Artemis.xyz Weekly Ecosystem Wrap-up (2/3/2023)

your go-to source for weekly fundamental updates

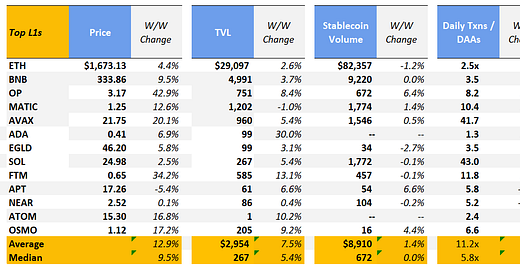

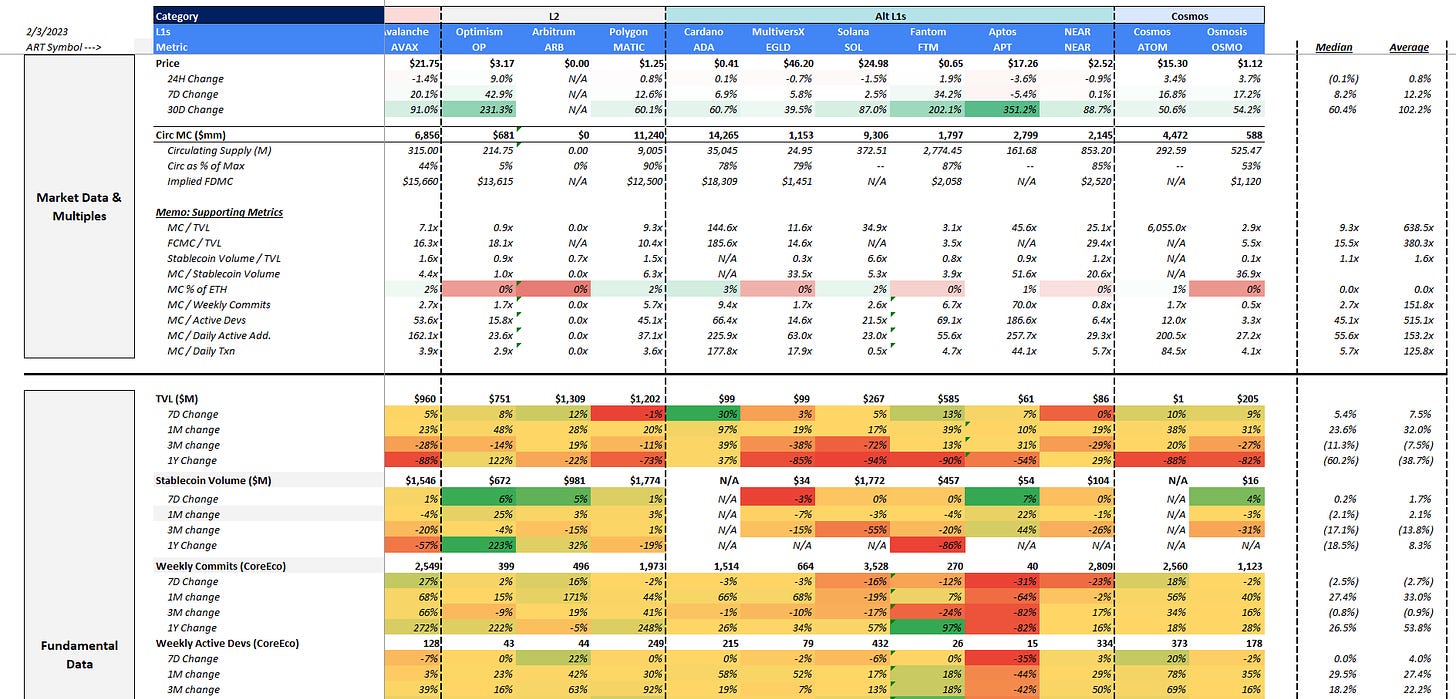

Happy Friday hombres 👻 The white-hot crypto market continues with a median and average 7D increase in price of ~10% and ~13%, respectively. The crypto markets have been all green in 2023, with an eye-watering ~60% median rebound in the L1 ecosystem since the start of the year.

Price / Activity WoW Change:

OP and FTM are the week’s biggest gainers, with OP up ~233% since the beginning of the year and FTM up ~202%. APT stalled this week around ~$17 per share (down 3.6% WoW) but is still the year’s biggest gainer at ~351% 30D change.

TVL and Stablecoin volume have also seen inflows over the week (up an average of 7.5% and 1.4%, respectively). While TVL has come up across all blockchains we cover, a meaningful amount of the uptick was driven by increases in native token prices. Changes in Stablecoin Volume on the other hand could be a better indicator of traction given it can be seen as a precursor to economic activity on a blockchain platform. Here, the story is a bit more mixed - major platforms including Ethereum, Solana, Avalanche and Osmosis saw ~3-4% declines in Stablecoin Volume over the past month, while Optimism and Aptos saw ~25% and ~22% increases, respectively (!!). Could Stablecoin Volume be a leading indicator for price action / activity on a blockchain?

Trading Volumes WoW Change:

7D Trading volumes came down a bit versus the prior week with median 7D volumes of ~$7.8bn (excl. BTC) vs. prior week of ~$8.2bn. SOL and MATIC saw the highest levels of trading (excl. ETH), with $6.1bn and $5.1bn traded over the past 7 days, respectively, representing ~66% and ~45% of current circulating market cap.

OP continues to be heavily traded with ~$2.7bn in transaction volume (vs. ~$2.8bn in the prior week), ~400% of its circulating market cap.

Developer / User Activity WoW Change:

Weekly Commits for CoreEco devs came down week over week (average decrease of 2.5%). Aptos and NEAR saw the sharpest drops, at 31% and 23%, respectively. Avalanche, Cosmos and Arbitrum saw big spikes with ~27%, ~17% and ~16% WoW gains - maybe a sign of new things to come? Developer activity has largely stayed consistent as we moved into February with median CoreEco Weekly Active devs staying flat week over week (0% change).

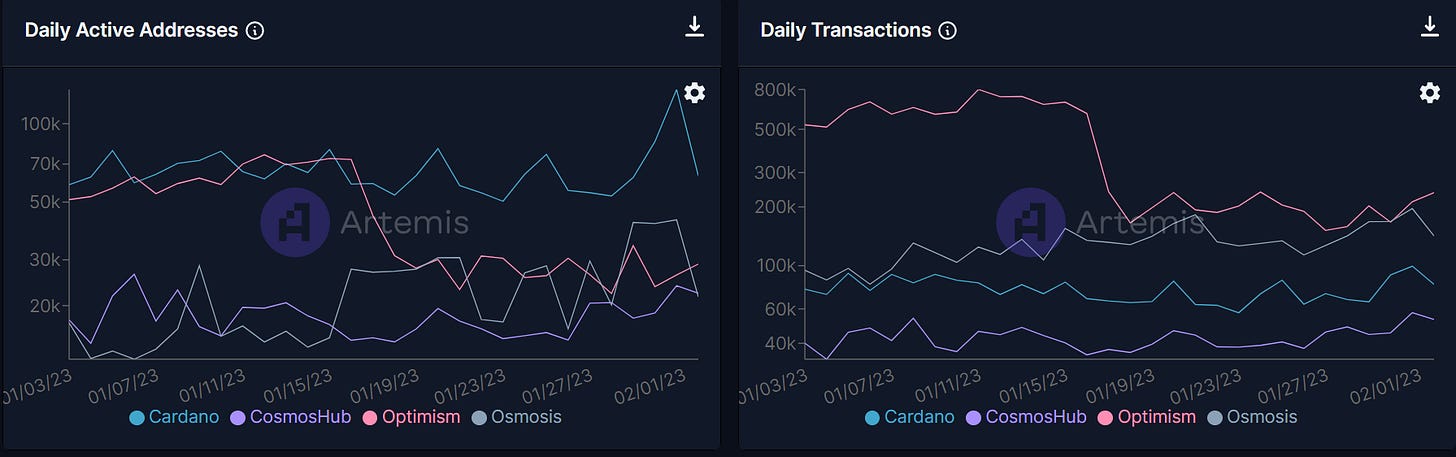

On the other hand, daily active addresses and transactions has continued to climb up this week (week over week average increases of 5.1% and 5.6%, respectively), driven by Optimism, Cardano and the Cosmos ecosystems (Daily transactions saw WoW increase of 25%, 26% and 41% for those platforms, respectively).

The Cosmos ecosystem saw a sharp influx of users with DAAs growing WoW by 51% for Cosmos and 33% for Osmosis. Aptos and Fantom saw deep declines in DAAs (alongside its drop-off in dev activity) with WoW declines of 39% and 20%, respectively.

application / ecosystem highlights below 👇

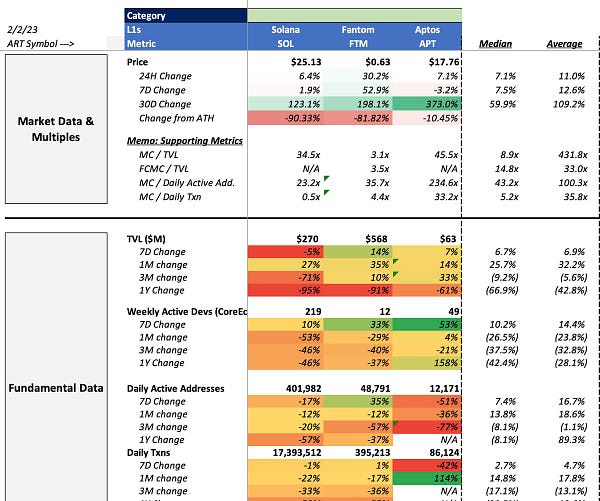

Fantom

Our team did a deep dive of FTM this past week and our conclusion is that it could look undervalued on some financial dimensions, but seems to lack engagement from a usage / developer perspective.

TLDR:

✅FTM has smallest market cap amongst NEAR, Aptos, and Solana

✅meaningfully lower MC / TVL vs. peers (3.1x fot FTM vs. median of 8.9x)

✅meaningfully higher TVL than key comps including Solana / Aptos / NEAR ($585mm on FTM vs. $61mm on Aptos, $267mm on Solana, $86mm on NEAR)

➖lower stablecoin than Solana ($450mm on FTM vs. $1.8bn on Solana) but almost 10x that of Aptos (~$55mm on Aptos) and 5x that of NEAR ($104mm)

➖lower dev engagement than peers (12 Weekly Active Devs on FTM vs. 49 for Aptos, 219 for Solana, 334 for NEAR)

➖Less than 1/10th of Solana DAAs, but 3x Aptos DAAs

Manifold

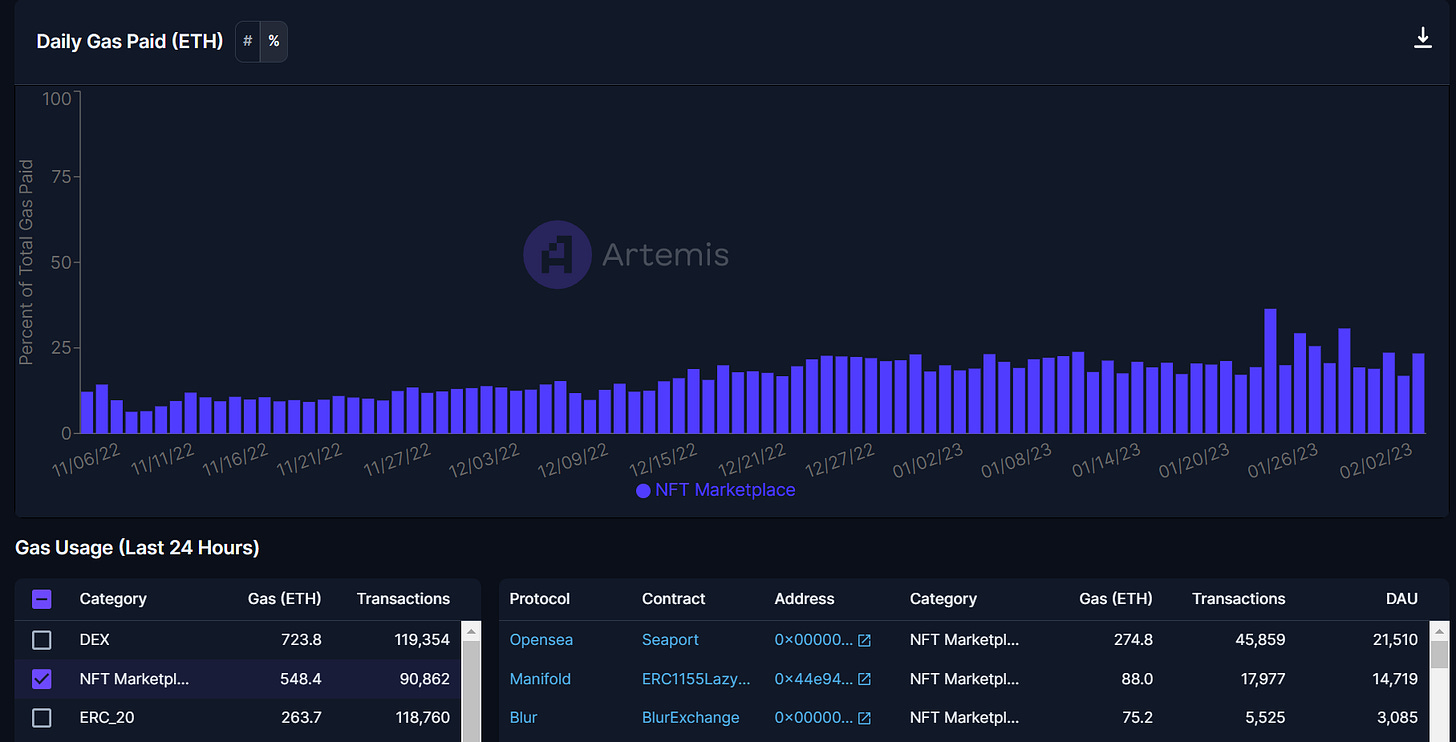

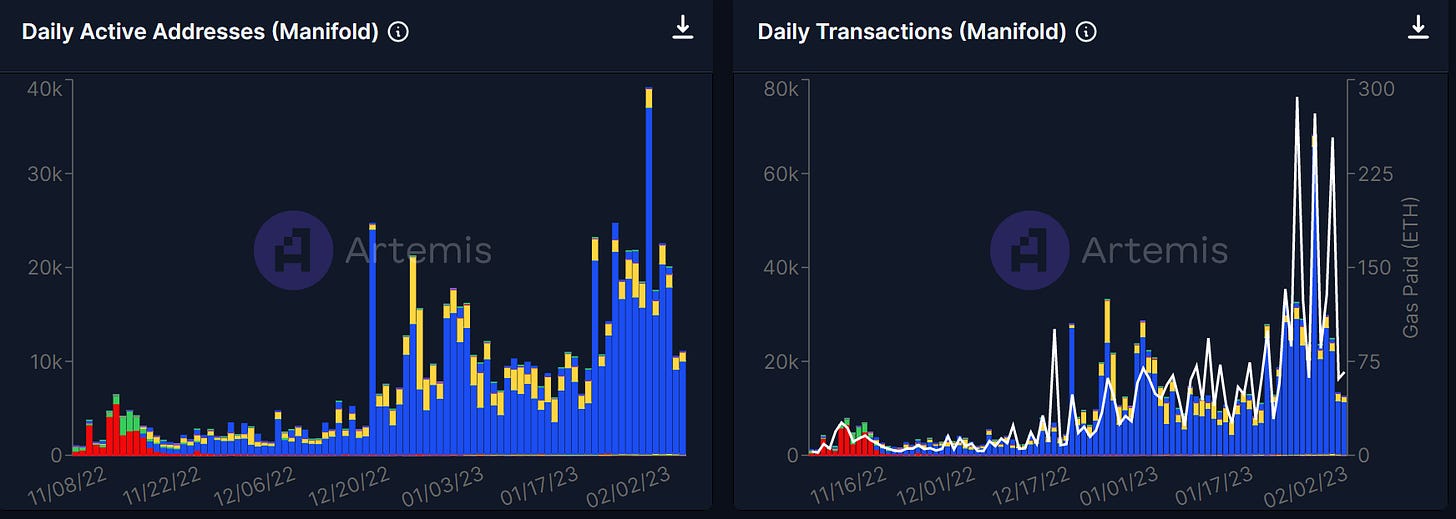

Manifold is an NFT marketplace that has been taking market share from its competitors and has been the 2nd largest NFT marketplace behind Opensea. Manifold boasted ~14.7k DAUs in the last 24 hours on its “ERC1155LazyPayableClaimV2” contract, which compares to 21.5k DAUs on Opensea’s “Seaport” contract.

Here is a view from Artemis Protocol Composition showing Manifold’s recent spike in user activity and gas usage.

Part of Manifold’s meteoric rise could be attributed to the introduction of Paid Claim Pages in Q4 of last year. This allowed artists to set up free mint drops and launch drop pages for limited and open editions for ERC-721 and ERC-1155 tokens. Per nftnow, “16,000 claims have been created by over 6,000 users on the platform, churning out nearly 15,000 ETH ($20 million) in total primary sales volume.”

Meanwhile, Opensea continues to enjoy steadyily growing daily active address and transaction usage, which saw a spike alongside the TOSHIES mint on SeaDrop. Will be interesting to monitor market share changes amongst the NFT marketplaces going forward, which you can do with Artemis Protocol Traction😎😎

That’s all folks

Artemis Product Update: Protocol Composition for Polygon ✨✨

We now support Polygon in addition to Ethereum for Protocol Composition! This view allows you to track application level activity for the Polygon network. You can check out deep dive on Polygon gaming activity here!

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 1/27/22.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments