This week was marked by a significant uptick in crypto markets driven by a flurry of tradfi activity ranging from Bitcoin ETF filings by traditional asset managers to the launch of digital asset platforms backed by a consortium of major financial institutions.

let’s jump right in 👇

🌞 Bitcoin rallies to YTD highs on the back of multiple ETF filings by traditional asset managers

💫 JPM continues stablecoin testing with Euro-dominated payments in JPM Coin to bring more efficient liquidity management to multi-national corporations

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: WOOFi

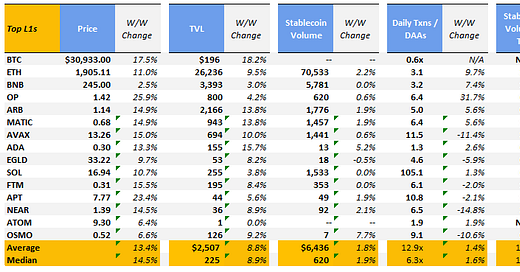

The market headed upwards in a meaningful rally (average and median WoW price increases of ~13.4% and ~14.5%, respectively) led by the ever volatile OP and APT (up ~25.9% and ~23.4%, respectively). BTC saw a ~17.5% run-up with ~$110bn of trading volume vs. ~$81bn of trading volume in the prior 7-day period. Meanwhile, ETH also realized a double digit price increase over the past week but saw subdued 7-day trading volumes of ~$53bn (a ~36% decline vs. the ~$83bn of trading volume seen in the prior 7-day period).

🌞 Bitcoin rallies to YTD highs on the back of multiple ETF filings by traditional asset managers

Bitcoin hit YTD highs of $31.4k after a flurry of investment firms including Wisdom Tree, Bitwise, Valkyrie, Invesco filed for spot ETFs this week following Blackrock’s filing last week. A chart from IntoTheBlock indicated that net inflows into addresses owning 0.1% or more of total BTC supply rose to an year-to-date high of 114,630 BTC on June 19, 2023. IntoTheBlock added that "Not only are large transactions climbing, whales appear to be accumulating... "comparing this with CEX net flows, we can confirm that the entities accumulating are not exchange-related as their net flows were negative while large holders' were highly positive."

Bitcoin hasn’t been at this price level since June 2022 when it last crossed $31.05k. While BTC prices have seen a ~90% increase YTD, liquidity in both spot and derivatives markets have continued to slow, allowing for small increases in large investor interest to meaningfully move price. Bloomberg notes that “spot trading volumes alone dropped nearly 22% to $495 billion, notching the lowest monthly reading since March 2019.” So while BTC continues its ride upwards, the market stands on very thin liquidity which could quickly drive prices in the opposite direction on a change in market sentiment. While the filings clearly indicate interest from large-cap traditional asset managers in offering crypto-related products, it remains to be seen whether these attempts will actually pass-muster with the crypto-skeptic SEC.

💫 JPM continues stablecoin testing with Euro-dominated payments in JPM Coin to bring more efficient liquidity management to multi-national corporations

JP Morgan has extended the capabilities of its JPM Coin project, a blockchain-based initiative that is among the bank's key forays into the evolving intersection of blockchain technology and traditional banking (Bloomberg). Originally launched in 2019 as a means to facilitate dollar transfers, JPM Coin added euro-denominated transactions to its platform this week, according to Basak Toprak, JPMorgan's head of Coin Systems for Europe, Middle East, and Africa (CoinTelegraph). The inaugural euro transaction was conducted by German conglomerate Siemens AG, marking a milestone for the bank's ongoing blockchain efforts. While the bank has used the platform to process $300bn of transactions since its launched, the value of the transfers is still miniscule compared to the $10tn of payments the bank processes on a daily basis (Bloomberg).

With that said, the utility of JPM Coin extends beyond simply offering another channel for payment. The current iteration platform intends to benefit corporate clients, particularly large multinationals, by allowing them to transfer funds across their various JPM accounts around the globe, or to other customers of the bank. Notably, these transactions are operational around the clock, faster, and are not restricted to business hours that conventional methods of transferring money are subject to. Additionally, the system provides an avenue for corporate treasurers to enhance liquidity management by timing payments more precisely and strategically than before. JPMorgan’s Toprak states that “there are cost benefits to paying at the right time… this could mean [multinational corporations] could earn more interest income on their deposits” (Bloomberg).

Ultimately, the extension of JPM Coin to facilitate euro transactions indicates that JP Morgan continues to explore using blockchain technology in an effort to optimize transactional efficiency, transparency and security for its customers.

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: WOOFi

WOOFi is a DeFi product offering cross-chain swaps and vaults on Optimism that has seen daily user figures grow from ~500 to ~4k+ over the past quarter. WOOFi launched in December 2022 and leverages Stargate’s cross-chain technology to power its swap product. While future DeFi products are still on the horizon, WOOFi states that 80% of the current revenue generated from swap fees on Optimism will be used to buy back WOO and reward WOO stakers.

WOOFi is a product of the WOO Network, which markets itself as “a deep liquidity network connecting traders, exchanges, institutions, and DeFi platforms with democratized access to the best-in-class liquidity, trading execution, and yield generation strategies at lower or zero cost.” WOO Network was incubated by Kronos Research, a multi-strat trading firm that specializes in market making, arbitrage, CTA, and high-frequency trading (HFT) and “averages around $5-10 billion of daily trading volume on global cryptocurrency exchanges.”

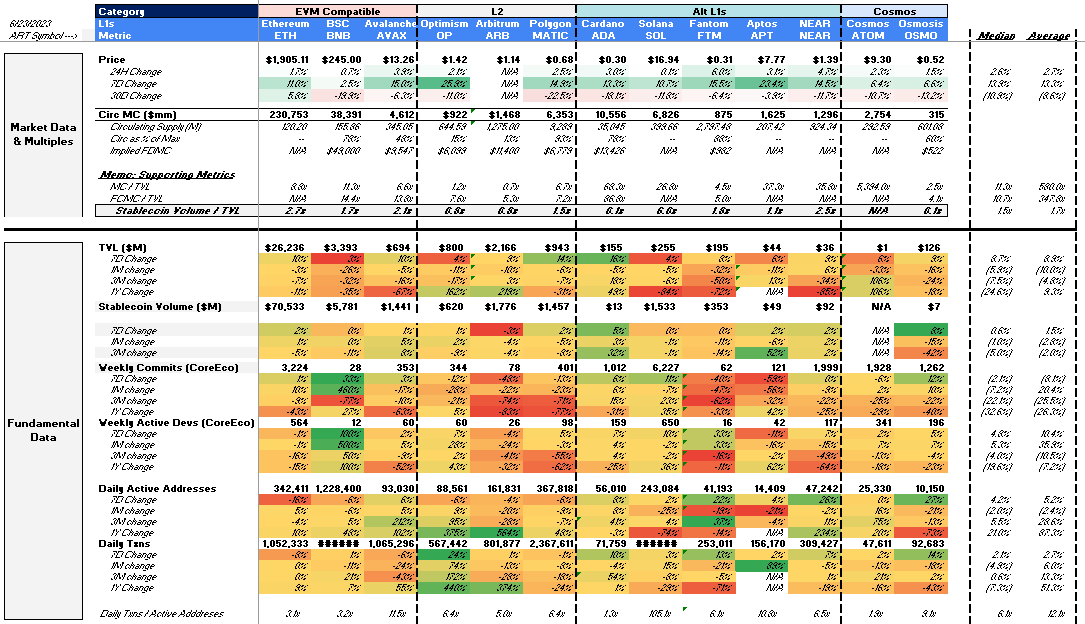

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 6/7/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.