gm folks, congrats on making it through another week.

here’s what happened in crypto 👇

👼 Silicon Valley Bank depositors are bailed out while fears of a broader bank crisis emerge

🤔 Balaji sends out the “BitSignal” wagering that bitcoin will reach $1mm in 90 days

🤯 Arbitrum launches a token!!

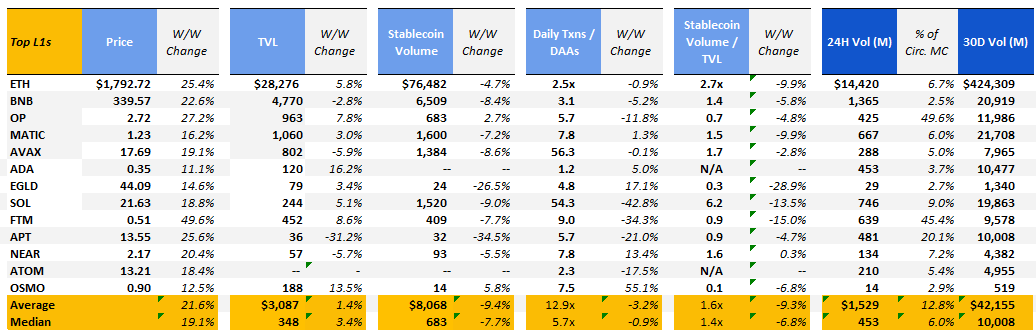

The crypto markets saw a huge rise in prices throughout the week with average and median WoW price increases of 21.6% and 19.1%, respectively. This week saw Silicon Valley Bank depositors get bailed out by the US government along with the Swiss government launching $54bn backstop for Credit Suisse, another (much larger) beleaguered bank.

🪦 Silicon Valley Bank depositors are bailed out while fears of a broader bank crisis emerge

Silicon Valley Bank depositors received joyous news last Sunday when the FDIC announced that they would be insuring all depositors after a $42bn single day bank-run caused the bank to be taken over by the FDIC early Friday morning (3/10/2023).

Couple of takes from around the wall street table:

Ken Griffin is unhappy with capitalism

“It would have been a great lesson in moral hazard,” he said. “Losses to depositors would have been immaterial, and it would have driven home the point that risk management is essential.” “We’re at full employment, credit losses have been minimal, and bank balance sheets are at their strongest ever. We can address the issue of moral hazard from a position of strength.”

Bill Ackman rejoices

“Our gov’t did the right thing. This was not a bailout in any form. The people who screwed up will bear the consequences. The investors who didn’t adequately oversee their banks will be zeroed out and the bondholders will suffer a similar fate.”

Meanwhile, Credit Suisse received a $54bn loan from the Swiss National Bank on Wednesday that would serve as a liquidity backstop for the troubled lender. This news came after a number of potential investors including the Saudi National Bank (a major CS shareholder) ultimately declined to make any further investments. The Saudi National Bank previously bought a 10% stake in Credit Suisse last year, and stated that owning a large share of the bank would result in “unwanted regulatory requirements.”

While Credit Suisse is one of the largest international banks facing immense pressure from the rapid rise of interest rates, this week saw trading halt due to precipitous price drops for a wide swath of major regional banks including First Republic, Western Alliance Bancorp and PacWest Bancorp.

The existential risk of the US banking system is now front and center for the mainstream media, and this article from the FT walks through a quick assessment of the US Banks asset exposure given recent rises in interest rates.

TLDR: The US banking system’s current market value of assets is ~$2.2tn lower than their book value of assets (accounting for loan portfolios). Furthermore, after the recent decrease in the value of bank assets, FT notes that “2,315 banks accounting for $11tn of aggregate assets have negative capitalization.”

🤔 Balaji sends out the “BitSignal” wagering that bitcoin will reach $1mm in 90 days

Elsewhere, Balaji, famed twitterer and former CTO of Coinbase and former GP at a16z put up the “BitSignal” and bet that bitcoin would reach $1mm a pop in 90 days.

He states that “the central banks, the banks, and the bank regulators have bankrupted all of us… they’re about to print $2T to hyperinflate the dollar.”

He goes on to message that the “banks are insolvent” and refers to a paper from the FDIC bank in November 2022 that details how the FDIC was concerned about unrealized losses growing in US banks’ bond portfolios and the possibility that those losses would have to be realized.

The “Bitcoin is a hedge against the collapse of traditional financial institutions” narrative appears to be back in full force, with heavy twitter hitters sounding the alarm.

🤯 Arbitrum launches a token!!

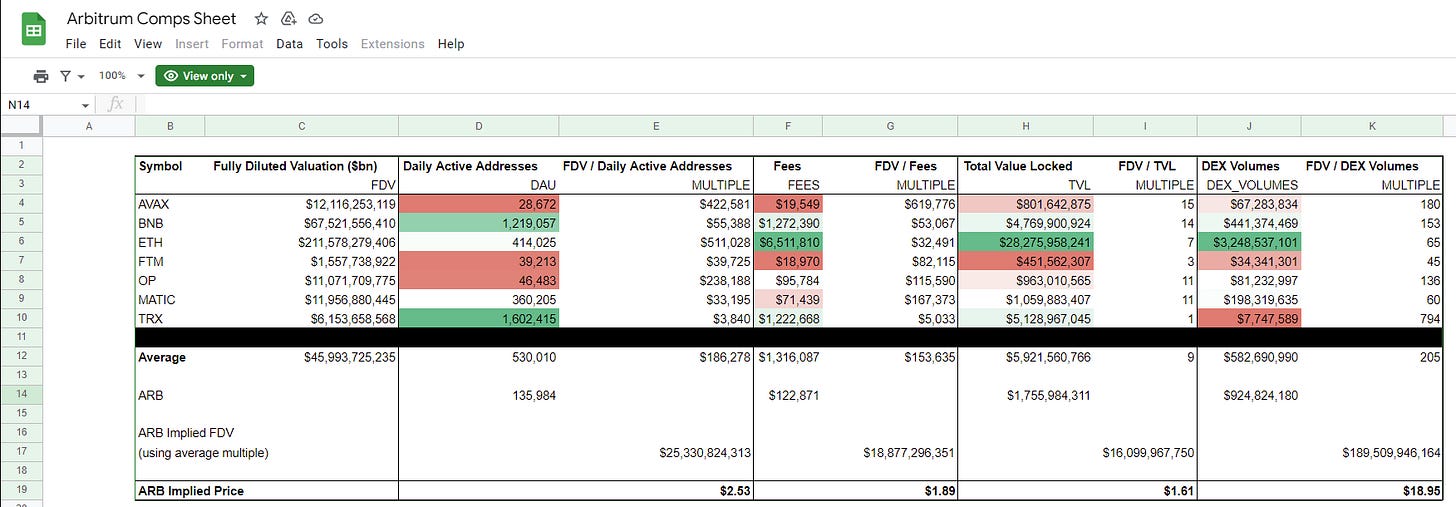

The long awaited Ethereum L2 scaling solutions Arbitrum (that currently boasts ~2x the daily active users of its competitor Optimism) is finally launching a token! The Artemis team broke down the airdrop dynamics and put together an airdrop calculator walking through how the market might react to the token 🫡

Arbitrum has been one of the most active DeFi chains with applications such as GMX, Gains and Camelot capturing market share over the past few months. In the last 24 hours, the top applications on Arbitrum by gas usage have been:

Gains Networks (decentralized perps trading)

SushiSwap (decentralized exchange)

UniSwap (decentralized exchange)

Camelot (decentralized exchange / launchpad)

You can directly view the Arbitrum Comps Table here (powered by Artemis Sheets)

that’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 3/10/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.