This week, Block will allow retail customers to automatically convert a portion of revenues to Bitcoin (Decrypt). Hong Kong Spot Bitcoin ETF to go begin trading April 30th (Decrypt). RFK Jr wants to put the US Government’s budget on a blockchain to provide greater transparency (The Hill). ezETH, Renzo’s liquid restaking token, depegged following dishonest tokenomics announcement (TheBlock).

This week in stablecoins:

🌞 Lummis and Gillibrand propose a new stablecoin bill

💫 Stripe announces stablecoin payments on Solana

🌞 Venezuelan government-run oil company PDVSA turns to USDT

💫 On-chain stablecoin supply approaches all time highs

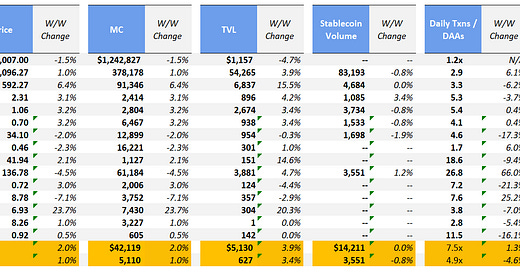

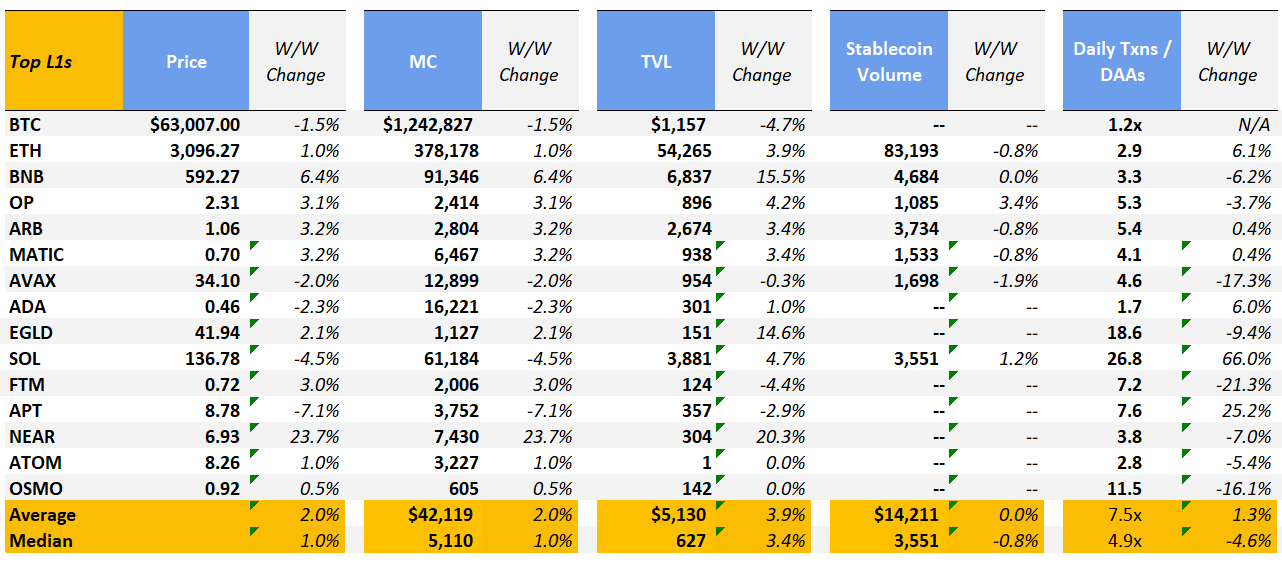

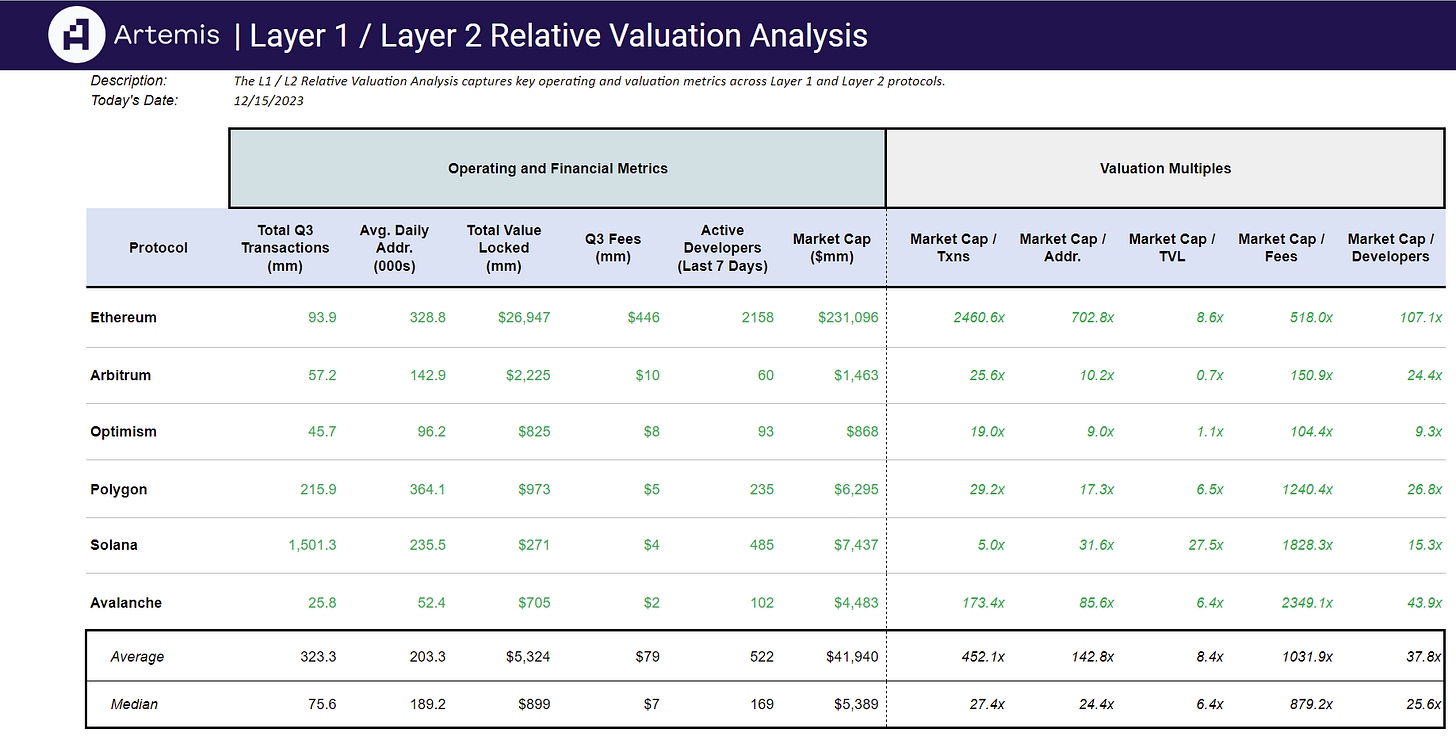

The week saw a divergence in prices across the board as average and median WoW prices increased by 2.0% and 1.0%, respectively. On one end of the spectrum, SOL and APT saw single-digit declines of 4.5% and 7.1%, respectively. Meanwhile NEAR realized a whopping ~24% WoW return as Artemis data demonstrated that NEAR has the highest LTM user retention among blockchain networks. Speculation around further AI integrations within the NEAR network have also contributed to token price action.

This week saw a flurry of regulatory action in the crypto ecosystem, as the Founders of the Samourai Wallet were arrested and charged with money laundering and unlicensed money transmitting offenses, and Consensys sued the SEC over the labeling of Ethereum as a security.

Meanwhile, the S&P 500 and NASDAQ increased by 2.3% and 3.5% WoW as corporate earnings from the communications and technology sectors surprised to the upside.

🌞 Lummis and Gillibrand propose a new stablecoin bill

U.S. Senators Cynthia Lummis and Kirsten Gillibrand introduced the bipartisan Lummis-Gillibrand Payment Stablecoin Act, aiming to establish a comprehensive regulatory framework for payment stablecoins. This legislation seeks to protect consumers, promote innovation, and uphold the dominance of the U.S. dollar, while preserving the dual banking system.

Key points of the bill include:

Consumer Protection: Mandates one-to-one reserves for stablecoin issuers and prohibits algorithmic stablecoins that are not backed by physical assets.

Regulatory Framework: Establishes regulatory regimes at both federal and state levels for stablecoin issuers, ensuring the dual banking system remains intact.

Prevention of Illicit Finance: Requires stablecoin issuers to comply with U.S. anti-money laundering and sanctions rules, aiming to curb money laundering and other illegal activities.

The bill has been drafted with input from major U.S. financial regulatory figures and agencies, and it addresses the urgent need for harmonized global rules for dollar-denominated stablecoins. It also includes measures to support the U.S. dollar as the primary medium of digital exchange and to create a competitive environment for compliant U.S.-issued stablecoins.

💫 Stripe announces stablecoin payments on Solana

On Thursday, Stripe announced that they will allow stablecoin payments using USDC on either Ethereum, Solana or Polygon. Josh Collison, Stripe co-founder and president, unveiled this news at Stripe’s Sessions conference, predicting the functionality would go live this summer. Stripe was initially one of the first major payments company to offer Bitcoin payments back in 2014. However, they ended support for Bitcoin in 2018 partly due to a lack of customer demand. They cited that transaction confirmation times had risen substantially, leading to an increase in the failure rate of transactions denominated in fiat currency (due to Bitcoin’s price fluctuations as transactions awaited confirmation). Additionally, fees on Bitcoin had risen substantially by 2018.

Blockchain technology has come a long way since 2018, with Layer 1 and Layer 2 chains boasting sub-penny transaction fees, and near instant transaction confirmation. This improvement in technology and infrastructure is allowing companies like Stripe to seriously revisit the idea of payments built on crypto rails.

🌞 Venezuelan government-run oil company PDVSA turns to USDT

Venezuela's state-run oil company PDVSA is planning to increase its use of digital currency, specifically USDT (Tether), for its crude and fuel exports as a response to the reimposition of U.S. oil sanctions. The sanctions, reintroduced due to Venezuela's lack of electoral reforms, will end a general license by May 31, complicating PDVSA's efforts to increase oil output and exports since future transactions will require individual U.S. authorizations. PDVSA began shifting to digital currency last year to avoid the risk of having sale proceeds frozen in foreign bank accounts due to sanctions. The reactivation of sanctions has accelerated this shift. Venezuelan Oil Minister Pedro Tellechea has stated that digital currencies may be preferred in some contracts, although the U.S. dollar remains the dominant currency for global oil transactions.

Tether, the company behind USDT, has stated its commitment to comply with U.S. sanctions. Amidst this strategic shift, PDVSA faced a corruption scandal involving unaccounted receivables from oil exports, partially tied to cryptocurrency transactions. Under Tellechea's leadership, Venezuela’s oil exports have increased, reaching their highest levels in four years. PDVSA is now demanding prepayment in USDT for many oil transactions and requiring new customers to hold cryptocurrency. The reliance on intermediaries and digital currencies is a tactic aimed at circumventing U.S. sanctions, although it may result in a lower share of proceeds for PDVSA. Despite challenges, Tellechea is optimistic about Venezuela's ability to continue expanding its oil and gas projects and handle sanctions commercially.

💫 On-chain stablecoin supply approaches all time highs

On-chain stablecoin supply is in a steady uptrend, nearing all time highs. Since the last bull market, stablecoin supply bottomed at around 124B in mid-October 2023, and is up 30% since then. The greatest supply of stablecoins was in April 2022 when there were over 179B in circulation.

We are also seeing all time highs in terms of number of daily active addresses using stablecoins, indicating that there is great demand for use. Contrasting the supply and daily active address chart we can observe that although the majority of stablecoin supply is on Ethereum, the majority of stablecoin users are on Tron, BNB Chain, Polygon and Solana.

Visa Crypto also put a fantastic stablecoin dashboard with Allium, inspired by Nic Carter’s stablecoin report last year. Cuy Sheffield, Head of Crypto at Visa, highlights this line chart below that shows stablecoins are catching up to Visa in terms of annual transaction volume. We’re excited to surface more data comparing traditional payment rails vs crypto payment rails adoption, especially in light of Stripe’s announcement.

Conclusion

We are seeing crypto’s first use case beyond speculation play out before our eyes. The US is making a serious push to regulate stablecoins, a move that would allow crypto to be used and accepted much more broadly. We are seeing examples of governments like Venezuela turning to permissionless stablecoins. It will be interesting to see how the entities behind these coins, such as Circle and Tether, continue to evolve to comply with increasingly sophisticated US regulations.

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 4/9/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

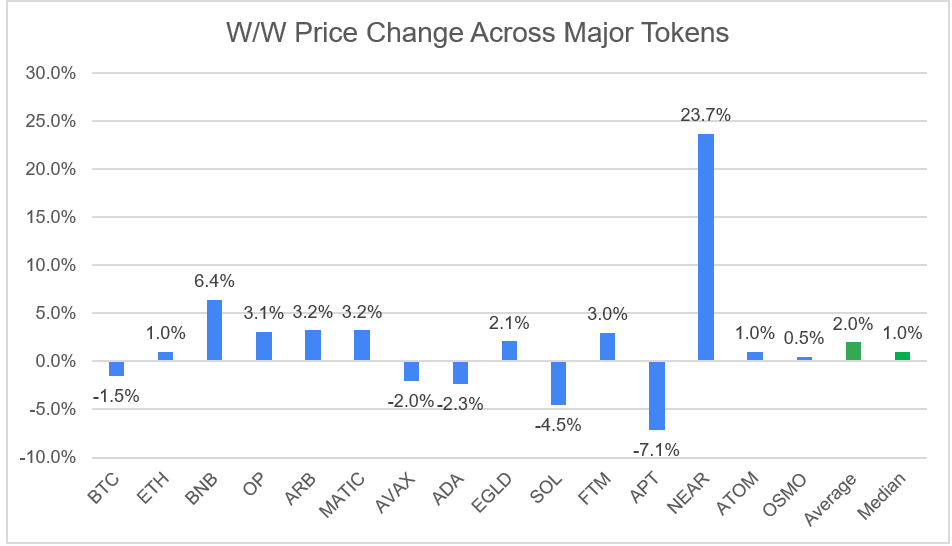

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞