This week, Artemis is flying to Singapore for Token2049! If you are around, join us at one of our events:

In other news this week, Friend.tech creators walked off with $44m as the project shut down (DLNews), Bigbrainchad.eth, an anon MEV searcher, has been taking the MEV space by storm by vanity mining transaction hashes starting with 0xbeef…(X/jtriley_eth), and ride-hailing platform TADA launches Telegram mini app, enabling bookings in TON or USDT (The Block).

🌞 Artemis releases Stablecoin Report in collaboration with Brevan Howard, Castle Island Ventures and Visa

💫 A rare Crypto Punk NFT worth $1.5m sold for 98% discount ($23,000)

Markets rallied this week with the Federal Open Markets Committee meeting next Wednesday to decide on rate cuts. As of Friday, futures markets are predicting equal probability that there will be a single or double rate cut. This is a significant increase over a week ago when futures markets only predicted a 30% chance of a double cut (FedWatch). The big catalyst for this change was likely the Bureau of Labor Statistics’ Consumer Price Index reading for August which indicated inflation had cooled to 2.5% YoY, compared to the 2.6% expected. In the crypto markets, SUI and TON led the pack at 19 and 23 percent gains, respectively. SUI surged on news that Grayscale’s Sui trust had opened for investment to accredited investors.

There were big regulatory movements in the United Kingdom this week, as the UK government introduced a bill in Parliament that aims to recognize digital assets as personal property (Decrypt). The very next day, England’s High Court ruled that Tether’s USDT could be considered personal property (Coindesk).

In the US, all eyes remain on the upcoming election on Nov 5. This week was the first presidential debate between Republican candidate Donald Trump, and Democratic candidate Kamala Harris. Disillusioning the crypto industry, the debate did not include a discussion of crypto policy. In spite of this, Trump has continued to lean into Liberty World Financial, his DeFi platform which he plans to launch via Twitter Spaces on September 16th (Barrons).

🌞 Artemis releases Stablecoin Report in collaboration with Brevan Howard, Castle Island Ventures and Visa

We are thrilled to power the onchain insights of "Stablecoins: The Emerging Market Story." Working closely with @Visa and @CastleIslandVC we highlighted:

-A new "adjusted" transfer volume metric

-Stablecoin vs overall crypto growth

-Dollar dominance of stablecoins

As shown above, today, stablecoins are responsible for between 70 and 80 percent of all value settled on public blockchains.

Stablecoin usage continues to break ATHs and has decoupled from the crypto market -While trading ebbs and flows, stablecoin monthly active users has consistently increased.

Stablecoin supply is also near all time highs. While the implosion of Terra Luna caused the market to contract, it has rebounded in 2024 and continues to grow.

We also introduced a new "adjusted" stablecoin transfer volume filter. The excludes known MEV bots, intra-exchange transfers, unlabeled addresses with >$10mn or 10k transfers in 30 days. Adjusted stablecoin volume is around $1trn per month and near all time highs.

Lastly, it remains the case that stablecoins are overwhelmingly linked to the US dollar. -The second most popular currency referenced by stablecoins is the Euro, with a supply as of June 2024 of $617 million, or 0.38 percent of the overall stablecoin market.

💫 A rare Crypto Punk NFT worth $1.5m sold for 98% discount ($23,000)

A clever scheme combined with blockchain’s unique characteristic of immutability, and a critical miscalculation led to the sale of a Crypto Punk (Punk #2386) for a >98% discount (X/0xQuit). Crypto Punks are one of the oldest and most valuable NFT collections. Despite the NFT hype to 2021/2022 having mostly faded by now, Punks still routinely sell for seven figures. In fact, last week an ape Punk, a Crypto Punk depicting an ape, sold for $1.5m. This week, however, a similar ape Punk sold for only $23,000!

The reason for this goes back several of years to the creation of the platform Niftex. This platform allowed users to fractionalize NFTs, such that an expensive Punk, for example, could be divvied up among many investors who then owned fractional shares of the NFT. The Punk in question, #2386, had undergone this process, and was held by 257 unique investors as of this week. The catch, is that the Niftex plaform had been decomissioned, and there was no longer an official interface to fractionalize or defractionalize these NFTs. However, the smart contracts that Niftex operated were not decomissioned, and continue to exist to this day on the Ethereum blockchain. This means that anyone can interact with the core business and operating logic of the Niftex platform, without needing the Niftex website/front end to exist.

These fractionalzations were set up such that at any time, a shareholder of a particluar fractionalized NFT could initiate a ‘shotgun’ and propose a price to buyout the other shareholders. If there are no counters within 14 days, all shares will be sold to the proposer of the ‘shotgun’. In order to properly counter a shotgun, a shareholder must “effectively purchase the proposer's shares at higher than their proposed price. 0x282 (the shotgun initator) proposed a price of 0.001 eth per share (10 eth for all shares), so a valid counter needed to be 0.0010000001, as defined by the shotgun contract” (X/0xQuit). However, the only shareholder who took note of the shotgun proposal failed to exceed the minimum counter offer threshold.

And just like that, due to a combination of the inactivity of the other shareholders and the astuteness of an individual to take advantage of the immutability of blockchains, a Crypto Punk sold for a >98% discount.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

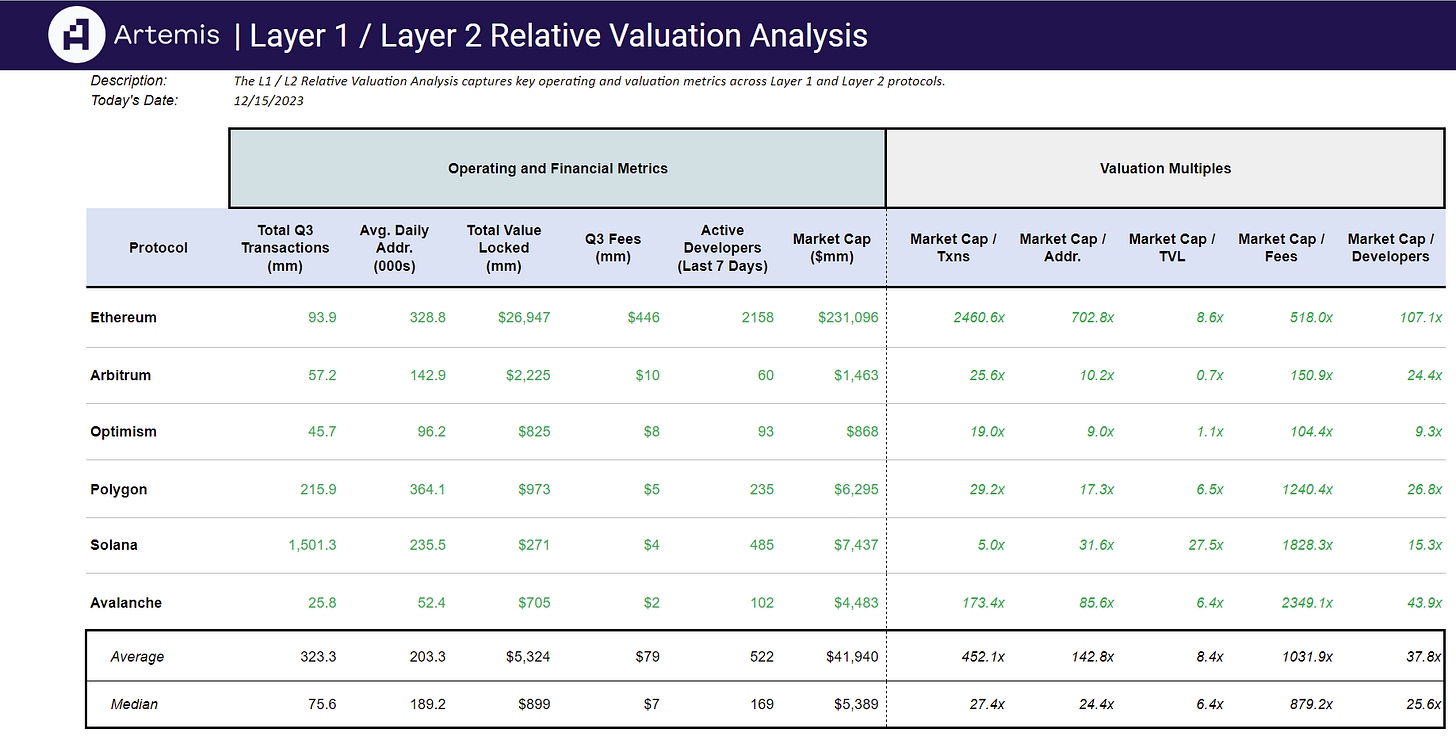

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞