This week, Coinbase accuses the SEC and FDIC for improperly blocking document requests (Coindesk), Vitalik Buterin backs new blockchain MegaETH which raises $20 million at '9-figure' token valuation (TheBlock), PolitiFi tokens fall in response to first US Presidential debate and Polymarket shows Biden likely to drop out.

💫 Volatility as VanEck files for Solana Trust, but SEC sues Lido, Rocketpool and Consensys

🌞 Blast’s airdrop flop, yet fundamental metrics holding up

The market trended down this week, with average and median returns across major tokens of -2.1% and -2.1%, respectively. Noteworthy are SUI and NEAR which saw drops of 13.6% and 9.6%, respectively. Both tokens saw major liquidations this week, according to Velo Data. Solana, on the other hand, saw a W/W increase of 4.0% largely driven by news of Van Eck’s Solana Trust filing.

In traditional equities, the SP500 touched all time highs again this week before cooling off and ending the week down 0.31%. The Nasdaq 100 teased all-time highs before ending the week up 0.05%.

In a major ruling this week, the Supreme Court of the United States overturned a major decision known as ‘Chevron deference’. This ruling set precedent for regulatory agencies, like the SEC, to interpret law that Congress had left vague. This could have big implications into how the SEC is allowed to enact and enforce regulations, including for cryptocurrencies. Chief Justice John Roberts said that “Chevron fosters unwarranted instability in the law, leaving those attempting to plan around agency action in an eternal fog of uncertainty” - a feeling all too common in the crypto industry in the US.

💫 Volatility as VanEck files for Solana Trust, but SEC sues Lido, Rocketpool and Consensys

The cryptocurrency industry witnessed significant regulatory developments this week, highlighting the ongoing tension between institutional adoption and regulatory scrutiny. VanEck made headlines by filing for a Solana Trust with the US Securities and Exchange Commission (SEC) on Thursday. This move marks the first attempt to launch a Solana-based ETF in the United States, potentially opening new avenues for institutional investors to gain exposure to the cryptocurrency. Matthew Sigel, VanEck's head of digital assets research, emphasized that Solana functions similarly to Bitcoin and Ethereum. He highlighted SOL's utility in paying for transaction fees and computational services on the Solana blockchain, drawing parallels to Ether's role in the Ethereum network. He believes that the combination of high throughput, low fees and robust security, makes Solana an attractive option for investors to get exposure to a versatile and innovative open-source ecosystem (Source).

On the other hand, reports emerged of the SEC filing lawsuits against Consensys - the company behind the popular crypto wallet, MetaMask. The SEC is alleging that Lido and Rocketpool staking programs are securities, and that Consensys has been engaging in the “unregistered offer and sale of these securities by participating in the distribution of the staking programs and operates as an unregistered broker with respect to these transactions. (SEC)” The SEC also cites Consensys’ collection of “hundreds of millions of dollars in fees” through MetaMask as a driver for the enforcement action. Almost immediately on the news, Lido and Rocketpool’s price dropped 18% and 10% respectively.

The week's events highlight the delicate balance between innovation and regulation in the crypto space. While VanEck's Solana ETF filing represents a step towards broader institutional adoption, the SEC's legal actions against key industry players serve as a reminder of the regulatory uncertainties that continue to shape the landscape. As the industry awaits the SEC's decision on Ethereum ETFs this summer, these developments underscore the complex and evolving nature of cryptocurrency regulation and adoption in traditional finance. The coming months will likely prove crucial in determining the trajectory of institutional involvement in various cryptocurrency assets beyond Bitcoin.

🌞 Blast airdrop flops while fundamental metrics hold strong

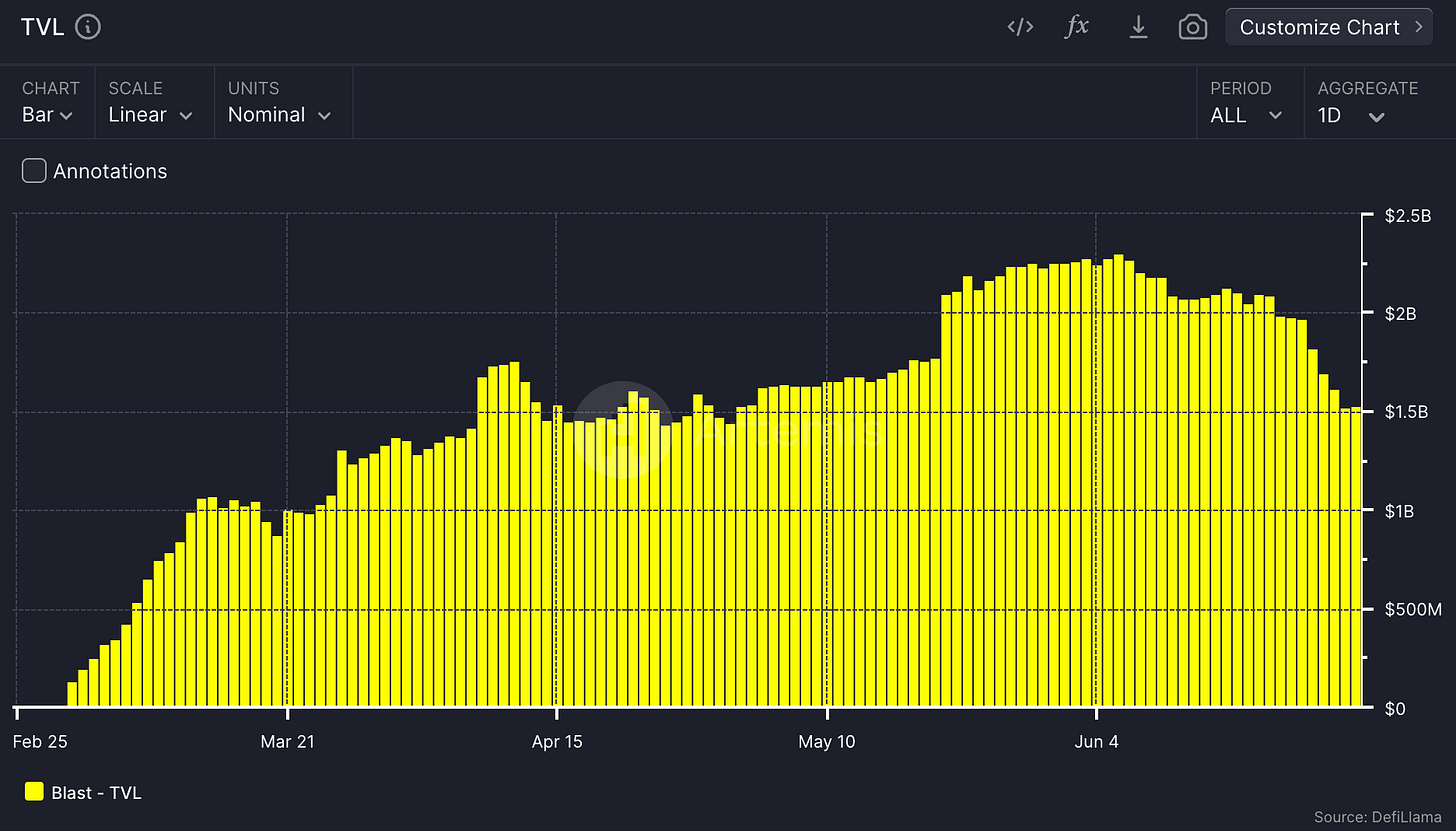

The Blast airdrop, one of the most anticipated events in the cryptocurrency world in 2024, has finally come to fruition, marking a significant milestone for the Layer 2 network. The airdrop, which took place on June 26, 2024, distributed 17 billion BLAST tokens, representing 17% of the total token supply. Blast, developed by the team behind the innovative NFT marketplace Blur, has rapidly gained traction since its launch in November 2023. The network's focus on speed, scalability, and native yield generation has attracted a substantial user base - at the highs, Blast had TVL of over $2.3 billion.

However, the airdrop’s launch was met with a fairly heavy load of criticism from the crypto community, with many airdrop farmers complaining about the bad distribution of $BLAST to users. Blast also saw an immediate sell-off in token price upon launch, and has yet to bounce.

As a result, Blast TVL fell sharply by $500m over the course of three days. Despite this, Blast’s other foundational metrics have held up well. Usage metrics show to be steadily climbing back to all time highs - while daily transactions saw a sharp decline, they tell a different story on the higher time frames. Daily active addresses have also hit all-time highs, recovering strongly post airdrop.

Looking ahead, this potentially shows that the Blast team has created sticky users. The Blast team's strategy of combining innovative features, attractive yields, and a phased token distribution approach appears to have created a loyal user base that is likely to continue engaging with the platform. This stickiness could be crucial for Blast's long-term success and its ability to compete in the crowded Layer 2 market. As the dust settles on this initial distribution, all eyes will be on Blast to see how it leverages this momentum to drive innovation and adoption in the competitive world of blockchain technology.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

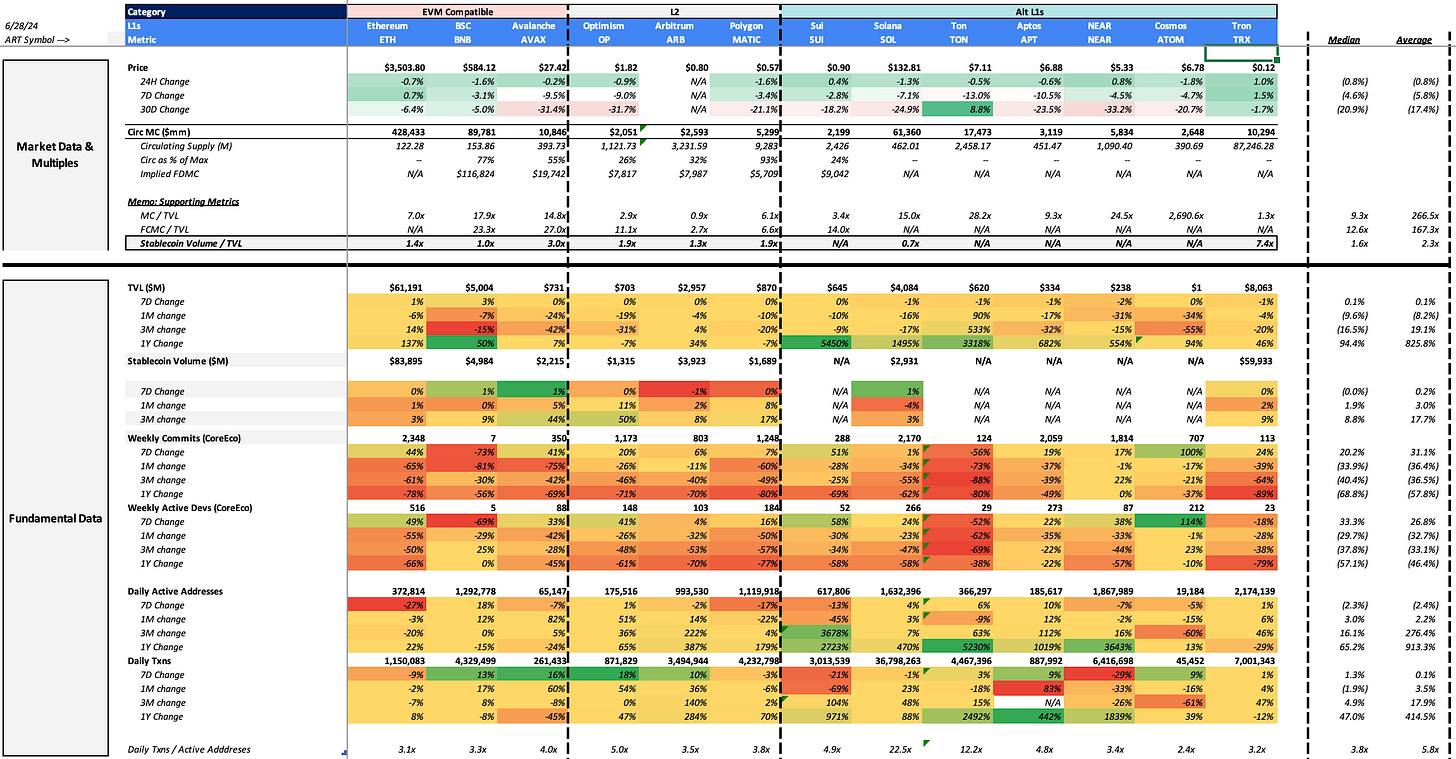

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 6/12/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

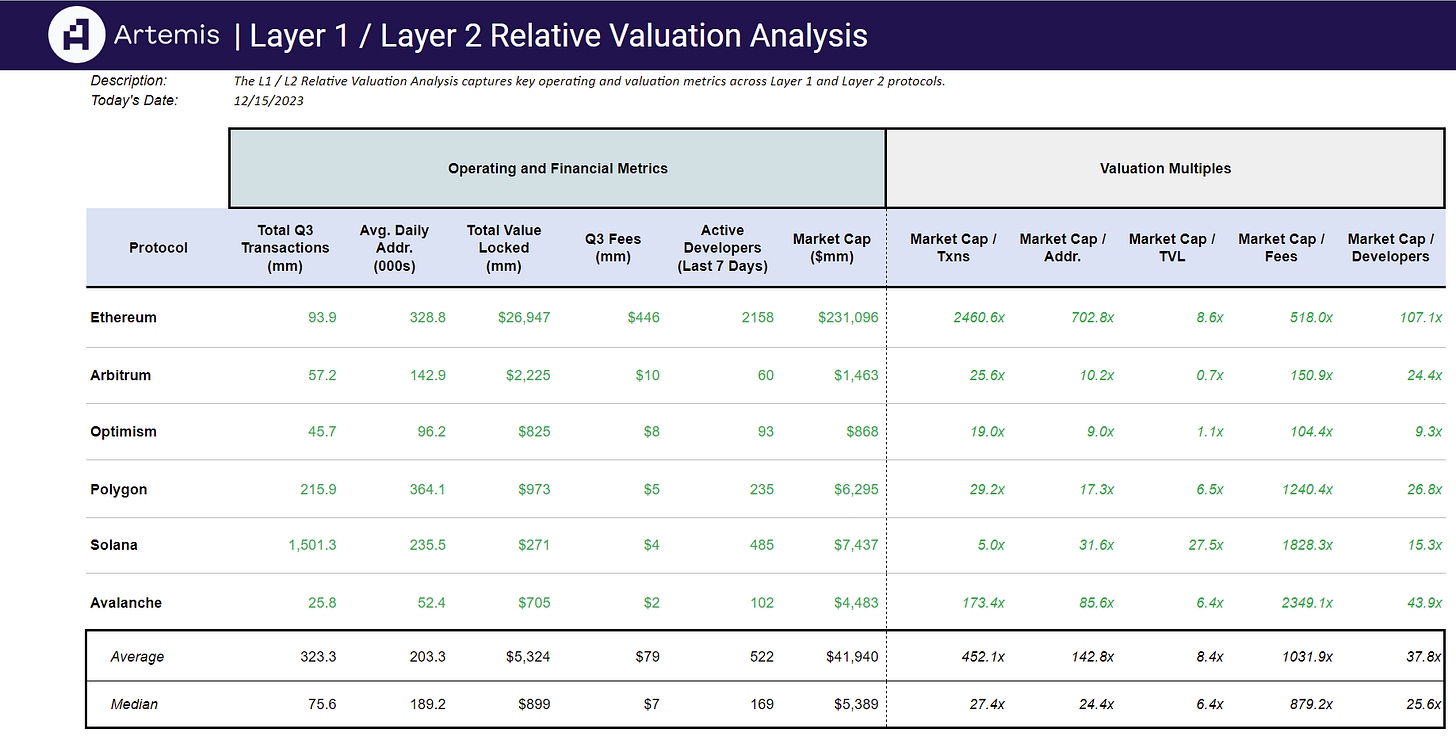

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞