gm friends. this week saw some up only action with YTD highs hit for the majors 🤯

here’s what happened in crypto this week👇

🌞 Ethereum gets the Shapella upgrade

💫 Avalanche launches the “Spruce” subnet, bringing on tradfi giants including T Rowe, Wellington and Cumberland

🫡 FTX has recovered $7.3bn in assets (wow!)

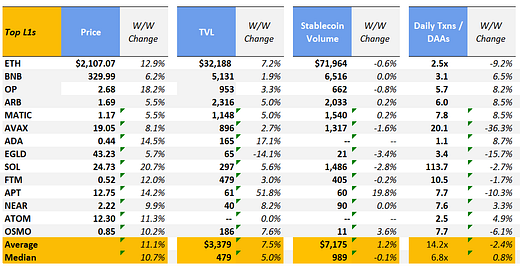

The crypto markets came ripping back this week with an average and median WoW price increases of 11.1% and 10.7%, respectively. Solana led the pack with a ~21% WoW gain while TVL trickled upwards as well (5.6% WoW increase). Other large gainers this week included some of the usual heavily traded suspects including OP (up ~18% WoW), APT (up ~14% WoW) and FTM (up ~12% WoW).

Bitcoin and Ethereum broke $30k and $2k, respectively, with major support appearing around both of these price points. It’s starting to feel like the headwinds against the crypto industry are beginning to fade as the majors make YTD highs - in recent months, the crypto industry has pushed past US regulatory headwinds, FTX and other centralized finance entities blowing up, charges against CZ and Justin Sun and millions of ETH now available for unstaking. What other fud is left?? (no pls actually tell us we want to know)

anyways, let’s jump into what happened this week 👇

🌞 Ethereum gets the Shapella upgrade

Ethereum’s highly anticipated Shapella upgrade was successfully executed on April 12th. ETH that was locked as early as the initial launch of the Beacon Chain in December 2020 to support Ethereum’s transition to proof-of-stake is now available to be unstaked.

Over time, this upgrade will allow network participants to unstake up to 18 million ETH (~$38bn USD) that has been staked on the Beacon Chain over the past two years.

Presently, Ethereum imposes a limit on the balance each validator can withdraw. Pooja Ranjan, founder of EtherWorld.co notes that at the time of the upgrade, 1,800 validators would be allowed to fully exit every day, which is approximately 57,600 ETH (~$120mm USD) per day that could be unstaked (TheBlock).

As the conclusion of the upgrade that successfully completed Ethereum’s move to a proof-of stake model, key members of the Ethereum Foundation breathed a collective sigh of relief. Vitalik Buterin, co-founder of Ethereum, stated that “After this fork is done, and then after scaling is done, we’re in a stage where the hardest and fastest parts of the Ethereum protocol’s transition are essentially over… Various things will need to be done, but those… things can be safely done at a slower pace” (The Defiant).

Going forward, the Ethereum community is focusing more aggressively on scalability and expects the next significant upgrade to take place in 2024, with Vitalik reportedly stating that “if we don’t fix scaling before the next bull run, people are going to be stuck paying $500 transaction fees” (The Defiant). Further upgrades will support the burgeoning layer 2 scaling ecosystem which has already begun to see significant traction from both a user perspective and as a % of gas consumed on Ethereum layer 1. Per Artemis, Layer 2 solutions such as Arbitrum, Optimism and Polygon made up as much as ~14% of gas fees on Ethereum Layer 1 as of April 10, 2023, and ~5% of gas fees on April 13, 2023.

Other links on Shapella you could check out~

the upgrade made it through a boo boo: https://blockworks.co/news/ethereum-shapella-ok-despite-bug

ethereum’s roadmap: https://ethereum.org/en/roadmap/

an update 40 hours after Shapella: https://twitter.com/christine_dkim/status/1646913568002957322?s=20

💫 Avalanche launches the “Spruce” subnet, bringing on tradfi giants including T Rowe, Wellington and Cumberland

Avalanche is launching a testnet that will allow a number of traditional investment firms to evaluate the benefits of on-chain trade execution and settlement.

Per Avalanche’s official post, “Institutional partners will use DeFi applications on Spruce to execute foreign exchange (FX) and interest rate swaps, with other areas in active research and development” (Avalanche). Interestingly, Will Peck, Head of Digital Assets at WisdomTree makes the explicit comment that he is “looking forward to experimenting in this EVM-based testing environment.”

Future iterations of the partnership will test other financial products including tokenized asset and credit issuances, trading and fund management. The advent of the Spruce platform could inspire more large-cap institutional adoption of blockchain technology - we’ll be staying tuned 👀

🫡 FTX has recovered $7.3bn in assets (wow!)

This week FTX announced it has recovered more than $7.3bn in cash and liquid crypto assets, an increase of more than $800mm since the company’s initial hearing just a few months ago in January (Reuters). The recent rise in crypto markets have meaningfully contributed to the recovery value of the assets in the magnitude of more than a billion dollars, given that the recovery value of the bankrupt company’s assets was worth $6.2bn as of November 2022 prices.

FTX is now entertaining “re-starting the exchange… [as] one of many potential options being considered for the future of the company” (Coindesk). While current FTX CEO John J Ray has expressed the potential for reviving the exchange as early as January of 2023, technical weakness of the underlying exchange product could provide additional hinderances to that longer term goal.

~ 🤓Special Artemis Announcement🤓~

Artemis is partnering with MetricsDAO to connect web3 data platforms with the best web3 analysts🤝! Check it out next Thursday to learn how to use the suite of Artemis products to find more on-chain alpha 🫡

https://twitter.com/Artemis__xyz/status/1644132531103494145?s=20

Sign up for the event here!

that’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 4/1/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.