CALLING ALL STABLECOIN USERS: If you use stablecoins like USDC or USDT anywhere in the world, we would love to chat with you as part of our ongoing stablecoin research efforts. Please schedule a time with us here.

This week, Pantera Capital seeks to raise funds for second TON investment (The Block), US Congressman discloses purchase of VELO tokens (X/PelosiTracker_), Telegram Game 'Hamster Kombat' Claims Explosive Growth, Topping 150 Million Players (The Block), audit and security firm CertiK finds exploit in Kraken exchange, steals $3,000,000 (Blockworks).

💫 zkSync and LayerZero airdrop over $2bn to community

🌞 Martin Shkreli claims he created DJT token with help from Donald Trump’s son

This week saw continued downward price movements as investors struggle to find near-term catalysts. The biggest losers this week were TON and APT, each posting double digit losses, twice the average among select major tokens. OP and AVAX were not far behind, while ETH and ATOM managed to stay positive this week.

ETH rallied early in the week following news that the SEC would no longer be continuing its probe into Consensys. In April 2024, Consensys received a Wells notice from the SEC, indicating the agency's intent to pursue enforcement action. This suggested that the SEC was considering charges against Consensys, possibly related to securities law violations. The decision by the SEC to cease the investigation is a strong signal that the agency no longer seeks to regulate ether as a security, although they have not confirmed it officially. More good news came this week as major asset managers Fidelity, BlackRock, Bitwise, and more submitted amended S-1 filings for their ETH ETF offerings. The ball is now in the SEC’s court to review these filings ahead of approval before the ETFs can start trading.

Meanwhile, equities indices like the NASDAQ 100 and S&P 500 continue to make fresh all-time highs, driven by AI giant NVDIA which briefly becomes world’s most valuable company this week (Financial Times). Although analysts feared a recession a year ago, the stock market has experienced unexpected tailwinds due to strong consumer spending and a robust labor market (MorningStar).

💫 zkSync and LayerZero airdrop over $2bn to community

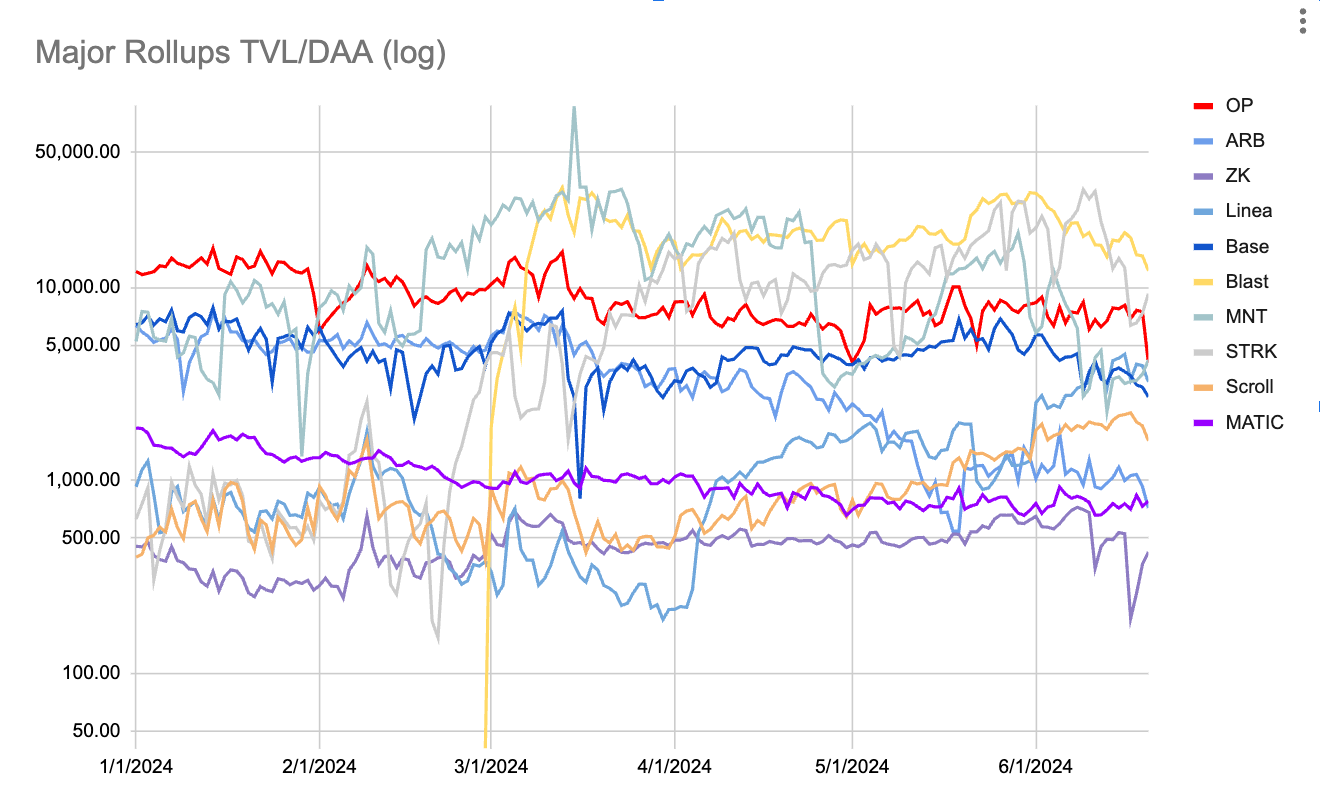

This past week two highly anticipated airdrops occurred. The first was zkSync’s ZK token, which debuted at a market cap of $1bn on Monday, sliding to ~$780m by Friday. The token was released on zkSync Era, the zero-knowledge proof-based Ethereum rollup. zkSync Era is the most successful zk L2 by daily active addresses and daily transactions, save for a spike in Linea activity in late March. It is also a significant competitor to in the broader Layer 2 space, often ranking among the top 3 Layer 2s by active addresses and daily transactions.

However, zkSync Era TVL pales in comparison to other Layer 2s, making up less than 2% of Layer 2s aggregate TVL. The zk rollup also makes up less than 2% of rollup fees generated. Then it comes as no surprise that zkSync Era ranks last among all L2s by TVL/DAA, indicating that each user adds very little economic activity to the network.

Later in the week, Layer Zero debuted their ZRO token, which opened at a market cap of $1bn as well before slipping to $760m in tandem with the broader market. The token was launched on Arbitrum One, which caused the rollup’s fees to spike to a new all-time high of $3.3m on June 20th.

The Layer Zero airdrop is of particular importance as the team went to great lengths to filter out Sybils from their airdrop in one of the most rigorous and open anti-Sybil campaigns to date. One sign of a successful Sybil campaign will be whether or not airdropped users sell their tokens shortly after receiving them, which is often the case with airdrop farmers. It may be too soon to tell, although the ZRO token is down 25% since launch but this could be due to broader market movements.

Looking at LayerZero’s analytics site, we can see that the protocol has facilitated the transfer of 134m messages to date. While activity dropped off sharply a month and a half ago following announcement of the airdrop snapshot, activity seems to be coming back in an equally dramatic manner. However, it remains to be seen wether or not these levels of activity can be sustained.

🌞 Martin Shkreli claims he created DJT token with Donald Trump’s son

This week, Martin Shkreli, notorious for his stint as price-gouging "Pharma Bro," revealed his involvement in the creation of the DJT token, a new cryptocurrency built on the Solana blockchain. Shkreli disclosed during a June 18th X Spaces session that he had been part of the DJT project since April, helping to kickstart it under a friend's initiative. He claimed that around ten entities contributed to the development of DJT, with roughly forty to fifty people aware of the project. Blockchain investigator ZachXBT shared insights from direct messages with Shkreli, who claimed to possess over 1,000 pieces of evidence supporting his role in DJT’s creation. This came after Arkham Intelligence offered a $150,000 bounty to uncover DJT’s creators. Despite the controversy, DJT's price skyrocketed, gaining 23% in one day and nearly doubling in value over the past week. The token's self-reported market cap now stands at $2.71 million, although leading crypto analytics platforms have yet to verify these metrics.

Shkreli claimed that Barron Trump, the son of former President Donald Trump, was involved in the project and held the private keys to its smart contract address. He also suggested that Donald Trump approved the token, although these claims have not been publicly confirmed by the Trump family. The DJT token has attracted significant attention and speculation, with bets totaling $2.17 million on Polymarket regarding the token's legitimacy. Prominent crypto figures including GCR of Terra Luna fame have also publicly announced their willingness to place large bets on the token's authenticity. Despite Shkreli's claims, there remains skepticism about the true origins and legitimacy of the DJT token. Some industry leaders have criticized the association with the Trump family, and the debate continues on social media. Overall, Shkreli's involvement has added complexity to the DJT token saga, fueling both interest and controversy in the cryptocurrency market.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

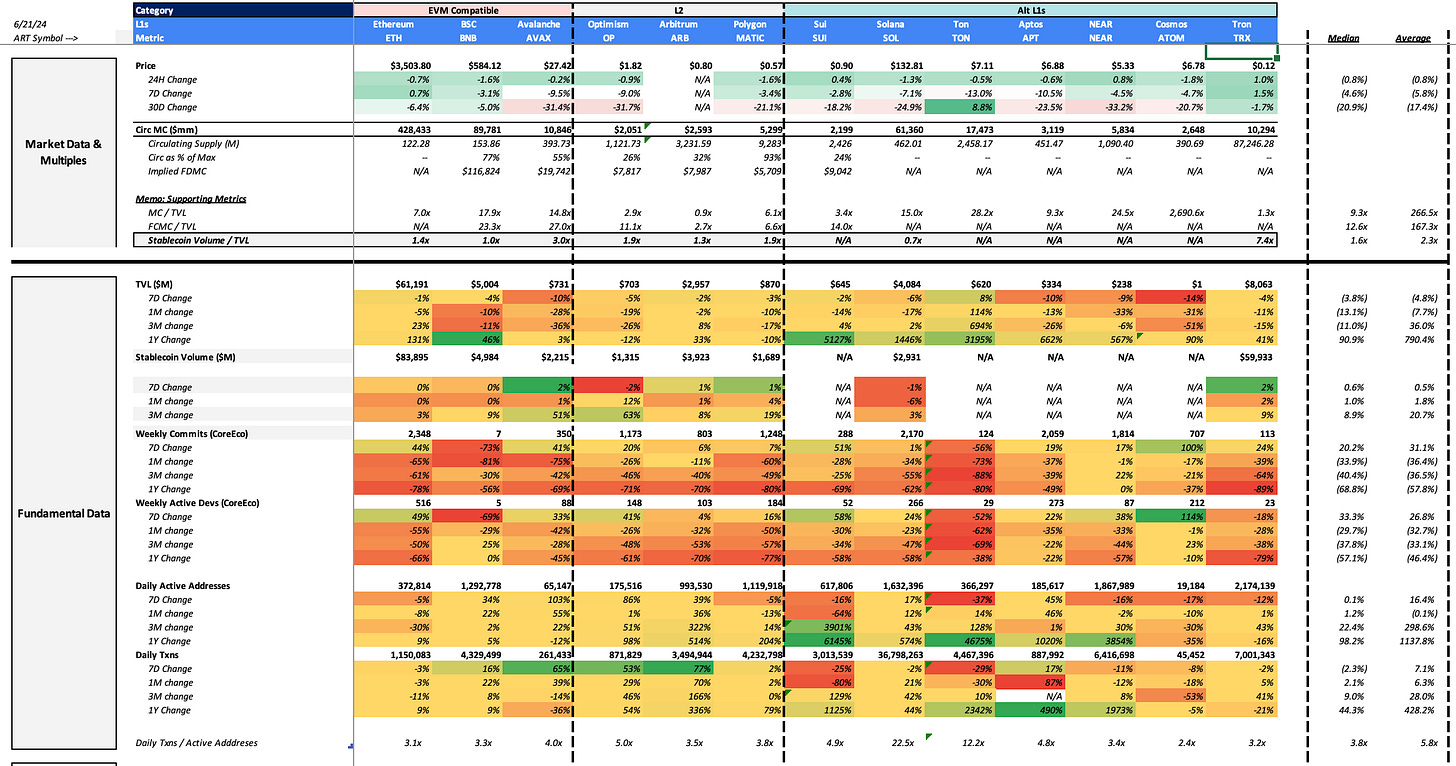

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 6/5/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

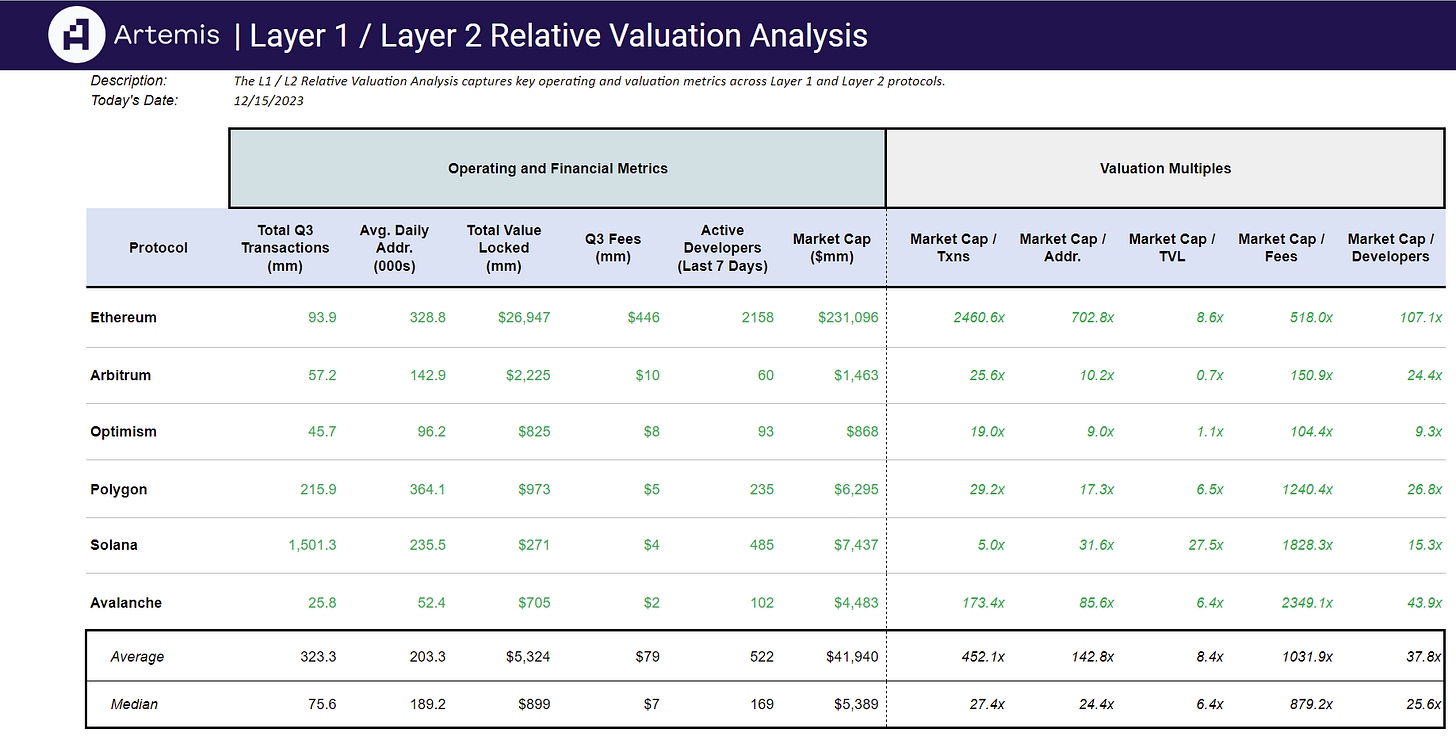

Artemis Sheets

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞