gm friends. An action packed week full of regulatory action and delistings of crypto assets on US platforms.

let’s jump right in 👇

🌞 SEC sues Coinbase and Binance, Robinhood plans to delist crypto assets including SOL, ADA and MATIC

💫 TradFi talks about crypto at Bloomberg Invest Conference

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: LayerZero / Stargate

This week saw a sharp drop-off in prices (average and median WoW price increases of ~1.8% and ~1.2%, respectively) on the back of SEC enforcement actions taken against behemoth centralized exchanges Coinbase and Binance. The drop in prices was led by ADA (down ~19% WoW) and APT (down ~17% WoW). BTC saw the smallest price impact with a price drop of ~2.8% WoW.

🌞 SEC sues Coinbase and Binance, Robinhood plans to delist crypto assets including SOL, ADA and MATIC

This week, the US Securities and Exchange Commission (SEC) filed lawsuits against two major cryptocurrency exchanges, Binance and Coinbase, accusing them of operating illegal securities exchanges. The SEC's action have made it clear that all crypto exchanges in the US are violating securities laws. While some crypto exchange executives vehemently disagree, others were more explicit about their understanding of the law. As it stands, the SEC's lawsuits against Binance and Coinbase clearly highlight the agency's belief that operating a crypto exchange in the US without proper registration is illegal.

With that said, there is a distinction between the Coinbase and Binance cases, which lies in their respective approaches and reputation. Coinbase, as a US-based public company, has followed regulatory compliance more diligently and has gone public with extensive disclosures. It is audited by Deloitte, its business model focuses on securing customer funds and it’s reputation is that it successfully provides a safe trading environment. The SEC's complaint against Coinbase mainly revolves around the exchange's failure to register as a securities exchange. On the other hand, Binance, which operates globally and is known for its lack of transparency, has faced scrutiny for potential involvement in illicit activities. The SEC's complaint against Binance and CZ touches on allegations of market manipulation and improper control of customer assets.

The implications for Coinbase are significant but somewhat less severe compared to Binance. While both exchanges are accused of operating illegal securities exchanges, Coinbase's compliance efforts and overall reputation may work in its favor. Coinbase had taken steps to analyze crypto assets based on the Howey test and had established committees and procedures to address regulatory concerns. It remains to be seen whether Coinbase's legal approach and efforts to follow the law will help its case against the SEC. However, if the SEC's view that operating a crypto exchange in the US without registration is inherently illegal prevails, the same questions persist about the future of Coinbase and other exchanges such as Binance attempting to comply with regulations in the US.

Robinhood also found itself in the crossfire, with three of the tokens it supports on its platform labeled as unregistered securities by the SEC in its legal actions against Binance and Coinbase. In a update via Twitter this week, Robinhood stated that it would end support for Solana, Cardano and Polygon on June 27th. Robinhood’s chief legal compliance officer and Former SEC commission Dan Gallagher stated in a congressional hearing earlier this month that Robinhood also came in and tried to register with the SEC. He explained that Robinhood “went through a 16-month process with the SEC staff trying to register a special purpose broker-dealer, and then we were pretty summarily told in March that that process was over and we would not see any fruits of that effort” (Cointelegraph).

💫 TradFi talks about crypto at Bloomberg Invest Conference

The topic of crypto and blockchain came up several times at the preeminent Bloomberg Invest conference. Former SEC Chair Jay Clayton joined a panel with Pantera CEO Dan Morehead, while Soros CEO Dawn Fitzpatrick shared some thoughts on how traditional finance firms could seize on opportunities in the crypto space.

Former SEC Chair Jay Clayton and Pantera CEO Dan Morehead spoke at Bloomberg Invest about potential applications of blockchain technology upon the traditional financial system. Jay lauded some elements of blockchain technology, explicitly mentioning that stablecoins are "a “remarkable technology” for international transfers of value. He also noted that stablecoins also provide for greater transparency and potential for compliance with KYC / AML regulation. He also stated that the applications of blockchains in the financial system “should not be controversial” and to urge separation of the underlying technology and the centralized exchanges that undertook illegal actions such as commingling of client funds.

Soros CEO Dawn Fitzpatrick leads the multi-strategy investment practice at the $30bn family office and shared some of her thoughts about the space. She noted that “crypto is here to stay,” but noted that the crypto exchanges that grew alongside the last crypto boom “would have benefitted from having an adult in the room” (TheBlock). She then noted that while “what’s happened is clearly a setback [for the crypto industry]… right now I actually think it’s a huge opportunity for the incumbent financial firms to actually take the lead.”

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: LayerZero / Stargate

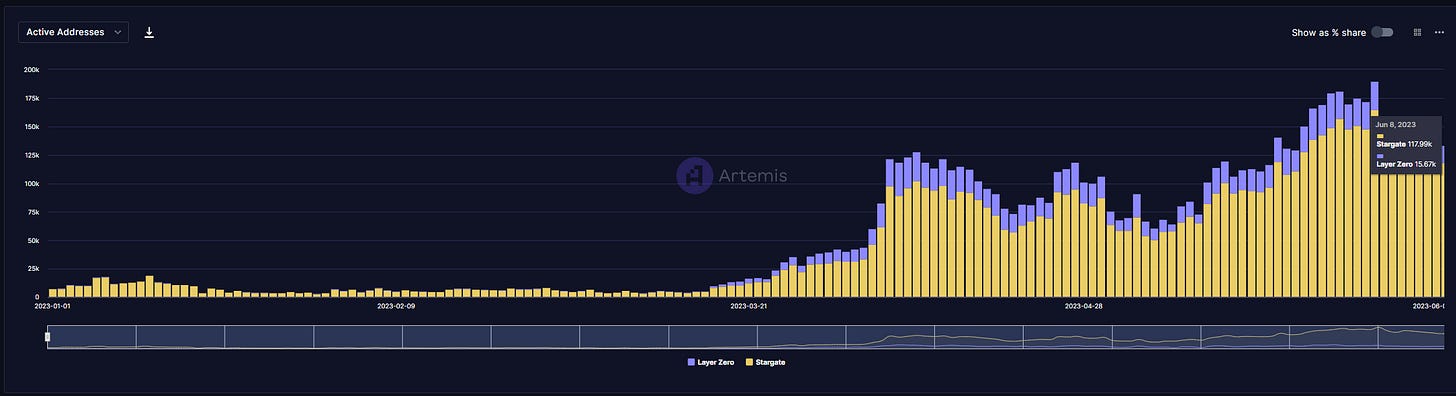

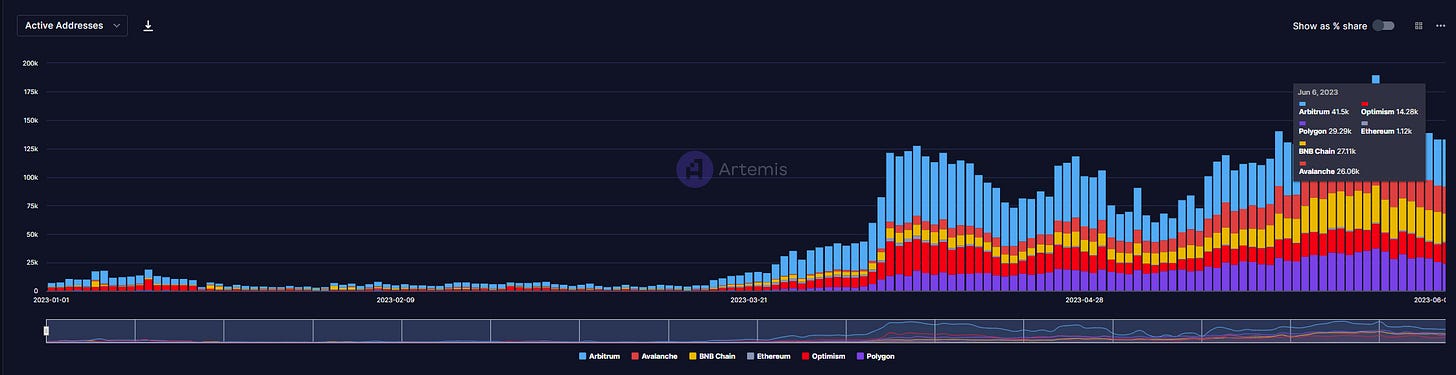

LayerZero and LayerZero-powered Stargate have taken the cross-chain world by storm over the past few months. While Stargate saw some drama around its token reissuance plans related to FTX’s purchase of STG tokens and subsequent bankruptcy, the launch of its staking program on March 25, 2023 and its successful proposal to deploy Stargate on several upcoming blockchains such as BASE, zkSync, Polygon zkEVM and ConsenSys zkEVM has led to immense active user growth over the past few months.

zkSync has been one of the fastest growing blockchain networks since launching in March, with ~156k daily active accounts as of June 7, 2023. While the growth numbers appear impressive, there is broad consensus that many of the users on these newer blockchains are likely hunting airdrops. At this time it remains difficult to discern what percentage of users are real vs. hunting for airdrops, but given the almost-certain guarantee of a future airdrop from platforms such as LayerZero and zkSync, we can likely assume that a significant portion of usage stems from airdrop farmers.

With that said, Stargate and LayerZero continue to build tech that allows bridging across more blockchains, which will be invaluable tools in a multi-chain world. Assuming current usage is primarily driven by airdrop farmers, it will be interesting to see how that usage changes if/when a LayerZero token is actually launched.

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 5/23/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.