greetings

here’s what happened in crypto this week👇

🫥 Binance and its founder CZ were sued by the CFTC over regulatory violations

🤪 The US Govt sold $215mm of BTC and no one knew

🫡 Crypto efforts continue from tradfi and tech giants including Fidelity, NASDAQ and Amazon

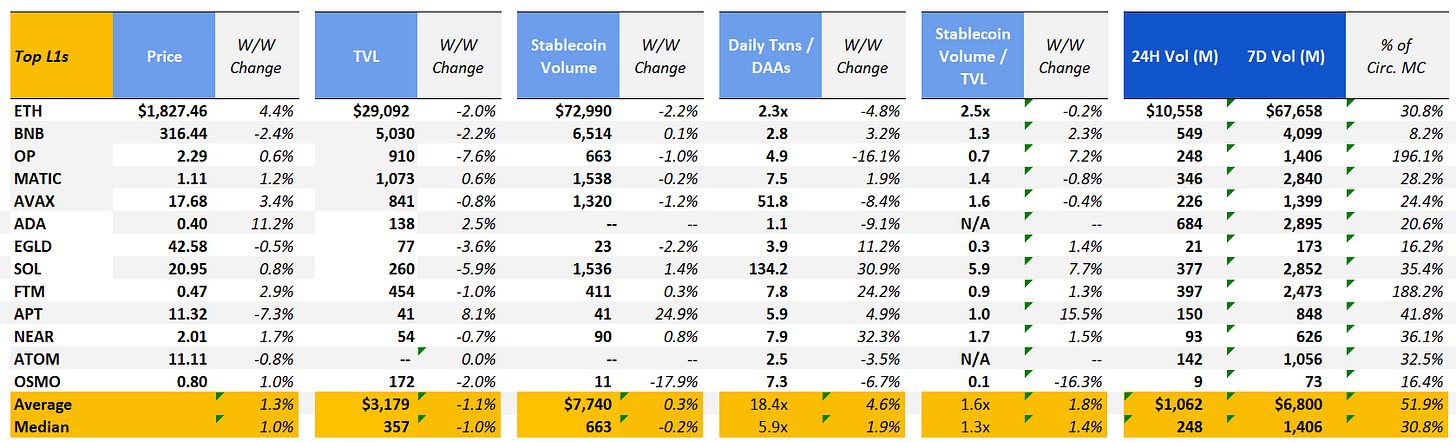

The crypto markets saw a dip in the middle of the week after the Binance / CFTC lawsuit was announced, but recovered and ended the week modestly up with average and median WoW price increased of 1.3% and 1.0%, respectively. Despite the continued US regulatory push to restrain the crypto sector, the ecosystem continues to trudge on and even appears to regain some support from geographies that previously put severe controls on its development.

Let’s jump right in

🫥 Binance and its founder CZ were sued by the CFTC over regulatory violations

The CFTC said in a complaint on March 27 that from at least July 2019 to the present, Binance "offered and executed commodity derivatives transactions on behalf of U.S. persons" in violation of U.S. laws… and that [the CFTC] is seeking monetary penalties, disgorgement of ill-gotten gains and permanent trading and registration bans” (Reuters). Interestingly, the complaint is largely centered around how Binance “offered trading services to large New York and Chicago high-frequency trading firms through their offshore subsidiaries” (Bloomberg).

Matt Levine notes that while the CFTC’s complaint largely “gestures at traditional regulatory concerns like retail customer protection and cracking down on money laundering… it is mostly about cutting off a big international crypto exchange from big sophisticated market-making firms in the US.”

This appears to read as the CFTC attempting to knee-cap Binance of its market making / trading capacity while advertising the motion as an effort to protect retail customers.

CZ responded with a truly profound note to the twitter community

followed by an official blog post calling the CFTC response “unexpected and disappointing” especially after “working cooperatively with the CFTC for over two years” (Binance Blog).

Side note: as part of the complaint, the CFTC noted that BTC, ETH and LTC are part of a set of assets that they considered “commodities” 👀

Jim Cramer of course weighed in 🤠

🤪 US Govt sold ~$215mm of BTC and no one knew

In November 2022, the US Govt seized 50,676 bitcoins from James Zhong as part of the broader Silk Road case after he plead guilty to committing wire fraud in 2012 (Forbes). This week, court filings disclosed that the US govt sold 9,860 bitcoins for ~$215mm after fees on March 14, and retains ~41,490 bitcoins that they intend to sell in four tranches over the course of the next year.

Funnily enough, the government liquidated the bitcoins via Coinbase, a company that the SEC recently served a Wells Notice to.

🫡 Crypto efforts continue from tradfi and tech giants including Fidelity, NASDAQ and Amazon

Announcements on crypto products from traditional tech and financial institutions have been steadily cropping up in recent weeks. Notable headlines include Fidelity Crypto going live for ~37mm consumers, NASDAQ eyeing a crypto custody launch by the end of Q2, and Amazon working on an in-house NFT initiative.

Even the Pentagon looks like it’s getting into the game with some bitcoin mining action (we’re honestly not sure if this is satire or not)

that’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 3/24/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.