This week, Trump-backed crypto project is supposedly building on Ethereum and will support lending and borrowing (Coindesk), De-Fi protocol Penpie was exploited for $27M (Coindesk), Uniswap settled with the CFTC over alleged illegal trading practices (Yahoo), and Ripple co-founder endorses Kamala Harris for president (Coindesk).

🌞 Polygon developers transition MATIC token to POL

💫 Exploited protocol Euler Finance Launches v2

This week, the markets ended up deeply in the red, with Bitcoin and Ethereum down -9.1% and -12.0% respectively, with ATOM down north of 20%. The largest notable gainer, however, was Helium, being up +21.6%. This week, we saw a streak of outflows on Bitcoin, with Thursday being the seventh consecutive day of net outflows. Overall, there have been over $1 billion USD in net outflows since 27 August. The equities markets have also been struggling with the S&P500 down 3.64%, and the NASDAQ down 5.74% on the week. Also of note, NVDA, this year’s largest gainer in the S&P, is down 13.93% in the past 5 days, having been subpoenaed by the DOJ over antitrust claims (Bloomberg). While this has been refuted by Nvidia (CNBC), the stock continues to slip.

This down move in the markets early in the week was further exacerbated by Friday’s non-farm payrolls print. The Bureau of Labor Statistics reported cooler-than-expected job growth in August as only 142,000 jobs were added last month, below the expected 161,000, stoking recessionary fears, as investors believe the economy is weakening faster than expected. This news is expected to inform the Fed’s upcoming rates decision in 2 weeks. Markets are currently factoring in a 70% chance of a 25bps cut, and a 30% chance of 50bps cut, indicating a 10% increase in 25bps probability compared to before the NFP print (CME FedWatch Tool).

🌞 Polygon developers transition MATIC token to POL

Polygon has begun transitioning from MATIC to POL, in a move that aligns with the Polygon 2.0 plan, which aims to increase network functionality and scalability. MATIC holders on the Polygon PoS chain automatically saw their tokens converted to POL, while users on other platforms such as CEXes were asked to move their tokens manually.

Polygon's shift is part of a broader strategy to advance its evolution into a zero-knowledge (ZK) chain and integrate with AggLayer. This integration aims to unify liquidity across various blockchain networks. The long-term vision includes expanding the token's utility, by allowing validators to contribute to block production, generate zero-knowledge proofs, and take part in Data Availability Committees (DAC).

The tokenomics of POL remain largely unchanged from MATIC’s existing tokenomics. One of the biggest changes is that with the introduction of POL, Polygon aims to emit 2% in emissions over the next ten years in order to support growth of the blockchain. These emissions will accrue to the Community Treasury. They state that increased competition at the infrastructure level with new infra projects launching with large treasuries informed their decision to create and fund a Community Treasury. "For validators, this emissions model ensures continuous rewards, making it attractive for new validators to join and participate," Polygon stated.

Note how although all MATIC have vested and been minted, POL introduces additional emissions for the Community Treasury and validators.

Polygon currently has two primary chains with different use cases. The first, Polygon PoS, is an EVM-compatible proof-of-stake Ethereum side-chain. Polygon PoS is split into distinct consensus and execution layers: Heimdall and Bor, respectively. The Heimdall layer is a consensus layer consisting of a set of proof-of-stake Heimdall nodes for monitoring staking contracts deployed on the Ethereum mainnet, and committing the Polygon PoS network checkpoints to the Ethereum mainnet. On the other hand, the Bor layer is where the block producing Bor nodes exist, running software based on the Ethereum’s go-ethereum (Geth). Polygon PoS was one of Ethereum’s first mainstream scaling solutions, and has historically been the market leader by DAA, although it has lagged Arbitrum by TVL since late 2022, and today ranks 3rd behind Base as well.

According to official documentation, Polygon PoS was “initially designed to scale Ethereum through a sidechain, [while] a new proposal on the Polygon forum suggests upgrading Polygon PoS into a zero-knowledge (ZK)-based validium on Ethereum. Polygon PoS will soon adopt the execution environment of Polygon zkEVM along with a dedicated data availability layer” (Polygon Docs). This change may help Polygon’s fledgling ZK chain attract more liquidity and adoption, which currently ranks dead-last by all fundamental metrics (when compared to other Ethereum scaling solutions). The chain is currently attracting around 5k daily active users who are generating about 20k daily transactions.

💫 Exploited protocol Euler Finance launches v2

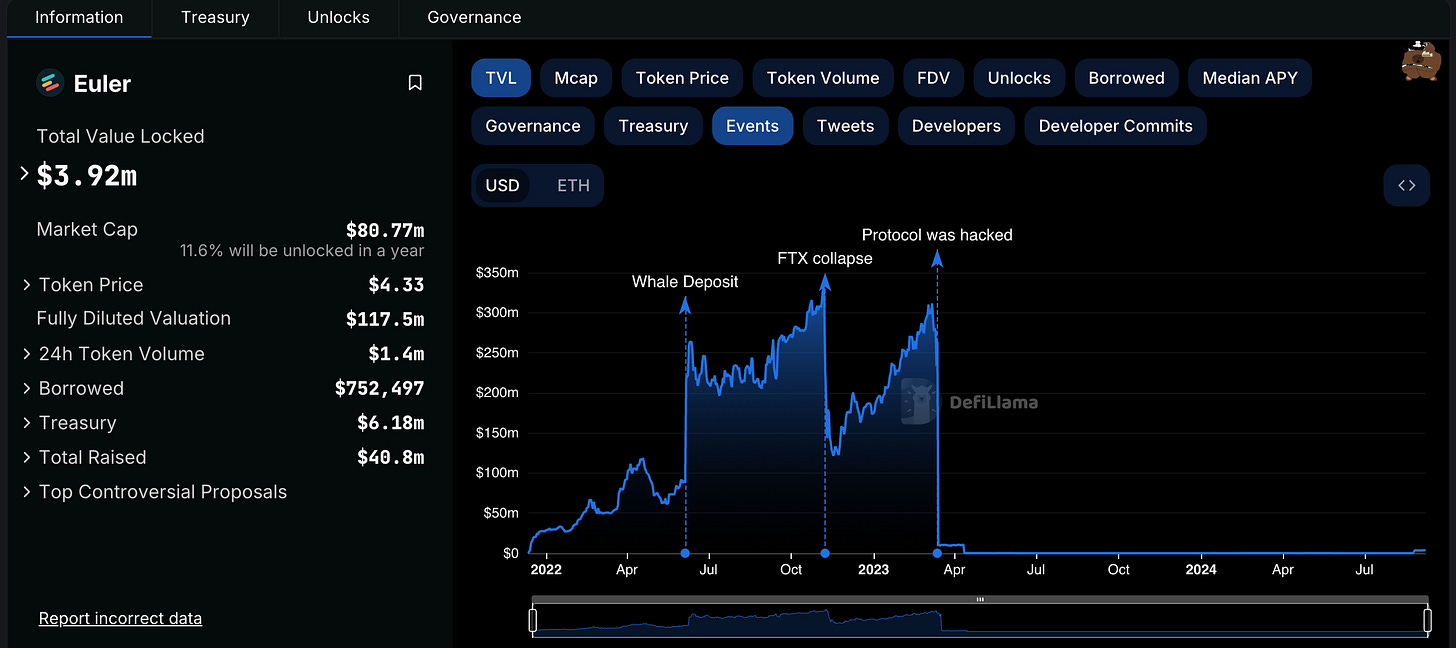

Euler Finance, the innovative DeFi lending protocol, has risen from the ashes of a devastating exploit to launch its highly anticipated V2 this week. Founded in December 2021, Euler Finance came onto the scene with a mission to revolutionize decentralized lending. The brainchild of Dr. Michael Bentley, Jack Leon Prior, and Doug Hoyte, Euler set out to create a permissionless, non-custodial lending platform that could support a wider range of ERC20 tokens than its predecessors.

However, Euler's journey took a dramatic turn on March 13, 2023, when the protocol fell victim to a devastating flash loan attack. The exploit resulted in losses exceeding $195 million, sending shockwaves through the DeFi community. According to Chainalysis, this hack was a flashloan attack, where a user borrowed funds, performed the exploit, and returned the borrowed funds in the same transaction (Chainalysis).

Despite the setback, the Euler team demonstrated remarkable resilience. Through a combination of strategic negotiations, technical prowess, and community support, they managed to recover an astounding $240 million – more than the initial loss (Euler). This unprecedented recovery not only saved users' assets but also positioned Euler for a strong comeback.

Now, with the launch of Euler V2, the protocol is poised to redefine DeFi lending once again. While specific details of V2 improvements are still emerging, early indications suggest enhanced security measures, improved risk management, and even greater capital efficiency. The Euler team has hinted at transformative projects that will bring them closer to their vision of a truly modular DeFi trading ecosystem.

As Euler Finance embarks on this new chapter, the crypto community watches on the edges of their seats. Will V2 live up to the hype and restore Euler to its former glory?

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

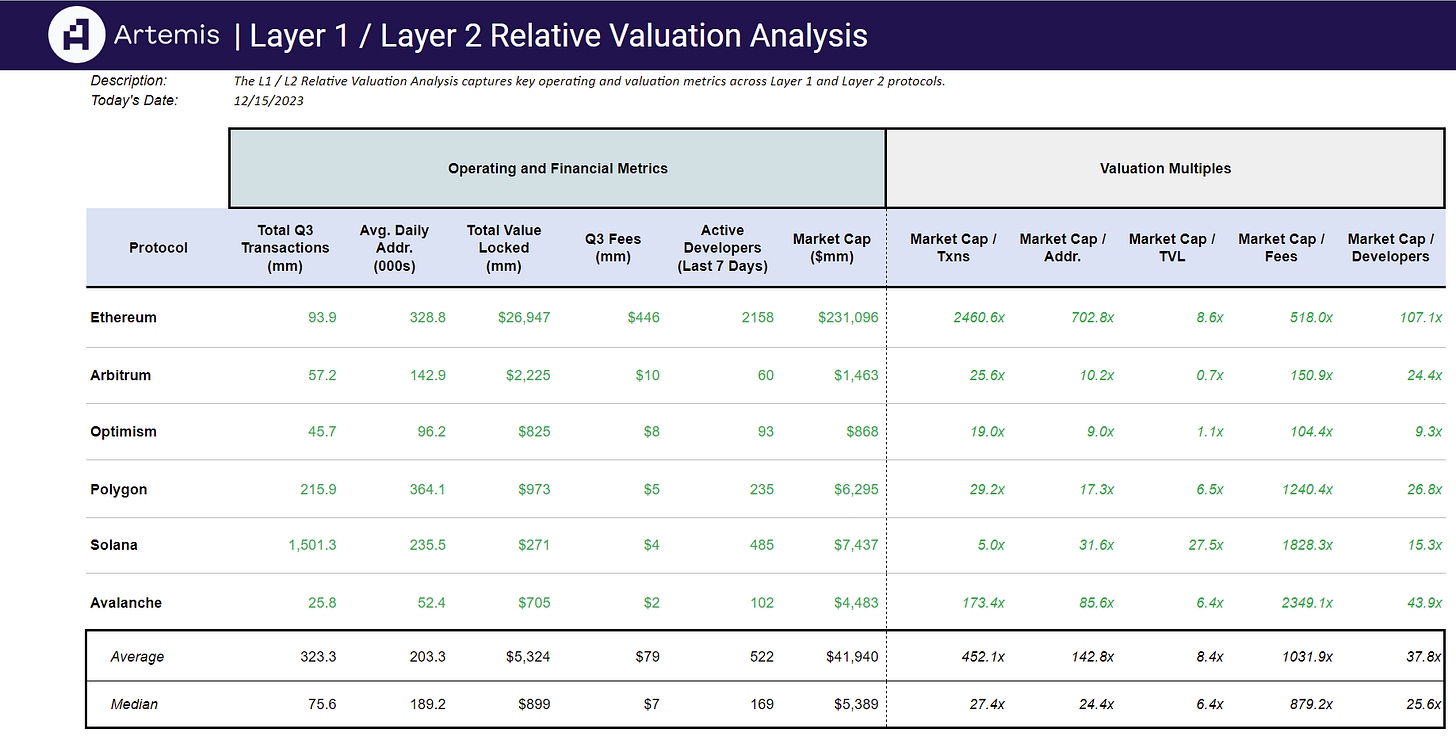

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞