This week, Coinbase announces new crypto wallet super-app, ETH CC conference attendees report a mixture of optimism, fragmentation, and boredom, and the US House failed to override the SAB 121 veto (The Block).

💫 MakerDAO announces $1bn initiative for onboarding RWAs

🌞 Bitcoin Overhang causes fear in the markets

💫 The Ethereum ETF inches closer as staking % nears all-time highs

After several weeks of continued losses, this week saw the market bounce across major tokens. Last week’s biggest loser, OP, was this week’s biggest winner at a 28% W/W increase, making back all of last week’s losses. Other altcoins saw significant recoveries, led by SUI and NEAR at 14%. The average W/W return was 7.4%, as BTC moved primarily sideways in light of the German government’s continued selling and Mt. Gox distributions beginning.

This week we saw cooler CPI data, with Core CPI being +3.3%, lower than the estimated 3.4%. The unexpected cooling of inflation initially sparked a positive reaction in the markets, with Bitcoin briefly jumping above $59,100. However, this optimism was short-lived, and Bitcoin's price dumped shortly after. This is worrisome given that cryptocurrencies are risk-assets, which should be rallying on the good news about lowering inflation (and thus, rate cuts). Across the board, Russell saw a sharp uptick as traders flock to small-caps as rate-sensitive assets ; yet, the adverse reaction in crypto sparked some fear amongst investors.

Matthew McDermott, global head of digital assets at Goldman Sachs, said the firm is looking to expand its crypto offerings as its peers, like BlackRock and Fidelity, continue to push deeper into the space (Fortune). McDermott said that the firm will aim to launch three tokenization projects this year, including its first in the US. It has perviously completed tokenization projects with the European Investment Bank and the HKMA. This comes as BlackRock’s tokenized BUIDL fund on Ethereum crosses the $500 million mark for the first time, marking a significant milestone for tokenized investment funds.

💫 MakerDAO announces $1bn initiative for onboarding RWAs

On Thursday, Steakhouse Finance announced the Spark Tokenization Grand Prix, “a groundbreaking competition aimed at onboarding up to $1 billion of tokenized assets”(Forum). Immediately, leaders of top projects in the tokenization space began expressing their eagerness to participate in the project, including comments by Ondo’s Nathan Allman, Securitize’s Carlos Domingo, and Superstate’s Francis Gowen. The project will aim to make Spark, Maker’s primary lending protocol, the central hub for real world assets in Ethereum.

The Maker protocol already boasts over $2bn in RWA vaults on its balance sheet, accounting for nearly half of its assets.

The proposal aims to specifically bring on short-duration US T-Bills and similar tokenized products. Currently, the market for tokenized US T-Bill is worth about $2bn. This implies that Maker’s ambitious plan will grow the market by 50%!

Much of this growth in tokenized US T-Bills has been fueled by the high-interest rate environment of the past year that has generated demand for stable yield onchain. As interest rates are expected to start being cut in September, it will be interesting to see how Maker will maintain demand over the long term for its new lending products.

🌞 Bitcoin Overhang causes fear in the markets

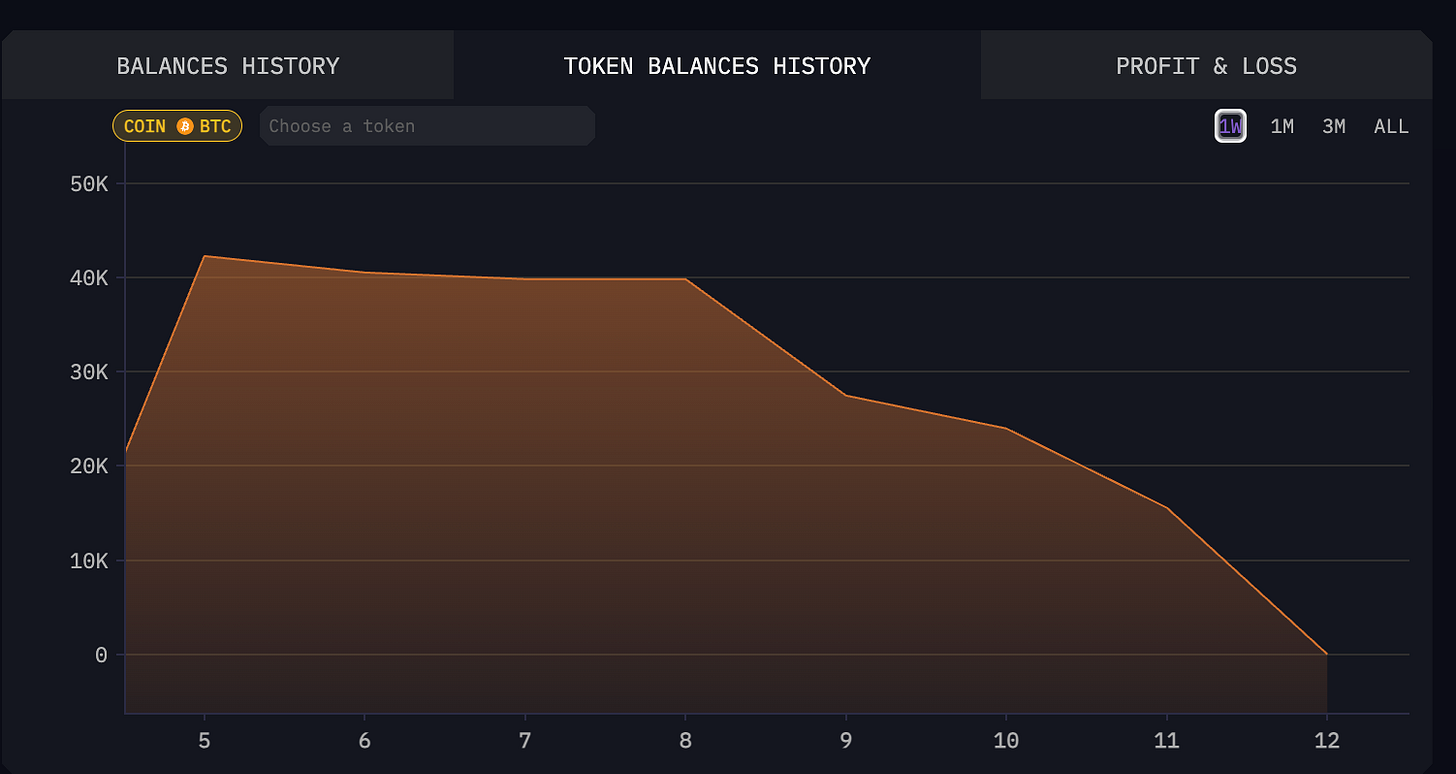

This past few weeks Bitcoin has been hit by a multitude of supply events - namely: The German government selling, and Mt Gox announcing that they would begin returning Bitcoin stolen in a 2014 hack back to creditors. The markets reacted weakly to this, as we saw dips to as low as $53,000. While analysts and forecasters expect the supply event to wane by August, current market sentiment remains cautious.

As of the end of the day on Friday, the German government has sold off all of its bitcoin, having come down from its initial numbers of over $2 billion in Bitcoin. Mt Gox also has moved approximately 47,288 BTC, valued at roughly $2.7 billion, from Mt Gox-associated wallets to new addresses. This is just the beginning, with a total of around 140,000 BTC — worth a whopping $9 billion at current prices. While the supply overhang is large for Mt Gox, the timelines for distribution are different for the exchanges its’ distributing to: Each exchange has its own timeline for processing the payouts, ranging from immediate distribution to a 90-day window (Source).

The shining light is, however, the uptick in ETF flows this week. After seeing a barrage of outflows in June, we seem to have “bottomed” - there has been an uptick of inflows the past two weeks as institutional investors look to “buy the dip”. With the longer-term outlook on Bitcoin highly positive and the general rising sentiment around crypto assets, this fear seems to be a buy for many institutional investors, especially given the next near-term catalyst: the ETH ETF.

💫 The Ethereum ETF inches closer amidst evolving staking landscape

Bitwise Chief Compliance Officer Katherine Dowling stated that Ethereum ETFs are "close to the finish line," noting that there are fewer issues being addressed in each S-1 amendment filed with the SEC. The past few days we’ve seen Grayscale, Blackrock, Fidelity, 21Shares and Vaneck update their S-1 files for spot Ethereum ETF. While the process is still ongoing, this catalyst is the shining light amidst the backdrop of bad news in cryptocurrency, with many speculating as to the level of flows that ETH would see - with prominent Twitter analysts like James Seyffart predicting $3-4 billion in net inflows in the first six months.

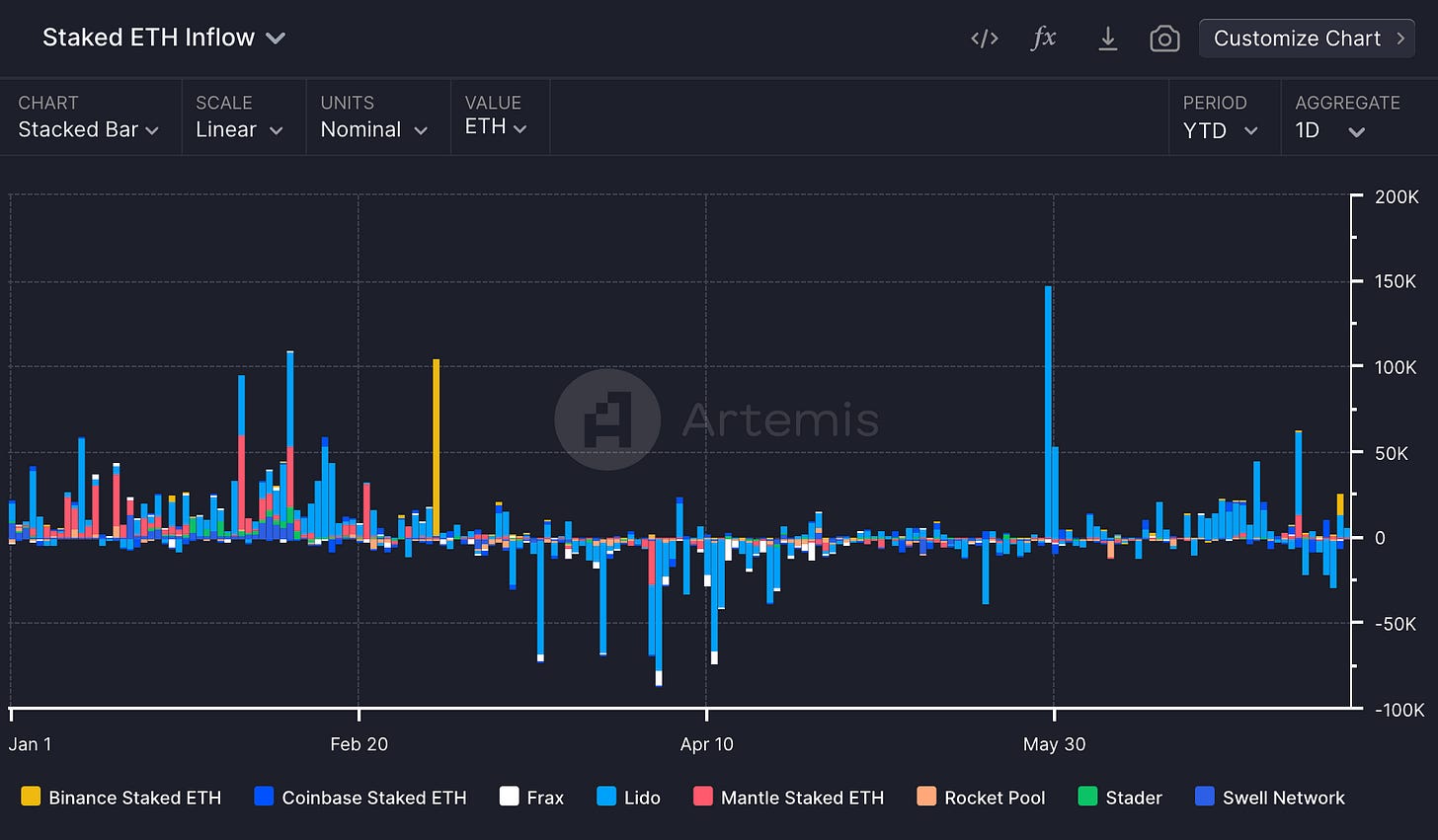

The total amount of staked Ethereum is also nearing an all-time high at 33.3 million ETH, representing 27.7% of the total supply. This surge in staking activity could be interpreted as a sign of growing confidence in Ethereum's future.

On the other hand, the amount of ETH staked through restaking protocols like EtherFi and Renzo have seen consistent net outflows since late June. This follows months of positive net flows to restaking protocols. Users may be experiencing exhaustion around restaking and may be looking to either stake directly themselves or go back to traditional liquid staking protocols like Lido.

In the meantime, liquid staking protocols have seen net flows skew slightly positive in the month of June. Note the large outflows around the end of Q1 which line up with the large positive inflows to restaking protocols.

As the crypto community eagerly awaits the SEC's decision, the potential approval of Ethereum ETFs is widely seen as a significant step towards mainstream adoption of cryptocurrencies. The coming days will be crucial, with all eyes on the SEC's feedback and issuers' responses, which will ultimately determine the exact timeline for the launch of these highly anticipated Ethereum ETFs.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 6/12/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

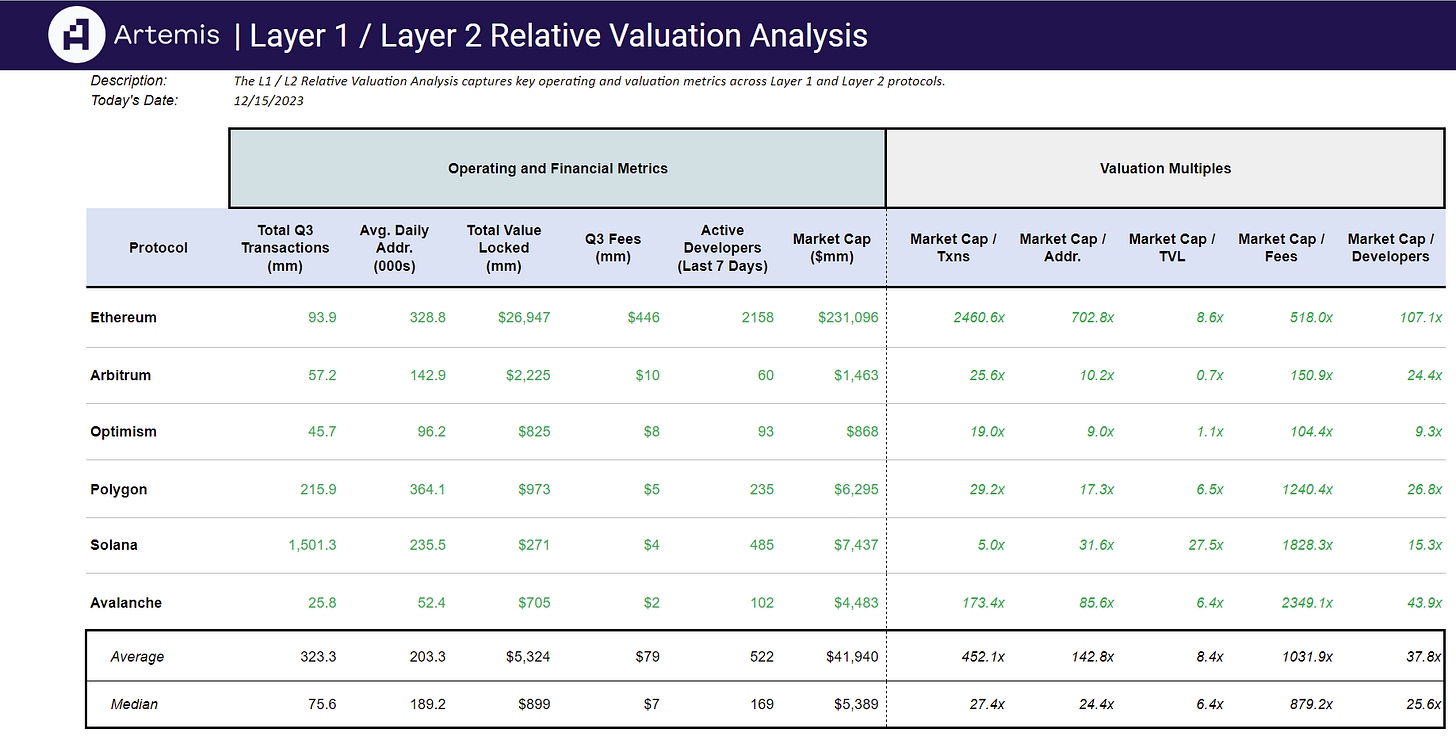

Artemis Sheets

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞