This week, a trailer for a documentary focused on the CryptoPunks NFT phenomenon was publicly released, VanEck teases its upcoming Ethereum Strategy ETF on X, and Arbitrum launches a partnership in Japan.

let’s jump right in 👇

🌞 FASB’s new fair value accounting for cryptocurrencies such as Bitcoin receives positive feedback from pro-crypto constituents

💫 Artemis Data Insights:

GMX new users spike on Arbitrum after quests launch on Arbitrum Odyssey: Reignited

Ethereum Layer 2 Networks Gas Usage

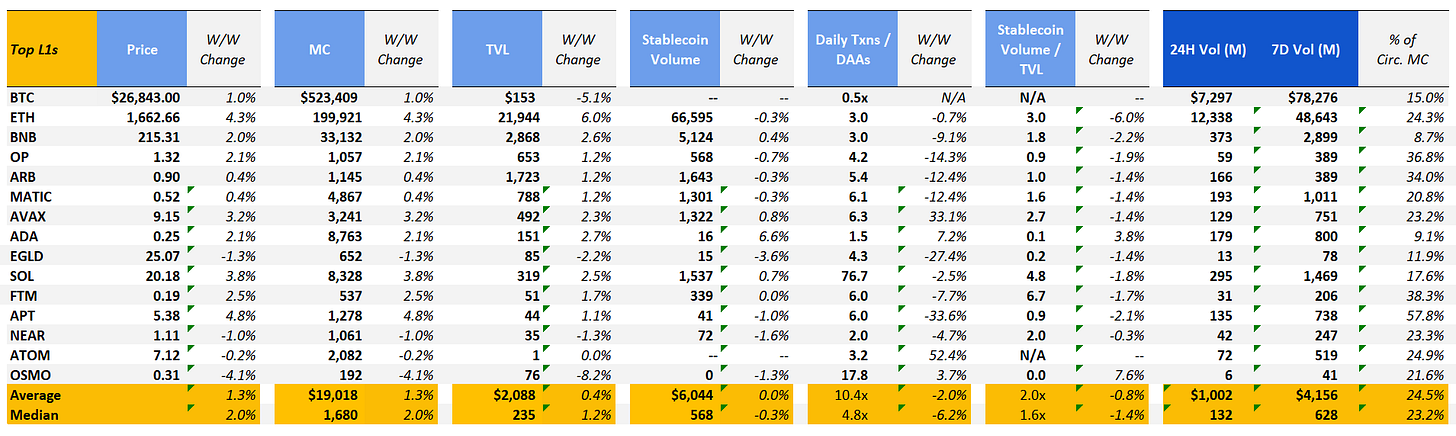

L1 / L2 market prices saw average and median WoW price increases of ~1.3% and ~2.0%, respectively, vs. equity markets chopped sideways (S&P 500 and NASDAQ index down ~0.5% and up ~0.4% over past 5 days, respectively). ETH led the pack across major tokens (up 4.3% WoW) with anticipation that the SEC will likely approve the futures ETF, while altcoins such as EGLD and OSMO fell low to mid single digits over the week (down 4.1% and 1.3%, respectively).

🌞 FASB’s new fair value accounting for cryptocurrencies such as Bitcoin receives positive feedback from pro-crypto constituents

The FASB’s new accounting rules revealed in September 2023 allow corporate balance sheets to reflect both upward and downward price movements of bitcoin and other crypto assets. Previously, crypto assets were measured as intangible assets where the value on a corporate balance sheet only changes when the asset is “impaired”, adjusting for when the price went down but not up. The new change allows the balance sheet to reflect the crypto asset’s “fair market value” which tracks the asset's most recent valuation.

Per Bloomberg, “the accounting rules will be mandatory for all companies—public and private—for fiscal years beginning after Dec. 15, 2024, including interim periods within those years. This means 2025 adoption for calendar year-end companies. Companies will be allowed to adopt the rules once FASB formally publishes them later this year.”

Crypto industry participants such as Sazmining (Bitcoin Mining) COO Kent Halliburton believe that this change will help remove barriers for corporations to hold and report cryptocurrencies on their balance sheets.

Microstrategy, a business known for holding large amounts of BTC on its balance sheet (~$4.5bn as of Q2 2023) is another major proponent of the new changes. Earlier this year, the company released a statement noting that "while the current [accounting] model offers a distorted picture of an entity’s crypto asset holdings that may confuse investors unfamiliar with the accounting standard it reflects, fair value accounting provides investors with the ability to make clear 'return on investment' calculations, thereby providing the basis for economic reality-driven investment decisions."

Non-fungible tokens (NFTs) and wrapped tokens (tokenized assets that allow crypto assets from one blockchain to be used across other blockchain networks), are exempt from the accounting rule change.

Halliburton believes that this distinction is due to bitcoin's classification as a commodity by the Commodity Futures Trading Commission (CFTC), which is a definition that has not been made for NFTs and wrapped tokens.

💫 Artemis Data Insights: GMX new users spike on Arbitrum after quests launch on Arbitrum Odyssey: Reignited

GMX (v1+v2) saw a huge influx of new users over the past few days, with 3.3k and 10.8k new users coming onto the platform on September 26 and September 27, respectively. This compares to an average daily new user count of ~265 over the past 3 months before September 26th.

The spike in new users appears to be driven by GMX quests associated with Arbitrum Odyssey: Reignited, a 7-week event filled with various on-chain challenges to bring in new members into the on-chain community. The challenge started on September 26, 2023 and goes through October 8, 2023.

GMX specifically has a few challenges related to making a leveraged trade on the platform along with some social media related actions. Completing the challenge provides you with a Blueberry Nebula NFT, and has currently been completed by ~16k+ people.

While the challenge is clearly bringing in new users into the system, it remains to be seen whether those users continue to stay on the platform after the program ends. We will monitor retention of these GMX users to see how effective the campaign was for retaining longer-term users.

💫 Artemis Data Insights: Ethereum Layer 2 Networks Gas Usage

As Layer 2 solutions have continued to proliferate over the course of 2023, we wanted to evaluate how trends in gas usage have changed over the past year. Using the Artemis Blockchain Activity Monitor, we can see that the USD value of gas paid for blockchain networks has declined over the past few months, from ~$1mm+ across the L2 ecosystem in May to ~$300k in September.

However, another interesting cut of this data is how the make-up of gas usage across these networks have changed over time. In May, Arbitrum was the largest driver of L2 gas usage on Ethereum L1 making up ~67% of total L2 gas usage at its peak. Since then, zkSync has taken a commanding lead and has consistently generated ~45-50% of the total L2 gas spent on Eth L1.

Finally, the number of new layer 2 solutions continues to proliferate which have made a meaningful dent in the gas usage % share graph over the past few months. With the launch of new solutions such as Linea and Polygon zkEVM, we see that newer solutions are starting to consume greater amounts of gas as a % of total Layer 2 network gas usage, indicating that the new scaling solutions are generating activity on their chains.

We expect these trends to change over time as specific blockchain networks develop idiosyncratic use cases and user-bases, and as network upgrades such as EIP-4844 are implemented (a proposal that will reduce the costs that L2 networks spend to post data to Ethereum L1).

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 9/15/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.