gm friends.

here’s what happened in crypto this week👇

🌞 Visa explores account abstraction and ERC-4337 on Ethereum Goerli Testnet

💫 Institutional Investors including VanEck ($75bn+ AUM), Felipe Montealegre (Theia Capital) and Sam Andrews (FRNT Financial) Apply Fundamental Investment Frameworks to Crypto

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: Avalanche and Holographxyz

This week saw muted price action (average and median WoW price decline of ~1% and ~0%, respectively) with minimal crypto market reaction to the SEC’s muted response to Coinbase’s request for further regulatory clarity from earlier this year. ATOM and OSMO saw the largest price drops with ~5.5% and ~4.3% WoW declines, respectively, while APT, typically a high beta asset, held up vs its peers with a ~1.4% WoW gain.

🌞 Visa explores account abstraction and ERC-4337 on Ethereum Goerli Testnet

As part of Visa’s “Crypto Thought Leadership” series, the financial services giant released an article this week walking through how technological innovations on Ethereum such as “Account Abstraction” could help enable frictionless crypto onboarding experiences, a prerequisite for digital currencies are able to earn mainstream adoption.

Why does Account Abstraction Matter?

Today, there exists significant friction for a new user to interact with a blockchain. New users have to generate seed phrases, pay a volatile sum of gas each transaction and sign each individual transaction through their web3 wallet. These heavy points of friction make broad adoption of consumer adoption of blockchain technology difficult in its current state, given that the end consumer continuously needs to step through multiple (ever-changing) hoops in order to interact with blockchain platforms.

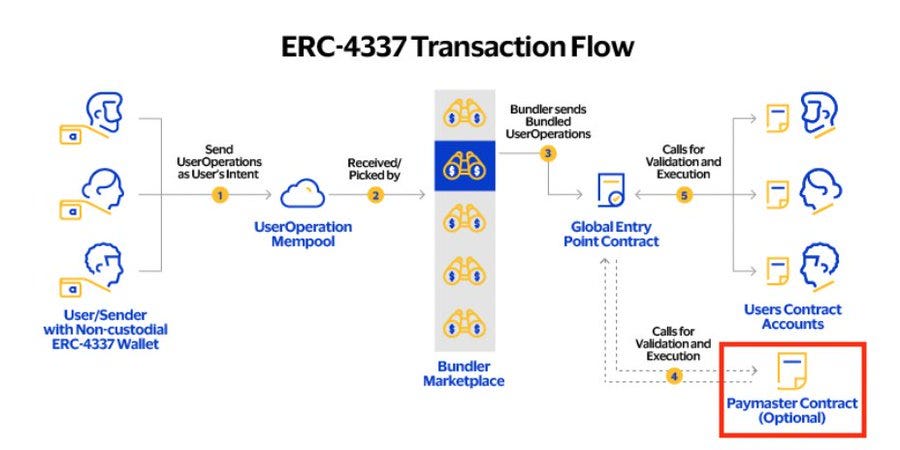

Enter Account Abstraction and ERC-4337. As quick background, ERC-4337 (the current proposal for implementing account abstraction) aims for smart contract platforms to reduce the friction for the end consumer to interact with blockchain platforms. The proposal will allow for solutions such as allowing applications to pay gas on behalf of the consumer, or allowing the consumer to pay for gas using non-ETH tokens (i.e. ERC-20 tokens or application native tokens).

In a future state of blockchain adoption with ERC-4337 implemented, applications could take on the gas costs associated with interacting with public blockchains and abstract that inconvenience away from the end consumer. This would lead to more seamless user experience that would be more akin to how users expect to interact with online applications in Web2, where users are paying only for the consumer-facing product, while the application is paying for cloud compute / on-prem servers to actually host the service.

What is Visa doing?

Visa is currently conducting experiments on Ethereum Testnet to evaluate whether ERC-4337 can be utilized in practice to execute transactions where applications could pay gas for their end-consumers or whether consumers could use ERC-20 tokens instead of native gas tokens to pay for on-chain services.

Visa put together two Ethereum Goerli (Testnet) prototypes attempting to put these concepts to the test: 1) a structure that allows for an application pay for gas on behalf of its end user and 2) a structure that allows for gas to be paid in ERC-20 tokens instead of the native ETH token. These interactions are enabled by an optionally deployed “Paymaster Contract” that will give application developers the choice to include these features in future smart contract deployments.

Ultimately, Visa recognizes that enabling crypto payment experiences that are comparable to traditional financial services will be essential to the broader adoption of consumer-facing blockchain technology. These steps that Visa is taking to improve the end-user experience are critical to onboarding the next wave of cryptocurrency users.

💫Institutional Investors including VanEck ($75bn+ AUM), Felipe Montealegre (Theia Capital) and Sam Andrews (FRNT Financial) Apply Fundamental Investment Frameworks to Crypto

We've been bombarded with the hackneyed phrase "the institutions are here" for what feels like an eternity in the crypto space. But only recently have we seen some of the big guns of traditional finance finally rolling up their sleeves, stepping into the ring, and flexing their intellectual muscle in the battle for thought leadership in this burgeoning digital asset universe.

VanEck, a global investment manager with ~$75bn+ AUM offering traditional financial products such as exchange-traded funds (ETFs), mutual funds, institutional funds, recently released an investment memo utilizing fundamental investment frameworks to investigate the potential future value of the Ethereum token.

The comprehensive piece covers the fundamental value proposition of Ethereum, offers some slick analogies to help the tradfi folks understand the potential vectors of long-term value capture (blockspace is akin to shelf space in a supermarket, and MEV is akin to paying to occupy premium shelf space), as well as the end-markets that Ethereum could eventually take market share of (spoiler: they expect Finance, Banking and Payments to be a meaningful end-market).

Meanwhile, ex-tradfi investors Sam Andrew of FRNT Financial and Felipe Montealegre of Theia Capital teamed up on a long-term, fundamental thesis on GMX, the decentralized perpetuals exchange. The team evaluates GMX on its future earnings growth in relation to its current price / earnings multiple, its ability to take market share from CEXs over time and its positioning vs other exchanges within its competitive market. Check it out below:

The Artemis team was fortunate enough to host a Twitter Spaces with Sam and Felipe, and we look forward to facilitating more conversations with investors sharing their fundamental investment theses with the world🫡

🤝 Trends to Look out for on the Artemis Blockchain Activity Monitor: Avalanche and Holographxyz

Avalanche has seen a significant increase in active addresses over this month growing from ~55k on May 1, 2023 to ~77k as of May 18, 2023. The growth is primarily driven by an increase in interactions with Stablecoin ERC-20 contracts, with USDC driving the lions share of the growth.

Holographxyz is a “natively multi-chain” digital asset platform with built-in distribution across multiple chains. The team recently celebrated ~1mm on-chain transactions.

Last week, Holographxyz deployed a free multichain mint of @thespacebrat, which according to @lostmidas was one of the largest primary NFT distributions of all time.

Per Artemis, the bulk of the mints occurred on Polygon, while Avalanche and BNB Chain saw a meaningful level of volume as well. Ethereum saw the lowest level of mint volume at ~2% of total volume as of May 16.

Since that day, May 18 saw an escalated number of transactions interacting with the same Holograph Operator and Holograph Factory contracts. What’s going on here 🤔

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 4/29/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.