This week, Wormhole announced its W token airdrop, Revolut teamed up with MetaMask to enable easier crypto onboarding, and the long awaited Ethereum Dencun upgrade is coming next week (March 13th)! Also, Tether Tops 100B in USDT stablecoin circulation.

🌞 Memecoins and BTC ETF demand drive on-chain transaction fees

💫 CFTC unveils draft Digital Assets Taxonomy

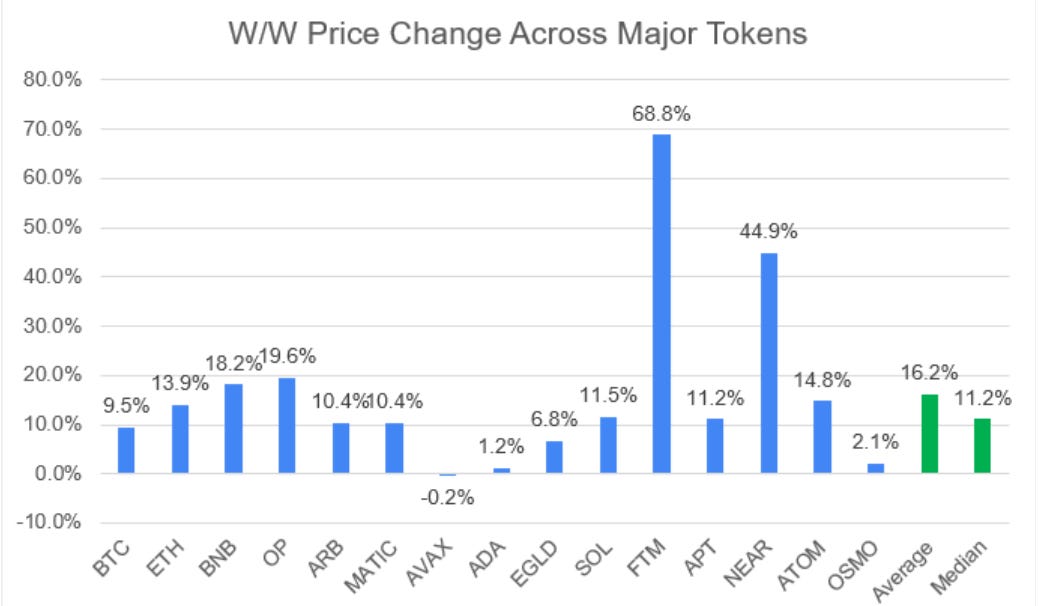

The week saw continued momentum across all major tokens as average and median WoW prices increased by 16.2% and 11.2%, respectively. Bitcoin spot ETFs smashed yet another record with $10bn of trading volume this past Tuesday, with BlackRock’s IBIT transacting over $3.8bn of volume. FTM and NEAR saw the largest WoW gains as liquidity began flowing into alt-L1 blockchains, with WoW gains of 68.8% and 44.9%, respectively.

Meanwhile, the S&P 500 and Nasdaq Index declined by 0.1% and 1.1% WoW, respectively, as Federal Reserve Chair Jerome Powell testified before the House Financial Services Committee. Powell reemphasized that the Fed requires more data that show recent inflation readings can be sustained, which sent stocks higher after a larger pullback on Tuesday.

🌞 Memecoins and BTC ETF demand drive on-chain transaction fees

Markets have been re-hot recently, largely driven by Bitcoin ETF inflows. This week alone saw Bitcoin ETF volumes of ~$36bn, surpassing last weeks record of $30bn. IBIT opened Friday morning with over $1bn in volume per hour, according to Bloomberg data.

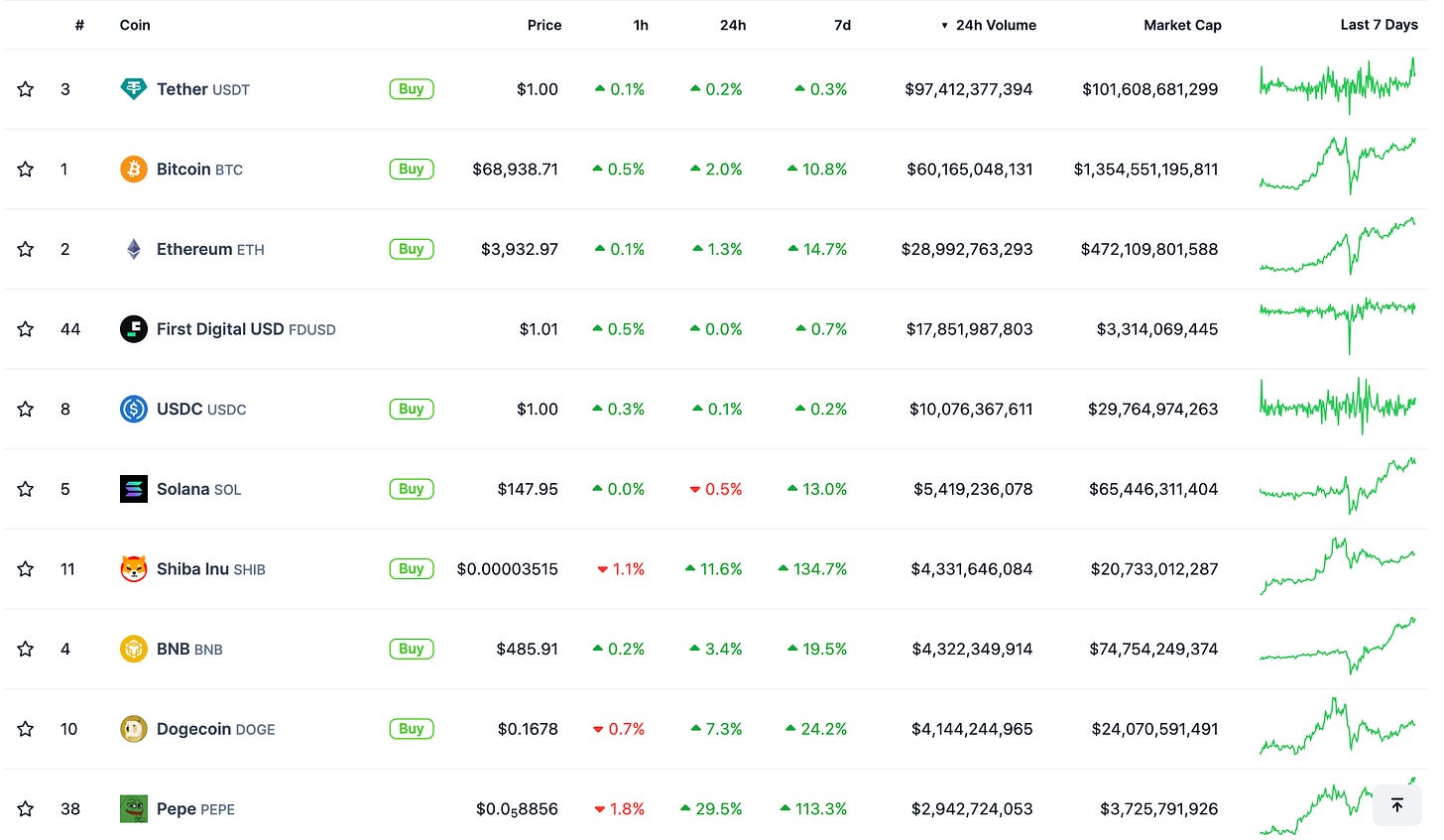

Beyond interest in large-cap tokens such as Bitcoin, there has been a wave of activity in the “Meme” category. According to Coingecko data, the best performing category in crypto the past seven days has been ‘Cat-themed Coins’, up ~250%. Overall, the “Meme” category is up 100% over the past seven days, demonstrating investors’ desire to ride beta on the crypto markets via highly risky trades on relatively ‘cheap’ assets. As a refresher, memecoins are cryptocurrencies that tend to originate from internet culture and jokes. Prime examples include Dogecoin, Shiba Inu, and Pepe. Coingecko data also shows that Dogecoin, Shiba Inu, and Pepe make up 3 of the top 10 digital assets by 24 hour trading volume.

This activity is reflected within on-chain DEX Volumes, which has been up over ~4x over the past few weeks. A closer look at Ethereum and Solana DEX volumes reveals that Solana has flipped Ethereum in 24hr volumes this week, with the two blockchain networks recording $2.5bn and $2.3bn in daily volume, respectively. This could partly be attributable to the rise of Solana memecoins. Projects like BONK and Dogwifhat have become leaders in the Solana memecoin market. Solana has also become home to several celebrity and politician based memecoins like BODEN, a coin based on president Joe Biden. It’s important to note that these coins are incredibly risky and purely speculative in nature.

DEX volumes have also surpassed all time highs on Solana this week, exceeding previous highs seen in late December 2023. These increases in DEX Volumes have corresponded with massive increases in on-chain revenue for Solana, with the chain recording $550k in daily revenue on March 7th, up from less than $200k on March 1st. On-chain revenue seems to be poised to break the previous daily record set during the Jupiter airdrop in late January. Ethereum has also seen a great increase in on-chain revenue, although it has tapered off in recent days. With Ethereum gas prices through the roof, it will be interesting to see if users will remain on the chain or bridge to supporting Layer 2s, or to competing Layer 1s like Solana or Avalanche. At time of writing, a single swap costs an average of $109.19 on Ethereum, which could prove to be prohibitively expensive for regular users. According to estimates, swaps may become half as expensive after the Dencun upgrade next week, while Layer 2s may see gas costs decrease 100x. We expect that as fees get cheaper on Layer 2s, liquidity could follow and L2 memecoins may have their time in the sun.

💫 CFTC unveils draft Digital Assets Taxonomy

The Commodity Futures Trading Committee, CFTC, recently voted to advance a recommendation to publish a first-ever digital asset taxonomy to support U.S. regulatory clarity and international alignment. This comes the week after SEC Commissioner, Hester Peirce, spoke about the need for greater regulatory clarity for digital assets at the annual ETHDenver conference. The CFTC recognize that many companies in the digital asset space have been forced to create their own proprietary taxonomies. In light of this, the CTFC’s Digital Asset Market’s Subcommittee has come up with a new taxonomy after engaging various stakeholders in the space.

The CFTC’s approach defines a digital asset as “a controllable electronic record, where one or more parties can exclusively exercise control through transfer of this record and where the controllable electronic record itself is uniquely identifiable”, making note to exclude records that exist and function solely in a financial institutions books. The subcommittee identifies a set of features that pertain to digital assets in order to classify them. These include the asset’s issuer, mechanism underpinning its value, rights conferral, fungibility, redeemability, and ‘nature’ i.e. whether it is a digital twin or digital native.

The classification itself is divided into seven groups.

‘Money or Money-Like Digital Assets’.

‘Digital Money’ like CBDCs, tokenized bank deposits

‘Money-Like Assets’ such as stablecoins.

‘Financial Digital Assets’, includes securities and derivatives.

The CFTC subdivides these into digital twins such as tokenized securities, and digital natives like securities tokens

‘Alternative Digital Assets’ group includes tokenized real estate

‘Cryptoassets’ group including everything from Bitcoin to Ethereum to Shiba Inu coin

‘Functional Digital Assets’

These cannot be exchanged for value but confer some utility like governance rights

‘Settlement Controllable Electronic Records’

These are tokens used in digital record-keeping, particularly in facilitation of financial transactions

‘Other Digital Assets’

The CFTC purposefully leaves this group blank in anticipation of a growing digital asset market and landscape that will yield new use cases for digital assets

This taxonomy is a big step towards standardizing the language used around digital assets, and a step in the right direction for U.S. crypto regulation. Defining language is a crucial step in building more comprehensive legislation in any industry, and especially in an industry as opaque at crypto, clear guidelines will be important in building trust.

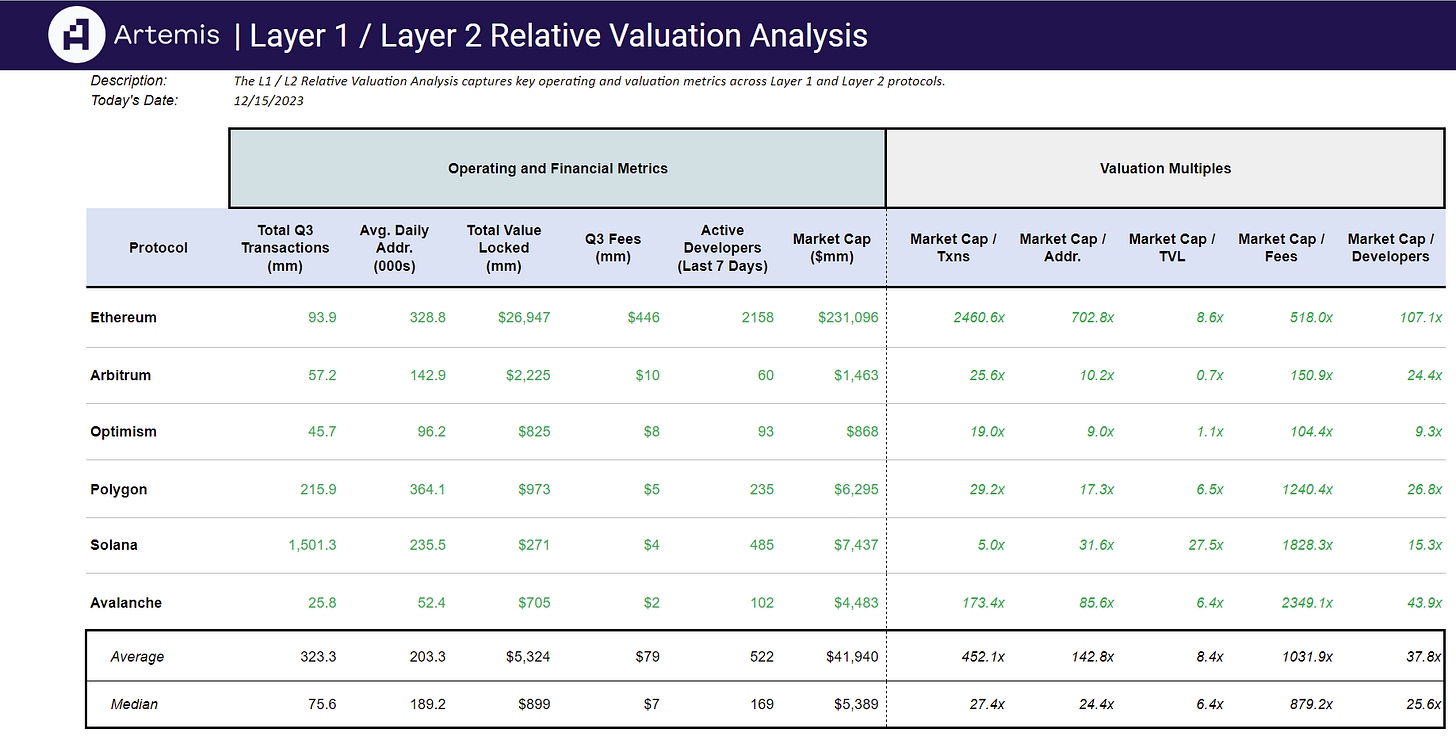

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 2/17/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞