This week, Monad raises a monster $225 million round to build a high throughput EVM-compatible Layer 1, Telegram’s Toncoin enters the Top 10 coins by market cap, passing Cardano, and Uniswap receives enforcement notice from the SEC.

🌞 Solana Experiences Network Degradation

💫 Eigenlayer Mainnet goes Live

The week continued to see major losses across the board as average and median WoW prices declined by 14.5% and 15.1%, respectively. Altcoins were hit hardest, with Alt L1s including APT and NEAR seeing 20%+ declines WoW. BTC and ETH saw the most resilience over the week, with 1.9% and 3.3% drawdowns WoW.

Spot Bitcoin ETFs turned positive again towards the end of the week, as GBTC’s net outflows of $17.5mm on Wednesday marks the vehicle’s single lowest day of outflows since it launched in January 11th, 2024. Meanwhile, Hong Kong is expected to approve Spot Bitcoin ETFs as early as next week which could open up another pool of liquidity for the asset class.

Meanwhile, the S&P 500 and NASDAQ declined on the week by 1.7% and 0.7% WoW as large-cap banks such as JP Morgan saw their stocks fall after they missed Net Interest Income (NII) guidance, along with news that Biden expects Iran to strike Israel “sooner rather than later.”

🌞 Solana Experiences Network Degradation

A few weeks ago Artemis wrote about the negative externalities of Memecoin Mania on Solana. The article detailed how MEV was being extracted through DEX sandwich attacks, resulting in a subpar end user experience and ultimately leading to Jito Labs shutting down its mempool service. Since then a new issue has emerged to plague Solana users and developers, which has once again caused a material decline in the end user experience.

The current problem with Solana arises from its networking layer, which manages data communication between computers by defining protocols for sending, receiving, and decoding data packets. These packets travel through physical wires from one computer to another, necessitating a standardized method for data transfer. Solana employs the QUIC protocol, designed to combine TCP's reliability with UDP's speed—both protocols are well-established in the networking community, with UDP being Solana’s previous choice. For an in-depth look at QUIC, TCP, UDP, and Solana, refer to Helius’s blog post.

It has become apparent that Solana's QUIC implementation falls short in handling spam effectively, exacerbated by a surge in spam linked to bot-driven activities in the DeFi and memecoin sectors. In Solana's system, transactions are directed to the block leader responsible for transaction execution and block addition. This block leader has a limited capacity for transactions; once this capacity is reached, it randomly drops additional transactions. Consequently, bots attempt to increase transaction success rates by flooding the block leader, complicating the process for users who send transactions individually.

When you send a transaction on Solana, three outcomes are possible:

The transaction executes successfully, such as swapping WIF for BONK on Raydium.

The transaction executes but fails, for instance, if your WIF for BONK swap exceeds your slippage tolerance.

The transaction is dropped, meaning it never reaches the scheduler for execution and is neither successful nor a failure.

The third scenario is currently problematic for Solana. Recent dune dashboards have highlighted graphs (below) showing the percentages of transactions that have succeeded versus those that have failed. However, these do not capture the critical issue: transactions being dropped at the networking layer before they even make it to the scheduler. To track dropped transactions, data must be gathered and provided by an RPC provider, as it isn’t available on the blockchain itself.

The chart below shows just how much spam the network is flooded with. 58% of all compute done on Solana is wasted on failed arbitrages, while 98% of arbitrage transactions fail.

With that said, the Solana network is still processing ~568 transactions per block, with a block time of ~400ms and TPS of ~1500.

Several teams are working on patching the issue. In the short term only temporary fixes might be available, until a larger network upgrade is released. Firedancer, Jump Crypto’s implementation of a Solana client, will release in late 2024 and will help address these problems.

💫 Eigenlayer goes live on mainnet

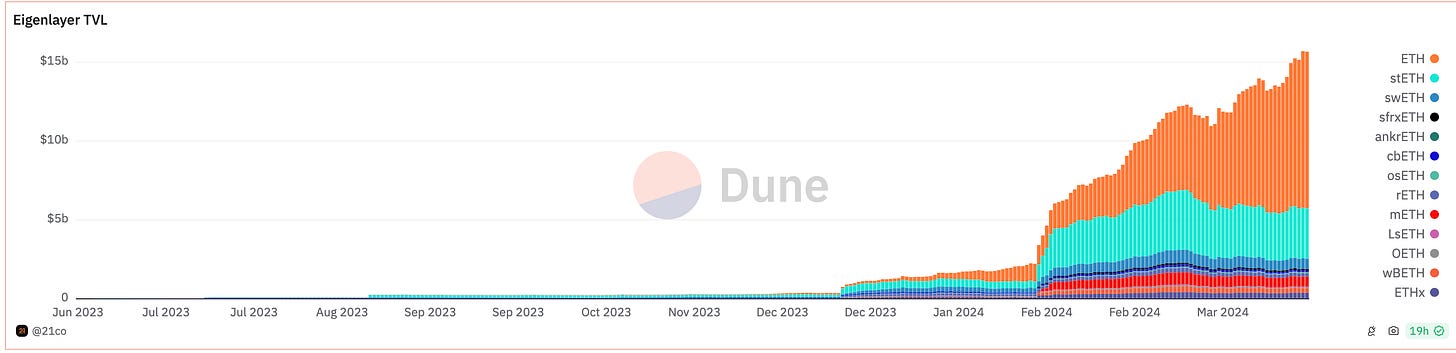

Since restaking took Ethereum by storm, EigenLayer has become the 2nd largest protocol by TVL, and has been rapidly growing larger since February. Earlier this week some of the protocol’s main functionalities went live including Operators and AVSs.

EigenLayer is a new protocol built on Ethereum that introduces "restaking," a novel cryptoeconomic security primitive. It allows users already staking ether—either directly or through liquid staking protocols like Lido—to "restake" their ether into EigenLayer smart contracts. This process enables them to enhance the security of their stake across additional applications and earn extra rewards beyond the basic ether staking yield. Users can allocate their staked ether to an actively validated service (AVS), which are applications that use EigenLayer for enhanced cryptoeconomic security. AVSs could range from bridges and rollups to DeFi platforms, presenting a vast and largely untapped design space. Operators, who run the AVS software, may also receive delegated stakes from users.

With the launch of EigenLayer's mainnet, the first AVS, EigenDA, went live. EigenDA is a modular data availability protocol that secures itself using both EigenLayer and Ethereum. It is the first of many upcoming AVSs, with others like AltLayer MACH and Witness Chain on the horizon. As of Friday, April 12th, EigenDA had 40 operators and nearly 10,000 stakers.

At present, more than 4 million ETH, valued at approximately $15 billion, are locked in EigenLayer smart contracts. Of this, 2.8 million ETH are in liquid restaking protocols, which allow users to deposit ETH, have it restaked via EigenLayer, and receive a liquid restaking token (LRT). This token represents their staked position and includes all accrued yield.

One critical consideration for restakers is slashing risk. Slashing, a penalty for misconduct, will vary in its implementation across different AVSs. By engaging with multiple AVSs, restakers introduce themselves to novel slashing risks and must carefully choose Operators to minimize this exposure. As of now, slashing has not been implemented in the mainnet version of the protocol.

EigenLayer promises to revolutionize application design by eliminating the need for applications to establish their own economic security. Yet, this innovative protocol introduces new vulnerabilities. Concerns about overburdening Ethereum’s consensus system, sparked by a blog post from Vitalik, have been addressed by EigenLayer’s founder, Sreeram Kannan, who acknowledges these risks while emphasizing the careful design of the protocol. The evolution of the restaking market in 2024, with EigenLayer's full deployment and the entry of competitors, will play a critical part in the continued development of Ethereum.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 3/25/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

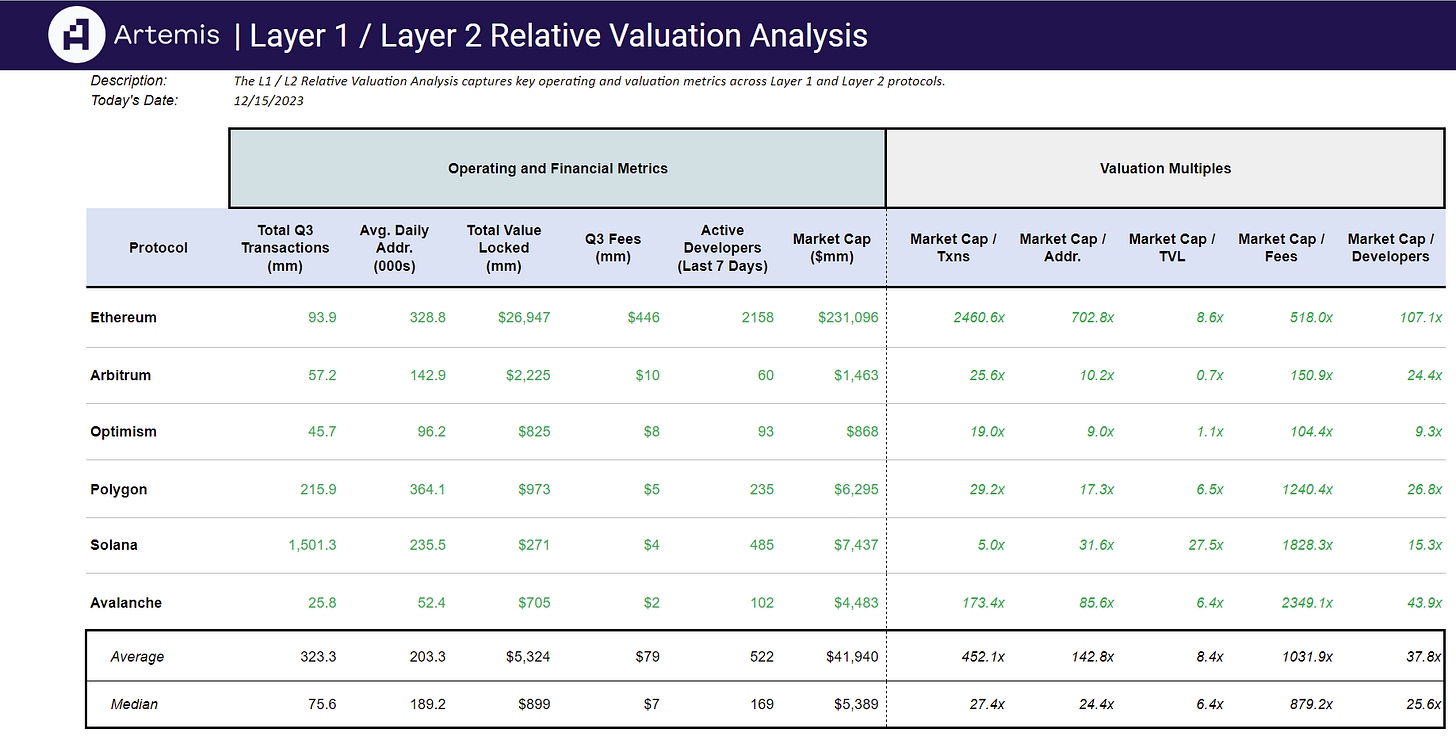

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞