greetings friends

here’s what happened in crypto this week👇

🫥 Mr. Gensler looks to shake things up in traditional equity markets, Mr. Griffin and the Citadel homies don’t like it

🤪 Binance faces further regulatory pressure from key ex-US market Dubai

🫡 MicroStrategy keeps buying bitcoin

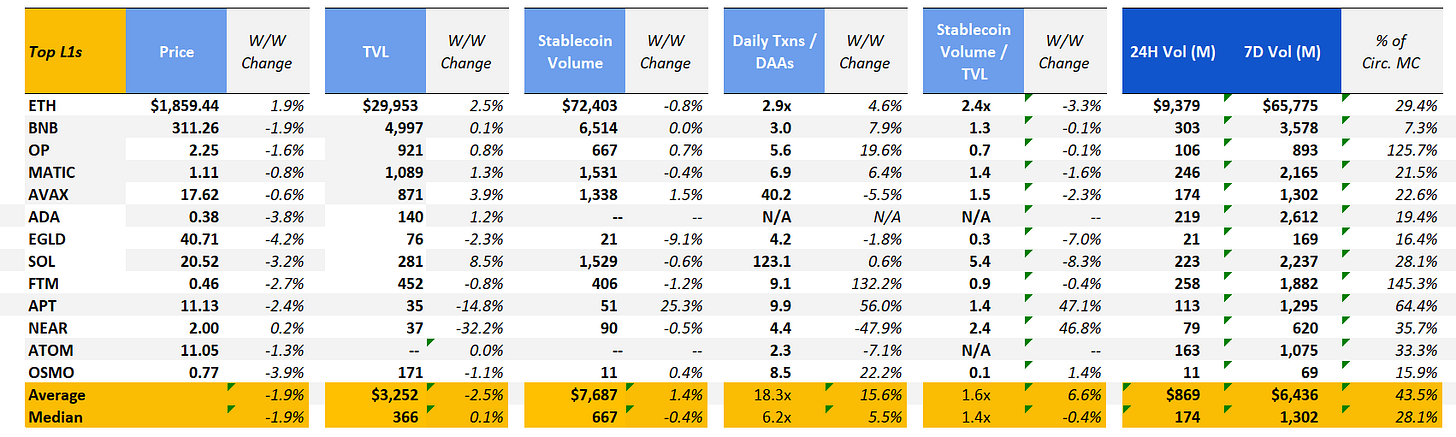

The crypto markets saw an average and median WoW price decline of 1.9% and 1.9%, respectively. This week saw more crypto related activity from the US Govt with the US Treasury Department sounding the alarms around how DeFi is being used to launder dirty money and the Justice Department recovering ~$112mm in cryptocurrencies linked to investment schemes (spoiler alert: looks like Binance helped out here!).

Let’s jump right in

🫥 Mr. Gensler looks to shake things up in traditional equity markets, Mr. Griffin and the Citadel homies don’t like it

The SEC announced on March 30th that it was considering new equity market structure rules that would impact both traditional equity market and digital asset trading structures.

TLDR: the SEC’s arguments center around how the wholesale broker-dealer market is too centralized and does not support either a fair nor optimal trading experience for institutions and retail investors. As part of the SEC’s proposals, the minimum pricing increments offered by wholesale broker-dealers would decrease (requiring more ticks / increments) while also creating a new exchange auction mechanism that would serve as a new venue for virtually all retail equity trading.

https://twitter.com/GaryGensler/status/1641411009272328193?s=20

Citadel put out a 22-page response that began with: “The [SEC’s] proposals to abruptly and unilaterally redesign the U.S. equity markets are a dangerous, baseless experiment that (1) exceed the Commission’s legal authority, (2) would harm investors and damage the resiliency and efficiency of our markets; and (3) otherwise violate the Administrative Procedure Act several times over.”

Pretty strong words from team Griff-dawg, but that wasn’t the end of Citadel’s harsh criticism. The letter continued to state that “these proposals would not better our markets, but rather risk creating a market structure that is far more fragile, opaque and inefficient. Retail and institutional investors alike will suffer from poorer market quality and increased trading costs, while American businesses will face a higher cost of capital… These proposals will benefit no one, certainly not retail investors.”

Gary Gensler’s regulatory crusades have spread beyond the niche of crypto and have touched a nerve with behemoth firms in the traditional finance world. We shall watch to see how these large firms respond and work with the SEC on these new proposals.

🤪 Binance faces further regulatory pressure from key ex-US market Dubai

Per Bloomberg, “VARA officials are also seeking information on ownership, auditing and board procedures at the global group level of Binance, the people said. Because of Binance’s size and complexity, those queries are taking longer to address, according to two of the people. Binance doesn’t have a global headquarters and rather than a regular board of directors, it has a global advisory board.”

Binance is facing some questions from the premier crypto regulatory body in Dubai around its corporate structure and legal entities. While other entities currently operating in Dubai under the same license have received the same line of questioning, given the sprawling, global nature of Binance’s organizations, Binance has faced a longer process than its peers.

Additionally, given the CFTC and the United States has recently ramped up charges against Binance, there are questions on whether Binance is facing additional pressure from other jurisdictions given the high level of scrutiny the West is currently applying on the centralized exchange.

Dubai has been a critical part of Binance’s expansion strategy with CZ himself taking up a residence in the city as a foundation for his plans to continue building out his empire in the Middle East.

🫡 MicroStrategy keeps buying bitcoin

MicroStrategy announced this week that it bought an additional 1,045 bitcoins for $23.9mm, or an average price of $28,016. MicroStrategy now holds ~140,000 bitcoins worth ~$4bn at current market values.

Purchasing Bitcoin continues to be a core part of the firm’s strategy, with MicroStrategy disclosing on March 27th that it had been buying bitcoin throughout Q1 with 6,455 bitcoins purchased during that time at an average price of ~$24,900 per bitcoin.

Meanwhile, the core business continues to generate real revenue (wow). MicroStrategy reported $499.3M in 2022 Revenue, which was a ~2% decrease on total revs but a ~2% increase on a constant currency basis (wow!). The SaaS business attached to the bitcoin buying machine appears to still be chugging along.

The twitterverse noted that given MicroStrategy now owns 1/150 bitcoins that will ever exist, it is likely that a “career making short” will result from Saylor’s genius bitcoin business strategy when he someday needs to sell said bitcoins to generate shareholder returns.

that’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 3/24/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.