Artemis.xyz Weekly Ecosystem Wrap-up (2/10/2023)

your go-to source for weekly fundamental updates

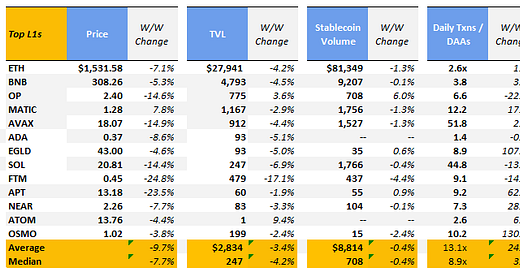

Happy Friday! 👻 The 2023 crypto market finally sees some chop with a median and average declines in 7D prices of ~8% and ~10%, respectively. Let’s jump right into it 👇

L1 Comps Dashboard

The crypto ecosystem saw some regulatory headwinds this week, with Gary Gensler and his homies at the SEC coming after Kraken for “the unregistered offer & sale of securities thru its staking-as-a-service program.”

Brian Armstrong (CEO of Coinbase) took to Twitter to express his displeasure with the rumors swirling around prior to Mr. Gensler’s public remarks.

The point of contention is around centralized exchanges and their offering of “staking” services. As a brief primer, “staking” is the act of locking up your tokens on a blockchain such as Ethereum to help validate the network and produce future blocks - in exchange for locking up your tokens, you receive some issuance of tokens that coincide with the production of new blocks.

How does this relate to centralized exchanges? Some of these platforms intended to offer staking-as-a-service to their consumers, which meant that an exchange like Kraken would aggregate tokens from consumers would they would then stake to a validator and earn rewards on. The consumer would take the bulk of the issuance rewards and Kraken would take a spread.

However, Mr. Gary contends that proper disclosures need to take place, and that investors in these platforms need to be aware of how their tokens are being utilized by the centralized exchange in question. His point is that some centralized exchanges (i.e. FTX) have previously used consumer deposits as house money to trade with, and that Kraken could potentially be able to do the same thing with their staking program given they did not have proper disclosures in place.

With that said, the crypto community has been up in arms about the ridiculousness of Mr. Gensler’s statements. Hester Peirce argues that the SEC’s actions were “paternalistic and lazy” and that “using enforcement actions to tell people what the law is in an emerging industry is not an efficient or fair way of regulating.”

Jesse Powell, CEO of Kraken, has a snippy reply for Mr. Gensler whereby he disputes Gary’s assertion that it would’ve been as simple to fill out a form on a website to comply with the appropriate regulations.

Perhaps more concerning is Nic Carter of Castle Island sounding the alarm on a “Operation Choke Point” operation that began targeting the crypto ecosystem at the beginning of the year. He speaks about the coordinated attempt by the US government to “marginalize the industry” and cut its connectivity to the banking system. Within Nic’s article, he provides a broad timeline of the many events that have transpired in recent months that have limited the crypto ecosystem’s access to the banking system.

Price / Activity WoW Change:

The largest price declines came from some of the more volatile names that have run up in recent weeks, including SOL (down 14% WoW), FTM (down 25% Wow) and APT (down 24% WoW). As negative news hit the market, tokens that were trading at multiples of their circulating marketcap on the way up and saw meaningful jumps in price also saw the same effect on the way down.

On another note, we have seen an uptick in overall blockchain activity, with the bellwether ETH seeing net decline in supply growth over the past week. With more NFT marketplace activity to come with the drop of the $BLUR token this coming week, we’ll see if this trend sustains or fades away.

Trading Volumes WoW Change:

7D Trading volumes came down for yet another week with median 7D volumes of ~$7.1bn (excl. BTC) vs. prior week of ~$7.8bn. SOL saw a ~33% decline in trading volumes ($3.2bn this past week vs. $6.1bn the prior week) while MATIC and BNB saw the highest levels of trading (excl. ETH), with $5.3bn and $4.8bn traded over the past 7 days, respectively, representing ~47% and ~10% of current circulating market cap.

Developer / User Activity WoW Change:

Weekly Commits for CoreEco devs came down week over week (average decrease of 14%). Fantom and Osmosis saw the sharpest drops, at 31% and 28%, respectively. Arbitrum continued to see week over week gains with a 24% jump in weekly active devs - maybe a sign of new things to come? @Dynamo_Patrick also noted that this week saw an influx of stablecoins being bridged to Arbitrum.

Other Artemis Updates

This week we launched a view for Perpetual Trading Protocols on Artemis!!

You can use it to check out fundamental data such as trading volumes, unique traders, transactions and more for protocols such as GMX and dYdX.

Our team looked into the total crypto users around the globe over the past 5 years. While the total number of users has 4xed since 2018, it has declined ~15% YoY so far in 2023. We shall see what the figure looks like by the end of the year!

The Artemis team did a deep dive on gas usage within top applications over the past few months. Spoiler alert - January saw gas usage rebound and NFT marketplaces activity actually grow beyond its pre-FTX usage.

That’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 2/3/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments