This week, Sony partners with Startale Labs to “[build] a Web3 network that connects souls across generations,” and Binance US is accused of not cooperating with a probe by the SEC.

let’s jump right in 👇

🌞 Deutsche Bank dives deeper into Crypto Custody, Tokenization with Taurus Partnership

💫 Artemis Data Insights:

Spike in New Users on Ethereum (Wallet Transfers)

ERC4337 activity on Optimism

L1 / L2 market prices saw average and median WoW price declines of ~2.3% and ~3.6%, respectively, while equity markets fell further (S&P 500 and NASDAQ index down ~0.7% and ~1.3% over past 5 days, respectively). While BTC and ETH saw less volatility than the average of the market (up 1.9% and down 0.9%, respectively), altcoins such as ARB, AVAX OSMO and APT fell mid single digits over the week (down 4.2%, 6.5%, 6.0%, and 5.4%, respectively).

🌞 Deutsche Bank dives deeper into Crypto Custody, Tokenization with Taurus Partnership

This week, Deutsche Bank announced a partnership with Taurus, a digital asset infrastructure firm, to begin establishing digital asset custody and tokenization services.

Taurus provides enterprise-grade digital asset infrastructure to issue, custody and trade crypto assets, tokenized assets and NFTs. Taurus raised a $65mm Series B round earlier in 2023 from strategic investors including Credit Suisse and Deutsche Bank.

Paul Maley, head of Deustche Bank securities services noted that their initial plan is to offer custody of “selected cryptocurrencies and some stablecoins” for institutional clients in “home market regions.” Maley went on to add that "in the first instance, we will offer custody for selected crypto currencies and some stablecoins. We expect the first wave of activity to be around these selected cryptocurrencies and stablecoins. However, we see the opportunity in the broader emergence of tokenized financial assets."

Commenting on international differences in regulation, Malay said: "It would be fair to say that the emergence of regulation outside of the U.S. (particularly in Europe and Asia) has provided market participants with greater clarity in those jurisdictions." Given that regularity clarity that MICA has provided for the digital asset industry in the EU, it is likely that the near-term focus for the partnership will be European clients.

In a statement released by Taurus on Thursday, Maley stated that “as the digital asset space is expected to encompass trillions of dollars of assets, it’s bound to be seen as one of the priorities for investors and corporations alike… as such, custodians must start adapting to support their clients.”

💫 Artemis Data Insights: Spike in New Users on Ethereum (Wallet Transfers)

Wednesday September 13th saw a huge spike in active wallet activity on Ethereum, with ~1mm active wallets on that single day compared to a daily average of ~395k over the past 6 months.

The spike in activity appears to be primarily driven by wallet to wallet transfers, most of which ran through a Binance hot wallet. The Artemis team picked up the spike in wallet interactions which saw similar anomalies with activity in December 2022.

Interestingly, a meaningful amount of the was driven by new wallet activity, which means that the wallet had never initiated a transaction before that day. Similar to the spike in existing wallet activity, the number of new wallet activity was more than ~2x that of the average activity over the past 6 months.

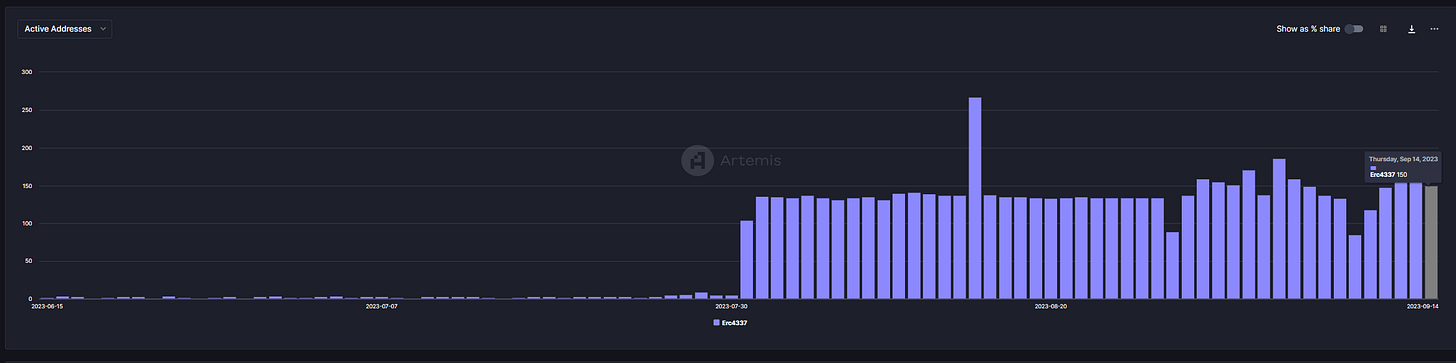

💫 Artemis Data Insights: ERC4337 activity on Optimism

Since ERC-4337 was deployed on Ethereum mainnet earlier in 2023, there have been a number of bundlers released into the crypto ecosystem to help support Account Abstraction.

Through August 2023, we have seen a spike in usage of the “Entrypoint” contract on Optimism which has consumed ~$100k in gas over the past 30 days.

Per Stakeup documentation, the EntryPoint is a singleton contract that acts as a “central entity for all ERC-4337 Smart Contracts and Paymasters.” The EntryPoint contract handles all of the validation and execution of “user operations” which are transactions packaged into a single object. The “user operations” are grabbed a “Bundler” which monitors the mempool and validates transactions while collecting a small fee.

Per the Optimism Scanner, we can see that Bundler Contracts from infrastructure platforms such as “Pimlico” are sending transactions to the EntryPoint contract.

As the ERC-4337 landscape evolves, we will continue to monitor how it changes the landscape of application level gas usage.

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 9/1/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.