This week, Telegram’s ‘Notcoin’ game hits 30 million total players, shared sequencer firm Espresso Systems raises $28m, and BlackRock says it only sees a “little bit” of demand from clients for access to Ethereum.

🌞 MakerDao Sees Competition Heat Up across Decentralized Stablecoins / Lending

💫Blackrock launches Tokenized fund on Ethereum

The week saw double digit declines across a number of major tokens as average and median WoW prices decreased by 8.0% and 11.2%, respectively. Spot Bitcoin ETF inflows continued to suffer with four consecutive days of net negative inflows, driven by massive outflows from the Grayscale Bitcoin Trust (GBTC). Thursday saw $359mm in outflows, resulting in $94mm in outflows for the overall fund group. Bitcoin fell ~8.5% over the week as spot ETFs recorded $830mm of outflows as of Thursday March 21st. The rest of the crypto ecosystem fell alongside BTC except for FTM and APT, on the back of expectations around FTM’s Sonic Upgrade and RWA integrations on Aptos.

Meanwhile, the S&P 500 and Nasdaq Index increased by 1.54% and 1.70% WoW, as Mr. Powell indicated that the Fed will hold rates steady and still foresees three interest rate cuts this year despite higher than expected CPI figures. The S&P 500 and Nasdaq both hit all time highs after the reassurances from the Fed this week.

🌞 MakerDao Sees Competition Heat Up across Decentralized Stablecoins / Lending

The Maker Protocol is a foundational DeFi protocol through which the crypto collateralized stablecoin Dai is minted. Any person can deposit a whitelisted token such as ETH or USDC as collateral and receive Dai in exchange, and pay a yield to Maker in order to borrow that Dai. In 2019 the Dai Savings Rate (DSR) was introduced. The DSR allows all Dai holders to earn savings automatically and natively by locking their Dai into the DSR conract. This yield is generated by fees paid by users who post collateral to a Maker Vault in exchange for borrowing Dai, which are known as “Stability Fees.”

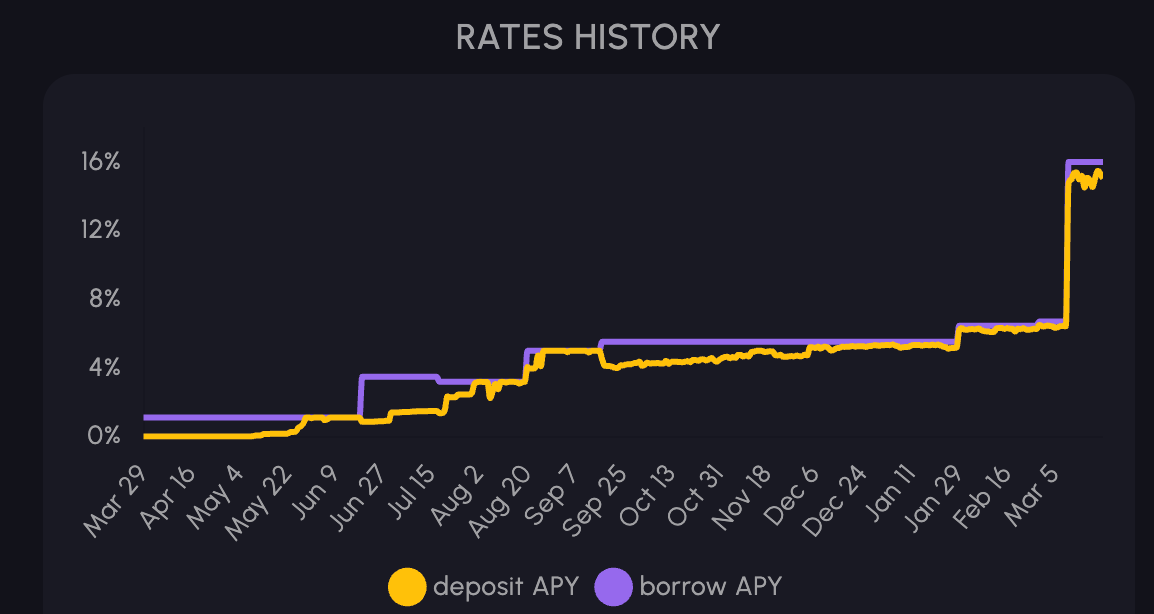

Recent weeks have seen high volatility and high rates in the crypto market. In anticipation of a Dai demand shock caused by further volatility, MakerDAO passed an accelerated governance proposal on March 8th to increase both the Stability Fees for core Vaults and the Dai Savings Rate by approximately 10% each. The DSR yield was increased from 5% to 15%.

Across the DeFi ecosystem stablecoin yields have been on the rise with protocols like Ethena offering ~30% yields on USDe. Similarly, USDC lending rates recently reached yearly highs at 15% on Aave, up from ~1% a year ago.

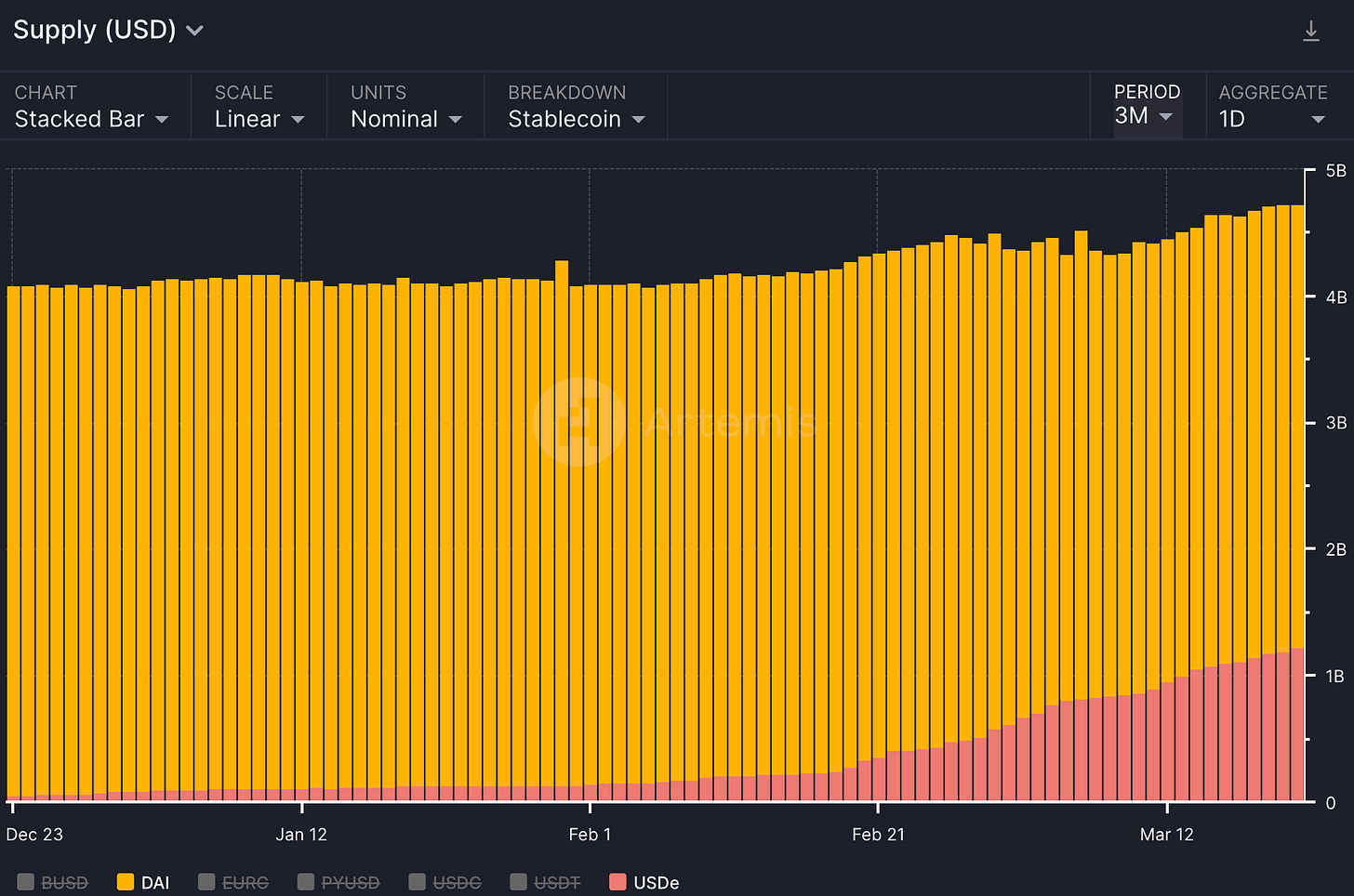

According to the Artemis Stablecoin Dashboard, Ethena’s USDe has taken considerable market share from Dai over the past month and a half, as users are drawn to increasingly high APY rates. Meanwhile, there is still debate around the sustainability of USDe’s source of yield, and whether it qualifies as a stablecoin at all.

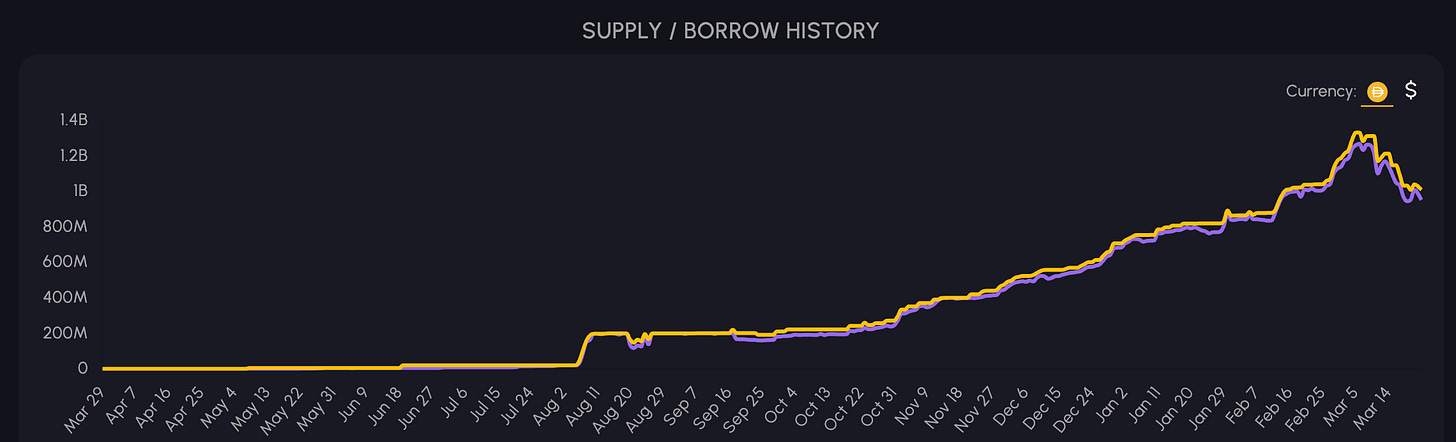

Amid the current market environment, demand for DAI has reached all-time highs on SparkLend, The Dai Ecosystem’s native lending protocol. Demand was so high that SparkLend almost reached their debt ceiling of 1.5bn Dai, prompting a governance proposal to increase their debt ceiling to 2.5bn. The governance proposal passed, but demand for Dai on SparkLend started to taper off shortly after, likely due to a general downturn in the crypto markets. It is good to see that SparkLend is now well equipped should the crypto markets bounce back and demand for Dai return.

The Maker Protocol is also in the process of reinventing itself from being a foundational, albeit simple staple of DeFi into a modern ecosystem of DeFi applications. It plans to rename itself “Endgame” and ultimately reach a self-sustaining equilibrium called the Endgame State. This process will feature an overhaul of existing tokenomics and governance processes. Thus far, popular voices within crypto have criticized this move, saying that the DAO should focus its efforts on scaling Dai rather than focusing on other products.

💫Blackrock launches Tokenized fund on Ethereum

On Wednesday, BlackRock launched the first tokenized fund issued on a public blockchain. The BlackRock USD Institutional Digital Liquidity (or BUIDL) fund is tokenized pooled investment fund on Ethereum. Tokenization refers to the act of creating a representation of something in the real world as a token on a blockchain. Tokenized assets are often referred to as Real World Assets (RWAs) in the crypto space. In a recent report, Citi estimated that the tokenized securities market will become a $4-5 trillion USD market by 2030.

Investors can subscribe to the fund through Securitize Markets, LLC, a RWA specialist that BlackRock worked with to create the fund. According to BlackRock’s filing, there is a minimum investment balance of $100,000. The BUIDL fund aims to offer a stable value of $1 per token and pays out daily accrued dividends to investor wallets in the form of new tokens every month. The funds will invest in safe, high liquidity, high credit rating securities like cash, US Treasury bills, and repurchase agreements. This allows investors to earn a low-risk and stable yield while holding ownership of their position on the Ethereum blockchain. Tokens have some transfer restrictions in order to comply with regulations and investors may only transfer tokens to other pre-approved investors, but they can execute transactions on a 24/7/365 basis - a unique utility enabled by public blockchains. At first, participation in the fund will include crypto industry participants like Anchorage Digital Bank, BitGo, Coinbase and Fireblocks, among others. The fund is structured with various TradFi institutions sitting at different layers of the stack. BlackRock will be the investment manager, the Bank of New York Mellon will be the custodian of the fund’s assets and its administrator, and PWC has been appointed as the funds auditor. Securitize will act as a transfer agent and tokenization platform managing the tokenized shares and reporting on Fund subscriptions, redemptions, and distributions.

The Ethereum address associated with the fund has already been identified by crypto Twitter (0x13e003a57432062e4eda204f687be80139ad622f), and was immediately airdropped tens of thousands of dollars worth of memecoins upon launch. Separately, the address received an unsolicited transfer of Ether from Tornado Cash, an OFAC sanctioned Ethereum mixing protocol. Crypto Twitter has speculated that there may be legal ramifications of this ‘interaction’ with an OFAC sanctioned protocol.

Ultimately, this step into on-chain tokenized assets is a major move for institutional adoption and will not serve as a test of institutional usage of public blockchains, but also as a test of the viability of the Ethereum user experience. It remains to be seen what personas actually buy into the fund: will it it be mostly crypto natives, or will more traditional investors be willing to cross the chasm? Additionally, with respect to the SEC’s recent decision to delay a decision on BlackRock’s Ethereum ETF, the BUIDL fund could help to move the needle in the right direction for an ETF approval.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism. Weekly commits and weekly dev activity as of 3/4/24.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

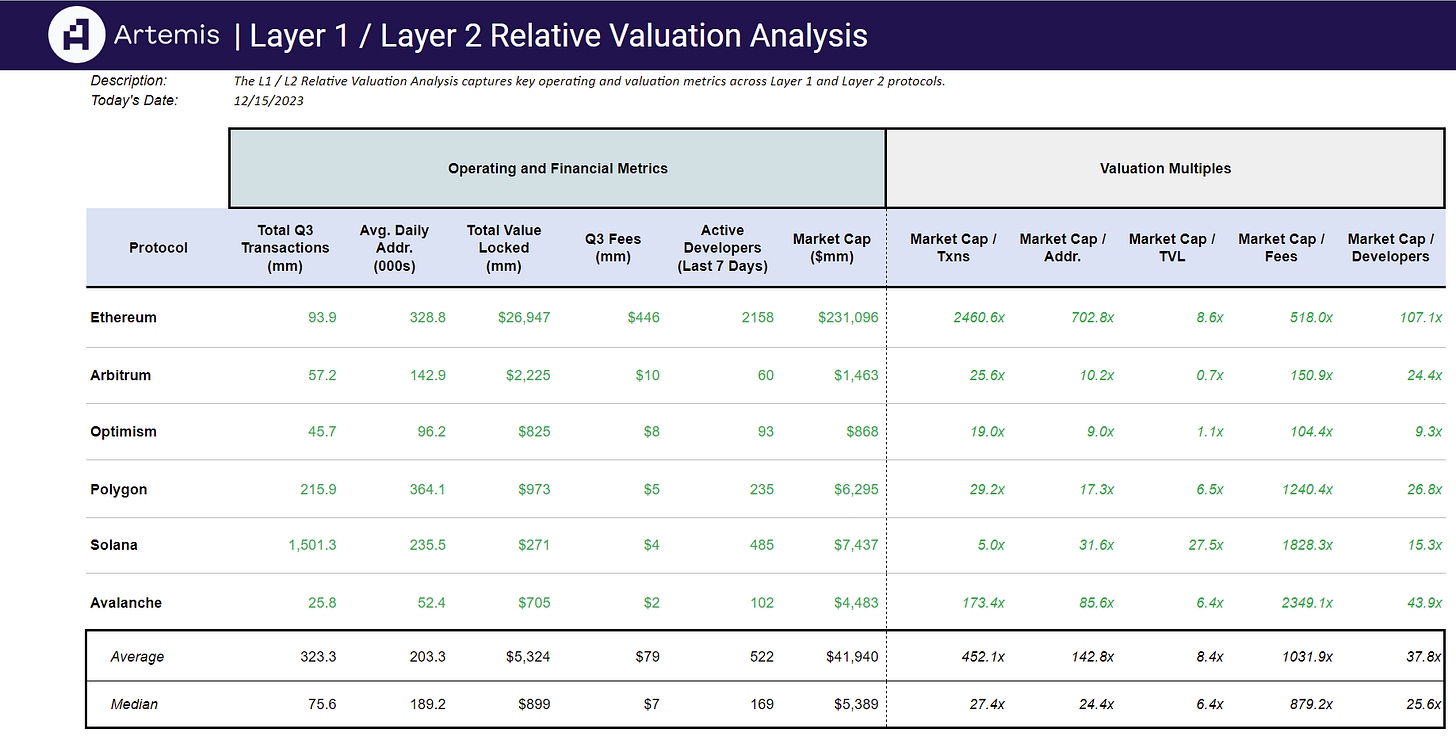

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞