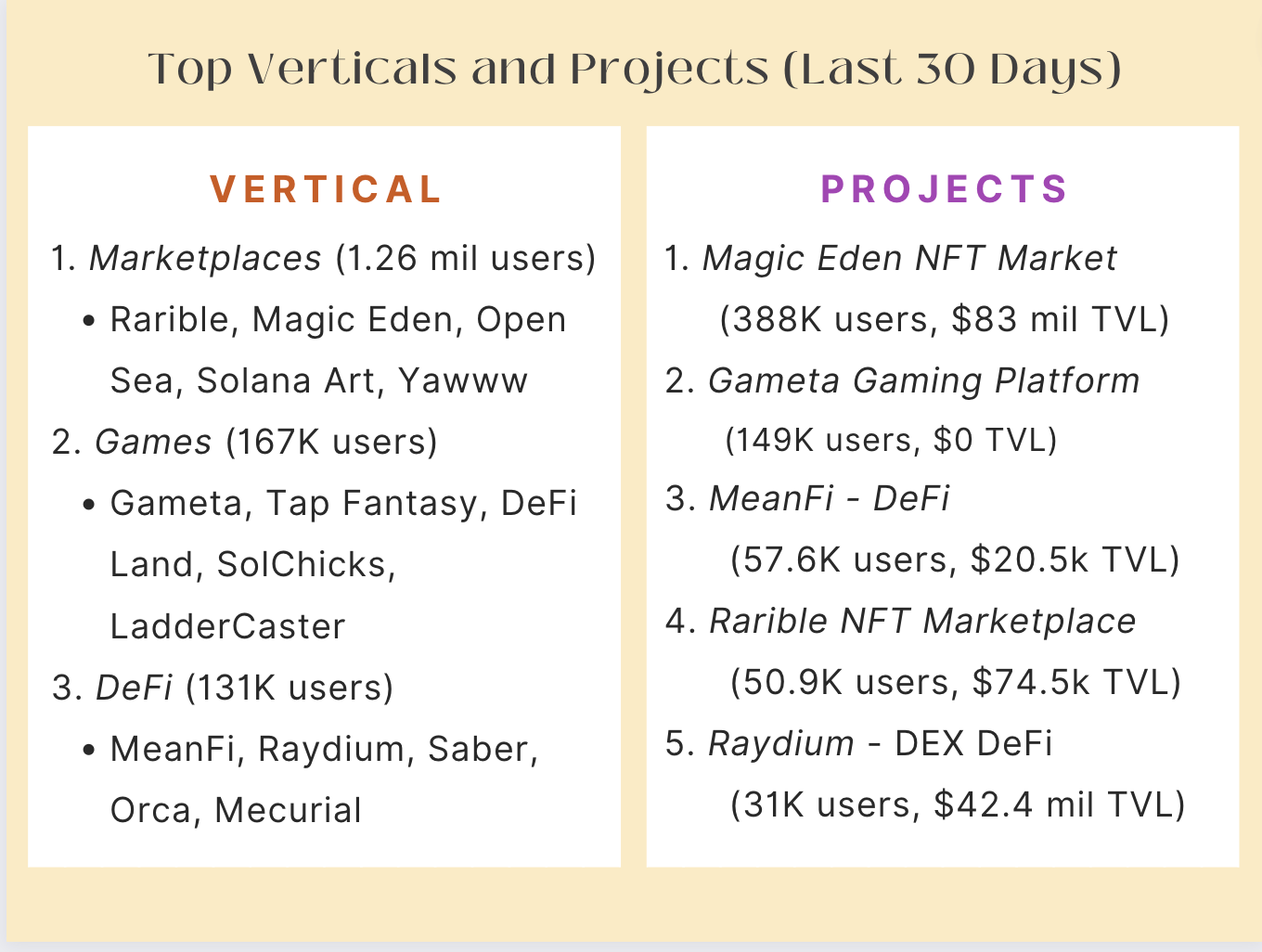

why is defi tvl so concentrated on ETH? why have games taken off on BSC? what makes marketplaces so prevalent on SOL? we explore these questions and more in this Big Fundamental deep dive 🏊♀️

Key Takeaways

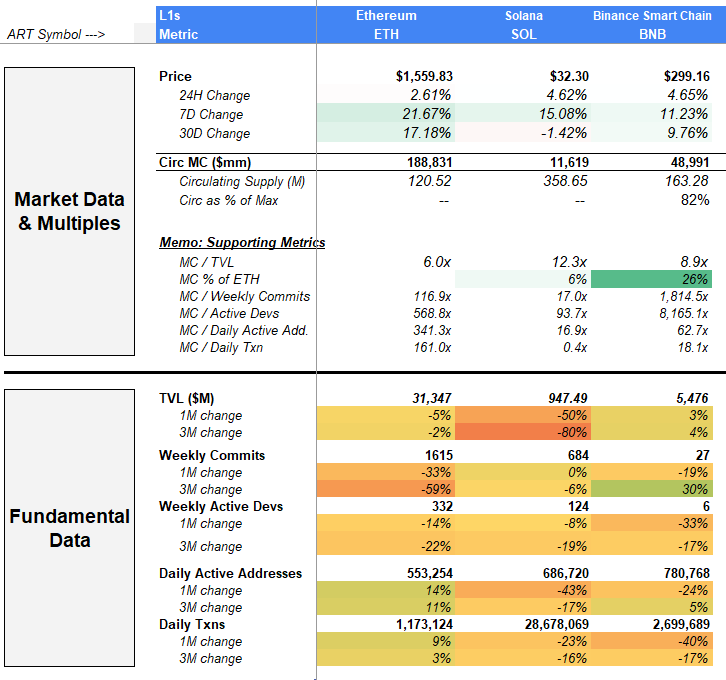

Ethereum, Solana, and Binance Smart Chain (BNB) are three of the most widely used layer ones in the blockchain ecosystem, averaging nearly 2 million daily active addresses in total and nearly $40 billion in total value locked (TVL).

A measure of a blockchain’s transactions per second shows the chain’s ability to sustain and process a large number of transactions rapidly. Traditional payment processing infrastructure, like that of credit card company Visa, can handle about 1,700 tps. Ethereum, known for its low transactions per second, handles around 30 tps. BNB is more scalable, handling around 160 tps. Solana is impressively scalable, handling around 3,000 tps.

Developing on Ethereum is easy and familiar, with plenty of support. Ethereum’s smart contract language (Solidity) is not challenging, and the Ethereum Virtual Machine is compatible with a variety of languages and is integrated with many user-friendly tools such as MetaMask. BNB is also EMV-compatible, with additionally similar tools and support. Solana has its own virtual machine and is programmable in Rust, a more difficult but arguably more powerful language, leading to a smaller but advanced developer base.

Ethereum leads all L1s in weekly commits (9.8K) and weekly active developers (1.8K). Solana comes in 6th with 338 weekly active developers with 1.9K weekly commits. Binance Smart Chain (BNB) comes in 8th, with 66 weekly active developers and 777 weekly commits. Data is from Artemis.xyz’s Gokustats on 10/19/22.

Ethereum, BNB, and Solana pricing information and fundamental valuation multiples, taken from artemis.xyz. Solana is trading at significantly higher multiples than Ethereum or BNB, but has remarkably strong developer activity and thus potential development momentum.

Ethereum.

the og heavyweight, the granddaddy of DeFi, the first of the EVMs

Ethereum Thesis: Ethereum’s safety and security make it an ideal blockchain to build the necessary infrastructure for cryptocurrency, especially decentralized applications that facilitate token and asset liquidity. Evidence of Ethereum’s competitive edge in this area is clear. Its NFT marketplaces, token exchanges, and decentralized finance applications are among the most popular and well-established across the crypto landscape. However, for investors seeking explosive growth, Ethereum might not be ideal. Its lack of network speed (post-Merge Ethereum addresses this issue) and minimal developer activity on innovative projects in categories beyond token exchanges, marketplaces, and defi tools presents an obstacle to growth.

Ethereum’s robust development interface and tools, combined with its established and resourceful community, make it the primary layer one solution from which many decentralized applications are created. Developing on Ethereum involves a familiar set of tools: the Ethereum Virtual Machine, which supports any coding language; smart contracts using Ethereum’s native (and simple-to-use) language named Solidity; alongside integrations with popular tools such as MetaMask.

Ethereum’s top dApps fulfill vital functions in facilitating the exchange of tokenized assets. For example, OpenSea and Uniswap, perhaps the largest NFT marketplace and decentralized exchange, respectively, are built on top of Ethereum. These projects enable the primary current functionality of crypto assets, which is the acquisition or exchange into different tokens or assets. Additionally on Ethereum, there are a number of DeFi projects that, in its simplest form, allow investors to stake tokens and generate rewards.

Thus far, however, most of these projects aren’t major transformations in the application and usage of cryptocurrencies. The convergence between blockchain and gaming is an exciting market, with opportunities to grow at a 5.6% CAGR, but Ethereum’s gaming projects lag those of other chains in terms of user activity. Over the past 30 days, Ethereum’s top game has been Mirandus, a massive MMORPG, with only about 2,000 users. Games on Solana, HIVE, and other layer ones have collected many more users, and of course, Minecraft’s monthly active users is often around 90 million.

Much of this lack of innovation may be due to Ethereum’s slow network transactions speeds. No matter how developer-friendly the environment is, or how famous Ethereum is with the general public, the slow transaction speeds cannot support a robust network of online gamers, gamblers, or marketplaces without additional layer two solutions. For developers attempting to create a massive, immersive, metaverse-esque world, questions remain over whether Ethereum will be able to completely support that volume of transactions.

Ethereum App Case Study: Compound Protocol

The Compound Protocol is a DeFi protocol built on Ethereum that essentially enables the rapid borrowing and lending of a variety of supported tokens. It’s a rethinking of traditional banks: people deposit tokens (i.e. depositing cash) and earn a return (i.e. interest rate on a savings account), while some people borrow tokens (i.e. taking out a loan). The mechanisms are, of course, a little more detailed, and the current use cases of DeFi loaning protocols are not like TradFi loans yet.

The primary takeaway, however, is the strong presence of DeFi protocols that are built on Ethereum. The exact figures are not certain to calculate, but some articles have suggested that up to 90% of DeFi protocols’ TVL is on the Ethereum network. This is in spite of Ethereum’s high transaction fees and over-congested network. So why is Ethereum the home of DeFi, and not other chains?

The primary explanation might be ETH’s continued dominance as a token, second only to BTC. There is no chain more compatible with ETH, with more developer support and more substantial investment, than Ethereum itself. Although other tokens might increase in popularity, ETH’s market share remains high. For DeFi projects that rely on the exchange of assets, often involving ETH tokens, Ethereum provides the greatest compatibility and application support.

Binance Smart Chain.

the consumer behemoth, the gaming king, web3’s trojan horse for retail

Binance Smart Chain Thesis: Although Binance Smart Chain (abbreviated as BNB or BSC) benefits from better scalability than Ethereum and compatibility with the Ethereum Virtual Machine, other low-transaction-fee, highly-scalable chains attract more attention from developers of decentralized applications. There’s no clear way for BNB to change its perception as lagging behind its peers. Its lack of true decentralization is a significant security concern and its inability to attract a strong set of native core applications present significant obstacles to growth.

Binance Smart Chain has a markedly different decentralized application landscape as compared to Ethereum. There are significantly more users of the top BNB dApps, although there are a much lower number of highly used applications. Decentralized gaming and decentralized finance tools represent a significant portion of BNB’ss dApp offerings, but BNB offers far less in terms of marketplaces, collectibles, and exchanges.

Indeed, from the developer-perspective, building on BNB has benefits. Quick transaction speeds and low gas fees are advantages that BNB has over many other L1s, reducing costs and increasing efficiencies. These conditions are more conducive to transaction-intensive and high-network applications, such as games, which explains why BNB has quickly surpassed Ethereum as a superior L1 from which to build the future of decentralized gaming on. In addition, BNB’s compatibility with the EVM allows it to seamlessly integrate with many Ethereum-adjacent technologies.

One of the chief complaints against Binance is its lack of decentralization, coming from its consensus model. Its delegated proof-of-staking model features only 26 validators, whereas Solana and other L1s often have no upper bound to the number of validators. The reduction in processing speed comes at a security risk, which was unfortunately exploited just over the last few days, with nearly half a billion dollars worth of crypto tokens being taken by hackers exploiting a security vulnerability. For technically-minded readers, do note that the chain did not necessarily target BNB itself, but a cross-chain bridge. Stil, however, BNB is not considered the most secure L1.

The lack of security might explain its lack of development in NFT marketplaces. It would be devastating to BNB users if digital assets were stolen, which would be amplified by NFT marketplaces in which people sell digital assets they created or owned. If a malicious transaction were to occur, there may be no way of recovering the correct information or preventing the exploitation. Although games certainly have the potential to be hacked as well, they often represent smaller sets of funds per capita as compared to a valuable NFT.

Despite its scalability, and perhaps compounding with its centralization concerns, BNB does not possess much of the dApp momentum. BNB controlled 20% of TVL across all chains in early May 2021, now, it’s fallen to under 7%. Some of the most well-known and reputable dApps, such as Curve and Uniswap, function on competing chains. In response to these challenges, BNB outlined its transition from a single-chain to a multi-chain network that improves scalability and optionality for developers. Even then, however, dApps have not been keen to move over to BNB.

BNB Case Study: Gameta

Gameta is the most popular GameFi project on Binance Smart Chain, and for that matter, across all layer ones. However, it wouldn’t be accurate to describe Gameta as a singular game, like Minecraft or Call of Duty. Its mission is to gently introduce people to gaming on Web3 by mimicking a familiar Web2 user experience and hosting a variety of fun, simple games. For example, the most popular game, Ghost Run, is similar to Temple Run, where the user controls an avatar that seeks to escape from a ghost. Rewards are collected in the form of coins that can be used to earn NFTs. On aggregate, user traffic across all these games makes Gameta an extremely popular GameFi Project.

Gameta was actually originally built on Solana, before migrating to BNB in early August 2022. Before the migration, Gameta was already semi-popular, with about 31K daily users. Post-migration, however, Gameta became significantly more popular, with its user base increasing by nearly 500% in 7 days. The reasons for this rapid increase in popularity are not completely clear. One possible explanation is Binance’s popularity and centralized nature. Binance’s mission is to encourage people to use Web3 products through educational content, frictionless access, and investing in exciting crypto projects. Thus, when a project like Gameta is migrated to BNB and supported by Binance, user engagement to the project increases significantly. It’s like taking someone from off-stage to the spotlight.

Gameta’s rapid ascent in popularity highlights BNB’s pros and cons as a chain. BNB is well-integrated and easy for users to understand and access. Projects attempting to mimic the Web2 experience benefit from BNB’s large and relatively crypto-inexperienced user base. Yet many

signaling developers’ lack of trust in BNB’s security and a lack of excitement regarding its future.

Solana.

the young upstart, the spry contender, the speediest of the bunch

Solana Thesis: Out of the three chains we’ve discussed thus far, Solana is the true boom option. Solana’s highly-scalable, low-transaction-fee technology is promising, capturing developer and investor momentum alike. Solana’s dApp landscape, while nascent, is growing quickly, especially in NFT marketplaces and decentralized finance applications, especially as crypto users tire of paying high transaction fees and experience slow time to finality.

Imagine L1s to be one large family. Ethereum and Binance Smart Chain might be considered to be brothers with similar interests. Their cousin-once-removed Solana, though, has gone down quite a different path.

Solana’s consensus mechanism is a modified proof-of-stake with an innovative proof-of-history component that enables 3,000 transactions per second (although has a theoretical upper limit of around 700,000 tps). Thanks to that, and 7 other innovations, it’s one of the fastest L1s, processing more than Visa’s average 1,700 tps. In terms of scalability, Solana is a clear winner.

Unlike ETH and BNB, Solana’s smart contracts are written in Rust, which is notoriously fussy and difficult. These two facts lead to important implications for developers. Firstly, the learning curve is difficult, leading to less active developers and perhaps poses an obstacle to first-time developers. However, this often leads the existing developer base to develop more secure smart contracts with greater performance. Furthermore, Solana is not independently EVM-compatible, meaning that Solana dApps do not port to Ethereum. However, Neon Labs has developed a bridge enabling Ethereum apps to be portable to Solana - taking advantage of Solana’s throughput.

Ultimately, the dApp landscape on Solana is still emerging. Much like Ethereum, marketplaces and defi are two primary categories of dApps. So, why marketplaces and defi? Solana’s user base and TVL is significantly lower than Ethereum’s, but growing rapidly. The steady influx of users is often due to complaints about high transaction costs - with Solana a cheap, fast, and secure alternative. Many of Solana’s most popular marketplaces were developed to support cheap NFT trading, and have actually developed better multi-chain compatibility in the process.

But is the secret already out on Solana? Venture capitalists have flocked towards Solana, with nearly 50% of Solana’s value held in private wallets by the likes of Andressen Horowitz and Polychain Capital. That’s led to a spike in Solana’s value, which sat at around $260 about a year ago. However, Solana’s blockchain technology is truly promising, capturing developer and investor momentum alike. Solana’s price currently sits at $30, and while the current dApp landscape is limited, continued complaints about Ethereum may lead this alternative L1 to be the best long-term growth investment.

Solana Case Study: Magic Eden

Magic Eden is the most popular NFT Marketplace on Solana, capturing somewhere between 97 to 99% of daily Solana NFT transactions. As of August 2022, Magic Eden has begun offering Ethereum and other chain-compatible NFTs. While OpenSea still remains the largest NFT marketplace in terms of daily transaction volume, Magic Eden’s dominance on Solana and emerging presence on Ethereum is impressive and highlights Solana’s potential benefits.

Magic Eden differentiates itself by its focus on a remarkable user experience, presenting itself as an immersive way for users to engage with the best Web3 content available. Solana’s rapid transaction speeds and low transaction costs enable users to focus on acquiring and selling NFTs and Web3 assets. But Magic Eden has expanded beyond just being an NFT Marketplace, increasingly offering a diverse mix of gaming NFTs and even games themselves.

The team behind Magic Eden deserves recognition for leveraging Solana’s unique benefits. Its transaction capabilities enable applications to quickly draw users over from less-scalable, more-transaction expensive chains, but its potential to support transaction-intensive projects such as gaming allow Solana dApps to have an especially high ceiling.

Conclusion.

We are beginning to see application specific verticals develop across monolithic chains. While Ethereum’s decentralization and security encouraged development of DeFi and token liquidity applications, BNB’s speed and consumer-friendly presence has allowed it to develop as a retail gaming chain. Solana’s highly scalable, low transaction fee environment has led to a booming NFT ecosystem alongside increasing adoption of decentralized finance and gaming.

Although other chains are not discussed in detail within this piece, we are seeing application traction across other chains as well. Avalanche chain has two subnets dedicated to gaming, emerging as another low-cost, high-speed network. Polygon and NEAR are two additional layer ones with gaming and consumer-facing applications that are increasing in popularity.

As the application ecosystem matures, Artemis will continue to keep the community appraised of the most important developments in blockchain activity.

more to come