Artemis.xyz Weekly Ecosystem Wrap-up (1/6/2023)

your go-to source for weekly fundamental updates

Happy new year Artemists! Here’s to a 2023 packed with fundamental insights and learnings 🤓😈

We are now actively tracking “Daily Txns / Daily Active Addresses” and “Stablecoin Volume / TVL" in our weekly updates - metrics that we think are important to understand the fundamental health of a blockchain ecosystem. What other metrics do you think we should be tracking? Tell us in our discord or telegram!

Daily Txns / Daily Active Addresses:

Why it’s important: Daily Txns / Daily Active Addresses provides a sense of how many transactions a specific address is conducting on a daily basis, and serves as a proxy for how active users are on specific chains. A low Daily Txns / DAA number could indicate that there is relatively low activity per user. An increasing Daily Txns / DAA number could indicate increasing usage on a per user basis. This week, we saw a ~26% increase in Daily Txns / DAAs for Optimism alongside a ~45% decline in Daily Txns / DAAs for Solana. Meanwhile, Cardano has consistently sat at ~1.0x Daily Txns / DAAs multiple, the lowest across all the blockchain platforms indicating meaningful lower levels of usage vs. peers.

As always, this figure needs to be taken into consideration alongside other relevant variables. Are total daily active addresses increasing broadly over time? This could be an influx of new users who may be just testing out a blockchain for the first time with a few transactions, which could bring down the overall Daily Txns / DAAs figure but indicate real growth in the ecosystem. Assuming those users become more regular participants, we would expect the Daily Txns / DAAs figure to normalize again after a period of such growth.

Additional ways to parse the data / items to consider: We would then like to break down the activity further into specific activity types - are users buying NFTs, transacting on DEXes, playing games? Artemis’ Protocol Traction page provides an overview of economic activity on Ethereum Layer 1, with more chains to come 💃

We’d also want to further segment activity in various ways, such as seeing activity type by wallet balance (users holding more than [x] balance of tokens, users holding more than [x] amount of stablecoins, users staking more than [x] balance) and understanding how much user activity overlaps across chains (is it the same user conducting SOL and OP transactions?).

Stablecoin Volume / TVL:

Why it’s important: Stablecoin Volume / TVL provides a sense of how much “loose change” in USD value there is to deploy on a certain chain vs. how much value is locked in smart contracts. This is an interesting metric to consider as it gives a sense of whether network participants are potentially readying to deploy / lock capital into projects on a chain. For example, on Solana this week we saw a 10% increase in TVL but de minimis change in Stablecoin volume. However, the cause of this could from several different causes: 1) players could be putting capital to work in DeFi while continuing to keep stablecoin volume on hand, or 2) The Solana token and associated ecosystem tokens could just see increases in price, and the TVL increases could be associated with price action and not new capital coming in.

Additional ways to parse the data / items to consider: Following up on the above - we are working to break down TVL into its further constituent components. TVL is composed of price and volume, and it’s important to understand how much change is driven by changes in token volume (folks actually moving capital in and out of the system) vs. simple price movements driving changes. We also want to understand how much of TVL is from the native ecosystem token vs. that of other assets (stablecoins, ecosystem tokens).

Similarly, we also think it’s important to further break down Stablecoin Volume into the constituent stablecoins - are folks using USDT on Solana, or is it mostly USDC? What chains / applications is DAI most dominant in? Not all stablecoins are created equal, and as the digital asset ecosystem becomes more regulated and matures it will be increasingly important understand where stablecoins sit across the blockchain ecosystem.

L1 Overview & Highlights

Price / Activity WoW Change:

This week saw meaningful increases in price across the board, a nice hopium-type start to the new year. Solana pumped the hardest with almost a ~40% WoW increase after hitting single-digit lows. Overall layer 1 ecosystems were up ~11% on average with meaningful gains in Alt L1s APT and NEAR (~18% Wow increases) and layer 2 scaling solution OP (~18% WoW gain).

Trading Volumes WoW Change:

This week we have also begun to track 24H and 30D trading volumes. The top traded tokens by 30D volumes are ETH (~$144bn), BNB (~$14bn), SOL (~$11bn) and MATIC (~$8bn). Interestingly, ADA is a top 5 traded token by volume with ~$6bn in 30D trading volume despite its low TVL and stablecoin volume.

We also look at 24H trading volumes as a % of circulating market cap - using this metric, we can see that OP actually has the highest trading volume as a % of circulating market cap at ~43%. Given OP’s small circulating market cap of ~$231mm, the $100mm of OP traded in the past 24 hours, although small on a nominal basis vs. trading volumes of other blockchains, is meaningful to price action given the extremely low float.

Developer / User Activity WoW Change:

Core weekly active developer activity fell off a cliff over the last month with average weekly commits across the ecosystem declined by ~20% - even devs need their Christmas break 💤.

Meanwhile, weekly active addresses have come back up in the past week, with meaningful jumps in activity from three of the four top platforms including Ethereum, Polygon and Solana (40%, 42% and 73% WoW activity, respectively). Daily Active addresses for the largest ecosystem, BSC saw a ~20% decline over a 7 day period but still remains the largest layer 1 ecosystem by daily active addresses.

ecosystem highlights below 👇

Solana

SOL has seen a ~40% rebound in price after hitting 52-week lows of ~$8.14. While its price has been heavily knocked down with its association with the FTX and SBF ecosystem and significant stablecoin volume and TVL have left the system (down ~55% and 82% over the last 3 months, respectively), daily active users have stayed quite consistent over time (3M change of -1%).

Solana has been one of the most volatile, controversial chains in 2022, and the Artemis team shared some of the most bullish 🦬 and bearish🐻 charts on Solana 👇

Here’s Vitalik sharing some of his thoughts on Solana 🤔

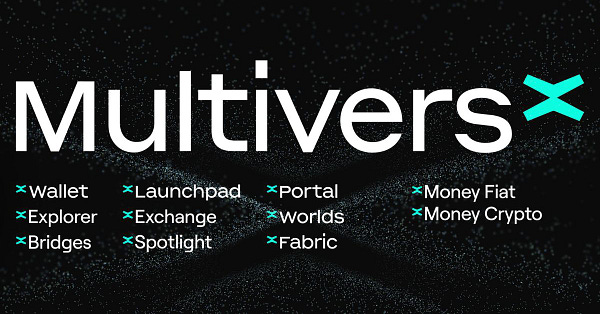

MultiversX (formerly known as Elrond) 🚨new chain alert ⏰

This week we have added MultiversX (!!) brought to you by popular demand.

MultiversX was previously known as Elrond, and is labeled as a highly scalable blockchain focused on the Metaverse. The ecosystem boasts a TVL of ~$87mm and Stablecoin Volume of $37mm, putting it the same league with peers such as Cardano and Aptos. The chain currently sees ~17k daily active addresses and has been seeing increased traction over the past few months (~11% 3M increase), which soutpaces its fellow Alt L1 Aptos (current daily active addresses of ~14k).

that’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 12/24/22.