gm friends. This week we witnessed an interesting divergence in Ethereum price vs. that of comparable blockchain ecosystems. As of Friday May 5th, ETH saw a WoW mid-single digit % increase while the broader ecosystem traded down. More on this new phenomenon below 👀

here’s what happened in crypto this week👇

🌞 Ethereum’s deflationary pressure takes center stage courtesy of Uniswap + memecoins

💫 Stripe introduces fiat to crypto on-ramp

🤝 Protocols to Watch out for via the Artemis Blockchain Activity Monitor: Dustsweeper and Stargate

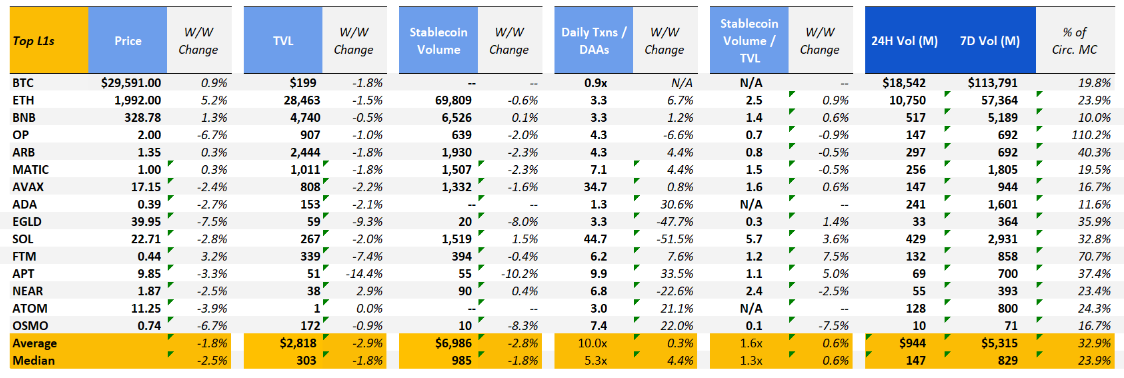

Friday saw a 5.2% jump in ETH prices while the broader crypto ecosystem saw an average and median WoW price decline of 1.8% and 2.5%, respectively. OP once again saw the largest price drop with a ~6.7% WoW decline, while FTM saw the largest WoW price gain (behind ETH) of 3.2%. BNB and BTC also saw small gains over the course of the week with WoW price increases of 1.3% and 0.9%, respectively.

let’s jump right in

🌞 Ethereum’s deflationary pressure takes center stage courtesy of Uniswap + memecoins

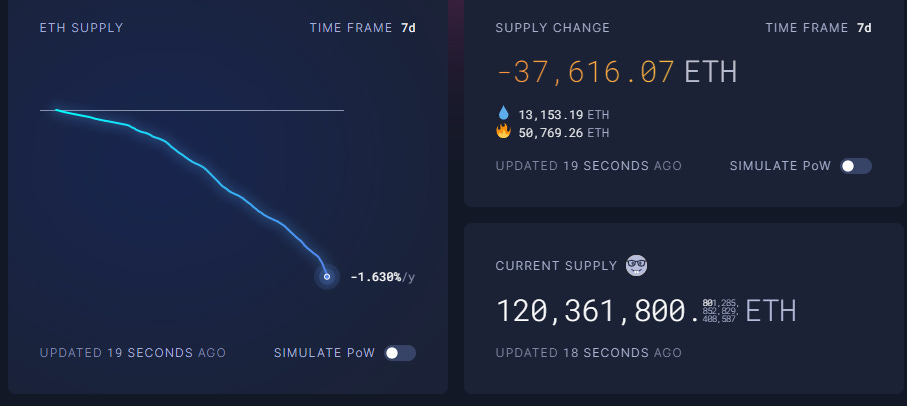

This week, Ethereum supply saw a wave of heavy deflationary pressure: per ultrasound.money, the network observed a ~37.6k decrease in the supply of ETH (~50.7k ETH burned versus newly issued ETH of ~13.1k). As a reminder, 90%+ of Ethereum gas (transaction fees paid by consumers) are burned while a small portion is paid out to validators as a form of “tip.”

Per Artemis, we tracked the source of the increased gas fees to the DeFi category, where we found Uniswap to be the primary culprit of inflection in gas usage.

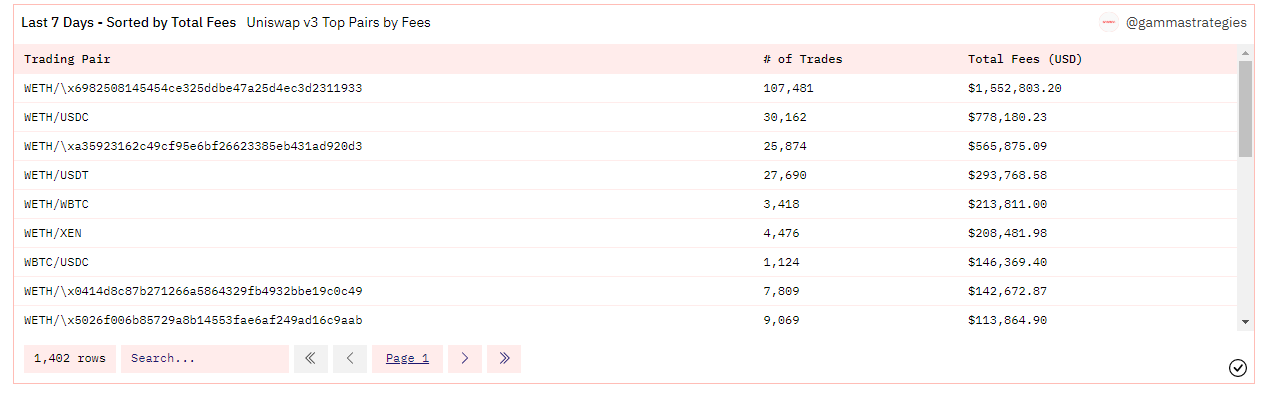

What was driving this crazy spike? Per @gammastrategies, the trading pair generating the highest fees and # of trades trades was the WETH / x698… pair. What is this mysterious token?

If you’ve been on crypto twitter at all this week you’ll have figured out it is indeed Mr. $PEPE. The memecoin has grown to a ~$1.4bn valuation and driven a frenzy of on-chain trading activity from Uniswap on Ehereum.

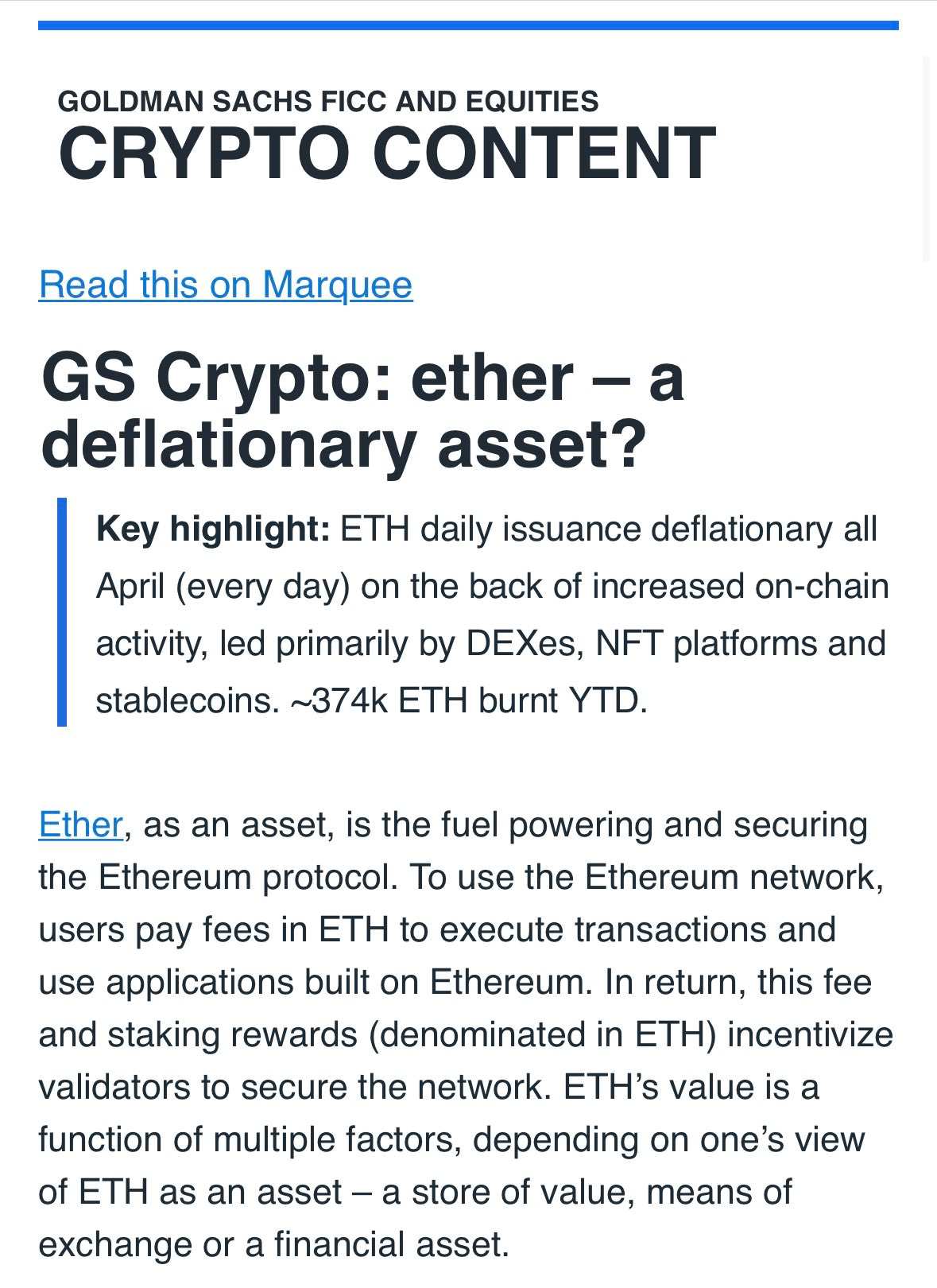

While it continues to be both sad and funny that pepe is a driving source of usage on blockchain networks, the narrative of “Deflationary Ethereum” has caught on with the tradfi homies. In a recent note from Goldman Sachs, the investment bank notes that ETH has become an “increasingly deflationary asset over the past months” on the back of “increased on-chain activity led primarily by DEXes, NFT platforms and stablecoins. ~374k ETH burnt YTD.” While the note highlights the recent deflationary pressure on the asset, the firm also recognizes that “ETH’s value is a function a multiple factors… a store of value, means of exchange, or a financial asset.”

At Artemis, we believe that fundamental investment methodologies will evolve in the crypto space and eventually drive longer-term price discovery. The idea that Ethereum needs to be viewed across multiples lenses (ex. store of value, commodity for consumption, financial asset) is consistent with how we believe Ethereum will eventually be valued. More on that to come

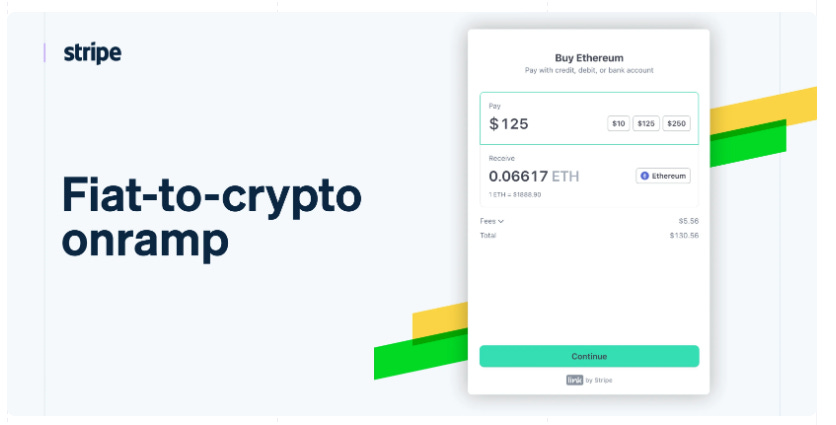

💫 Stripe introduces fiat to crypto on-ramp

Stripe announced this week that it plans to provide access to crypto on-ramp options for existing Stripe customers. Companies that offer cryptocurency and blockchain-enabled experiences will now be able to integrate a seamless on-ramp experience to reach a new wave of web3 users.

Stripe notes that blockchain-enabled businesses oftentimes face a cold-start problem: new web3 users don’t have crypto into their wallets to carry out transactions and thus are turned off from transacting with platforms that require the prior purchase of crypto. Stripe states that its onramp “allows customers to purchase crypto at the precise moment they need it… [the consumer] could purchase Ethereum, for example, and immediately use it to buy an NFT.” This feature would remove the friction for a potential new web3 user looking to transact on the blockchain for the first time.

Along with the product announcement, Stripe also unveiled a number of web3 partnerships with household names such as Brave (privacy-focused browser), Safe (custody solution on EVM chains), 1inch (decentralized-exchange aggregator) and Lens Protocol (web3 social network).

Stripe’s partnerships across this diverse range of categories of blockchain-enabled businesses (consumer social, infrastructure, custody) aim to improve the accessibility and safety of blockchain enabled applications.

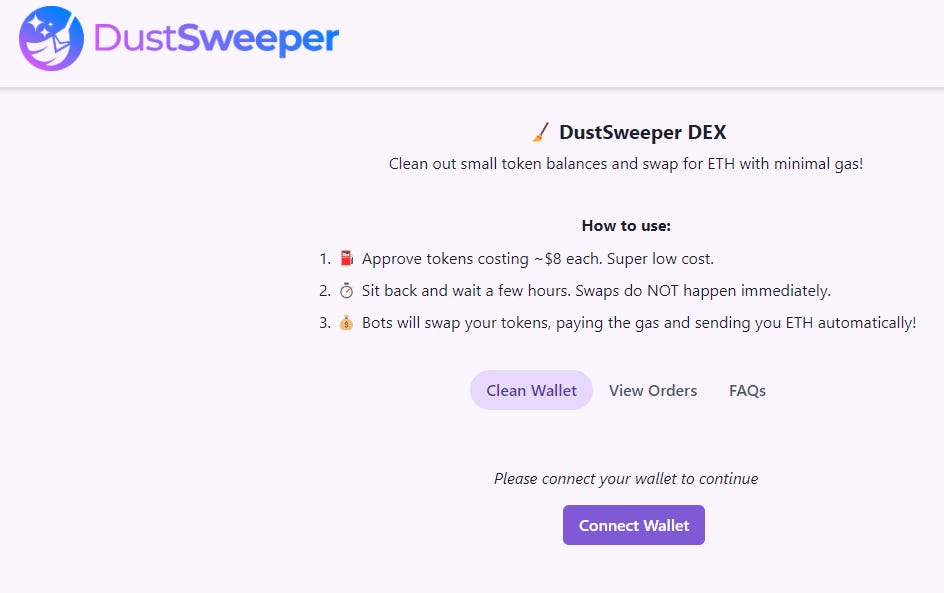

🤝 Protocols to Watch out for via the Artemis Blockchain Activity Monitor: Dustsweeper and Stargate

DustSweeper is an application on Ethereum that has seen a big jump in active addresses and gas usage over the past week.

Dust Sweeper is a protocol that allows you to clean out small token balances by swapping them into ETH at a low cost. After approving the tokens for sweeping, the protocol will activate bots that will automatically swap your tokens, pay the gas and send ETH into your account.

With the barrage of memecoins that traded this week, we imagine DustSweeper was used to swap old, low-value memecoins into ETH to try and catch some of these newer pumps. We’ll see if this activity continues post current meme-coin craze 🤷

Stargate is a omnichain liquidity protocol that allows users to transfer tokens across blockchains. In April 2023, Stargate announced that it had surpassed $1bn in monthly volume for the first time, which coincides with the heavy user traffic we see on BAM.

Stargate has cemented a number of aggregator partnerships with platforms such as OpenOcean, Arbidex, Rubic and Layer 3, allowing users to swap stablecoins via Stargate to the seven blockchains Stargate currently supports (Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Arbitrum and Optimism). Per the Blockchain Activity Monitor, we can see that there has been a huge influx of new users of Stargate alongside continued retention of returning users.

Some of Stargate’s recent appears to stem from airdrop hunters: CoinDesk notes that volume on the Stargate bridge surged by ~30% in a single day when traders attempted to meet the criteria for a potential LayerZero airdrop (CoinDesk). Going forward, we will continue to track whether Stargate is able to retain its new users or whether its growth will fade post airdrop szn.

You can check out the BAM of the week on our site for more insights like these, and even submit your own questions!

that’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 4/22/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.