Stablecoin Marketmap - November 2024

Stablecoins are at all time highs. Stripe acquired Bridge for $1B. Tether had $4.5B in Q1'24 profit. How can you invest behind this trend?

Summary

Stripe bought Bridge.XYZ $1.1B after Bridge raised $50m from Sequoia, Ribbit Capital, and Haun Ventures. That’s nearly a 10x for Series A investors in <1 year.

Yellow Card raised a $33m Series C to shift towards B2B payments for stablecoins and announced they serve over 30,000 businesses with 8 figures in revenue.

Meanwhile, stablecoin on-chain metrics are surpassing or reaching all-time highs. We showcase the quantitative and qualitative in the report with Castle Island Ventures + Visa.

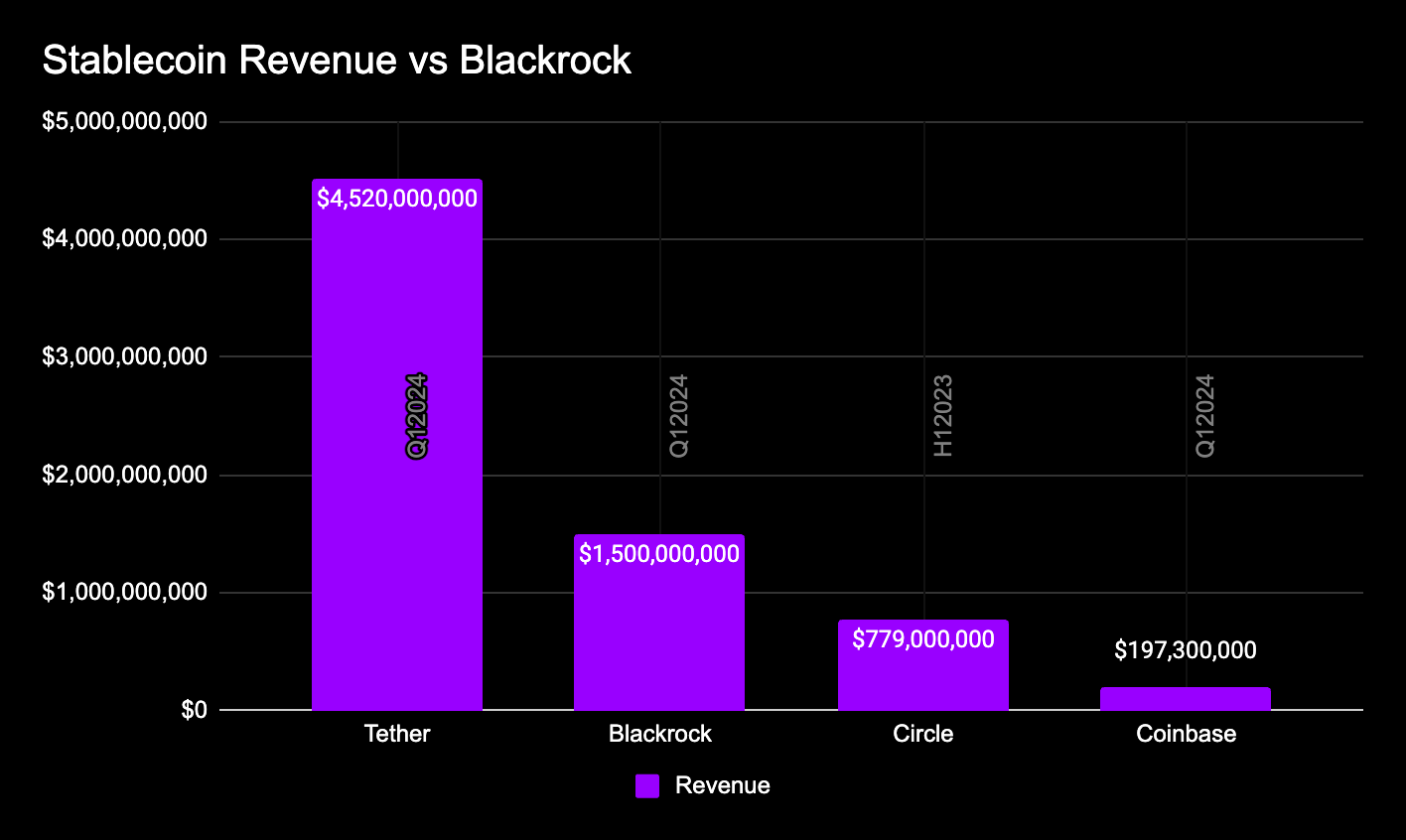

Historically, investors have argued that stablecoin issuers are the primary beneficiaries of stablecoin adoption.

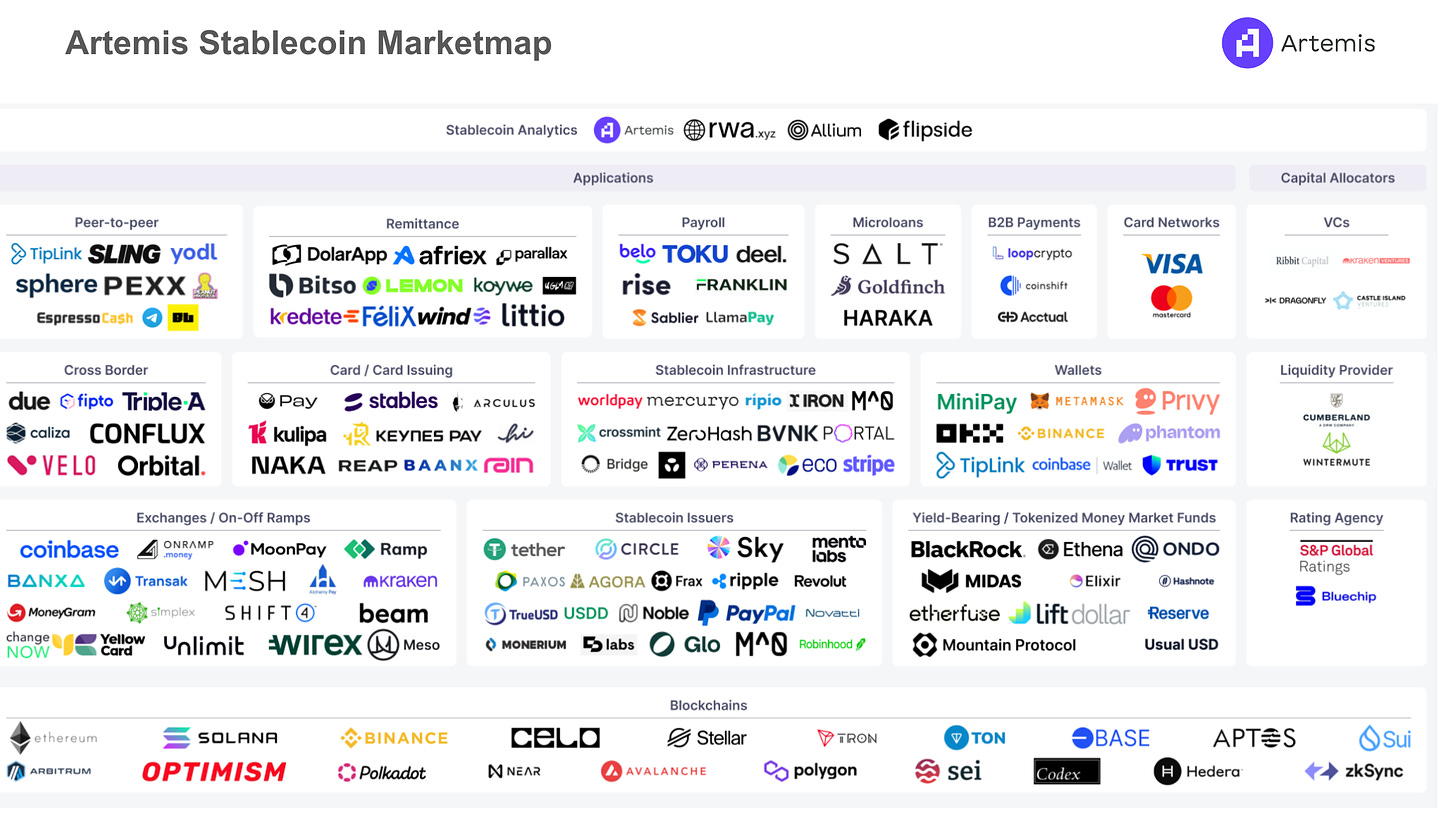

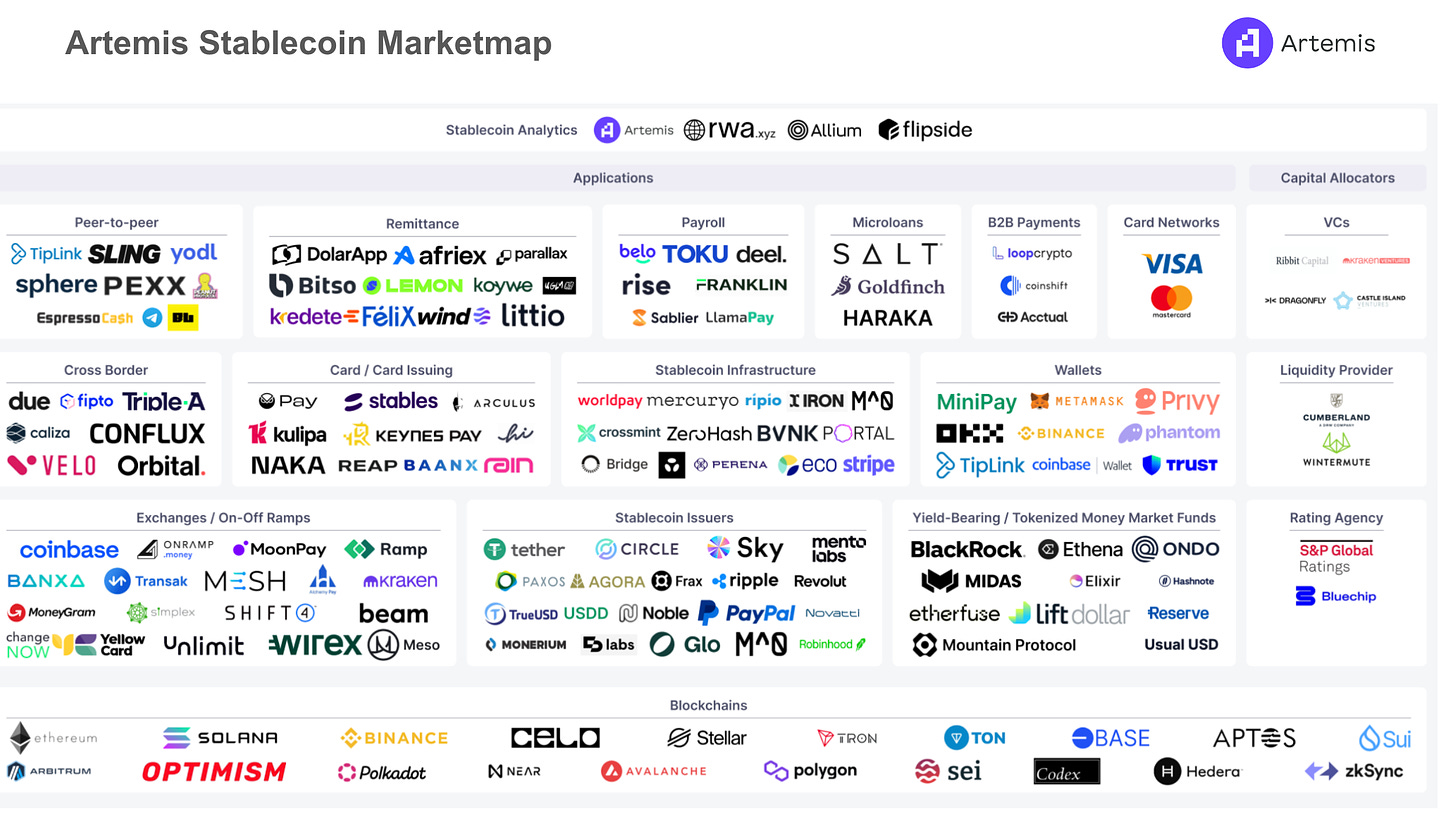

There’s been a paradigm shift in 2024: fintech apps, networks, infrastructure, on/off ramps, and analytics are starting to drive and accrue value as stablecoins proliferate.

We found many businesses we believe will accrue value as stablecoins proliferate. Today, we share our research with the rest of the community.

Here is the LIVE and open source market map: If you’d like to add a company, please DM Crystal Tai

Introduction

“Even if we just got stablecoins, we did something really useful” -Nic Carter

Satoshi wrote about a peer-to-peer electronic cash system that’s completely decentralized with no central servers or trusted parties. We believe in 2024, we are moving closer to that vision and that stablecoins are THE killer use case for blockchain networks.

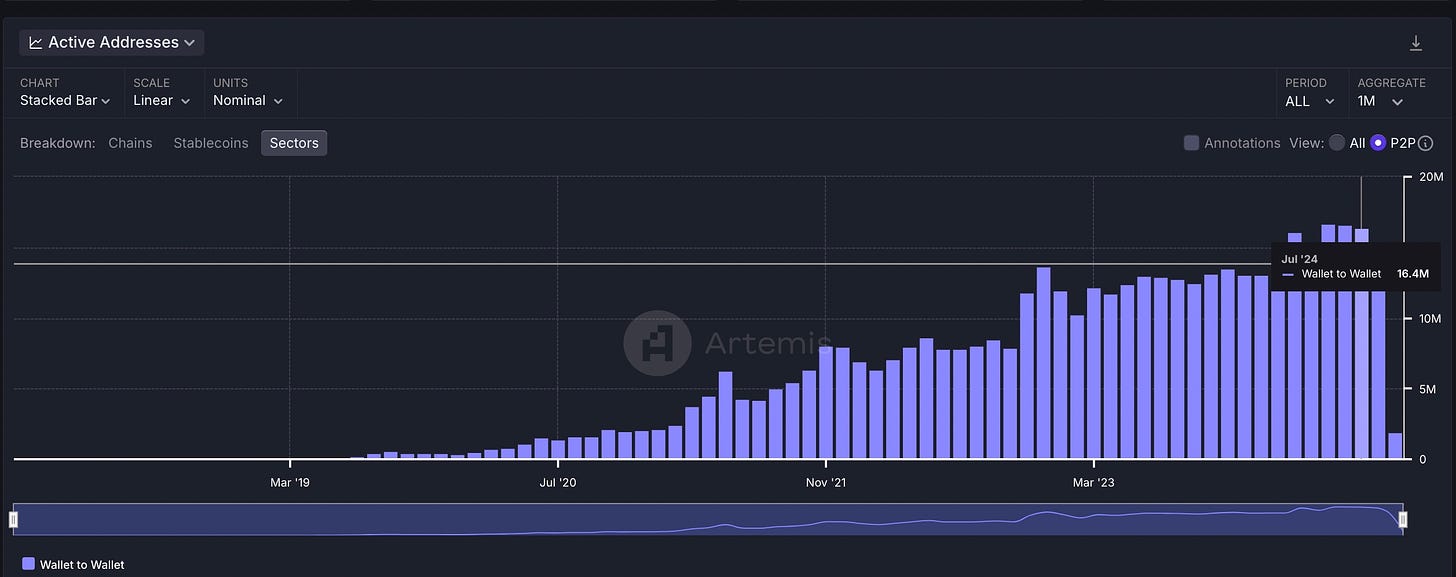

Stablecoins enable anyone worldwide to transfer value, accept or make payments, and protect themselves from high inflation. Onchain data shows massive growth in supply, transfer volume and active addresses. To confirm these trends, we spoke with a few users in Lebanon, India, and the US who verify these claims. Castle Island Ventures just published Stablecoins: The Emerging Market Story a report powered using Artemis onchain data and showing growing real world use cases of stablecoins in emerging markets.

Stablecoins are gaining mainstream adoption.

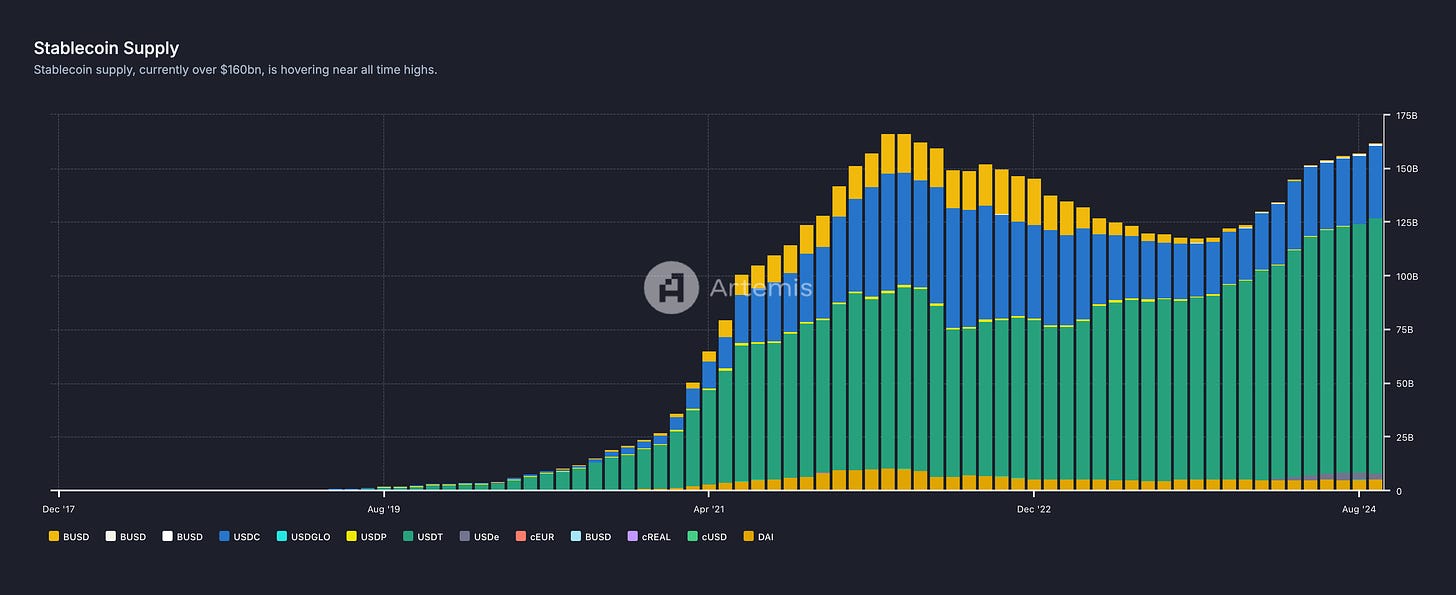

While crypto goes through bull and bear markets, stablecoins continue to hit or approach all-time highs across numerous metrics:

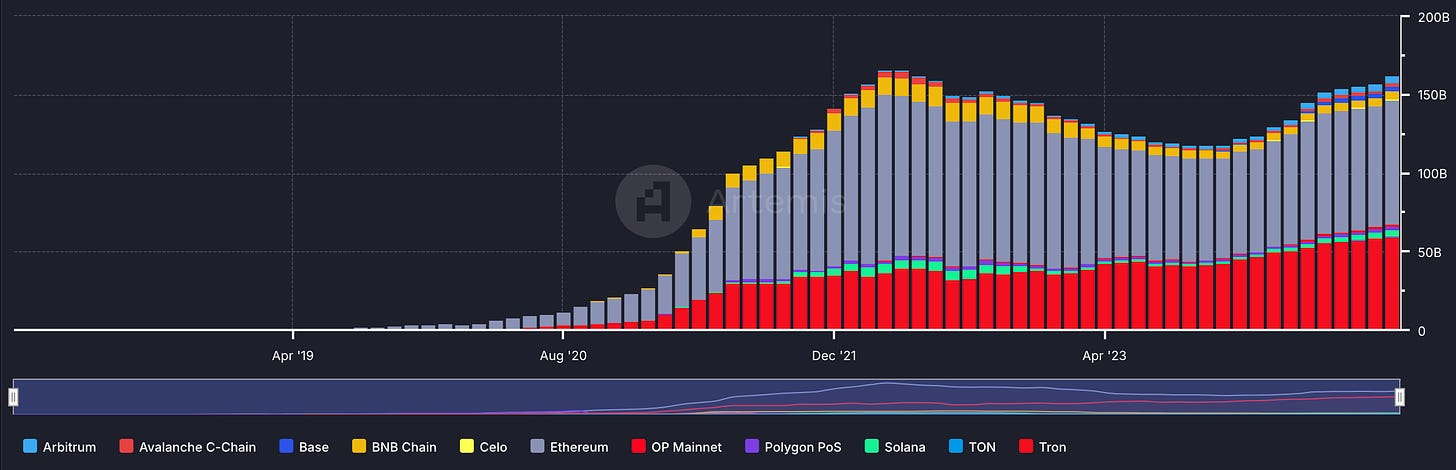

Stablecoin Supply is over $160bn — near all-time highs.

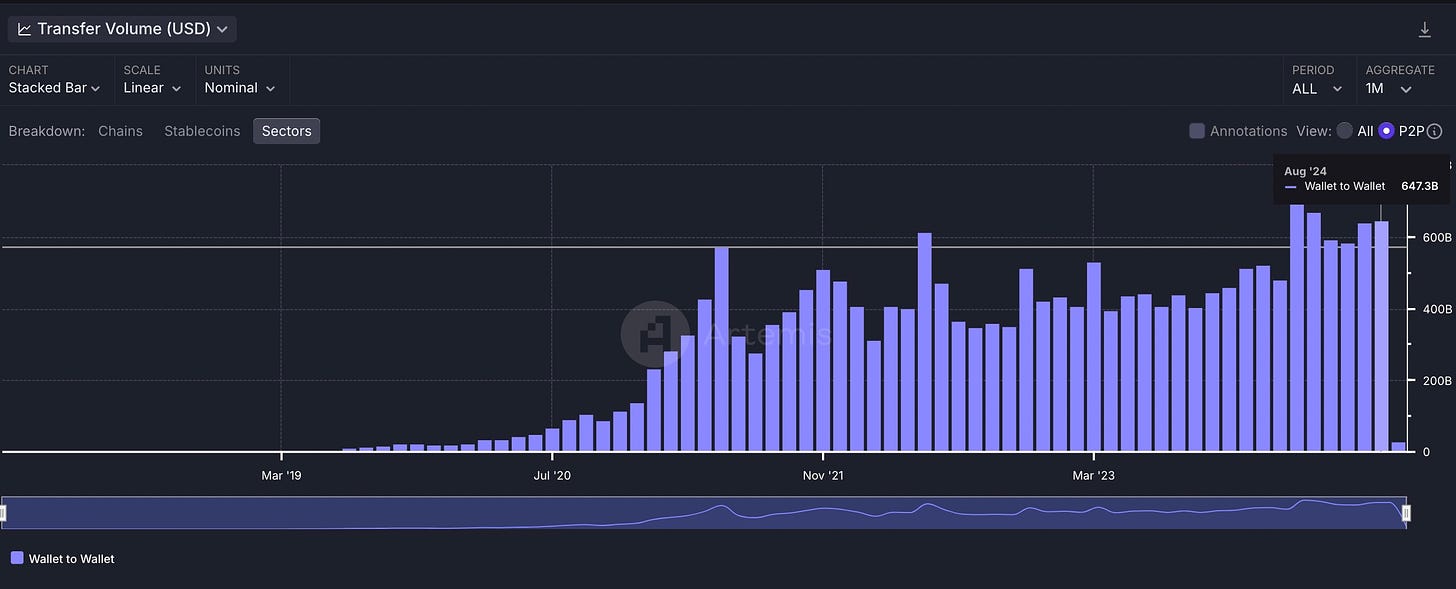

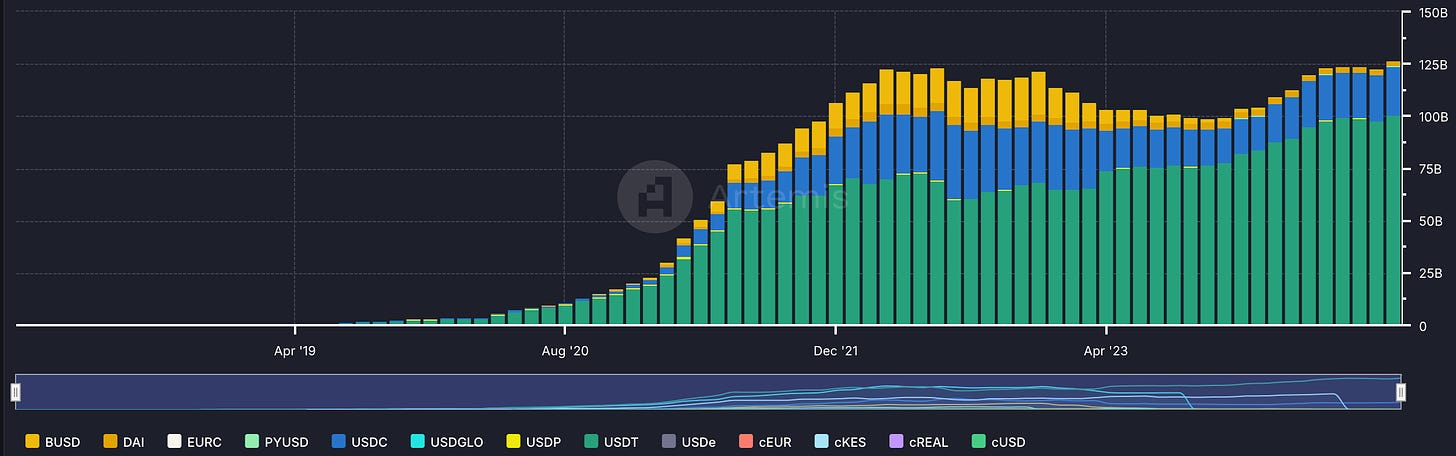

>16 million monthly active addresses in May - July 2024, sending stablecoins from wallet to wallet, displaying peer to peer payment like behavior — an all-time high.

Stablecoin Transfer Volume for P2P reached over ~$700B in March ‘24 — an all-time high.

Investors Are Taking Notice

The conventional wisdom is that investing in stablecoins is challenging: they are, by definition, pegged to a fiat currency. Most conversations with investors revolved around the value ultimately accruing to the stablecoin issuer, like Circle and Tether.

Circle shared they had $779mn of revenue in H12023 and Tether did $4.52B of net profit in Q1’24 (3x that of Blackrock’s $1.5B of net income in Q1’24).

But this is changing. In August 2024, crypto-related payment companies announced that they would receive over $100 million in funding. One example, Bridge.xyz announced they have stablecoin customers like SpaceX and Bitso, indicating the broad demand for stablecoin like products.

In our research, we find many companies accruing value in the stablecoin space. Today, we share our research with the rest of the community.

In our market map today, we hope to educate investors and the community that there are multiple ways to invest behind the proliferation of stablecoins globally. While some are private companies, others are public blockchains or tokens.

Stablecoin Value Accrual Chain

Blockchains

The foundation at which stablecoins settle is the blockchain.

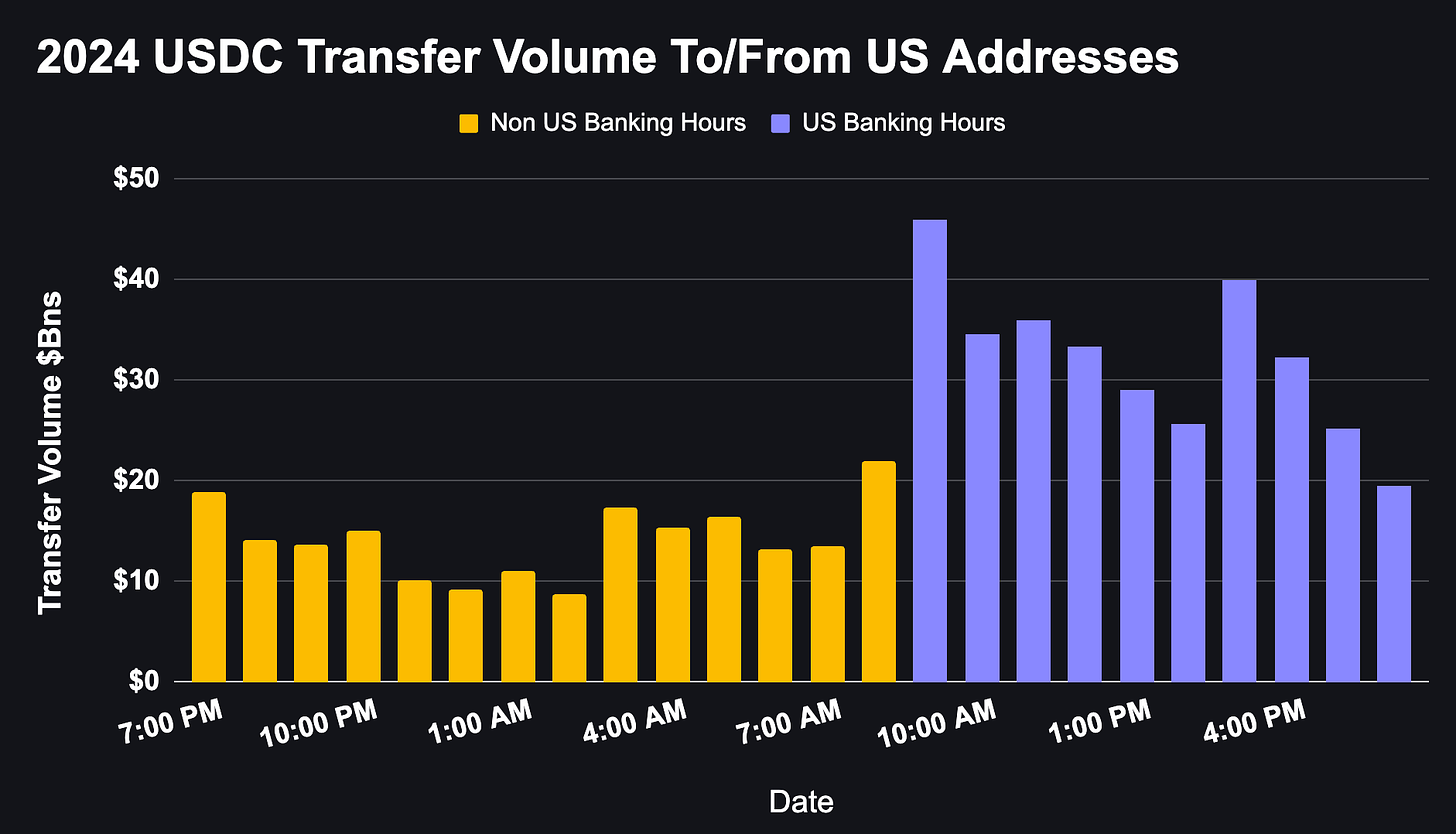

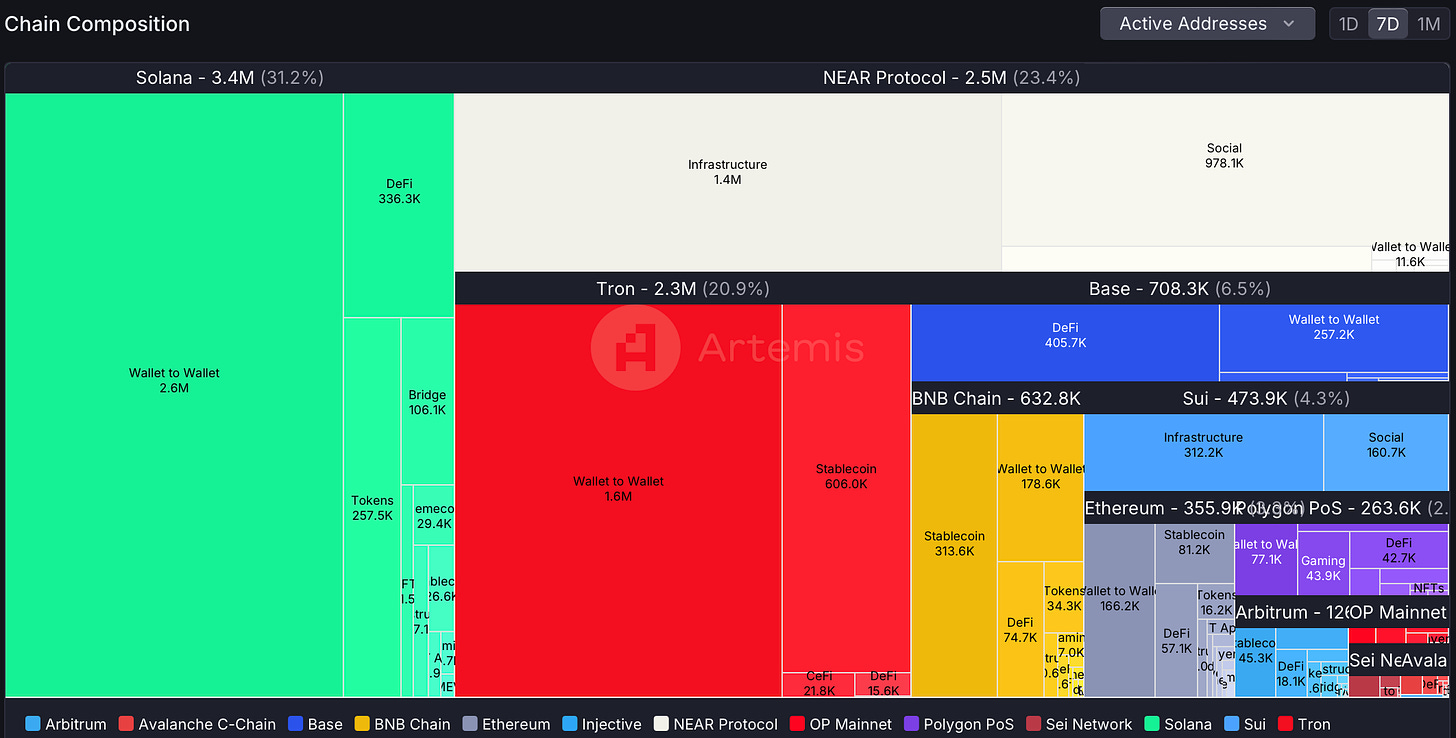

Blockchains play a fundamental role in facilitating transactions with stablecoins. Stablecoins ultimately settle on blockchains, which serve as the public and open ledger for anyone to verify transactions. Blockchains run around the clock and are “always” on. When looking at US transfer volume of USDC, we see activity peak during US banking hours, but also significant activity when US banks are closed.

Source - Internal Artemis Data

While most of the stablecoin activity has been on Ethereum, new chains with faster block times and lower fees have allowed stablecoin growth to increase. These chains, which have faster block times and lower fees, include Solana, Tron, TON, Base, Celo, Stellar, and the BNB chain. New chains are continuing to pop up, as Sui just announced their partnership with Circle.

We are also faced with the question of how blockchains accrue value. If stablecoin supply grows on a network, does that mean network price grows as well? TRON price and circulating supply have seen a very close correlation as stablecoin supply increases, indicating a correlation between the two.

Stablecoin Issuer

A stablecoin issuer is a company or entity responsible for creating, distributing, and managing stablecoins. The issuer backs each stablecoin with a reserve asset, such as cash or equivalent, to ensure the stablecoin’s value remains consistent. The role of a stablecoin issuer typically includes issuing/redeeming stablecoins, managing reserves, transparency, and compliance/regulation.

Tether is the top issuer in the stablecoin space with reported over $5bn of net profts for H1 2024. Circle is also considering an IPO at a valuation of around $5bn.

There are also yield-bearing stablecoin issuers like Mountain Protocol (~$48m circulating supply) that offer yield to holders. Often, these providers capture the spread between the assets they hold and the interest they pay out.

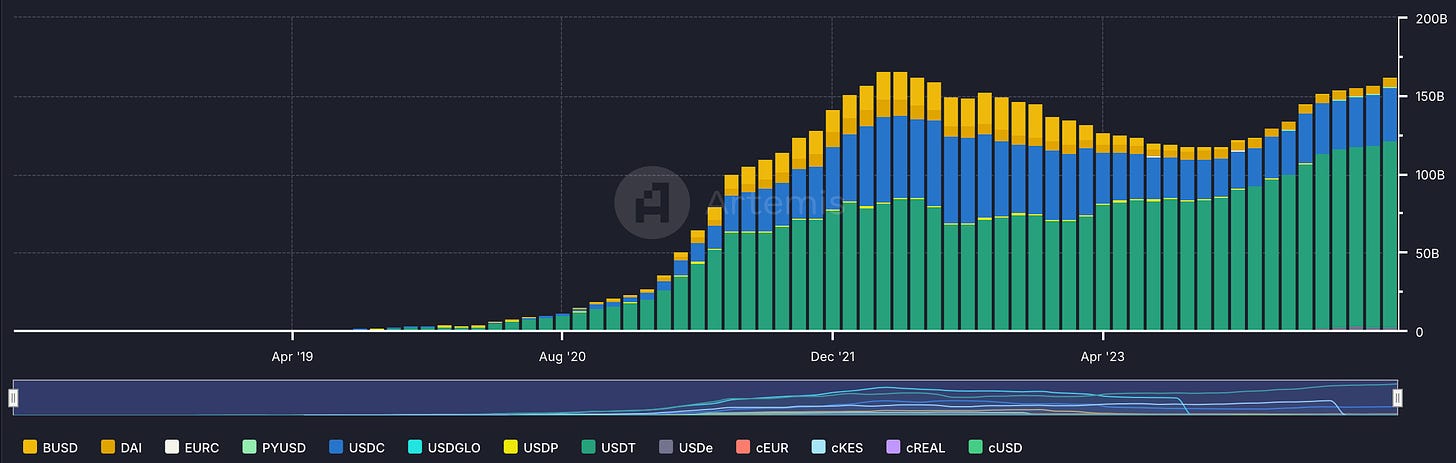

Stablecoin Supply by Issuer

Stablecoin Infrastructure

Infrastructure needs to exist to allow stablecoin issuers to easily launch stablecoins compliantly and for apps that want to leverage stablecoins to be able to move to and from fiat and crypto easily. These players sit in the stablecoin infrastructure layer.

On the fiat side, companies like Bridge.xyz and Brale.xyz provide tools like APIs and infrastructure for developers and teams to enable the movement of money between fiat and stablecoins. These fiat stablecoin infrastructure players enable companies to accept cross-border payments, issue their own stablecoins, and provide easy tools to move money. These firms typically handle the regulatory, compliance, and technical components which can be costly and very time consuming.

Time Savings: For example Glo Dollar (stablecoin for funding public goods, ) was able to issuer Glo Dollar in a few weeks versus 6 months.

24/7/365 Access: Users are now able to make stablecoin transfers around the clock, with these providers like Bridge serving as the backend infrastructure.

On the onchain side, companies like Perena and M^0 enable scalable issuer proliferation without liquidity fragmentation. These decentralized protocols position themselves as the money middleware for stablecoin issuers.

OnRamps

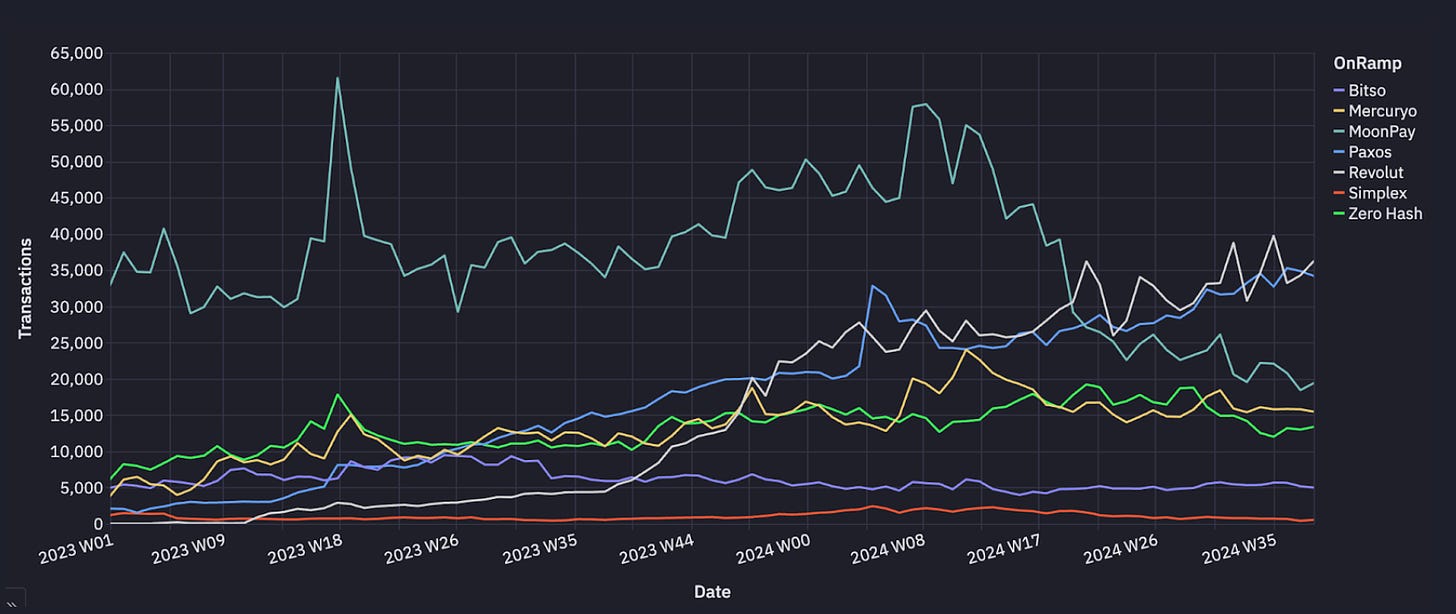

Crypto Onramps like MoonPay and Transak allow users to purchase cryptocurrencies directly using traditional payment methods, such as credit/debit cards, bank transfers, or mobile payment solutions. Often users crypto is onboraded into wallets like MetaMask and Coinbase Wallet and bypass traditional exchanges. These firms often take a small fee to account for providing infrastructure, KYC processes, etc. As seen below, crypto on-ramp activity on Ethereum has been steadily increasing since 2023 of major players.

Crypto On-Ramp Activity - Ethereum

Source - Internal Artemis Data

Cross Border /Remittance/P2P

These companies allow easy transfer of funds from different regions. Often these apps are designed in an intuitive way and often hides the “crypto” aspect from users. These companies charge much less than traditional remittance companies and often offer better rates. As shown below, stablecoin transfers from Coinbase/Kraken to Bitso, a Mexico City based exchange, indicate a growing way of stablecoins being used for remittances.

Source - Internal Artemis Data

P2P crypto transactions, often referred to as “global venmo” are global way for users to send money, and companies like TipLink and Sling offer extremely easy UI for anyone to accept payments via crypto rails. Often, users of these products do not know they are accepting crypto, making for a seamless experience.

Monthly P2P Stablecoin Transfer Volume by Stablecoin

Wallet

Wallets allow users to take a self custody approach to their crypto. These wallets typically work across multiple networks and allow users to hold a myriad of assets. Often, wallets have embedded fiat to crypto onramps located within them. According to Artemis data, Wallet to Wallet transfers are the largest use case of blockchains.

Here is an example of a seamless transfer using Sphere. The user selects what type of transaction they want to make (Fiat → crypto, crypto→ crypto, etc), how they want to send it (Wire, ACH, SEPA) and within a few minutes the transactions is settled.

Card/Card Processors

Crypto credit cards and the card processors are working together to allow users to pay with crypto. This is a valuable service that allows for users to stay within the crypto ecosystem, without having to convert back to fiat. Companies like Visa allow for the settlement of stablecoins between consumers and merchant acquires.

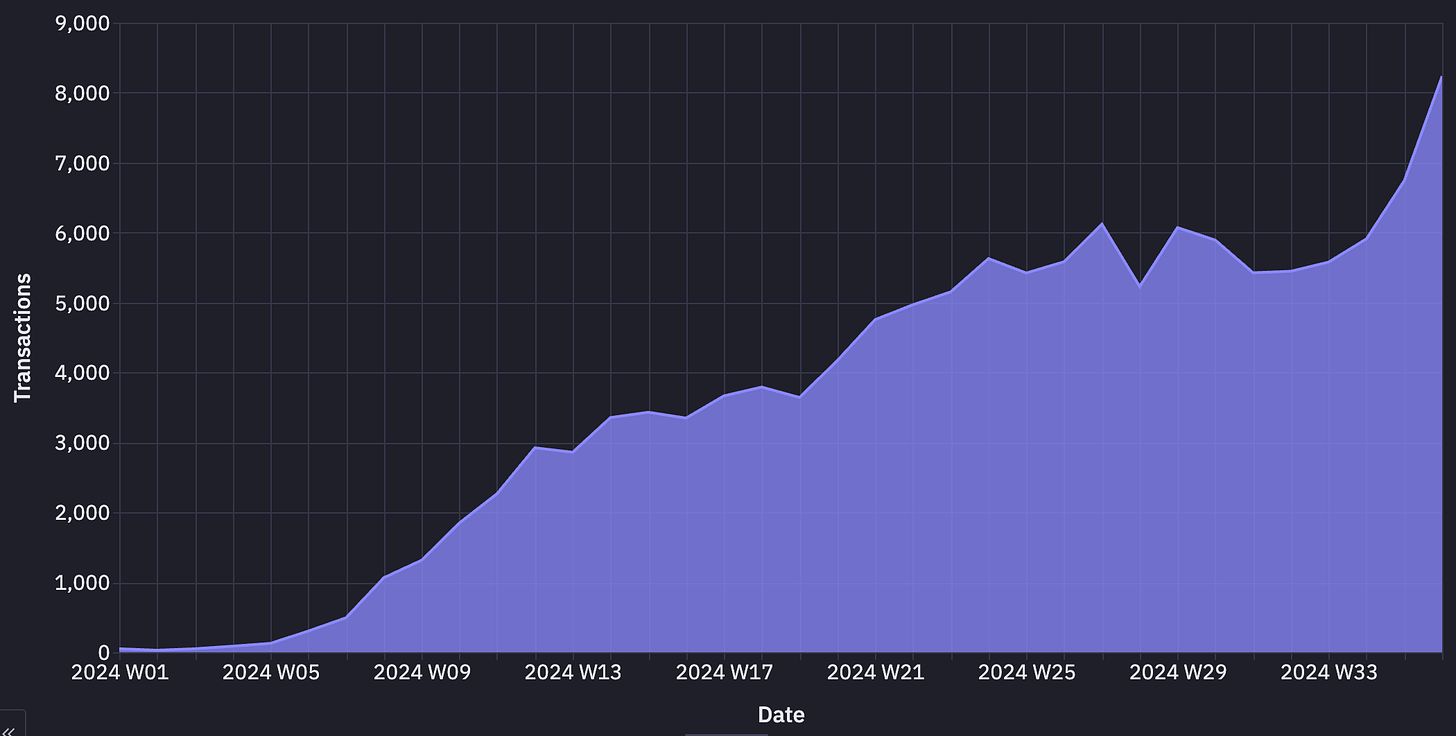

Gnosis Pay launched a Visa card last year which allows European users to make credit card transactions via their Gnosis safe. While adoption is still small, Gnosis Pay has seen consistent week/week growth in almost all metrics.

Gnosis Pay Weekly Transactions

MicroLending

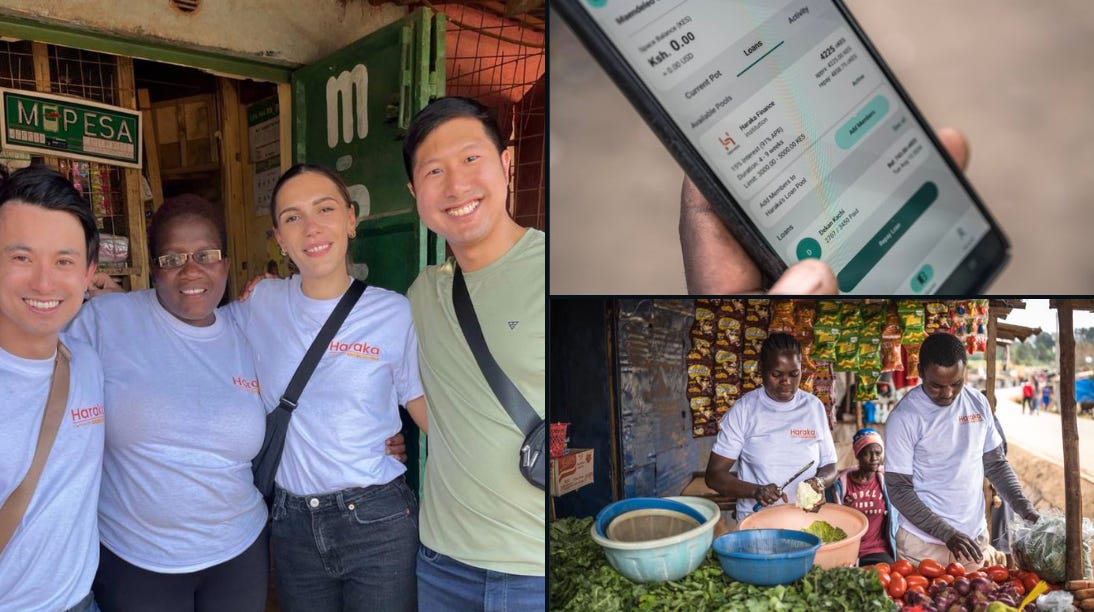

We travled to Nairobi to see microlending over the blockchain, and were amazed at what we saw.

These companies extend loans to small businesses or individuals via the blockchain. Companies like Haraka and Goldfinch are offering loans to businesses in emerging markets with lending rates lower than traditional banks. Due to the nature of the blockchain, money can be transferred almost instantly and at a much lower cost.

Payroll

These companies allow users to receive crypto as part of their employment. As the global economy expands and users work remote, there is an increasing need to have a global financial system where users can receive funds in a quick and efficient manor. Numerous systems are experimenting with real time payments, where users can be paid weekly, daily or even stream by the second.

Ravi Kiran, Head of Growth, shared why freelancers accept stablecoins:

“A freelancer whom I worked with from an emerging country, recently got paid in USDC; she kept talking about how brilliant was this instead of the local currency (Tax saving, non-volatile, and much higher in value than local currency). I never knew every payment had a story associated with them till that moment. Now 2 months later, she only accepts in stables. The moment, commerce gets enabled Circle, Tether will be even more powerful.”

Stablecoin Analytics

Artemis along with our friends at Allium, RWA.xyz, Flipside provide stablecoin analytics. Allium launched the Visa Onchain Analytics dashboard with Visa and RWA surfaces many key metrics across stablecoins and stablecoin issuers.

We believe as the stablecoin market grows, interest in understanding what’s driving stablecoin usage will only grow.

What’s Next for Stablecoins?

Inflation continues to climb in 2024 and with stablecoins as the #2 use case outside of trading according to the CIV / Visa / BHD stablecoin report, we think stablecoin adoption will only continue to grow.

We think we’ll see network effects where the more friends / family / businesses use stablecoins in a region, more people locally will use stablecoins like Global Venmo, which ultimately creates more liquidity in network. We also believe there will be US regulation to support the continued demand for US dollars through stablecoins.

While most of the stablecoin supply today is USD-denominated, we expect non-USD stablecoins to see adoption. Euro-backed stablecoins are starting to see an uptick in circulating supply. Bitso recently announced a peso-based stablecoin, MXNB.

Yield-bearing stablecoins have gained interest and are significant sources of US Treasury holders. Ethena introduced a novel delta-neutral yield generating mechanism and was one of the fastest-growing stablecoins ever.

How Artemis Can Help

Artemis provides stablecoin analytics to help users and businesses understand how people use stablecoins. We collaborated with Nic Carter and his team at Castle Island Venture on the most comprehensive stablecoin report ever by providing on-chain metrics.

If you are curious about the stablecoin space or need help analyzing stablecoin adoption, please feel free to reach out! We are on X.com, or you can email us at team at artemis dot XYZ.

Thank you to Anna at Perena, Isaiah Washington, the Castle Island Ventures team, Peter Schroeder, EffortCapital, and others for your input! Thank you to everyone on Twitter who added suggestions as well.

Amazing report - long overdue and congrats to Artemis for putting it together.