This week, Sam Bankman-Fried gets 25 years in prison, Alexey Pertsev - Tornado Cash developer - goes on trial in the Netherlands, over $1bn worth of US Treasury notes have been tokenized on public blockchains.

🌞 Developments in the land of Ethereum Roll-ups

💫 Munchables, Blast L2 protocol, gets hacked for $62m

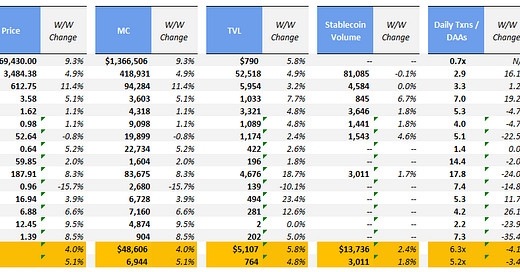

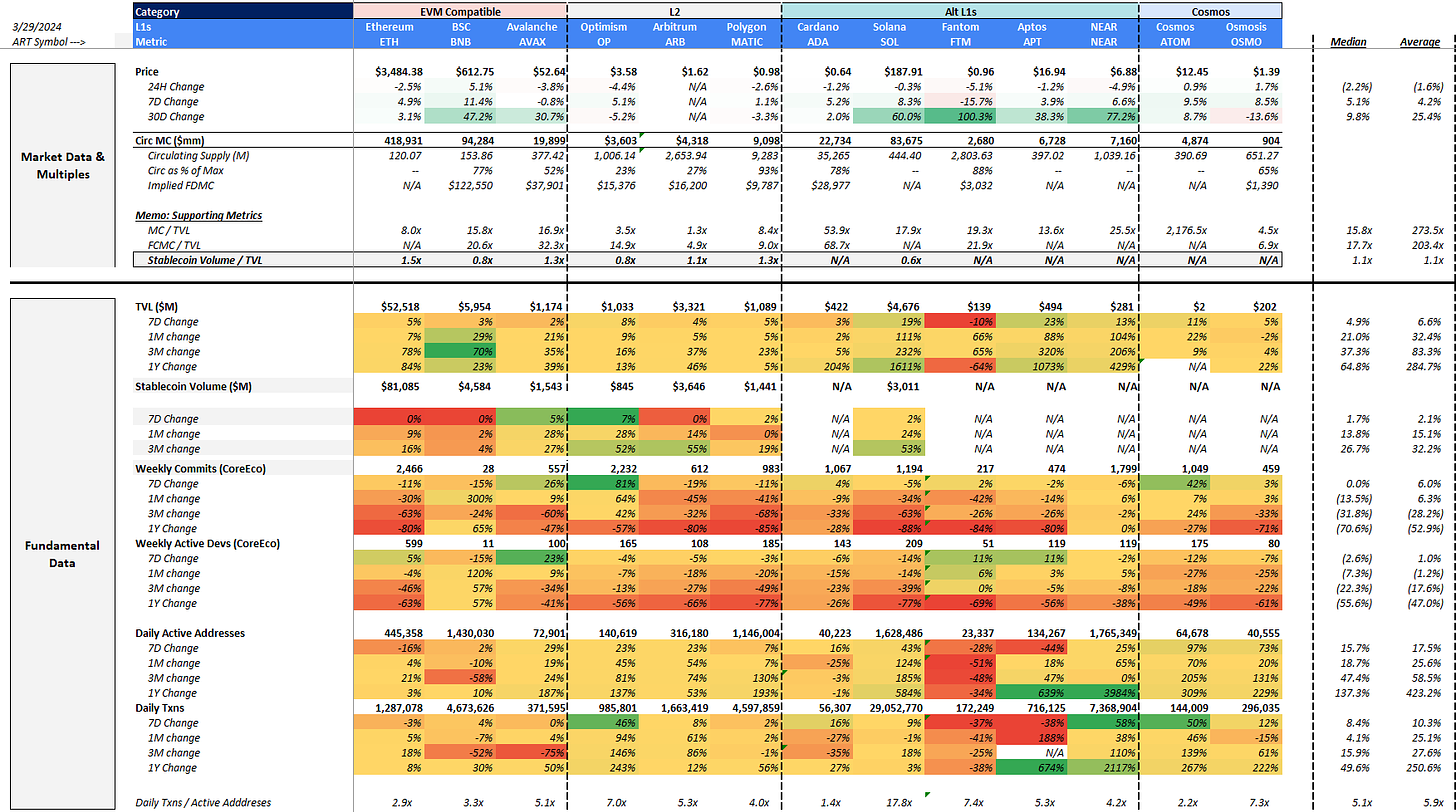

The week saw continued upward momentum across a various major tokens as average and median WoW prices grew by 4.0% and 5.1%, respectively. Spot Bitcoin ETF inflows snapped its 5-day outflow streak with $15mm of net inflows on Monday, pushing Bitcoin’s price above 70k. Fidelity found $262mm of buy pressure on Monday vs. $18mm, 3mm and $13mm in its previous three sessions. The rest of the crypto ecosystem rebounded alongside BTC except for FTM, which saw a steep double digit drop after a double digit run-up in the previous week.

Meanwhile, the S&P 500 increased by 0.2% while the NASDAQ declined 0.05% WoW. The S&P 500 index rose 10.2% during the first three months of the year, its best first-quarter performance since 2019. The Dow Jones Industrial Average and the Nasdaq Composite gained 5.6% and 9.1% over Q1 2024, respectively.

🌞 Developments in the land of Ethereum Roll-ups

Ethereum rollups have taken center stage after Ethereum’s Dencun upgrade on March 13th introduced blob transactions, drastically lowering rollup fees.

Fees on Base spike, prompting an increase in the gas target

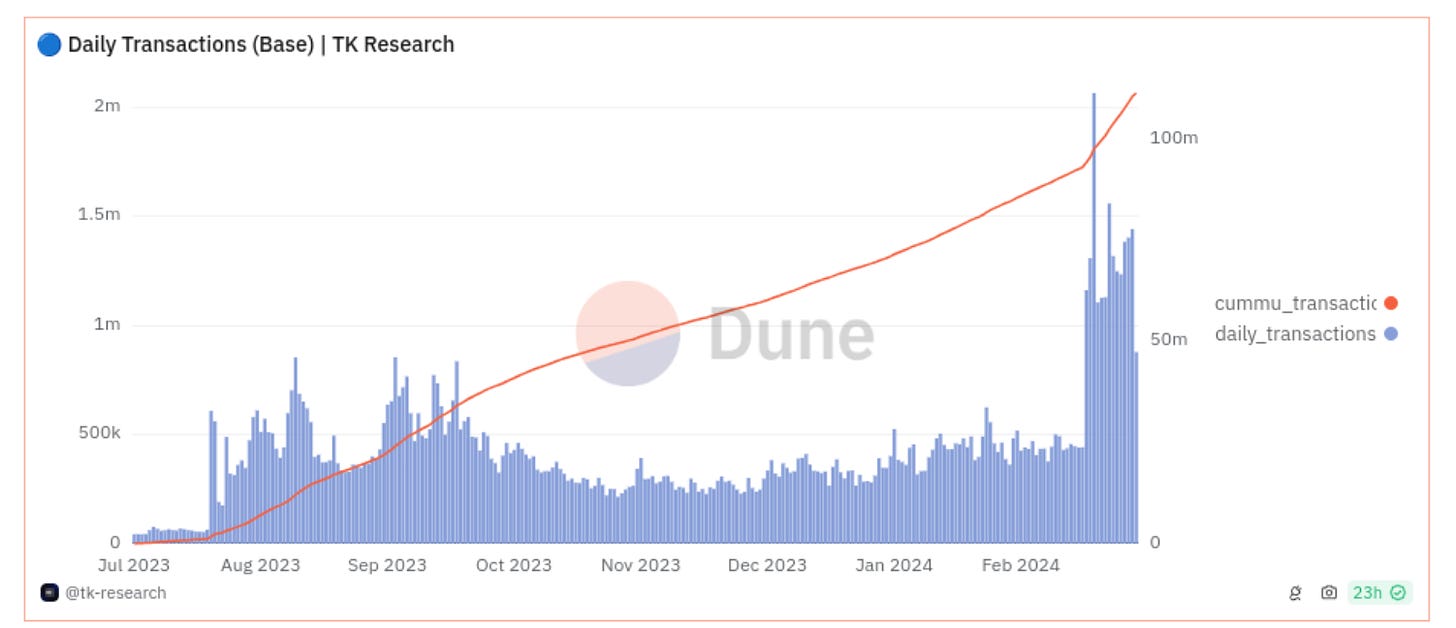

Gas fees on Base, Coinbase’s layer-2 rollup, spiked last week with certain transactions fees reaching pre-EIP4844 prices. In response to the spike in usage on the network, the Base team decided to increase the ‘gas target’. The gas target is a value that is indicates the network’s ideal gas usage per block, and is an essential component in calculating dynamic gas fees. If a block uses more gas than the target, fees in the next block will increase, and vice versa. Jesse Pollack, creator of Base, announced on X that reducing fees on Base was a top priority for the chain. Cheaper fees as a result of EIP4844 induced greater demand, driving gas usage above the gas target, leading to increased fees for end users.

As announced, Base increased the gas target by ~50% (blue line below) on Wednesday. Gas usage actually continued to trend upwards (purple line), but since now blocks were below the gas target, fees dropped drastically (yellow line). The Base team plans to continue increasing the gas target to about 400x in the long run in order to keep fees low as demand continues to increase. Readers may be wondering why Ethereum doesn’t simply increase the gas target on L1 to make Ethereum transactions cheaper. The main reason is that this would require increased hardware requirements for nodes, pricing out smaller validators and further increasing network centralization.

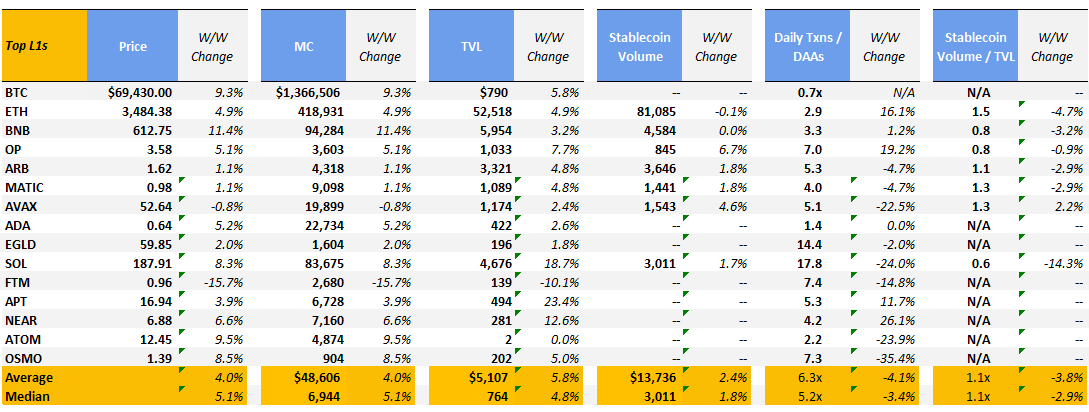

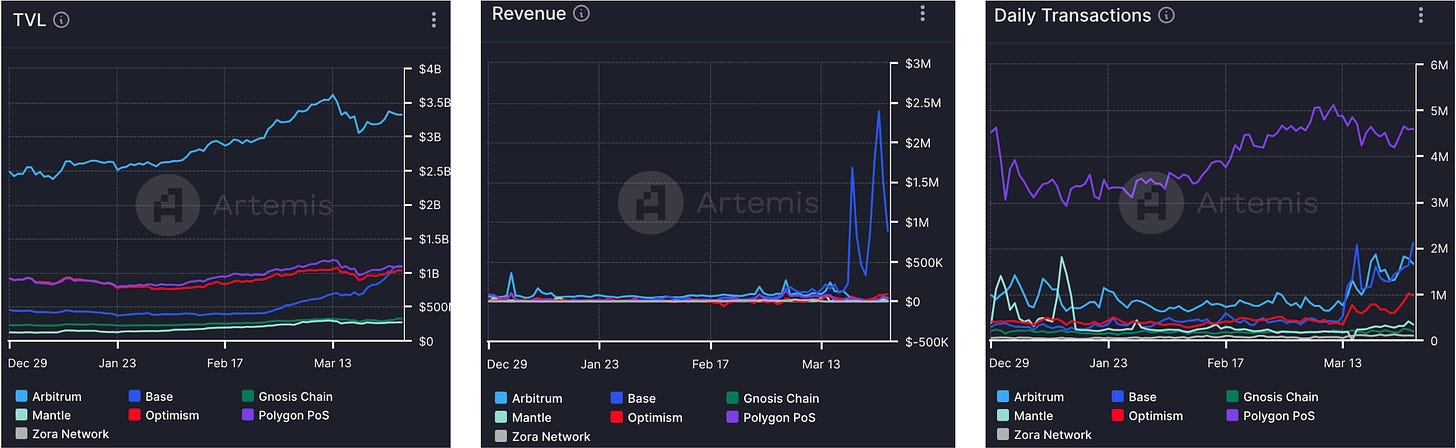

Fundamental metrics across Base have been on the rise since the introduction of EIP4844, relative to other rollups. While Base has not surpassed Arbitrum in TVL or Polygon in daily transactions, it has climbed up to second in both of those fundamental metrics. Base has been the rollup that has seen the most growth as a result of the upgrade. We can also observe that revenue spiked massively due to increased demand, but we should expect revenue to decrease as fees decrease as a result of the increased gas target.

Blobscriptions take over blobspace

Ethscriptions is a protocol inspired by Bitcoin ordinal inscriptions that allowed users to turn satoshis, bitcoin’s smallest denomination, into distinct digital assets. Ethscriptions allow users to attach information to Ethereum transactions in the form of call-data without the need to interact with a smart contract. They essentially function as cheaper NFTs and tokens.

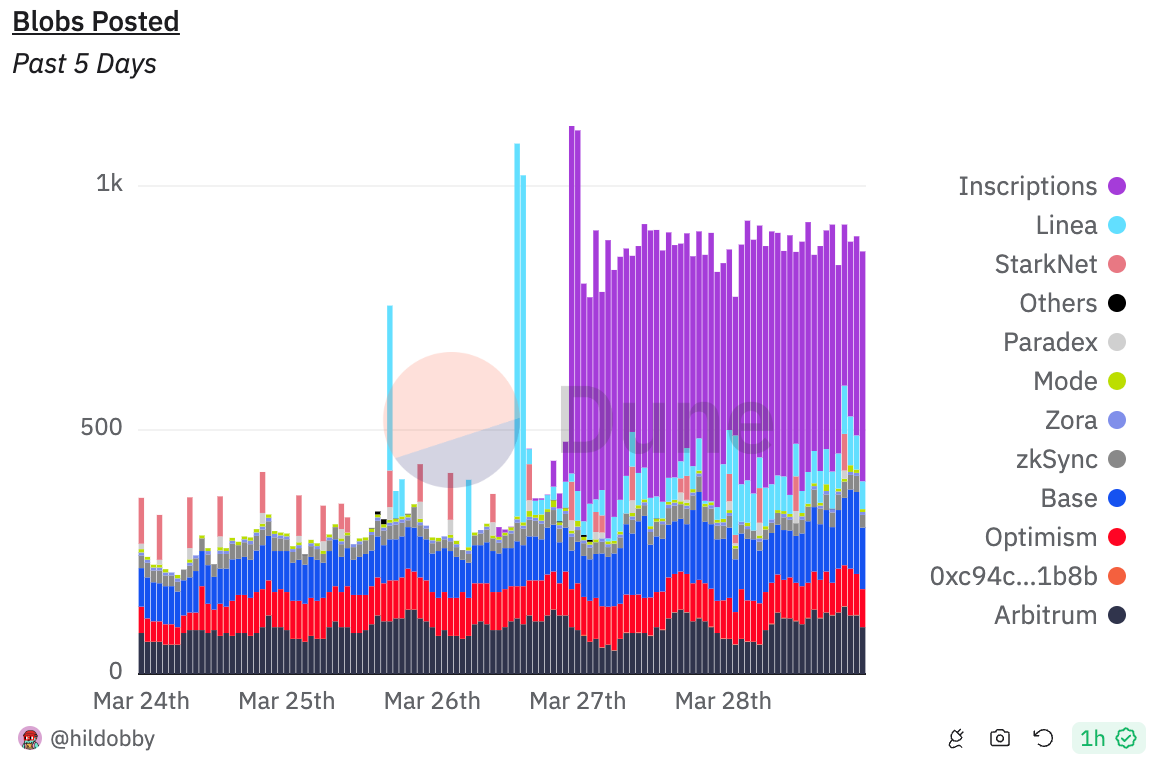

While blobs are meant to be used by rollups, theoretically anyone that is willing to pay for them can use them. The folks developing Ethscriptions realized they can drive more value to their users by allowing them to add details to their Ethscription transactions in the form of blob data. Users can include things like image data. Blobscriptions went viral this week and had a stark impact on blob fee markets, which up to that point had had minimal price discovery. In the past couple of days blobscriptions have began to dominate the blob data market. Today they account for about half of all daily blobs posted, and have driven blocks to contain blobs ~70% of the time (up from ~20% prior to the advent of blobscriptions).

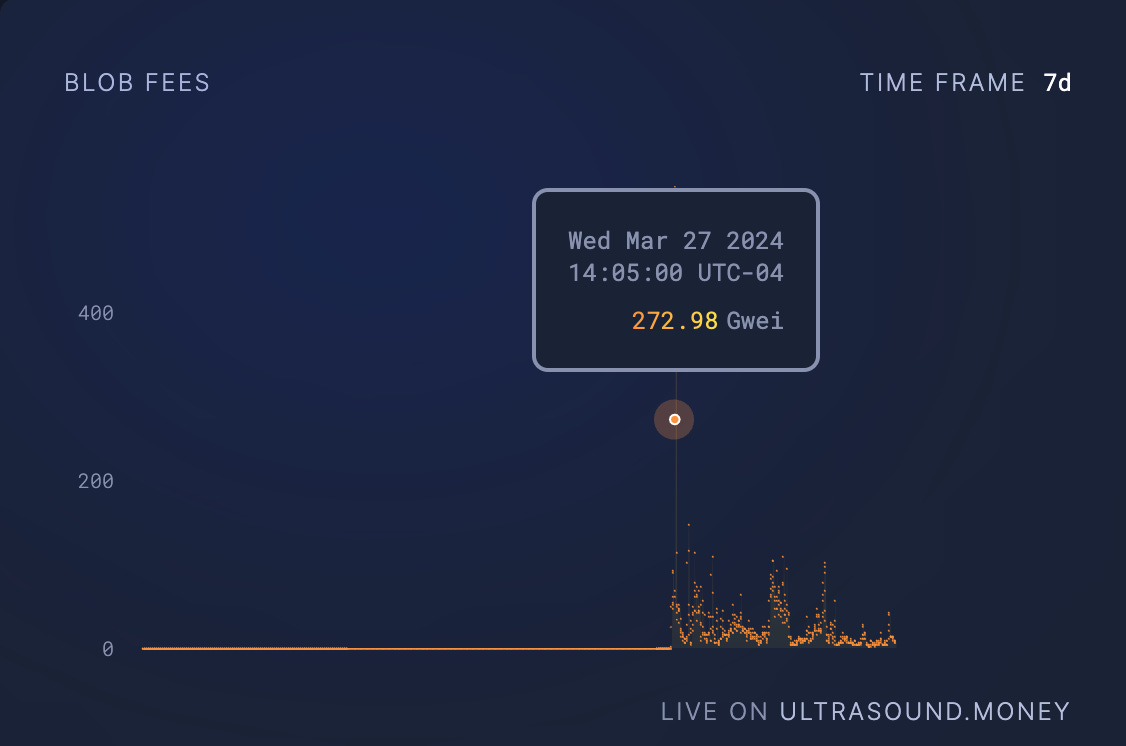

As a result, the market for blob gas skyrocketed, as the intended ~1 wei per blob gas spiking to 272.98 Gwei (1 Gwei = 1x10^9 wei). According to ultrasound.money data, the market has since stabilized around the 5-10 Gwei per blob gas range. Since the market for blob data had been relatively quiet (~80% of blocks didn’t even contain blobs) a true price for blob space had not been found as supply far outstripped demand. However, with the increased demand, the market is now undergoing a phase of price discovery, during which it is expected to adjust and eventually settle at a market clearing price — the price at which the quantity of blob gas demanded by buyers equals the quantity supplied by sellers.

💫 Munchables, Blast L2 protocol, gets hacked for $62m

This week the crypto community got flashbacks to the 2016 DAO fork as Blast, a recently launched Ethereum rollup, saw one of its top gaming applications exploited for $62m. For about a day the community faced an existential question: should Blast roll back the chain to a state prior to the exploit, or should they allow the exploiter to get away with the funds? This is the exact same question that faced the Ethereum community back in 2016 after a hacker made away with $60m worth of ETH stolen from The DAO. In 2016, the community chose to fork the chain at a previous state in order to undo the hack. About seven years later we are facing a similar question. There have been many hacks in crypto in the past few years, but many of these happened on L1s that were fully established and where rolling back the chain would have been a massive social undertaking. The current case with Blast is different in the sense that Blast is rollup with a centralized sequencer and rolling back the chain would be a much smaller social and technical endeavor. This brought up some key questions around rollup centralization, with some asking if many “rollups” even qualify as “decentralized”.

The exploiter was one of the project’s very own developers who had retained ownership of the relevant private keys. There were some allegations that the exploiter had ties to North Korea. Thankfully, the developer was convinced to return the stolen funds without ransom, and saved the community from making a big decision. The curious can check out the exploiter’s address on Blastscan.

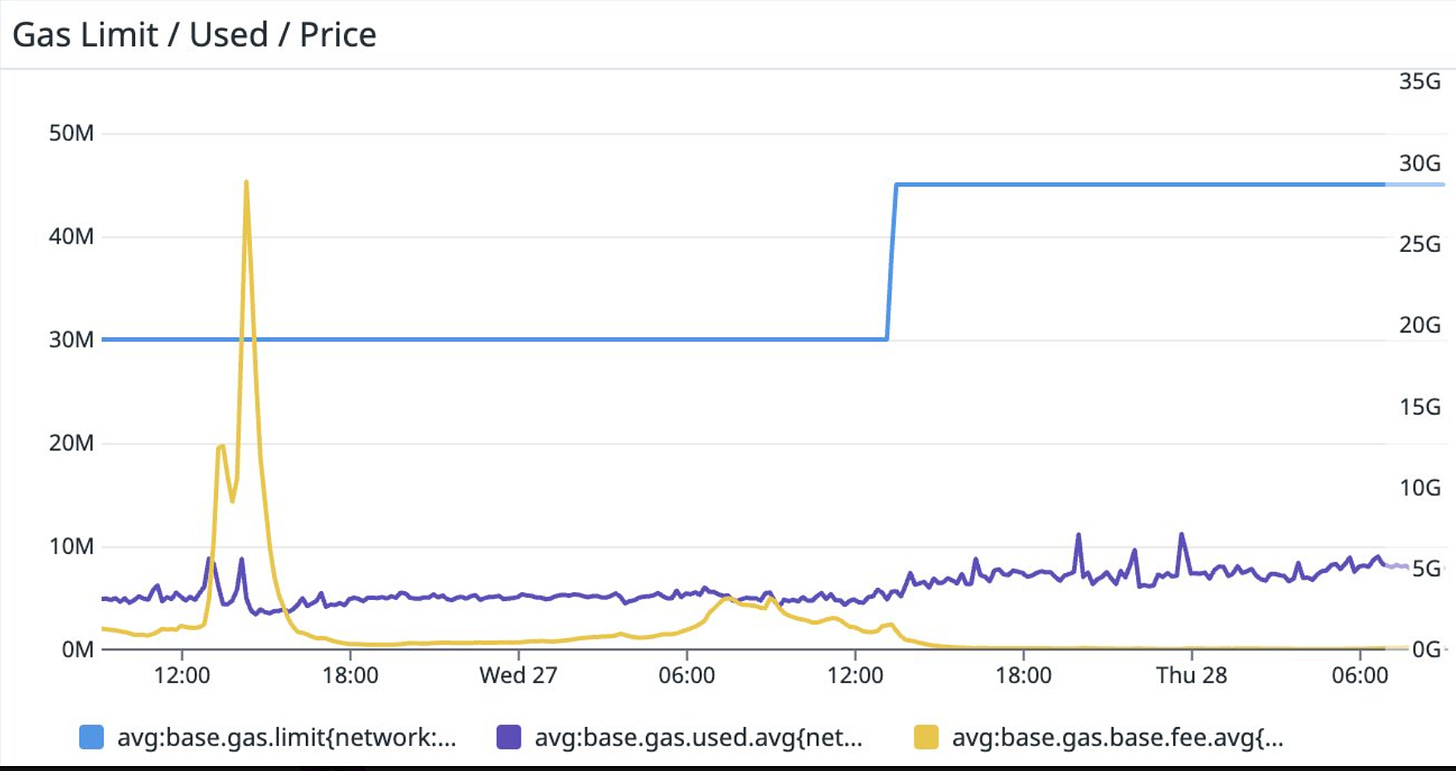

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 3/11/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

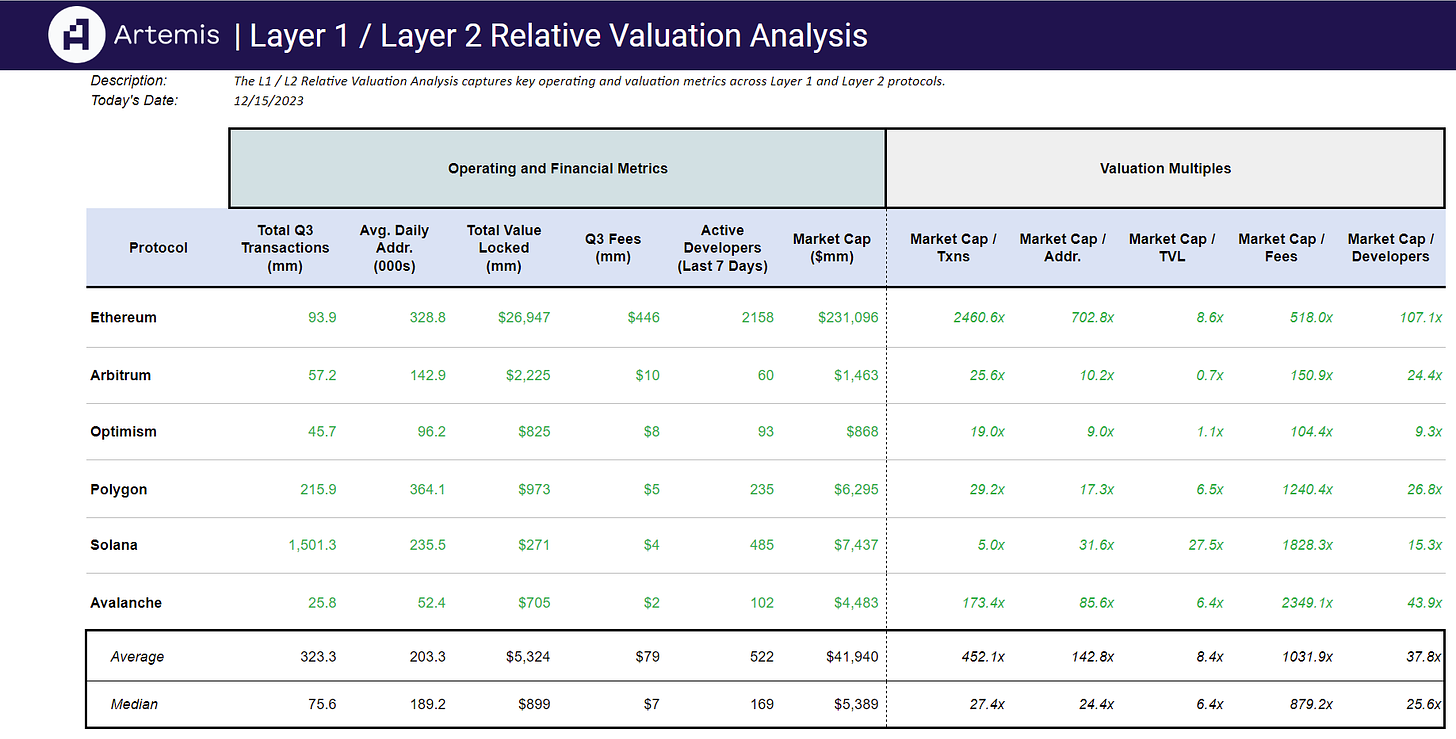

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞