This week, newly announced “Solana Economic Zone” to be hosted in Buenos Aires (X/FormaCity), Sanctum, Solana liquid staking application, launches much anticipated $CLOUD at $300m FDV (X/SanctumSo), and Ryan Selkis, Messari cofounder and CEO of 6 years, steps down amid backlash regarding political comments (Axios).

💫 DeAI: NVIDIA acquires brev.dev, Grayscale announces new fund

🌞 Base and Arbitrum heat up as on-chain season swings wide open

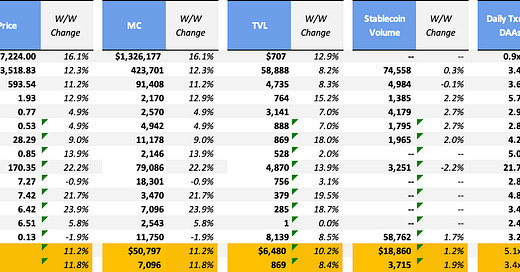

Crypto markets continued to bounce back this week, with most major assets up double digits. The big winners of the week were SOL, NEAR and APT, each booking weekly returns above 20%. Surprisingly, TON and TRX ended the week relatively flat. The Nasdaq registered its worst day since December 2022, dropping about 3% on Thursday. In spite of this, Bitcoin has showed strength, rallying +16.1% this week, on the back of rumors that Donald Trump would announce a Bitcoin Strategic Reserve Policy, and even headlining a campaign fundraiser at the Bitcoin Conference, where the top tickets are going for $844,600 per person (CNBC).

Trump also announced his running mate this week: JD Vance. The current Ohio junior senator is extremely supportive of cryptocurrencies - Vance is notable for being the first vice presidential candidate to hold Bitcoin, owning a significant amount that could be valued somewhere between $136,000 and $390,000, according to The Independent. This personal investment aligns him with the growing crypto movement. Furthermore, Vance has been an outspoken critic of current SEC Chairman, Gary Gensler, stating that the approach Chairman Gensler has taken to regulating blockchain and crypto is the exact opposite of what it should be.

It’s stunning to see how crypto has turned into a bi-partisan topic that politicians are fighting for. We are standing on the precipice of change - and it’s truly an exciting time. One thing is clear - the public perception of crypto from a few years ago to now has greatly changed, and the outcomes of this presidential election will surely shape crypto regulation across the world for the next decade.

💫 DeAI: NVIDIA acquires brev.dev, Grayscale announces new fund

This week, AI giant NVIDIA announced its acquisition of brev.dev, a platform built to help AI/ML engineers find the most cost-effective GPU compute across cloud service providers. Interestingly, in April of this year, Overclock Labs, creators of decentralized compute protocol Akash, wrote about how brev.dev leverages Akash Network’s permissionless GPU infrastructure.

The key benefits they cite in their article are that brev.dev gains permissionless access to GPUs, and cost optimization with Akash’s ‘industry leading pricing’. Through the integration, Akash gains distribution to users of brev.dev who are attracted to the platfrom for its superior developer experience.

The key problem Akash is trying to solve is that, globally, people sit on unused GPUs that could be rented out to perform AI and ML computations. Additionally, compute is often offered by centralized entities that have too much pricing power. They hope to bring together latent compute resources in a decentralized way to make GPUs more accessible to those who need them.

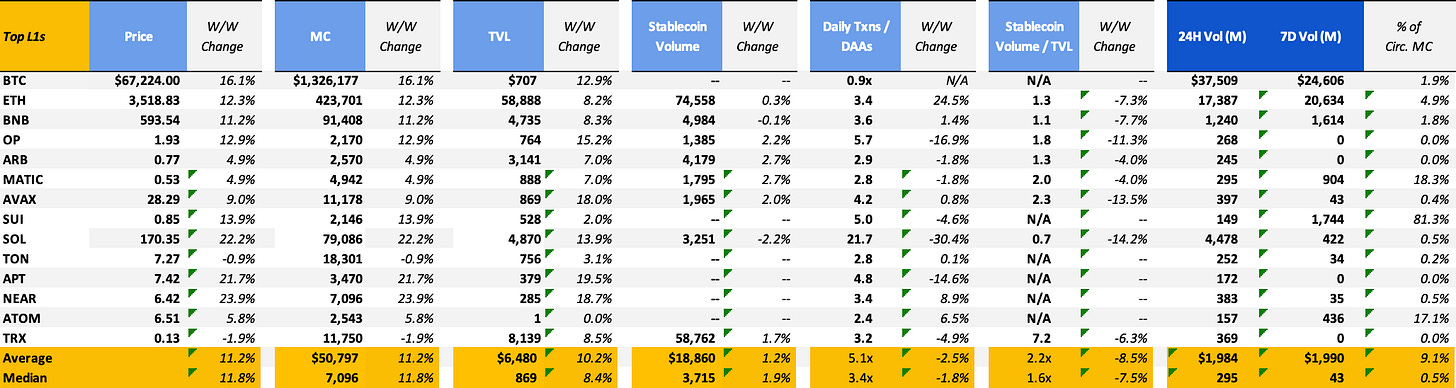

According to Overclock Labs, “By enabling anyone to become a cloud provider and monetize their compute, Akash has established itself at the forefront of the decentralized AI movement as the space has grown considerably over the past few years.” Akash is the premier decentralized compute protocol, priding itself on being open source, and has been in development since 2018 when it was founded Greg Osuri and Adam Bozanich. Since its inception, the network has grew slowly, until excitement around AI began bleeding over to the blockchain industry. Looking at Artemis’ data for Akash, the network generated <$5k in fees per month in 2022, and has been generating above $50,000 in monthly fees consistently since the start of 2024.

More news in the Decentralized AI space this week came by way of Grayscale’s announcement of a new private investment product titled the Grayscale Decentralized AI Fund. The fund will hold Near (32.99%), Filecoin (30.59%), Render (24.86%), Livepeer (8.64%) and Bittensor (2.92%). Notably, Akash is not included in the list of holdings for the fund, despite it having an FDV 60% higher than Livepeer.

In stark contrast to this positive news, key fundamental performance indicators for Akash Network such as active leases and active providers have seen a fall from grace. Notably, active leases on Akash peaked at over 5,000 in April 2024, and have since dropped 85% to 800 daily active leases. Additionally, the number of daily active providers on the network has only fallen 25%, indicating that the supply side has largely remained, but demand for Akash services has decreased.

This confluence of big news and developments in the DeAI space coincides with AI being the best performing sector of the week, with tokens in this bucket up an average of 40.6%, while the DePIN sector was the second best performer at 26.9%. While NVIDIA’s acquisition of brev.dev is not necessarily an endorsement of Akash, it is interesting to see some adoption of blockchain based applications.

🌞 Base and Arbitrum heat up as on-chain season swings wide open

As Base continues to push its ‘Onchain Summer’ campaign, we’re seeing an uptick across all metrics - TVL, trading volumes, daily transactions and active addresses. Coinbase Ventures bought over 2m of $AERO in an announcement that the Base Ecosystem Fund would be investing in them. On top of that, Coinbase has pushed out the Mr. Miggles meme in an “Onchain summer” campaign, and the $MIGGLES token has 20x’ed since. While the token itself is not affiliated with Coinbase or Base, its ascent is a self-fulfilling prophecy that might spark a true onchain season.

Another chain that has been heating up is Arbitrum which has seen an almost 2x spike in daily active addresses, from 465k on July 16th, to 1.1M on July 19th.

One of the reasons could be the resurgence in interest in Hyperliquid as Twitter chatter about $PURR picks back up - Hyperliquid trading volume surged by double on July 15th, before coming back down to about $1bn after a few days.

However, it is unlikely that Hyperliquid is the sole driver of daily active addresses on Arbitrum to near all-time-highs. Thursday’s 1.1M DAA are the network’s 3rd highest of all time. A look at Artemis’ Application Activity monitor reveals that Wallet to Wallet transfers are up 150% WoW, and are a large driver of the increase in daily active addresses. Another large driver is the ‘Other’ category, which contains all uncategorized and untagged apps. We encourage our readers to reach out about applications and their relevant addresses that should be tagged on Artemis, so we can continue to deliver the industry’s deepest onchain insights.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

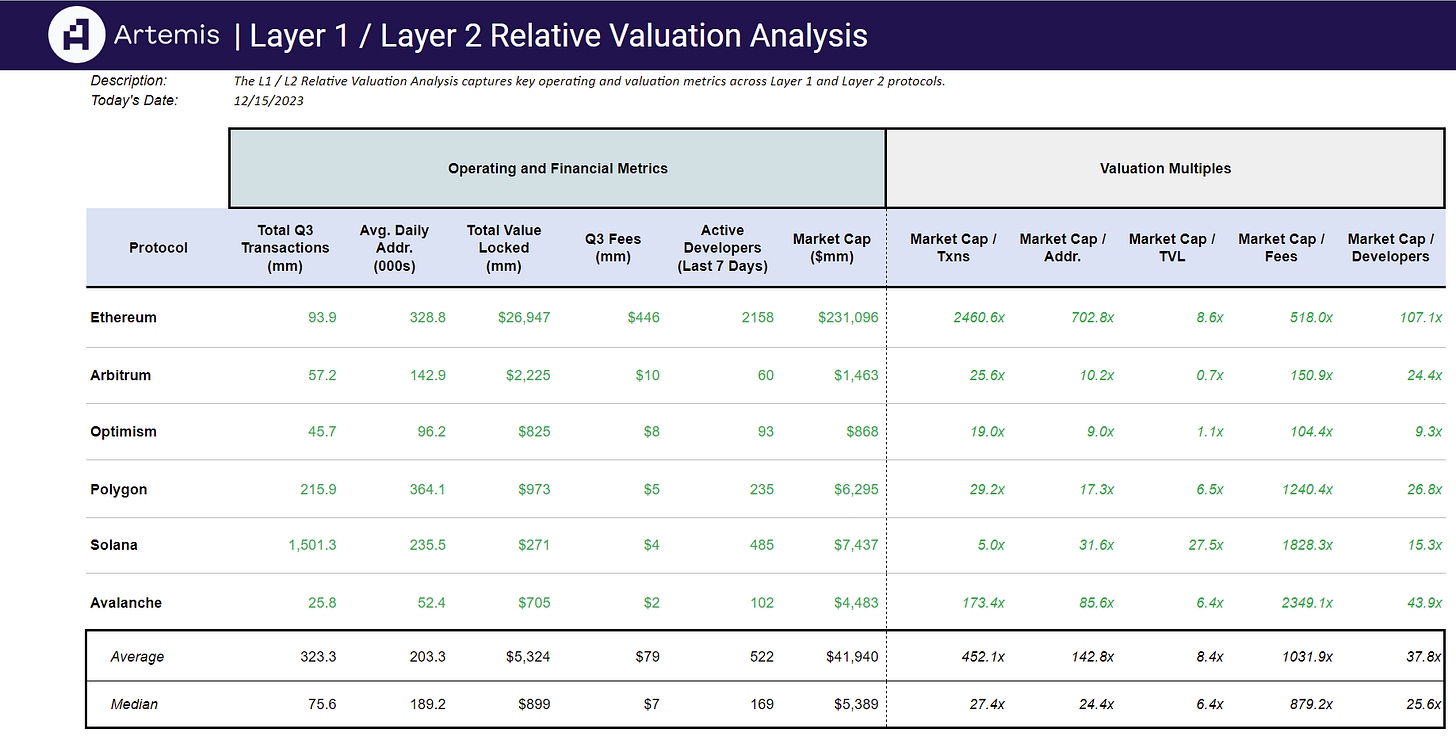

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 6/12/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

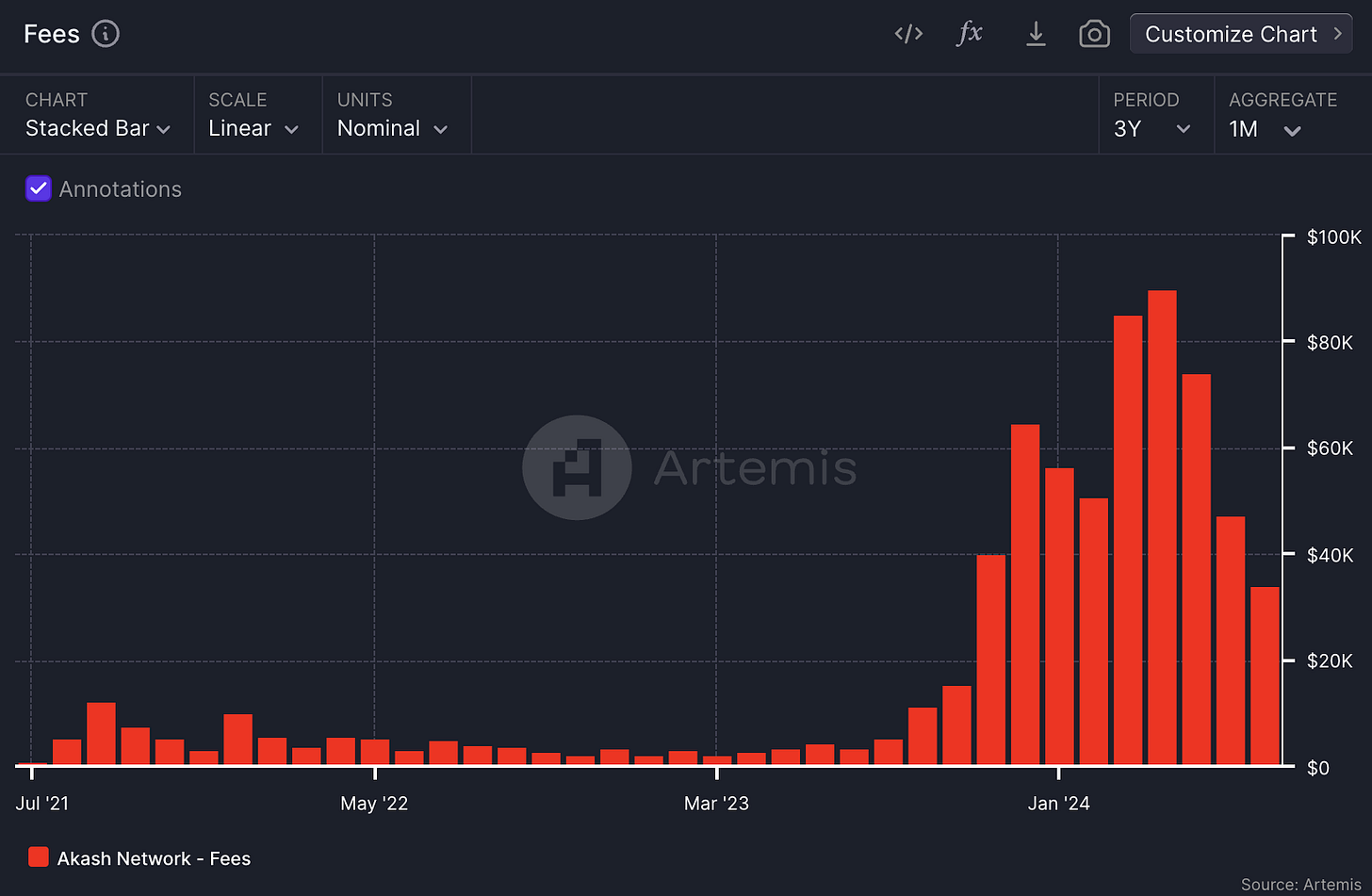

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞