Artemis.xyz Weekly Ecosystem Wrap-up (12/16/2022)

your go-to source for weekly fundamental updates

note: all analyses in this document created using the Artemis Sheets plug-in ✌

halfway through the last month of the year! hope everyone is starting to wind down for the holidays and makes time for friends and fam 🎄🎊🎿

meanwhile crypto keeps rollin

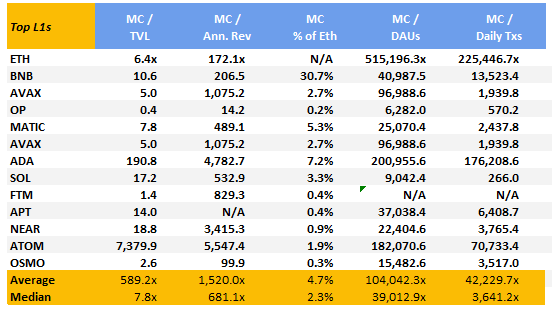

L1 Overview & Highlights

This week saw a slow bleed in asset prices as the L1 ecosystem saw a 7D median and average decline in prices of 2.3% and 3.3%, respectively. With that said, prices have actually seen a bit of a recovery over a 30 day time horizon (roughly a month after the FTX collapse unfolded) with median and average gains of 4.5% and 5.4%, respectively.

Weekly active developer activity has begun to climb back up with Optimism, Arbitrum, Solana and Aptos seeing 30%+ CoreEco Commit increases over the past 7 days.

There was muted movement in TVL and stablecoin volume across all ecosystems, with virtually zero change in activity over the past 7 days (average stablecoin volume and TVL 7D change of ~0%).

ecosystem highlights below 👇

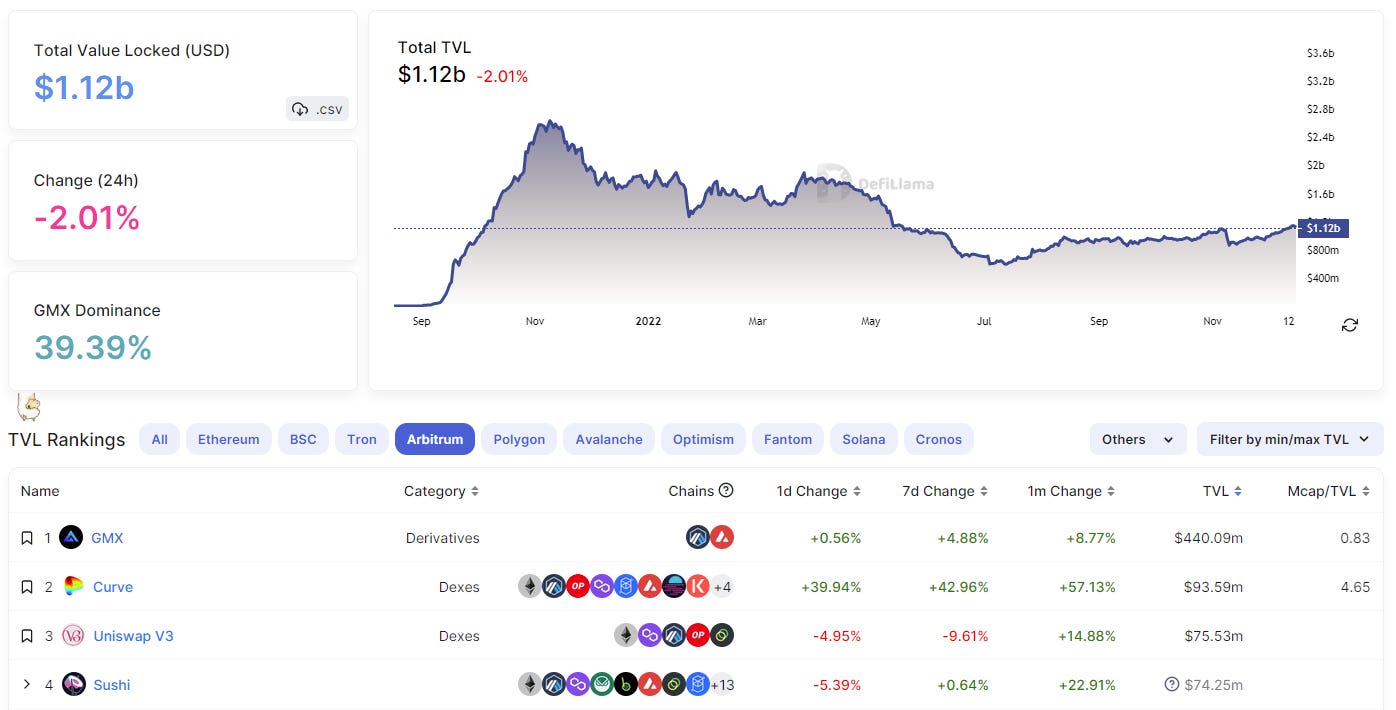

Arbitrum

Arbitrum was the only blockchain ecosystem with positive TVL growth over a 90 day time horizon. The layer scaling solution saw 21% 3M growth in TVL from $0.9bn to $1.1bn while the median of its peer set saw TVL declines over the same period of ~30%.

A meaningful amount of value was driven by user adoption and liquidity inflow to GMX after the collapse of centralized exchange FTX. GMX saw TVL inflows of ~9% over the past month, generating ~$40mm of Arbitrum’s liquidity inflow over the past month.

Quick Application Highlight🥳🤠: GMX (also featured in this week’s OurNetwork edition)

GMX is a decentralized perpetual trading platform currently available on Arbitrum and Avalanche (most liquidity resides on Arbitrum). Users can trade top cryptocurrencies such as BTC, ETH and AVAX using up to 50x on leverage. The platform has seen total trading volume of ~$90bn with a total user count of ~186k.

GMX has seen meaningful liquidity and user growth since the collapse of FTX (maybe a sign for greater demand for decentralized financial infrastructure in the next phase of blockchain ecosystem growth?). The cumulative number of new users on Arbitrum hit ~165k as of December 15, with ~28k coming online after FTX's collapse in mid-November while Arbitrum open interest has almost doubled from ~$95m to ~$187m over the same time period.

Interestingly open interest differs across Avalanche and Arbitrum users of GMX. Users on Avalanche are largely net short, with long open interest of ~8m and short open interest of ~$16m. Meanwhile, Arbitrum open interest is net long with ~$98m of open long interest and ~$65m open short interest. Would be interesting to see overlap in users across the two platforms…

Ethereum

Ethereum usage and gas fees consumed saw a spike on December 9th due to a Coinbase announcement that they would be offering zero fees on swaps between USDT to USDC.

https://www.coinbase.com/blog/switch-to-the-trusted-and-reputable-digital-dollar-usdc

Ethereum spiked to a record high of 1.4mm daily active addresses, with interactions with ERC-20 contracts (led by Tether_USD) driving ~48% of total gas usage on the day.

Since this update, USDC has seen a +5% 7D change in volume while Tether has held firm and maintained a +0.5% change in volume over the same period. Given the prevalence of USDT in non-US geographies, particularly in Eastern Asia, it will be interesting to see if there will be meaningful market share erosion of USDT by the recent actions of Coinbase even if Circle continues to offer this no-fee swap between the two assets. Implicit in this decision for Circle is also the willingness to accept material levels of USDT in exchange for USDC, which is an interesting byproduct of this marketing effort🤔. We wonder how much USDT Coinbase holds - could someone tell us? 👋

Since that spike 7 days ago on December 9th, Daily Active Addresses have declined by almost 80% on Ethereum layer 1. TVL and stablecoin volume has remained consistent over that time indicating that minimal liquidity left the ETH L1 system after the announcement.

that’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 12/03/22.