gm friends. Another wild week filled with mega-cap tradfi institutions pushing into crypto, a bizarre Congress hearing on crypto regulation and regularly scheduled programming of Tether fud.

let’s jump right in 👇

🌞 Tether sees sell-off after disclosure of 2021 settlement documentation by NY Attorney General’s Office

💫 BlackRock files for Bitcoin ETF

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: Perpetual Protocol

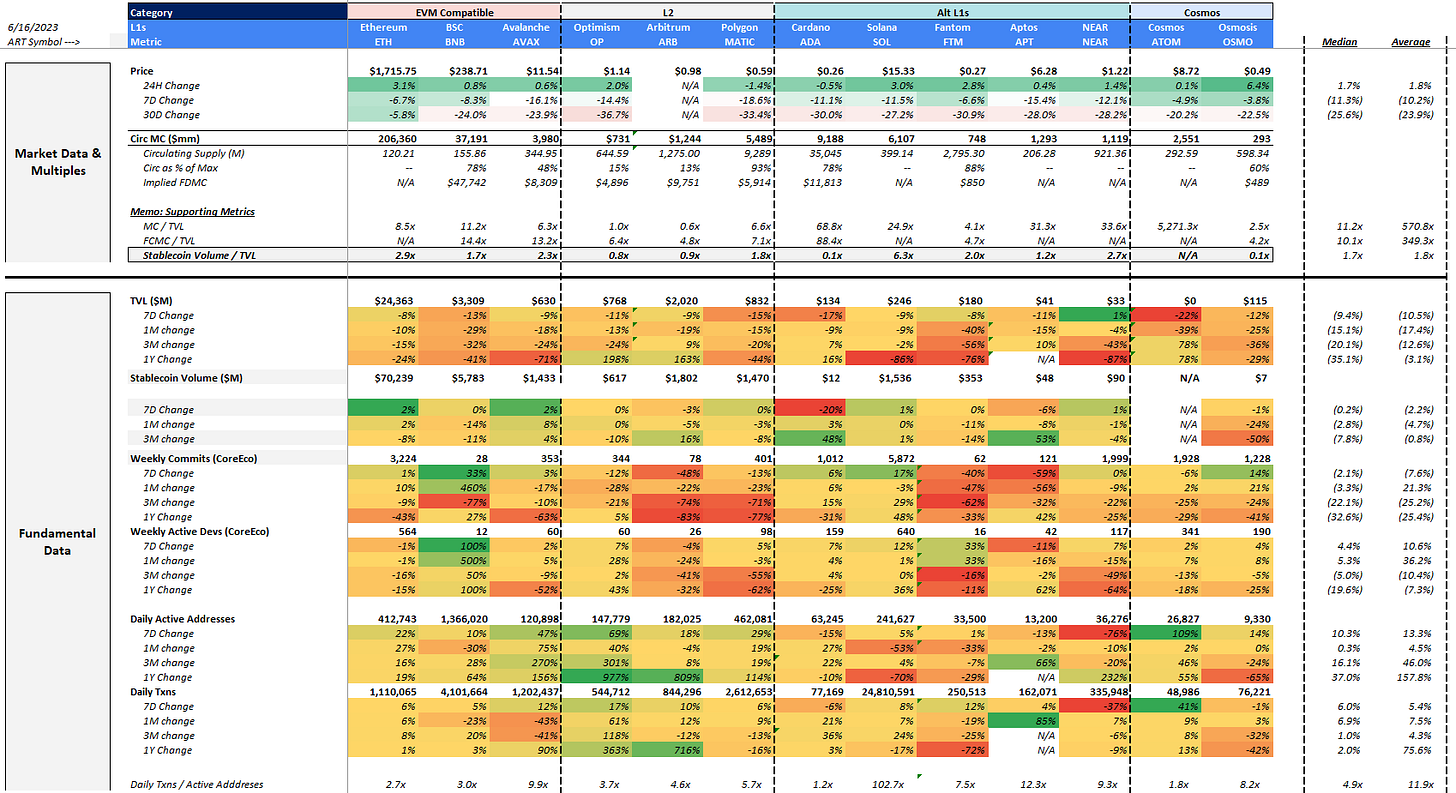

This week saw another drop-off in prices (average and median WoW price declines of ~10.8% and ~11.5%, respectively) as Binance continues to face regulatory challenges in multiple jurisdictions and token delistings across multiple exchanges continues. The drop in prices was led by MATIC (down ~19% WoW) and ARB (down ~19% WoW). while BTC saw the smallest price impact with a price drop of ~0.7% WoW.

🌞 Tether sees sell-off after disclosure of 2021 settlement documentation by NY Attorney General’s Office

On June 15th, USDT saw its peg to the US dollar fall to as low as $0.9968 (CoinDesk) as USDT balances on Curve’s 3pool rose to as high as ~72% of total pool liquidity. The Curve Pool saw over ~$300mm of USDT at one point during the day and only held ~$55mm of USDC and DAI. CoinDesk also noted that similar imbalances occurred during other market dislocations events such as the FTX implosion in May 2022 and the FTX collapse in November 2022.

On the same day, Tether issued a statement regarding an “attack on USD₮ via both DeFi and centralized exchanges” (Tether). The attack apparently coincided with the disclosure of certain documents from the New York Attorney General’s Office to CoinDesk, which CoinDesk sought under New York’s Freedom of Information Law after Tether’s 2021 settlement with the NYAG. Despite the attack, Tether stated it remains confident in its financial strength and continues to assert that its reserves are more than sufficient. Having recently completed its obligation to provide quarterly reports to the New York Attorney General’s Office, Tether also stated that it has continued to remain transparent and has kept its reserves consistently adequate since that time.

Other media sources including Bloomberg also picked up on the documents disclosed by the New York Attorney General’s Office and noted that Tether had previously counted securities issued by Chinese companies among the reserves backing the USDT stablecoin. Tether previously acknowledged that it had held commercial paper in its reserves, but has since eliminated the asset class from its balance sheet since October of 2022.

Tether’s CTO Paolo Ardoino took to Twitter to express that Tether made it through an attack that “didn’t have much power anyway and it’s dying off already” and that the company is making a “continued commitment to transparency.”

💫 BlackRock files for Bitcoin ETF

It’s official: Mega-Cap TradFi has come for the crypto space. This week, BlackRock filed for a Bitcoin ETF in a push towards the crypto sphere.

Blackrock's iShares Bitcoin Trust application stands out from prior attempts to gain the U.S. Securities and Exchange Commission's (SEC) approval due to the proposal of a "surveillance-sharing agreement" with exchanges. This agreement, also known as the "Spot BTC SSA," involves the Nasdaq entering into a collaboration with a Bitcoin spot trading platform operator, allowing for the sharing of data on market trading, clearing activity, and customer identification. The aim of this unique approach is to mitigate the possibility of market manipulation, a major concern of the SEC in past rejections. Despite public data feeds being available from crypto exchanges such as Kraken and Coinbase, this formal arrangement may provide an added layer of security and transparency that could assuage the SEC's worries about market integrity.

What distinguishes Blackrock's iShares product from other ETFs lies in its operational mechanics, straddling the line between a trust and an ETF. While it technically falls under the category of a trust, its structure also includes a redemption mechanism, a characteristic typical of ETFs. This arrangement allows the iShares product to acquire Bitcoin at the end of the trading day to reconcile the fund's assets with its trading price, a feature that trusts typically do not possess. The ability to buy Bitcoin in real-time to maintain parity between the fund's assets and its market value is the key distinction that makes this trust different from products like Grayscale's Bitcoin Trust (GBTC), which frequently trades at a significant discount or premium to its net asset value due to the absence of such a mechanism.

The approval of BlackRock's Bitcoin Trust would likely bring significant benefits to the cryptocurrency industry. First, it would help alleviate the liquidity issues that have plagued the Bitcoin market since the collapse of FTX, as the credibility and attention a BlackRock-sponsored Bitcoin ETF would attract could trigger meaningful financial inflows. The Trust could also disrupt other crypto exchanges exchanges by offering investors lower fees for Bitcoin price exposure, which would be particularly appealing to those not interested in actually using Bitcoin. With that said, the approval would likely also spur the growth of "paper Bitcoin”: financial instruments and derivatives representing Bitcoin - given the cryptocurrency's fixed supply.

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: Perpetual Protocol

Perp Protocol on Optimism has seen increased usage over the past week with an influx of new users. Overall Decentralized Perpetual trading volumes have rebounded in the past week as regulatory volatility has impacted centralized exchange offerings including Binance, Coinbase and Robinhood.

While active addresses have spiked, trading volumes remain consistent with no major changes over the same time period. Could the new active addresses be a precursor to future activity on the Perp protocol?

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 5/30/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.