Artemis.xyz Weekly Ecosystem Wrap-up (12/9/2022)

your go-to source for weekly fundamental updates

note: all analyses in this document created using the Artemis Sheets plug-in ✌

Another week closer to the end of the year and another Christmas banger for your viewing pleasure

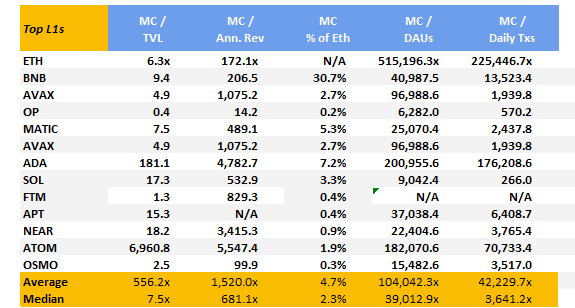

L1 Overview & Highlights

This week saw a small recovery in the L1 ecosystem led by large gains by Optimism (7D change of +18.5%) and NEAR (7D change of +10.5%). The market appears to have stabilized (for now) with minimal TVL and Stablecoin Volume loss in the system over the past week (7D average change of -1.1% and -1.0%, respectively).

A metric we mentioned last week but would like to highlight again is the Daily Txns / Active Addresses - although imperfect, it it gives some sense of level of usage on a per user basis across blockchains. We see that the highest figures come from Solana (70.4x), Avalanche (56.3x) and Arbitrum (10.1x) which are consistent with narratives that these ecosystems are known for high throughput and scalability.

Next part of the puzzle - what are the users actually doing? The Artemis team is hard at work trying to solve this question for y’all. As a quick plug, we do have an active Protocol Composition page on Gokustats which illustrates gas fees paid organized by application category (DEXs, NFT marketplaces, gaming, etc.) for the Ethereum layer 1 blockchain, giving you a stronger sense of what applications and use cases folks are actually paying fees to use. In the future, we hope to provide this level of detail across all L1 blockchains to allow for users to compare and contrast real economic activity across platforms.

This week saw more fallout from the FTX, this time from a slightly more unexpected place. The Block CEO Michael McCaffrey was revealed to have received a series of loans from Alameda Research, part of which was used to fund purchases of Bahamas real estate. Michael has since stepped down and CRO Bobby Moran is stepping into his place.

Elsewhere, a public spat between Mr. CZ Binance and Mr. SBF unfolds on Twitter. The two go back and forth on the details of FTX’s buyout of Binance’s stake, with SBF stating again that CZ “won” in this little, fun harmless game of theirs.

Ecosystem dives below 👇

Solana

Despite the continued FUD around the Solana blockchain, we are still seeing meaningful activity within the Solana ecosystem, with its 225k daily active addresses only surpassed by Ethereum, BSC and Polygon. Solana also still boasts stablecoin volume of ~$2bn, which is larger than all of its peers outside of Ethereum and BSC.

Solana’s subecosystem activity also continues to be active with ~240 weekly active devs, which only trails Cosmos (450 weekly active subecosystem devs) and Ethereum (~1800 weekly active subecosystem devs).

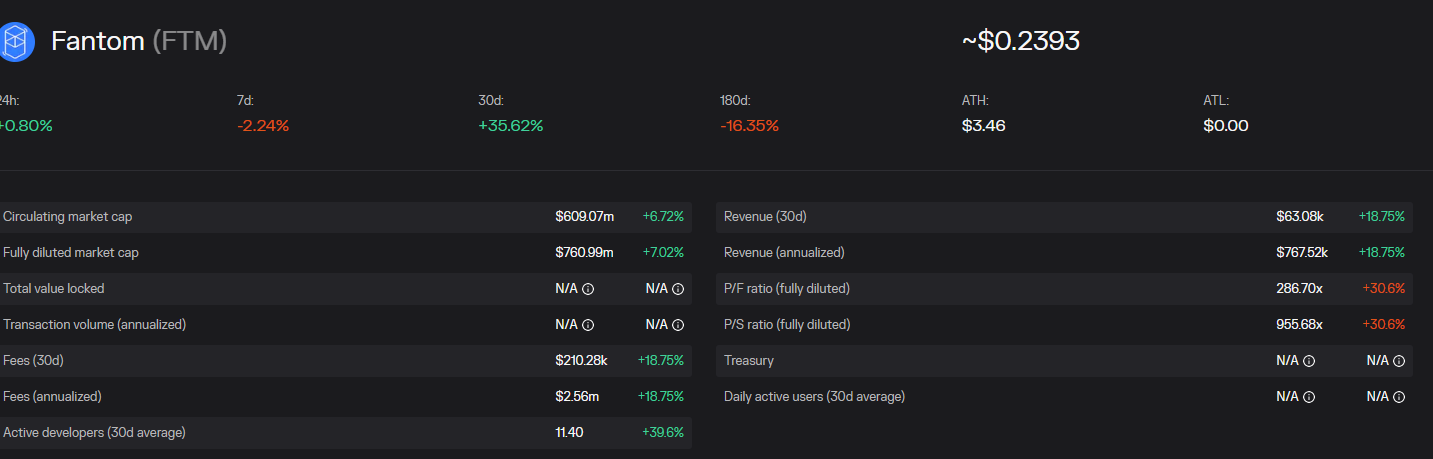

Fantom

We have added Fantom to the dashboard this week (currently missing some fundamental data metrics but planning to add), which has seen a brief resurgence in usage after Andre announced earlier this year in November that he was returning to the project.

https://cryptoslate.com/rumors-of-andre-cronjes-return-cause-fantom-to-spike-24/

Andre claims that the L1 blockchain is “cash-flow positive” and that Fantom generates more than $10mm in annual revenue.

https://blockworks.co/news/cronje-says-defi-saved-fantom-we-are-cash-flow-positive

We are curious to see whether the blockchain can live up to those claims, as data feeds such as Token Terminal and Cryptofees appear to indicate a run-rate annualized revenue closer to ~$800k.

Surprisingly, FTM has managed to maintain real liquidity in the system and boasts a TVL figure of ~$470mm which is higher than that of Solana (~$300mm), NEAR (~$80mm), and Aptos ~($40mm). Will be interesting to watch if DeFi and developers pick back up in the future.

Wrap

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 11/26/22.