This week, Grayscale withdraws Ethereum Futures ETF application to the SEC (filing). Trading of cryptocurrencies on exchanges went down for the first time in 7 months (Bloomberg). Wisdom Tree’s digital assets product goes live in New York (Wisdom Tree). German state-owned bank, KfW, prepares to issue its first blockchain-based bond under the German Electronic Securities Act (KfW announcement).

🌞 Robinhood Receives a Wells Notice

💫 LayerZero Announces Hunt for Sybils

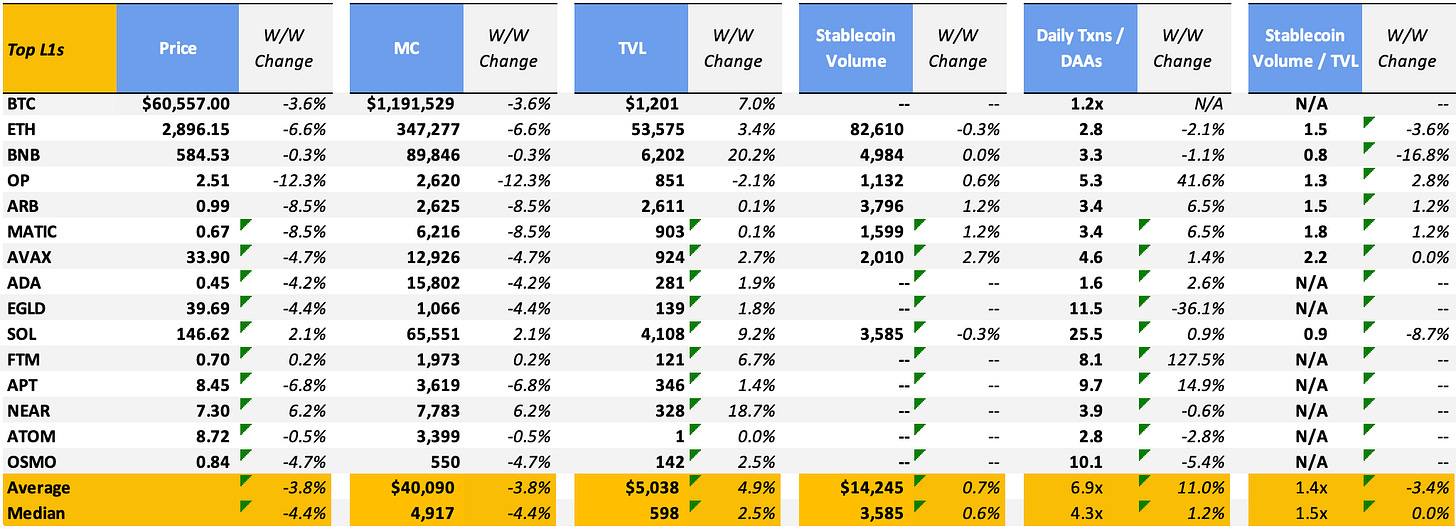

This week saw large drawdowns in prices across the board as average and median WoW prices decreased by 3.4% and 4.1%, respectively. The week’s biggest losers are all Layer 2s: OP down 11.2%, ARB down 7.0% and MATIC down 7.0%. Meanwhile, NEAR was up 5.3% on the week, while SOL posted a WoW increase of 1.8%. Price action reflects the negative investor sentiment as the industry faces macro headwinds following the Fed’s decision to keep the rates target at 5.25-5.50%, and the SEC’s continued harsh stance on the industry.

Meanwhile, the S&P 500 and NASDAQ moved up 1.27% and 0.48% WoW despite bearish macro news. The University of Michigan Survey of Consumers sentiment index for May posted an initial reading of 67.4 for the month, down from 77.2 in April and well off the Dow Jones consensus call for 76. The move represented a one-month decline of 12.7% but a year-over-year gain of 14.2%. Along with the downbeat sentiment measure, the outlook for inflation across the one- and five-year horizons increased. The one-year outlook jumped to 3.5%, up 0.3 percentage point from a month ago to the highest level since November.

🌞 Robinhood Receives a Wells Notice

This year, the Securities and Exchange Commission (SEC) has intensified its regulatory scrutiny of the cryptocurrency sector. Recently, the SEC issued a Wells Notice to Uniswap. Following closely, this past week, Robinhood, a financial services company providing both stock and cryptocurrency brokerage services, also received a Wells Notice. Back in late February, Robinhood made a push to offer more crypto services by partnering with Arbitrum to enable a better swapping experience in the Robinhood Wallet app. According to Robinhood’s 8K filing, the firm received investigative subpoenas into multiple parts of their business, including its cryptocurrency listings, custody of cryptocurrencies, and platform operations. On May 4th, the firm received a Wells Notice, indicating that the SEC had determined that Robinhood should be charged with a violation of securities laws. In this case, Robinhood is accused of violating Sections 15(a) and 17A of the Securities Exchange Act of 1934.

Over the past 6 months, Robinhood has had very similar returns to Coinbase, the largest publicly traded crypto company in the US. In this same timespan, it has greatly outperformed the likes of Amazon, the S&P 500, while narrowly beating out AI winner NVIDIA.

This week, Robinhood announced its earnings, reporting an earnings per share (EPS) of $0.18, which surpassed Wall Street's expectations, and a record first-quarter revenue of $618 million. The firm experienced particularly robust growth in transaction-based revenues, which increased by 59% year-over-year. This surge was primarily fueled by a significant 232% rise in cryptocurrency revenue. A closer examination of the company’s financials as of March 31st reveals that Robinhood holds more Dogecoin than Ethereum.

💫 LayerZero Airdrops and Sybils

Inorganic activity is prevalent on blockchains and has become a key focus at the intersection of blockchain technology and data science. Key concerns include wash trading and Sybil attacks targeting airdrops. Protocols, investors, and users are increasingly eager to discern how much on-chain activity is genuinely organic. This issue was highlighted once more this week when LayerZero declared its intention to tackle airdrop farmers.

LayerZero, a prominent figure in the interoperability space, initially announced plans for an airdrop in December. The protocol recently revealed that nearly 6 million unique wallet addresses have interacted with it since its inception two years ago. Last Friday, LayerZero announced its strategy to identify and exclude Sybils from the forthcoming airdrop. The goal is to foster a community invested in the long-term success of the protocol, rather than participants eager to sell their tokens immediately upon receipt. As part of this effort, Sybils are given two weeks to self-report in exchange for retaining 15% of their intended allocation. Following the self-reporting period, LayerZero will initiate a new two-phased approach to Sybil detection. The first phase involves releasing a list of identified Sybil addresses, and the second phase includes a bounty program where individuals can submit detailed reports of Sybil activity. Successful identifications will lead to the disqualification of the Sybil addresses from the airdrop and the bounty hunter receiving 10% of the Sybil’s allocation.

According to data by cryptoded on Dune, transaction volume on LayerZero exploded around summer 2023, before dying down in the fall. Announcement of an airdrop in December caused a sustained resurgence in activity. However, we can see that shortly after the announcement of the snapshot on May 1st, daily transactions dropped by more about 60%, from 172k on May 1st to 72k on May 3rd, before sliding to ~50k daily for the next 7 days.

Stargate is a DeFi application built on top of LayerZero which makes up about 50% of all LayerZero transactions. Their statistics page corroborates the decrease in usage of since the announcement of the snapshot.

Using Artemis’ Activity Monitor we can see that, for the Layer Zero contracts we have tagged on across Arbitrum, BNB Chain, Optimism and Polygon, active addresses have dropped off drastically, while Sybil users have slowly been trending down from 30-40% to 20-30%.

We are living through an interesting experiment in decentralized community and network building. It is in times like these that the industry learns and grows for the better. We are very excited to see what comes of the second phase of LayerZero’s Sybil detection plan!

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 4/20/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

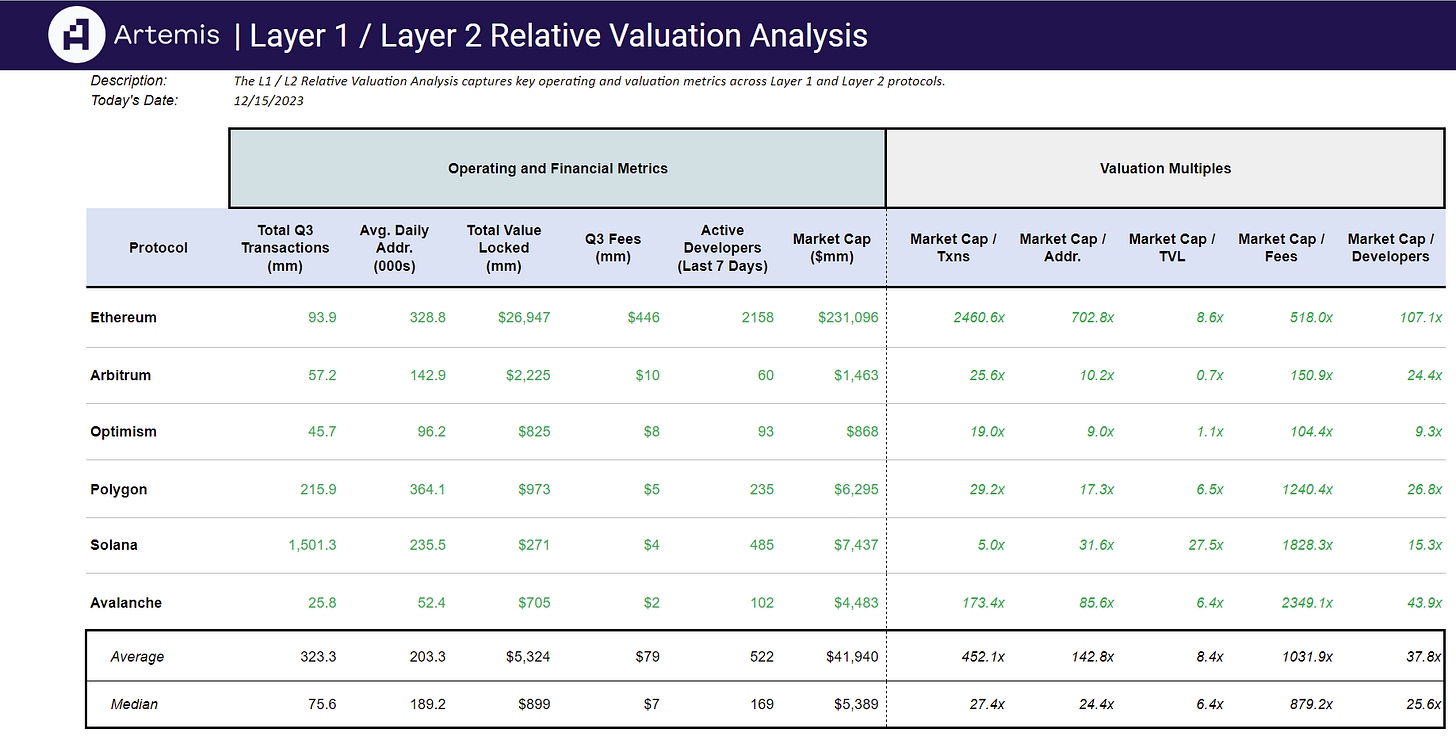

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞