This week, shares of Gamestop (GME) stock jumped >200% this week following cryptic tweets by @TheRoaringKitty, before crashing back down. Blast, an Ethereum L2 with native yield, confirmed an airdrop for June 26 (X). Fledgling Hong Kong Bitcoin and Ether ETFs saw large outflows (Bloomberg). U.S. State of Wisconsin purchased $100 million worth of IBIT shares in Q1 2024, as well as $64 million worth of GBTC (SEC filing).

💫 U.S. Senate votes to overturn SAB 121

🌞 Notcoin goes live on TON

This week saw the market rebound, with average prices across major tokens up 6% WoW. Alternative Layer 1s like Solana, Fantom and Near were this weeks top gainers, posting WoW gains of 14.8%, 11.4% and 9.9%, respectively. Meanwhile, Aptos and Cosmos greatly underperformed this week (up 1.5% and 0.3%, respectively), while BNB was the only token to end down on the week. The recent market uptrend was in part caused in part by a lighter than expected CPI print and positive investor sentiment as important crypto legislation passed the Senate this week.

In April, U.S. consumer prices rose by 0.3%, less than expected, signaling a downward trend in inflation according to the Bureau of Labor Statistics. The annual CPI increased by 3.4%, while core CPI, which excludes food and energy, rose by 3.6% year-on-year. Retail sales remained flat, indicating cooling domestic demand. These developments increased market expectations for a potential interest rate cut by the Federal Reserve in September.

In other news, Vanguard is set to appoint Salim Ramji, a former BlackRock executive, as its new CEO. Ramji, who previously led BlackRock's iShares and index investments, will assume his role on July 8, 2024. This move is seen as a strategic effort by Vanguard to strengthen its leadership with experienced ETF expertise. Ramji's appointment follows his departure from BlackRock in January 2024. Vanguard has historically been staunchly anti-crypto, and this hiring may signal their openness to exploring a Bitcoin product. This is also the first time Vanguard has hired an outsider as CEO. See this video for more on Mr. Ramji’s view on blockchain.

🌞 Notcoin goes live on TON

This year’s fastest growing blockchain has been not been a rollup, a Cosmos chain, or Solana. This year’s fastest growing network is TON, short for The Open Network, a blockchain initially developed by Telegram. After Telegram engaged in legal battles with the SEC over the TON token - allegedly a security -, Telegram agreed to settle with the agency, promising to quit their development of TON. A group of unrelated developers later decided to continue development of the project, separately from Telegram, in a showing of strength from the open source community. Telegram endorsed TON in September of last year, naming it Telegram’s ‘official Web3 infrastructure’ (Reuters).

The charts above depict TON’s massive growth this year relative to other blockchains. Daily transaction counts are up 1600% since the start of the year, while daily active addresses are up 2,300%.

Notcoin is a Telegram Mini App that has gained great attention over the past several months. Telegram Mini Apps are small applications integrated into the Telegram messaging platform that allow users to interact with various services without leaving the application. The Notcoin game consists of repeatedly tapping a digital coin to accumulate points (known as a ‘clicker’ game). According to their website, over 35 million people have played the game over the past 3 months, 95% of these coming through referrals.

On Thursday the $NOT token was airdropped to players of the game. The airdrop saw daily transaction spike on TON from 3.9M to 7.2M. The token was distributed to all players, called ‘miners’, in a fair launch that aimed to imitate Bitcoin. The token launched with a fully diluted valuation of ~$1B, and has since traded down to ~$700m. Since the airdrop, $6.8m worth of $NOT has been sent from half a million addresses to Pavel Durov, the founder of Telegram.

We are excited to see whether Telegram, an app with a global monthly user base of nearly 1B people, will be able to successfully onboard a new wave of users through applications like Notcoin. Blockchain projects frequently prioritize the development of technology over the cultivation of their community, while both aspects being equally crucial for success. Telegram, on the other hand, already has the community, and they are bringing the community to it. If you are interested in learning more about applications on TON and where the network is headed, check out our Protocol Highlight!

💫 U.S. Senate votes to overturn SAB 121

This past week the Senate voted on a bill to overturn Staff Accounting Bulletin 121. Issued by the SEC, SAB 121 provides guidance to custodians on how to account for crypto assets held on behalf of customers. The guidance states that custodians holding crypto assets on behalf of customers must record these assets as liabilities and hold them at fair value on their balance sheets. According to the Executive Office of the President, “SAB 121 was issued in response to demonstrated technological, legal, and regulatory risks that have caused substantial losses to consumers”. The Office additionally stated that if the bill reached the President’s desk, “he would veto it”.

This guidance is important and relevant to the blockchain industry because it adds regulatory hurdles to financial institutions wishing to offer crypto products. The regulation specifically applies to entities registered with the SEC, or looking to register with the SEC, including major banks looking to make plays in the blockchain industry such as BNY Mellon. Avichal Garg from Electric Capital elucidates the issues with an example:

Republican Senator Cynthia Lummis tweeted the following image after the bill to repeal SAB 121 passed the Senate with greater-than-expected bipartisan backing.

The question remains whether President Biden will veto the bill once it arrives on his desk as he previously claimed. The bill was expected to receive little support from the Democratic Party, led by Senator Elizabeth Warren's strong stance on anti-crypto legislation. Surprisingly, a dozen democrats voted in favor, helping the bill pass the Senate. This move indicates the Party’s willingness to diverge from not only Senator Warren's stance but also the SEC's and Gary Gensler’s positions. Now the President is left with a decision that could have significant second-order effects.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

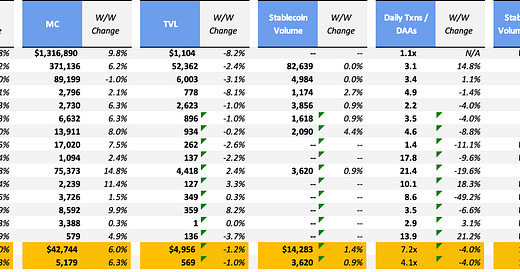

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 4/20/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

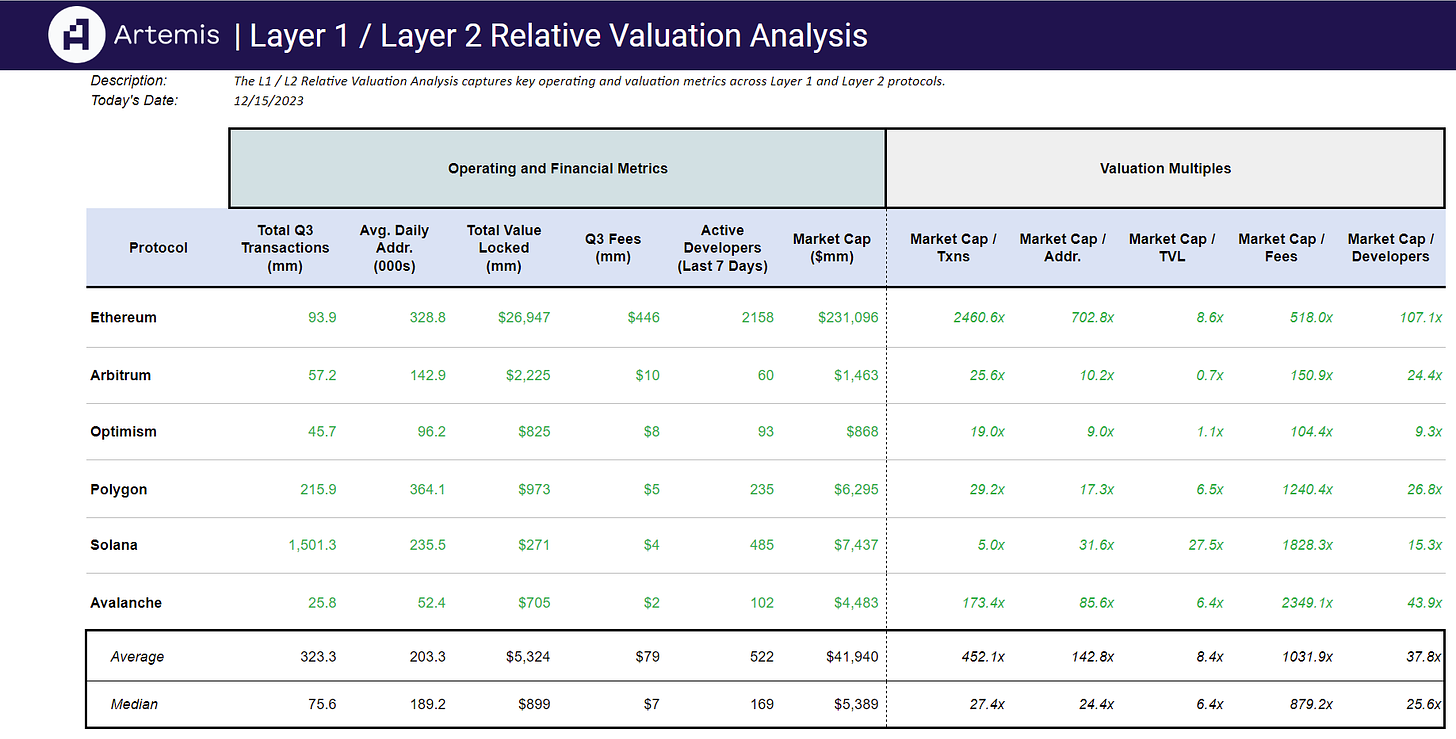

Artemis Sheets

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞