Happy Friday and gm to those in Denver 🏂

What happened in crypto this week 👇

👻 Prominent crypto institutions including Circle, Coinbase and Paxos drop Silvergate as a banking partner

🤌 Camelot and Sushi continue to dominate DEX activity on Arbitrum

🛳 New product updates from the Artemis team

The crypto markets saw a sharp drop-off at the end of the week with an average and median WoW price decline of 12.7% and 13.3%, respectively. The price action was preceded by Silvergate fud from earlier in the week where the crypto-friendly bank questioned whether it would be able to operate on a going concern basis.

👻 Prominent crypto institutions including Circle, Coinbase and Paxos drop Silvergate as a banking partner

A wide swath of institutional crypto businesses including Coinbase, Galaxy Digital, Circle, Paxos and Bitstamp announced on Thursday (3/2) that they were severing ties with Silvergate. Silvergate has been the pre-eminent bank for crypto companies and at its peak held $16bn of assets during Q4 of 2021.

Silvergate stated on Wednesday (3/1) that “it won’t meet an extended deadline to file its annual report and warned it may not be able to operate another 12 months” - shares dropped 50% on March 2 to an new all-time-low. Silvergate noted that new developments in 2023 included “the sale of additional investment securities beyond what was previously anticipated and disclosed in the Earnings Release primarily to repay in full the Company’s outstanding advances from the Federal Home Loan Bank of San Francisco (FHLBSF).” Silvergate previously stated on January 5, 2023 that it had sold $5.2bn of debt securities at a $718mm loss and now expects to “record further losses on its securities portfolio.”

Meanwhile, large-cap trading firms including Citadel and Susquehanna had previously made investments in the equity of the beleaguered bank. Citadel and Susquehanna own 5.5% and 7.5% of Silvergate’s equity as of Feb 14, 2023. This is not the first foray that heavyweight Citadel has made into the crypto ecosystem. Citadel previously disclosed a minority investment from Sequoia and Paradigm, with Matt Huang, Co-Founder and Managing Partner of Paradigm, noting that he looks “forward to partnering with the Citadel Securities team as they extend their technology and expertise to even more markets and asset classes, including crypto.”

🤌 Camelot and Sushi continue to dominate DEX activity on Arbitrum

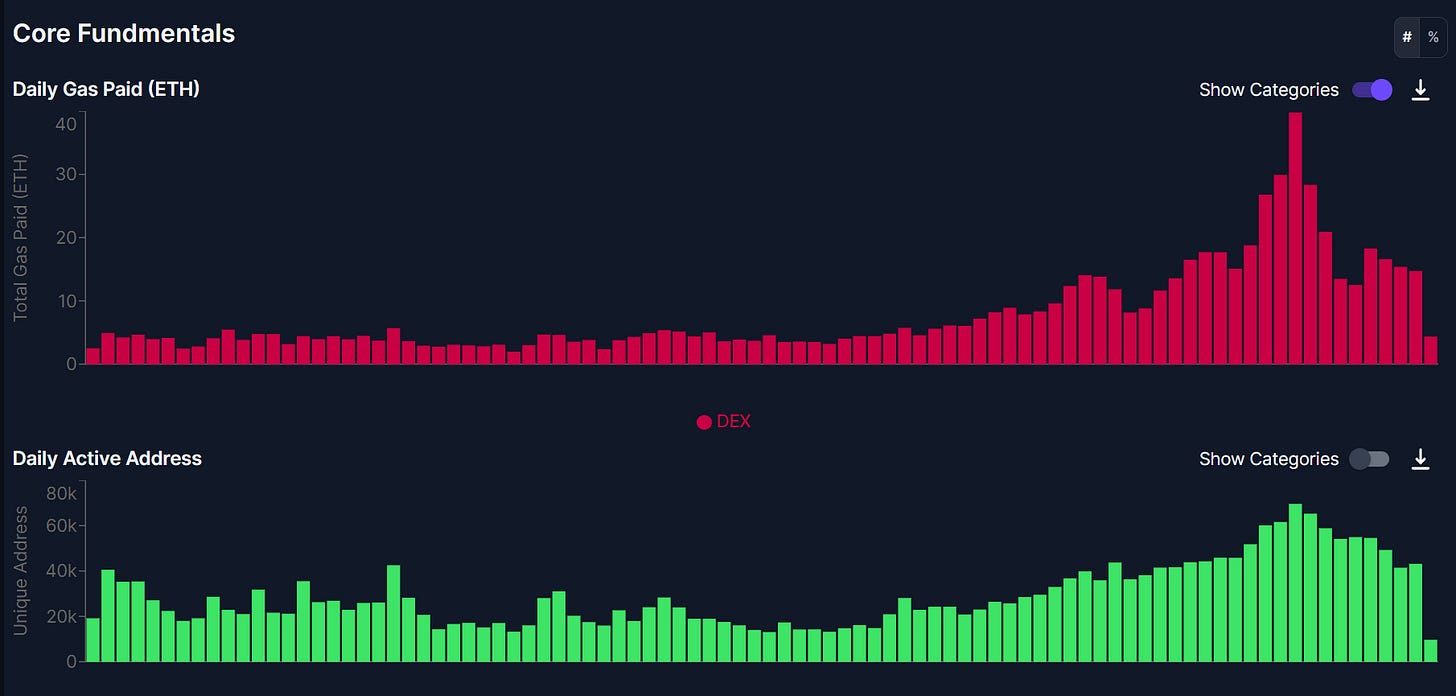

Back on-chain, DEX usage on Arbitrum has continued to heat up with Camelot and Sushi volumes seeing upticks towards the end of February. Arbitrum continues to see meaningful growth in daily active addresses and daily gas usage primarily driven by DEX activity, which represents 50%+ of total gas usage and 30%+ of total DAUs.

Camelot is a new DEX on Arbitrum that served as a launchpad for a few new projects including hyped DeFi project Factor. Factor was a major contributor to the spike gas usage, with an IDO period that ended on February 23rd, 2023 (coinciding with the increase in gas paid and daily active addresses. Factor saw some backlash on Twitter after FCTR tokens fell to ~44 cents in the first week of trading after pricing at 75 cents at IDO.

SushiSwap saw an uptick in active addresses, transactions and gas usage alongside the clamor for the FCTR IDO while Uniswap saw a decline in WoW usage.

A week later, Uniswap has reclaimed its position at the top of the Arbitrum DExs as the entire ecosystem saw a pullback in trading activity.

🛳🛳 New product updates from the Artemis team

Stacks, the Bitcoin L2 platform that supports the Ordinals NFT project is now live on Artemis! We can see that metrics including DAAs, DTs and TVL grow rapidly over the past 90 days

Base, the new L2 Coinbase-led project has launched on testnet, and you can now track fundamental data for the chain on Artemis!

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 2/24/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.