Digital Finance Fundamentals 05.20.2025 - Should Coinbase buy Circle?

Coinbase buying Circle for $5B? Does REV or Revenue matter for blockchains?

Hey Fundamental Investors,

IPOs and M&A are in full force for fintechs and crypto. I write this week about why Coinbase buying Circle at $5B isn’t crazy in our stablecoin update.

We started Artemis because we wanted to build a data platform to find what tokens we could buy and hold and let the token compound 20-30% IRR for 5-10 years. Each week we dive through tokens or stocks in digital finance — fintech / onchain finance.

This past week has been a particularly eventful week for digital finance:

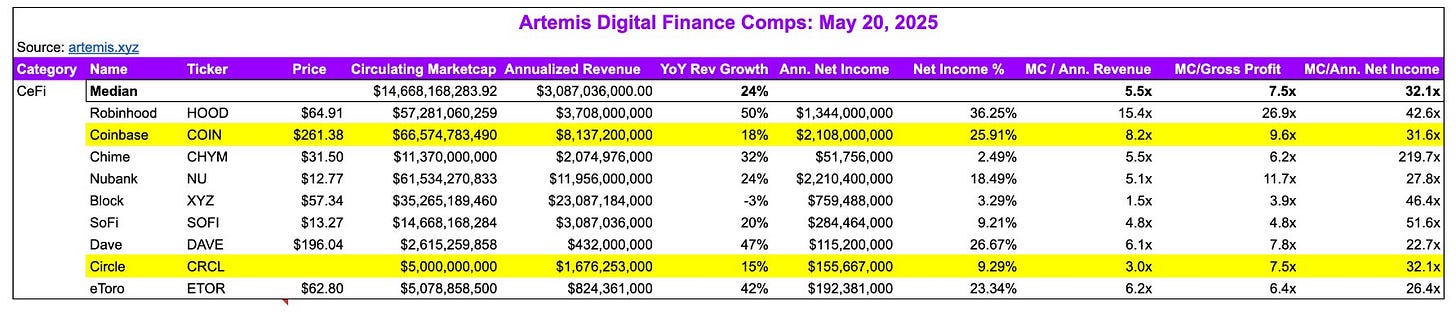

eToro went public at $5B. eToro is a trading platform w/ 37% of gross profits from crypto trading and trading at 6.4x gross profit

Chime (fintech with mobile banking app) dropped their S-1 and is trading at ~$12B on secondary markets with $1.6b annualized revenue run rate (most recent quarter * 4) growing 32% and trades at 6.2x gross profit.

Coinbase was added to the S&P500, but was hit with hackers bribing Coinbase staff. Coinbase trades at 9.6x gross profit, growing revenue 18% YoY.

Robinhood acquires WonderFi in Canada to expand markets for ~$184M. Robinhood trades for 26.9x gross profit growing 50% YoY.

Believe launched allowing web2 projects to launch tokens over the weekend reaching ~$4.75m in daily fees and Believe run-rating almost ~$490m fees. Fees have fallen off significantly since down now to ~$417k daily fees.

Axiom, trading platform on Solana leveraging Hyperliquid USDC, MarginFi for savings and rewarding SOL for traders, is growing quickly and over the weekend was generating nearly ~$2m daily fees (~$730m annualized)

Hyperliquid, is highlighted in Bloomberg’s recent article “Hyperliquid Grows Into a Major Player in Crypto Derivatives”.

IPO season is here with the US and China 90 day trade tariff pause and US recession chances plummeting from 66 cents to 40% cents on prediction markets.

Markets have swung positive particularly for crypto / fintechs and fever around stablecoins is at its peak with the GENIUS bill just passing the senate and now moving to the house.

We believe a brighter near term market outlook will lead to more trading / investing volume which should drive fintechs / crypto companies so its important to look at fundamentals.

1. Fundamentals Update

We argued last week that the only thing metric that matters for protocols and fintech is revenue.

It’s been encouraging to see protocols guide towards revenue targets like EtherFi with their Defi-enabled credit card AND leaning in the Fundamentals narrative w/ “Fundamentals season is coming.”

Here’s a paragraph from EtherFi’s announcing their approach to be a DeFibank:

Our colleague El Barto built a really cool chart last week showing 30D change of price vs 30D change of revenue. In particular Maple ($SYRUP) which has seen its revenue grow quickly seen its price grow considerably as well.

While not all tokens will move just on revenue / fundamentals, we believe that we’re continuing to move towards this path.

The CT and markets seems to be a lot more sober this time around with breakout apps like Believe — Cobie summed it up well here: getting a memecoin with no rights isn’t as interesting early stage equity or token into projects with legal rights.

Volumes and daily active users of Believe have fallen from its height of $1B daily volumes and 100k+ DAUs

.

There was a lot of debate on Crypto Twitter about how L1s should focus on maximizing REV (Transaction Fees paid by users + MEV Tips).

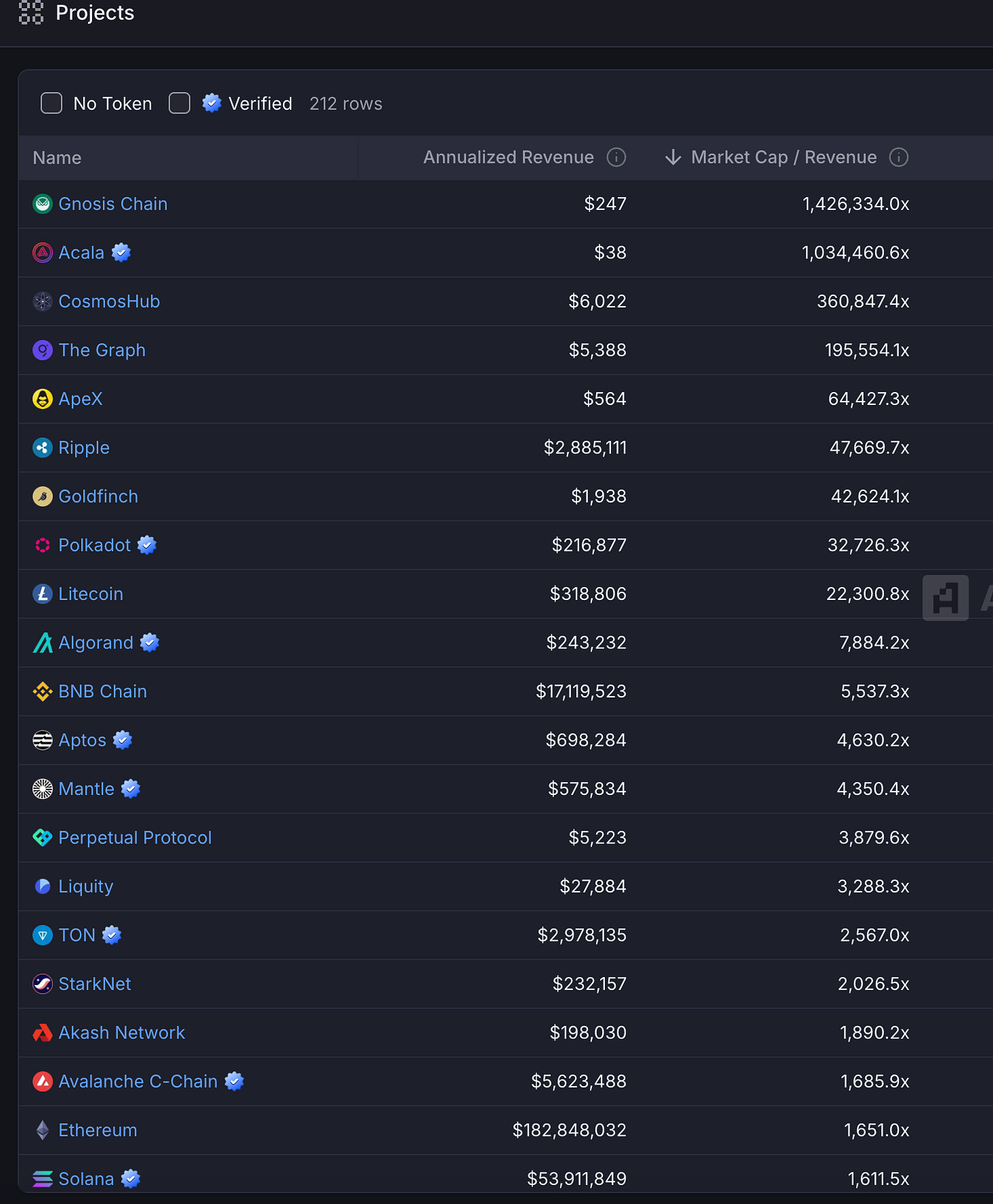

Blockchains clearly don’t trade on Revenue — 1,000X+ multiples just doesn’t seem to make sense and how investors would underwrite blockchains.

We took a look at annualized the REV metrics that Blockworks built out and came to a similar conclusion that given how wide the multiples trade from 39x Tron to even a 4,651x Aptos, the market simply isn’t using REV as the core driver of price today for L1s / L2s.

We think some form of GDP metric for each blockchain that is a sum of application revenue, consumer adoption and goods and services is ultimately how institutional investors will allocate towards L1 / L2s. Stay tuned as we build this piece out.

2. Market Update

Bitcoin was the top performer in the last 7 Days at +3.8% .

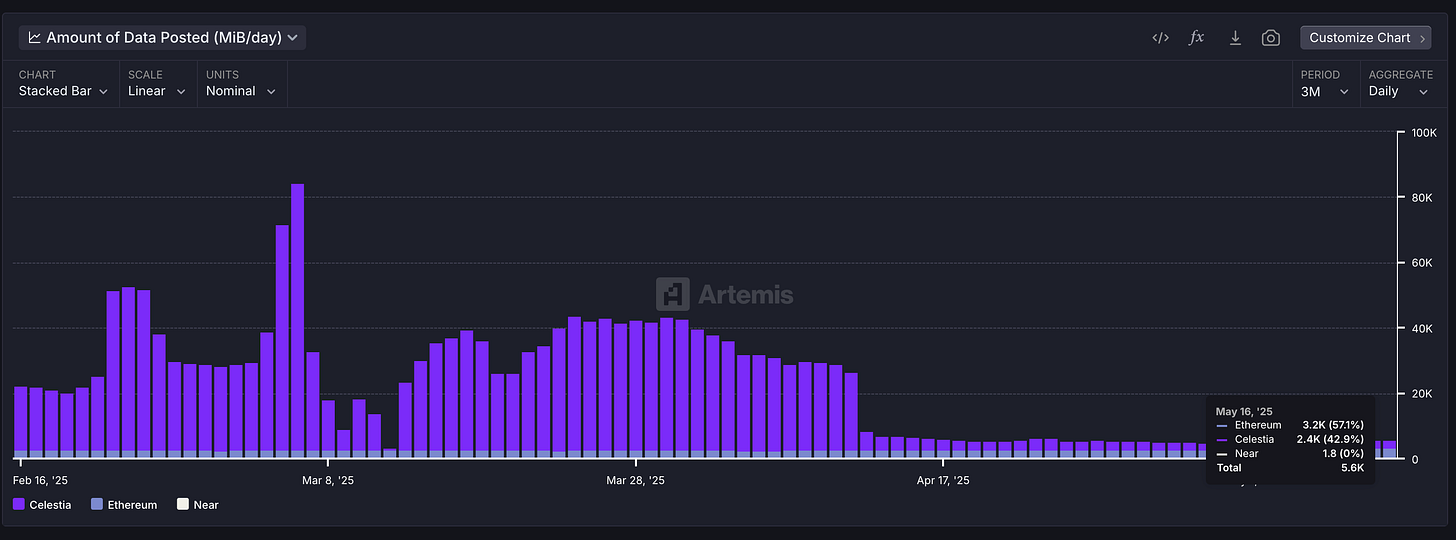

Data Availability tokens like Celestia were particularly hit hard, down ~29% in the last 7 days. The drop coincided with the sharp decline in Celestia's DA usage as the "tapping game" on the Eclipse platform was a heavy user of Celestia for data availability.

Zooming out, YTD the best performer assets have been core DeFi protocols like Ondo +330%, Sky / MakerDAO +14% as RWA becomes a core focus for the industry.

3. Stablecoins Update

Stablecoin Supply sits at ~$240B up 48% YoY and the GENIUS bill passes the Senate.

There are rumors that Circle is looking to sell for $5B to Coinbase or Ripple or another party.

Circle selling for $5B to Coinbase… isn’t crazy!

Coinbase is $66B marketcap, $2B in net income run rate, trades for 31.6x PE.

Circle at $5B marketcap, $155M in net income, trades for 32.1x PE

But with the GENIUS bill passing, USDC and stablecoins are only going to grow -- today USDC Stablecoin supply is ~$60B of marketcap and with 4.5% fed fund rate, USDC generates Circle $2.7B in top line.

If you believe

1) US Stablecoins are only going to grow as the global demand for dollars increase for merchants and consumers to pay for goods and services globally

2) There will only be a handful of stablecoin issuers in the end state (see Pareto Principle)

It's not hard to believe that the Stablecoin Marketcap will grow to AT LEAST $1-$2T in the next 3-5 years and USDC will maintain at least its share of 25% which translates to $250-$500B in the next 3-5 years.

YES interest rates are declining -- Circle makes 99% of revenue from reserve income which is a core concern as average 3 month T-bills have fallen from 5.28% in Q4'23 to 4.40% in Q4'24 and Kalshi prediction markets forecast 2 cuts in 2025.

But stablecoins are growing FASTER than interest rates are declining.

Even at 3% blended fed funds rate, on $250B of USDC stablecoin supply, that's still $7.5B of annualized revenue and assuming a 25-30% net income margin that Coinbase is able to maintain post acquisition, that's an additional ~$2B of net income and another ~$60B of marketcap for Coinbase.

Coinbase acquiring Circle would mean no more revenue share and majority of reserve revenue going to Coinbase.

Note, that we don't include the fact that Circle owns the #1 onchain bridge in CCTP that does $50B annualized bridge volume.

Circle today primarily makes $ from reserve income and Coinbase makes 86% of revenue from taking bps on trading volume from consumer trading.

Circle + Coinbase could be the most institutional / well regulated exchange and stablecoin issuer in the country and benefit from a pro-crypto / stablecoin regime over the next 3-5 years AND benefit from growing crypto trading volume and growing stablecoins.

In short, if you're bullish stablecoins and believe there will only be a handful of stablecoin issuers in the end state, Circle could generate $2B of net income in 3-5 years for Coinbase and at 32x PE, double Coinbase's marketcap of ~$66B by adding $60B of marketcap.

If the acquisition happens, I’d imagine investors will view Coinbase as one of the best pure play bet on stablecoin growth in the US.

Cheers,

Jon

The authors of this content, as well as affiliates of Artemis Analytics, may have financial interests in the protocols or tokens mentioned. This does not constitute investment advice or a recommendation to buy, sell, or hold any asset. The information provided is for educational purposes only and should not be relied upon for financial, legal, or tax decisions. Readers should assess their own circumstances before making any financial choices. Views expressed may change without notice, and Artemis Analytics is not liable for any losses resulting from the use of this content.