This week saw the former Celsius CEO arrested and the company agreeing to a $4.7bn settlement, Puma x Roc Nation crypto sneakers and a whole bunch of regulatory action.

let’s jump right in 👇

🌞 Crypto receives a small dose of regulatory clarity via XRP ruling

💫 TradFi things: Bloomberg evaluates cryptoassets, Fir Tree launches digital assets opportunities fund

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: Safe (fka Gnosis) - Wallet Infrastructure on Polygon

The market gained sharply this week with average and median WoW price increases of ~8.3% and ~9.1%, respectively) on the news that XRP was not considered a security when it was sold to retail investors via on-exchange trades. SOL continued to outpace the market with another double-digit WoW increase of ~20%, the largest gainer across the L1 / L2 sector. SOL had gained ~33% on a single day as investors extrapolated that SOL would likely be a beneficiary of the XRP ruling, after SOL had previously been taken off centralized exchanges such as Robinhood in the prior month. Other large gainers included Alt L1s including OP, ARB, MATIC and AVAX which all saw mid-teens WoW gains as spillover effects from the XRP ruling made its way over to other cryptoassets.

🌞 Crypto receives a small dose of regulatory clarity via XRP ruling

In December 2020, the SEC filed an action against Ripple Labs and two of its executives, alleging that they raised ~$1bn+ through “unregistered, ongoing digital asset securities offerings.” This week, the federal judge in this case, Judge Torres of the Southern District of New York ruled that XRP is “sometimes a security” and “sometimes it isn’t.” In what appears to be a highly nuanced and potentially still-to-be-litigated decision, the great Matt Levine asserted that Ripple’s sale of XRP to institutional investors in OTC trades that included traditional investor workflows such as due diligence and investment agreements was counted as an “investment contract” and thus defined as a securities offering, while Ripple’s sale of XRP to retail investors in on-exchange trades with no investor disclosure was not an “investment contract” and therefore not a “securities offering.” He deemed this distinction “so weird,” because it posits that the the sale of the tokens to the general public with less disclosures and guardrails was actually allowed while the sale of the tokens to sophisticated investors was deemed a securities offering.

While there is still uncertainty around the final outcome of the ruling, the current verdict was taken to be a huge win by the crypto community (see Exhibit A: token + crypto equity prices this week). Daniel Tramel Stabile, partner at Winston & Strawn, stated that “My overall impression is this is a positive decision for the digital asset industry… The court expressly concluded that XRP is not, in and of itself, a security. Instead, the focus must be on the circumstances of the offering itself” (Bloomberg).

The decision in the ruling appears to separate the whether the initial investment contract constitutes a securities offering and whether the underlying token itself is a security. The ruling appears to point to the fact that the underlying token (XRP) was NOT a security but that the form in which it was marketed and eventually sold to investors / the general public could have constituted a “securities offering”. Ultimately, the SEC will still have the opportunity to appeal the decision in other jurisdictions / higher courts but now has a higher hurdle to clear in its war against the crypto asset class.

We have shared a compilation of sources + tweet threads + on the subject for you smart smart readers to dive deeper into the subject yourselves:

💫 TradFi things: Bloomberg evaluates cryptoassets, Fir Tree launches digital assets opportunities fund

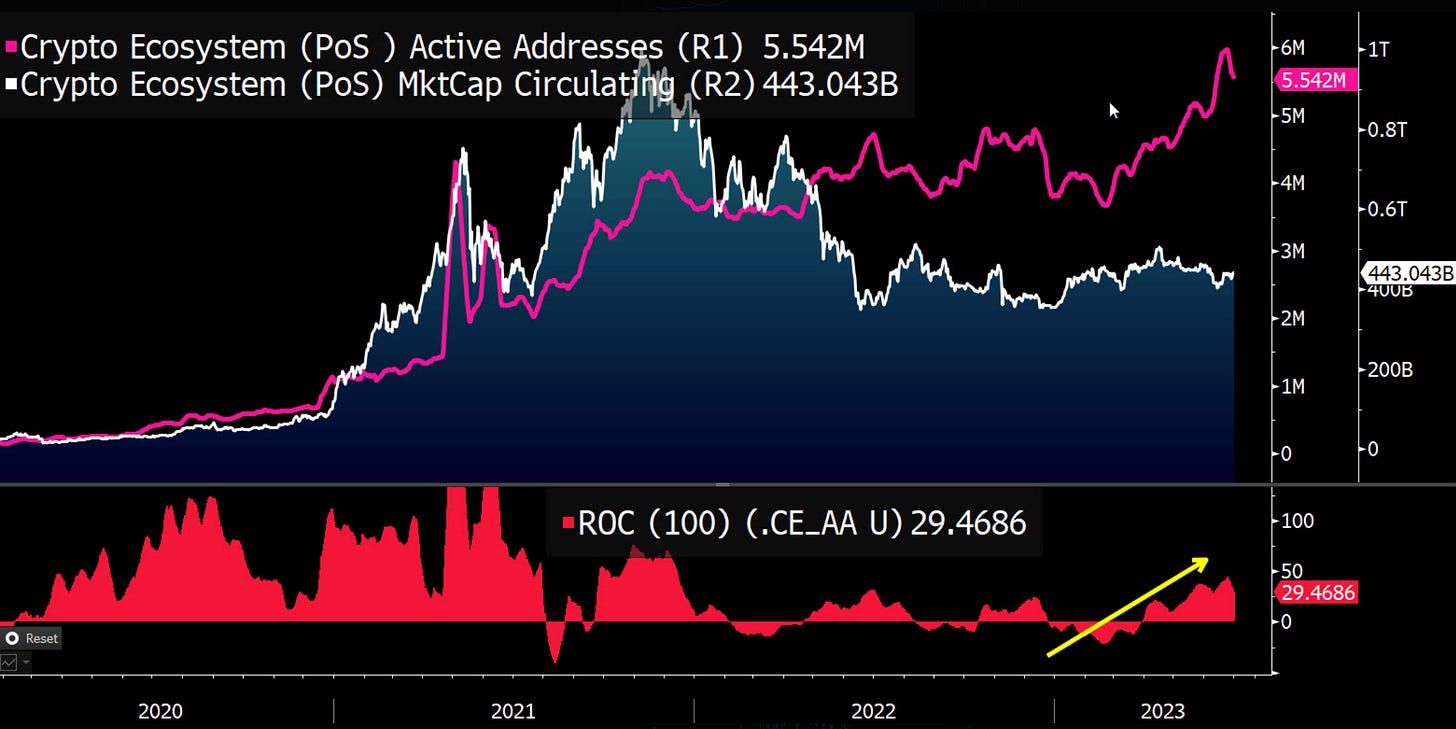

This week, Jamie Coutts, senior market analyst at Bloomberg unveiled Bloomberg Intelligence’s Crypto Ecosystem Fundamentals Dashboard, stating that the team is planning to expand coverage beyond the “two assets that we considered to be institutional-grade quality (BTC, ETH) to a wider proof-of-stake (PoS) ecosystem.

While Jamie acknowledges that the Blockchain S-curve is still in infancy and that vast majority of current usage can still be attributed to speculation, he expects that this will change as Zk proofs, layer 2 scaling solutions and other crypto-native solutions come into the public domain.

The new dashboard will continue to track the health over the overall ecosystem via select adoption and demand drivers. Some takeaways from the analysis:

Crypto user growth accelerated in Q2 2023, rising from 3.7mm to 5.2mm users. While momentum of new users has slowed since DeFi summer in 2020, it appears as though growth is beginning to re-accelerate. Additionally, Jamie’s analysis found that Active Addresses matter for the purposes of crypto market valuations. Since 2019, “active users have explained 93% of the daily log increase in market capitalization of the sector.”

In the same vein, Jamie went on to state that the crypto ecosystem appears “very undervalued", because of the divergence between price and users over the past two years. The Price to Active Addresses (P/AA) ratio [is] at the lowest point.”

In other tradfi news, recent collapses in the crypto market has prompted $4bn AUM hedge fund Fir Tree to launch a “Digital Assets Opportunity Fund” on August 1st (CoinDesk). Fir Tree has been active in several high-profile crypto situations and is known for shorting the USDT (Tether) stablecoin in 2022 and for suing Grayscale over “potential mismanagement and conflicts of interest” related to the Grayscale Bitcoin Trust.

In the internal email that CoinDesk reviewed, Fir Tree stated that they saw an opportunity in the space because conventional crypto investors do not have the experience to navigate “bankruptcy proceedings or effective activist efforts” and that expected other investors to have trouble “[getting] up to speed on this extremely complicated asset class.”

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: Safe (fka Gnosis) - Wallet Infrastructure on Polygon

Safe (fka Gnosis), a crypto wallet / custody protocol, has created ~30k+ new accounts per week in Q2 2023 since announcing its partnership with Sam Altman’s Worldcoin.

Worldcoin has now reached ~1.5mm total Safe accounts created per a Dune dashboard by @hashed_official, and announced that it passed a ~2mm World ID sign-up milestone as of July 13.

Check out a full list of Worldcoin’s Web3 partnerships here:

https://worldcoin.org/blog/product/composability-world-app-protocols-powering-worldcoin-first-wallet

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 6/21/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.