Happy Bitcoin halving to those that celebrate! This week, EY launches the OpsChain Contract Manager rollup built on Polygon PoS. Sam Altman’s Worldcoin to get its own Ethereum rollup built on the OP Stack. Centralized exchange OKX launches Ethereum rollup called X Layer, mirroring Coinbase’s Base. New US stablecoin bill is proposed, banning algorithmic stablecoins.

The Bitcoin Edition:

🌞 The Halving

💫 Runes, Ordinal Theory and BRC-20s

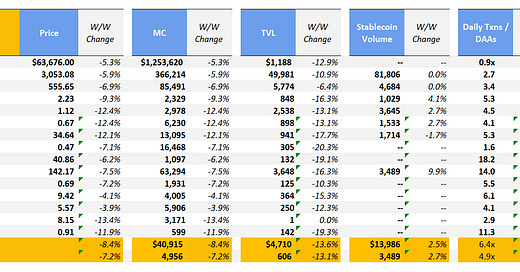

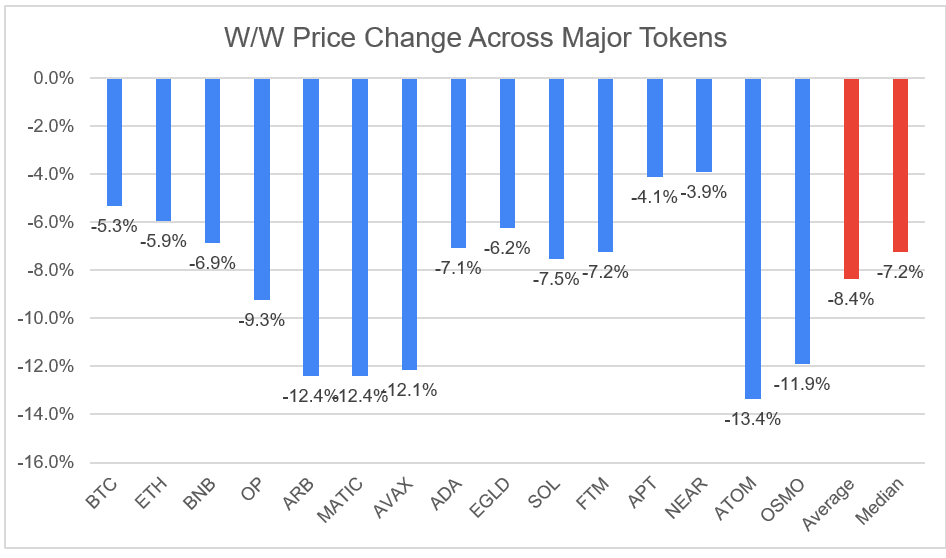

The week saw further declines across the board as average and median WoW prices fell by 8.4% and 7.2%, respectively. Altcoins were hit hardest, with Alt L1s and L2s including ATOM, ARB MATIC and AVAX seeing double digit declines WoW. BTC and ETH were also caught in the bloodbath and saw 5.3% and 5.9% drawdowns WoW.

This week saw crypto caught in the crossfire of military actions taken by Israel and Iran. Bitcoin fell 10% on Sunday April 14th on news of Iran’s strike against Israel, and fell another 4% Thursday night when Israel struck back. Bitcoin ETF flows saw five straight days of outflows leading up to the halving led by a continued exodus from the Grayscale Bitcoin Trust.

Meanwhile, Hong Kong approved the launch of Bitcoin ETFs which could open up another pool of liquidity for the asset class, but analysts expect that the ETF will likely not be open to mainland investors. However, with the approval in HK, other Asian jurisdictions such as Singapore, Japan and Korea could be expected to follow suit which would bring more legitimacy to the asset class.

Meanwhile, the S&P 500 and NASDAQ declined on the week by 3.5% and 6.1% WoW as semis stocks fell heavily, driven by steep falls by SMCI and Nvidia, which fell by 23% and 10%, respectively.

🌞 Bitcoin: The Halving

Bitcoin had its 4th issuance halving at about midnight UTC on April 20th. This is often one of the most highly anticipated events in the Bitcoin world as we see one of the key monetary policy decisions of the world largest blockchain in action.

What is the halving?

Let’s take a step back. Bitcoin is a blockchain network that is secured by miners. Miners are entities that participate in a protocol known as Proof of Work where they compete to solve a computationally intensive puzzle for the right to build the next Bitcoin block. In order to participate, miners require extremely specialized equipment, and incur high energy costs to keep their machines running. This means mining Bitcoin is expensive. So why do miners do it? Miners are incentivized to mine through block rewards (as well as transaction fees). Block rewards are some amount of bitcoin that are freshly minted by the protocol with every new block that is added.

Bitcoin has some important monetary policies etched into its protocol. Firstly, the maximum supply of bitcoins that will ever be created is 21,000,000. Secondly, every 210,000 blocks mined, the block reward is cut in half. In 2009, when the first Bitcoin block was mined, the miner received 50 bitcoins as a reward. After about 4 years the protocol appended block number 210,000, and the block reward was cut to 25 bitcoins per block. This has happened roughly every four years, and is set to happen again on April 19/20th. This time the amount of bitcoin emitted per block will go from 6.25 to 3.125. In the graph below (Glassnode), we can observe daily bitcoin issuance alongside bitcoin’s total circulating supply. Nearly 20,000,000 of the total 21,000,000 bitcoins that will ever be minted have already been minted. The sharp drops in daily issuance mark previous halvings.

There’s already a lot of thinking and writing about the relationship between Bitcoin’s halving and its impact on the price of Bitcoin:

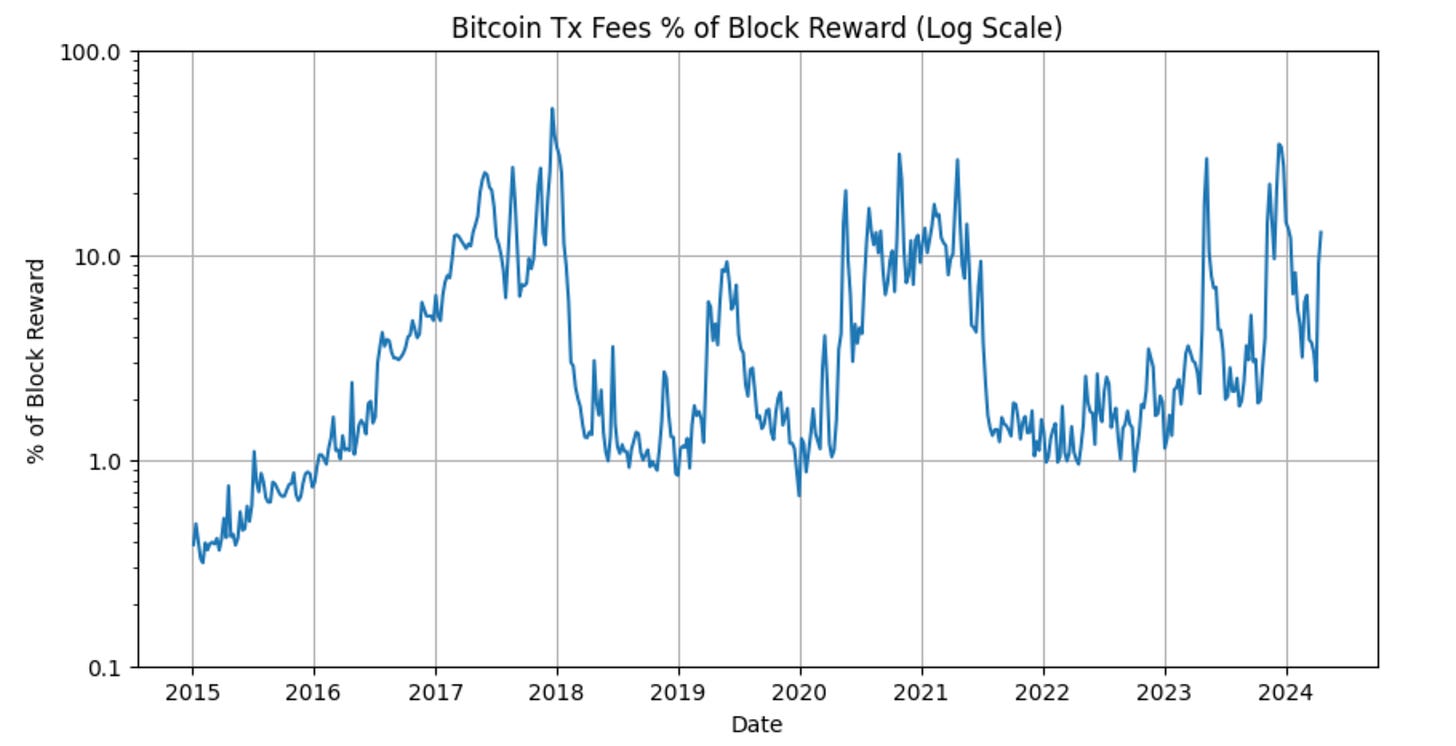

The halving has a huge impact on miners. Basic math tells us that if issuance of bitcoin halves, then miner revenues would halve as well. In order to reach their previous revenues in dollar terms the price of Bitcoin would need to double. In the graphs below we can see the percentage of Bitcoin mining rewards that come from Bitcoin transaction fees (left) and the frequency distribution (right). Since about 2016, transaction fees have consistently made up 1-5% of block rewards for miners, with some outliers around times of high volatility (2017, 2021). We also see transaction fees spike in 2023-24 as a result of ordinals and inscriptions, with a most recent spike likely due to hype around the Runes protocol.

The halving poses a difficult challenge for miners who will need to navigate the new environment. Some may be driven to unprofitability and be forced to disconnect from the network entirely while others figure out a way to stay afloat. Additionally, the halving could have implications on the speed of advancements of mining equipment, driving engineers to create more efficient rigs to bring down power costs which, according to VanEck, account for 75-85% of a miners cash operating expenses.

Looking farther into the future, an important question in the Bitcoin community is how to incentivize miners when all 21,000,000 bitcoin are minted. As the protocol stands today, miners would have to rely entirely on transaction fees to support their mining operations. There have also been discussion about forking the protocol at some point to introduce additional subsidies for miners. There is a possibility that transaction fees are not sufficient for miners to be profitable, forcing them to unplug their machines, ultimately leading to a weaker, less decentralized network.

💫 Runes, Ordinal Theory and BRC-20s

At block 840,000 bitcoin issuance will halve. At the same time, another exciting protocol will be launching on the Bitcoin network: the Runes protocol. The Runes protocol aims to bring fungible tokens to Bitcoin, improving on the existing BRC-20 standard which helped reinvigorate the Bitcoin community. The Runes protocol was created by Casey Rodarmor, the same Casey that created Ordinal Theory and catalyzed the creation of inscriptions and BRC-20s.

A Brief Primer on Ordinal Theory

Ordinal Theory proposes a new way of interacting with Bitcoin. Each bitcoin can be subdivided into 100,000,000 satoshis (or sats). Ordinals are a numbering scheme that allows the tracking and transferring of individual sats. Satoshis are numbered in the order in which they are mined. Inscriptions are a subset of ordinals that are inscribed with some metadata like images, videos, etc. making them similar to NFTs.

Ordinals and inscriptions drove activity on Bitcoin by demonstrating that it could be used for more than just a store of value. This led to high fees, making clear the need for Bitcoin Layer 2s and driving their development.

Although Daily Active Addresses has stayed somewhat flat over the past few years, daily transaction counts have spiked since the inception of Ordinal Theory. This has been largely driven by a new class of Bitcoin transactions that are attempting to bring more functionality to the Bitcoin protocol. The spike in transactions and lack thereof in active addresses, indicates that it is likely existing users of Bitcoin that are driving activity, while outsiders have yet to make the jump.

What are BRC 20s?

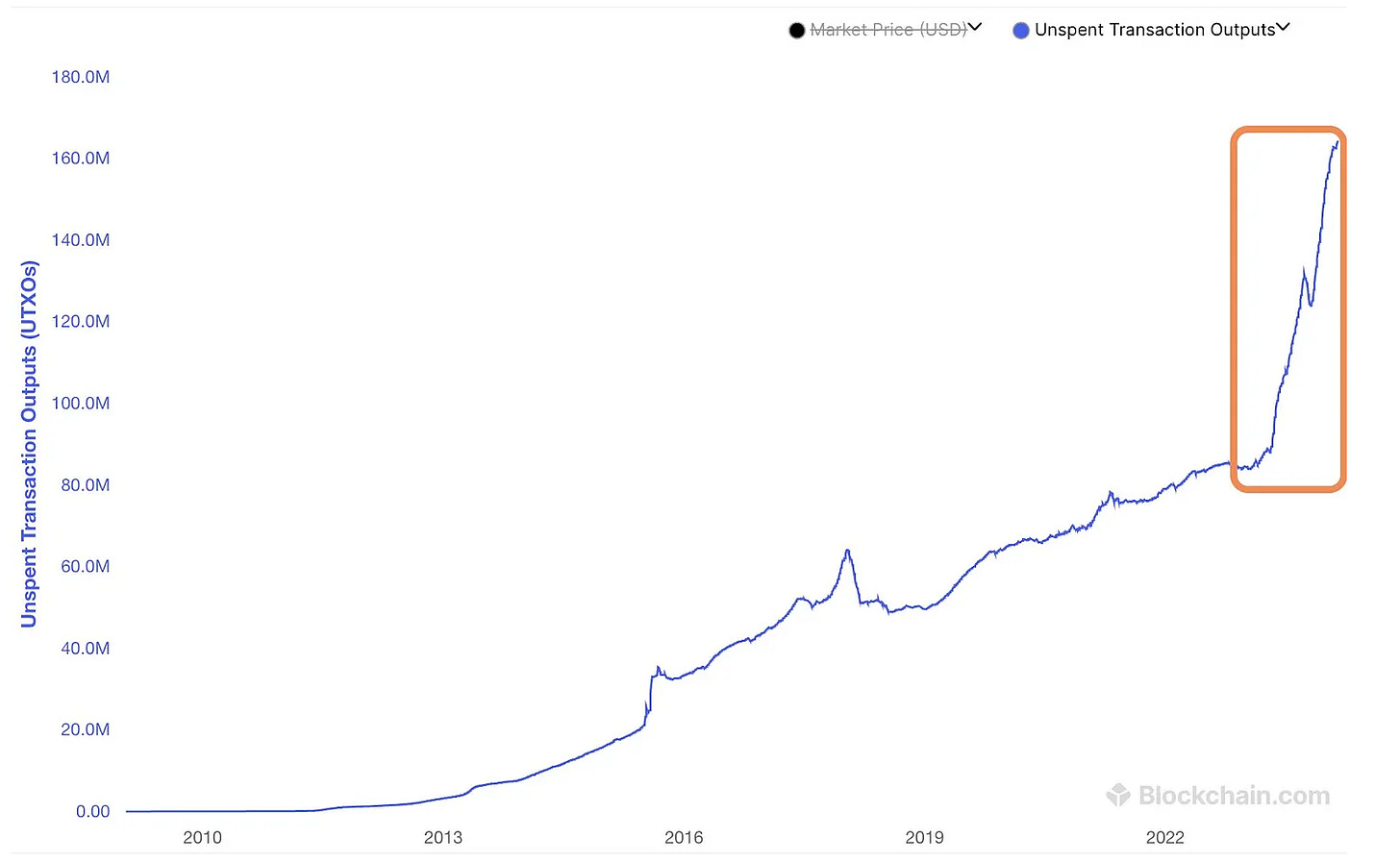

BRC-20s are the Bitcoin community’s first successful attempt at creating a fungible token standard on Bitcoin. The name comes from the popular ERC-20 standard on Ethereum on which some of the most used coins in crypto are built like USDC, WETH, UNI, etc. The BRC-20 standard builds on Ordinal theory to allow for the creation of Bitcoin-native fungible tokens. The protocol relies on offchain indexing and social consensus to adhere and enforce the standard. Since Bitcoin is not Turing-complete like Ethereum, it is not possible to enforce the logic on the protocol level, and this must be done off-chain. BRC-20s leverage Bitcoin’s unspent transaction output (UTXO) model to keep track of tokens. This has led to doubling in the amount of UTXOs on Bitcoin, and a consequent increase in the storage requirements to run a full Bitcoin node.

Runes are an attempt to innovate upon the initial BRC-20 token design to create a fungible token standard that is accessible to more people using the Bitcoin network. We will closely monitor the reception of the launch of Runes after the halving.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 4/2/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

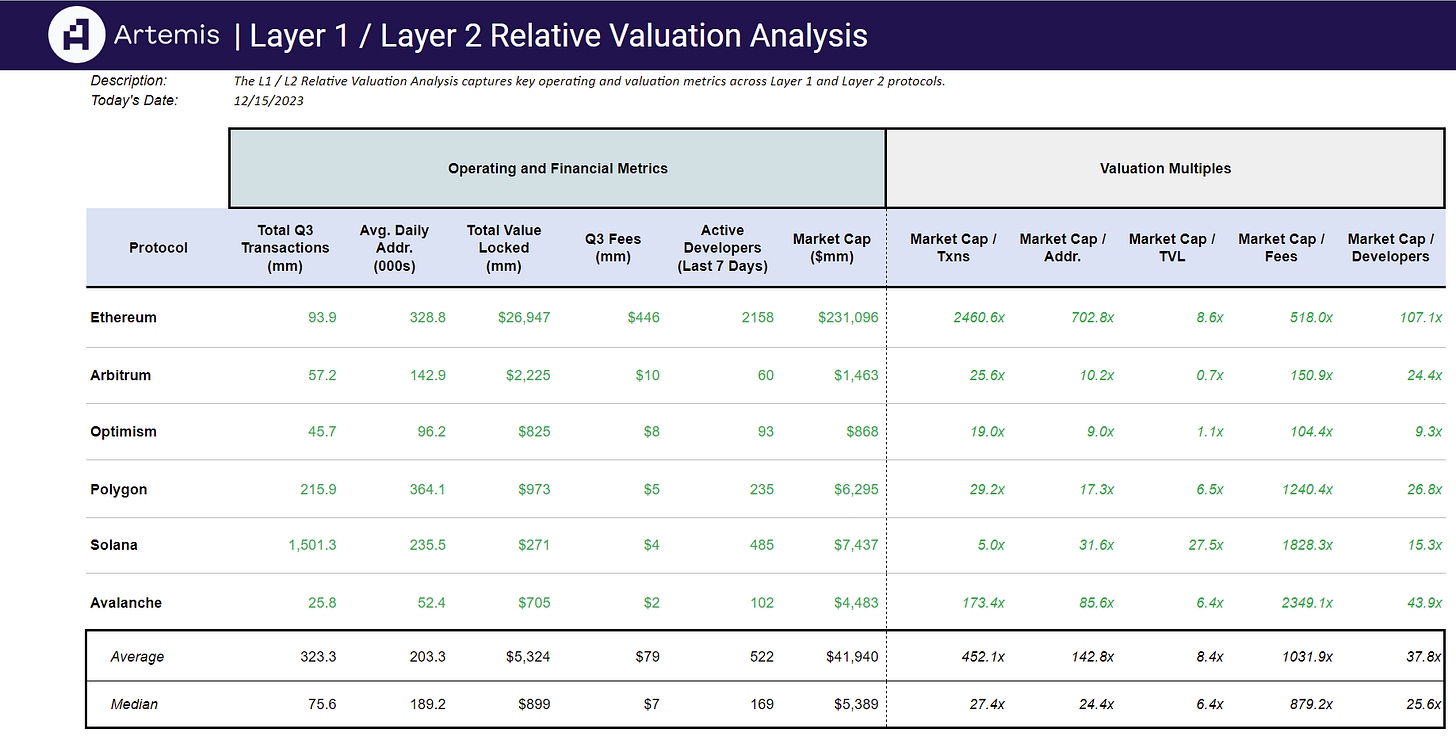

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞