This week, the CEO of Uniswap was hacked on Twitter, the DOJ plans to merge the National Cryptocurrency Enforcement Team into the Computer Crime and Intellectual Property Section and the SEC may appeal the Ripple ruling.

let’s jump right in 👇

🌞 Gnosis partners with Visa to launch crypto-based debit card to facilitate real-world transactions in the EU

💫 House Republicans launch market structure crypto bill

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: zkSync Era

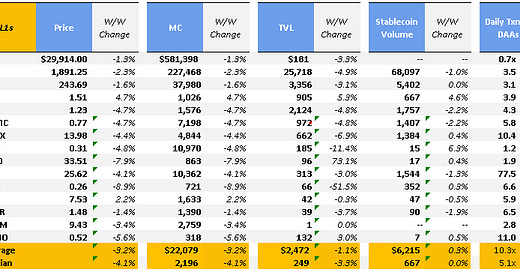

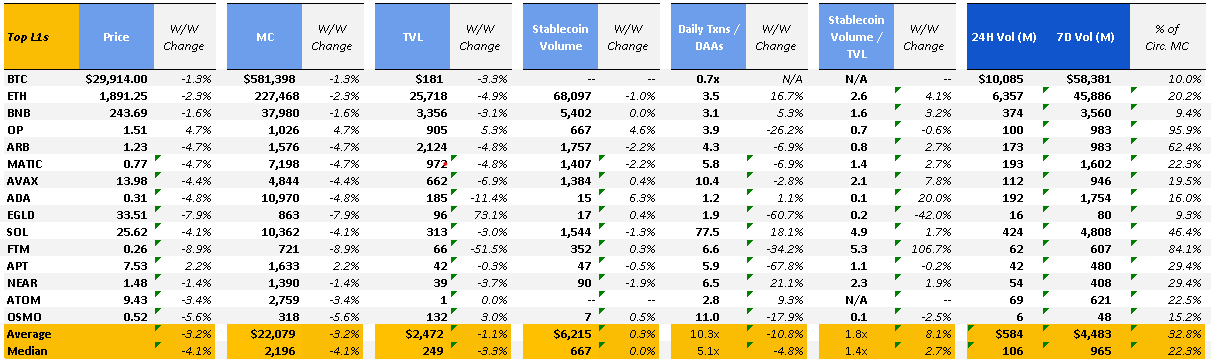

The market fell across the board with average and median WoW price declines of ~3.2% and ~4.1%, respectively) despite gains in equities (S&P 500 up ~0.7% WoW). OP was the week’s largest gainer with a ~4.7% WoW increase, while the broader L1 / L2 ecosystem fell.

🌞 Gnosis partners with Visa to launch crypto-based debit card to facilitate real-world transactions in the EU

This week, Gnosis, a web3 wallet infrastructure project launched a new product with Visa that allows users to spend funds from on-chain self-custodial wallets anywhere the payment method is accepted. The Gnosis Card is initially launching in the U.K. and the EU, with near-term plans to expand to other geographies including Brazil, Mexico, Singapore and Hong Kong. Gnosis is partnering with Monerium, a stablecoin company offering the euro-denominated EURe which is regulated in the European Union. Per TechCrunch, “Monerium allows users to connect their wallets to an International Bank Account Number or IBAN, a standardized system of identifying bank accounts across borders that are widely used in Europe.” Users will be able to pay for items in the real world and online using the Gnosis Card and Monerium’s euro stablecoin, EURe.

To initially onboard onto the platform, users will connect their desired wallet to the card, where they can select from popular selections such as MetaMask and Coinbase Wallet. When using the card to transact for a good, the payment will be executed using the EURe stablecoin, meaning that even if a user holds non-EURe crypto assets in their wallet, if they do not have sufficient EURe the transaction will fail. Separately, if a payment is not conducted in euros, a foreign currency exchange will be executed similar to that of other Visa card transactions.

Gnosis announced that it is looking to launch in the U.S. later in Q3 2023 and plans to work with MakerDAO to allow the usage of the USD-denominated stablecoin Dai.

When asked about whether there is a need for this type of technology given the current financial technology offerings we already have, Dr. Friederike Ernst, Gnosis Co-Founder, responded that “the user experience that will be afforded by truly peer-to-peer trust is superior in every way to what we currently have, and I think we need to get to a point where this is actually felt by the user.”

Gnosis Pay is launched as a layer 2 network on top of the Gnosis Chain layer 1 chain, which bridges to everyday products most consumers are familiar with such as debit cards, Apple Pay and Google Pay.

Gnosis Pay calls itself the “first Decentralized Payment Network (DPN)” and is ambitious attempt to connect the world of traditional finance and payments to a crypto native environment. It remains to be seen what real-world adoption looks like when the product goes live in multiple geographies later this year.

💫 House Republicans launch market structure crypto bill

This week, House Republicans introduced formal legislation aimed at providing a regulatory framework for cryptocurrencies in the U.S. Previously previewed as a draft in June, the bipartisan bill (Digital Commodity Exchange Act) seeks to provide more clarity and certainty for crypto market participants. The bill proposes handing oversight of crypto spot markets to the Commodity Futures Trading Commission (CFTC) while keeping securities-based tokens under SEC authority. Per Bloomberg, the “test for when an asset is a commodity would largely depend on whether the blockchain network it’s affiliated with is sufficiently decentralized.”

As part of the bill, the CFTC would be responsible for directly regulating exchanges, setting rules around custody, and overseeing various intermediaries. The bill also aims to apply consumer protection regulations to crypto exchanges.

Proponents of the bill argue that the legislation provides much-needed guardrails without stifling innovation in the nascent digital assets industry, while critics counter that the CFTC doesn't have the expertise or resources to properly oversee complex crypto markets. Critics also argue the bill is still too vague on key issues like which tokens qualify as commodities versus securities.

The bill continues to be a Republican-led effort, and key Democrat lawmakers such as Maxine Waters on the Financial Services Committee have already expressed concerns about the bill. Even if the bill does pass in the House, the legislation likely faces an uphill battle in the Democrat-controlled Senate, but ultimately reflects growing bipartisan consensus that crypto needs a tailored regulatory approach. The coming months will likely see continued debate around finding the right model for crypto oversight.

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: zkSync Era

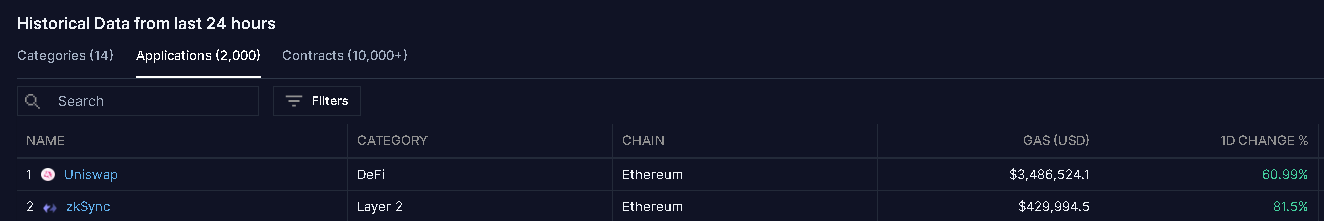

zkSync Era has taken the layer 2 world by storm by overtaking dominant layer 2 chains such as Arbitrum and Optimism in daily active addresses despite only launching earlier this year. Over the months of June and July, zkSync Era saw an average of ~300k+ daily active addresses vs. ~170k on Arbitrum and ~100k on Optimism.

While active addresses have taken off meaningfully on the network, zkSync Era retains only a fraction of TVL that Optimism and Arbitrum have captured. Since zkSync Era’s launch in March of this year, it has grown TVL to ~$192mm per DefiLlama. Optimism and Arbitrum have maintained TVL of ~$900mm and ~$2.1bn over the past month, multiples higher than that of zkSync Era.

It remains to be seen what core applications are driving usage towards the zkSync Era blockchain. There has been heavy speculation on Twitter that zkSync Era will likely conduct an airdrop to early adopters sometime in the future, which may have contributed to the rapid growth in active addresses.

Even if activity on zkSync Era remains primarily speculative, the layer 2 network is still driving meaningful gas spend on Ethereum layer 1 as the 2nd highest gas-consuming application after Uniswap. Ultimately, it remains to be seen whether the astonishing usage metrics will be maintained after an airdrop is distributed to early users.

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 6/21/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.