gm friends.

here’s what happened in crypto this week👇

🌞 Senior House Republican draft bill proposes path for digital tokens to go from securities to commodities

💫 Credit Suisse and Deutsche-backed custody and tokenization platform deploys on Polygon

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: Safe and Layer 2s

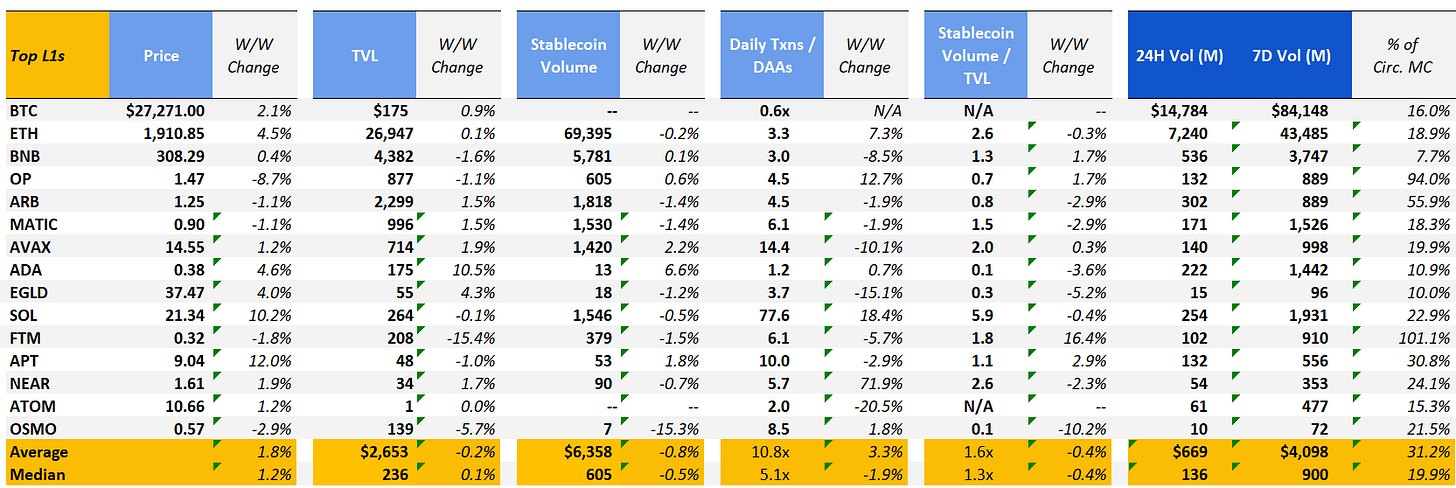

This week saw a slight rebound (average and median WoW price increases of ~1.8% and ~1.2%, respectively), led by SOL (up ~10% WoW) and APT (up ~12% WoW). OP saw the largest price drop of ~8.7% WoW which coincided with a ~$587mm token unlock this past week.

🌞 Senior House Republican draft bill proposes path for digital tokens to go from securities to commodities

A discussion draft unveiled on Friday by House Financial Services Committee Chair Patrick Henry and House Agriculture Committee Chair Glenn Thompson outlines a clear path for digital assets that begin as securities to become regulated as commodities. Bloomberg notes that while the 162-page draft bill will “likely face long odds getting the agreement from Democrats in Congress needed for it to become law,” it provides insight into how the Republicans are thinking about a regulatory framework for digital assets.

In the draft bill, tokens offered as part of an investment contract (and would therefore be considered securities) would sit within the SEC’s control, while tokens that are considered commodities would be overseen by the Commodity Futures Trading Commission. The primary determination for whether a digital asset is a security or commodity depends on the level of decentralization of the underlying project. The draft specifically points to certain decentralization requirements such as that over the prior 12 months, no entity had the authority to “control or materially alter” the function or operation of the network and that no affiliated member of the project owned 20% of more of the units outstanding. The draft also provides structure for projects to attest sufficient decentralization to the SEC - after that the SEC can either approve or object the decision after an initial 30-day review period.

Part of the bill would also push for more detailed studies on NFTs and DeFi, which could lay the groundwork for clearer regulations around those fields at a later date. While we expect the specifics of the bill to change dramatically as House debate unfolds, we hope that that US regulatory rhetoric continues moving in a direction that encourages sensible discourse.

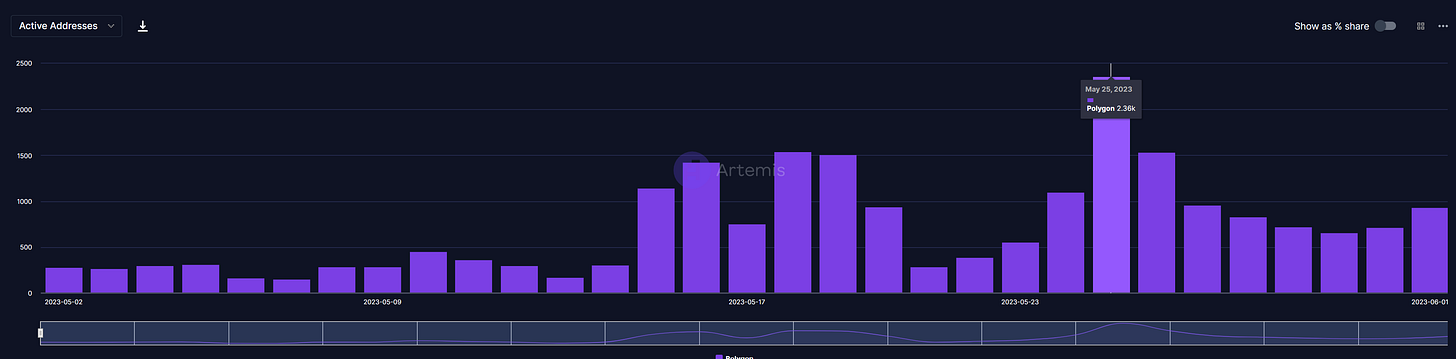

💫 Credit Suisse and Deutsche-backed custody and tokenization platform deploys on Polygon

Taurus, a custody, trading and tokenization solution has launched on Polygon as tokenization solutions continue to gain traction among financial institutions and large-cap corporates. This integration will allow for Taurus’s clients (i.e. Credit Suisse and Deutsche Bank) to leverage Polygon to tokenize assets such as traditional equities and debt. The integration is the fourth blockchain for Taurus, which previously deployed on Ethereum, Tezos and Cardano. Victor Busson, chief marketing officer and head of strategy partnerships at Taurus indicated that there was “high demand to integrate Polygon from clients, especially large banks” (TheBlock). In addition to low fees, Busson also highlighted that “user-friendly smart contract development platform and tools” were critical benefits of the Polygon ecosystem.

While Busson did not share the size of assets tokenized on the Taurus platform, he noted that 70% of the company’s clients are using the tokenization platform vs. 10% two years ago. A spokesperson for Taurus stated that “debt, funds and structured products are among the most popular assets for tokenization, though the demand varies depending on local regulations (Cointelegraph).

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: Safe and Layer 2s

Safe (prev. known as Gnosis Safe) is an on-chain wallet platform that operates across multiple blockchains. Safe recently announced that it is one of the protocols working with WorldCoin to “prove humanness… in the age of AI.” Safe works with WorldCoin by providing every World App user with a smart contract wallet that uses SafeCore, a technology stack built by Safe. To date, World App has onboarded 1.2 million self-custodial Safe Smart Accounts.

Layer 2s on Ethereum have continued on their tear of gas usage over the past few months, driven primarily by zkSync, Arbitrum and Optimism. Per the Artemis Blockchain Activity Monitor, Arbitrum and zkSync have been vying for the top gas-consuming layer 2 over the past month, with Arbitrum taking a heavy lead in early May, and zkSync leading the pack towards the latter half of the month. As users continue to move from Ethereum layer 1 towards layer 2 applications in search of lower fees and faster transactions, it will be interesting to see how gas consumption and user metrics change across Ethereum scaling solutions.

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 5/16/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.