This week, Solana experiences first major outage within the past year, Dymension airdropped $390mm in DYM amid Mainnet launch challenges, and a new ERC token standard has taken the crypto world by storm.

🌞 Decentralized social application Farcaster spikes in user activity

💫 New York Attorney General triples size of DCG lawsuit to more than $3bn

The week saw a renewed rally across major tokens as average and median W/W prices increased by 6.5% and 7.5%, respectively. OP saw the largest week over week gain with a increase of 15.3%. The rest of the ecosystem saw upwards momentum on the back of a strong rebound in BTC, with other layer 2s and alt l1s including ETH, SOL and ARB seeing high single digit WoW increases. The S&P 500 and Nasdaq Index grew by 1.4% and 2.4% WoW, respectively, with the S&P closing above 5,000 for the first time.

🌞 Decentralized social application Farcaster spikes in user activity

Farcaster is a “sufficiently decentralized social network built on Ethereum”, which needs to be distinguished from the Warpcast application that’s been touted as the “decentralized Twitter,” which is a Farcaster client. The meteoric rise in popularity of the application has been driven by the launch of Frames, a feature that allows users to create interactive and authenticated experiences on Farcaster. The key is that any cast (Warpcast’s version of a tweet) can be turned into a Frame. Popular use cases of Frames so far have been polling and NFT mintings. Per data from Vincent Liao (aka pixelhack Dune, Twitter), Farcaster DAUs (measured as number of unique users sending casts) exploded in early Q1 2024 from ~2k at the beginning of the year to ~40k by February.

User growth appears to be organic, driven by innovation in the product and not airdrop/points farming from sybils. That being the case, we can expect users to be sticky and growth to continue as new applications for Frames appear. From a cultural perspective, Warpcast is operating as a siloed version of Crypto Twitter, drawing few users from outside the crypto sphere.

A key piece of the Farcaster puzzle is the need to rent storage in order to keep ones messages on the Farcaster network. This serves as a spam resistance mechanism. According to FIP-6, Dan and Varun, owners of the storage multisig, ‘will consider spending [storage fees] in ways that benefit the protocol’ if it accumulates a ‘significant amount’ of fees. Below we can see that, to date, the protocol has generated nearly $600k in revenue.

The decentralized social story doesn’t end there. This week Bluesky, the decentralized social media platform envisioned by Jack Dorsey, opened up registrations to all users, moving away from its invite-only model. This move has generated substantial interest, with the platform witnessing a surge in new users. Within just a day of opening to the public, Bluesky added almost a million users, pushing its total sign-ups to just over 4 million (engadget). This expansion marks a pivotal moment for the platform, which aims to offer a Twitter-like experience but with a unique twist owing to its decentralized infrastructure, the AT Protocol. This protocol allows for a microblogging experience that isn't controlled by any single company, offering users more control over their social media interactions and the potential for interoperability between different platforms using the AT Protocol.

It will be interesting to see how the battle for decentralized social plays out over the next couple of months. Will either platform succeed in attracting a significant portion of X users? Will Farcaster be the first consumer crypto app to reach escape velocity?

💫 New York Attorney General triples size of DCG lawsuit to more than $3bn

“After months of false promises, we pulled the curtain back and revealed that DCG was lying to investors and defrauding them out of billions,” said Attorney General Latetia James.

Background on the initial DCG lawsuit

Gemini Earn was a program launched by Gemini, in partnership with Genesis Global Capital, LLC, allowing users to earn interest on their crypto holdings. Genesis, a subsidiary of Digital Currency Group (DCG), acted as the lender in this arrangement. However, in November 2022, Genesis announced it could not fulfill withdrawal requests due to insufficient liquid assets amid market volatility. This situation was exacerbated when the Securities and Exchange Commission (SEC) charged both Genesis and Gemini for conducting an unregistered offer and sale of securities through the Gemini Earn program. According to the SEC, this program raised billions of dollars' worth of crypto assets from hundreds of thousands of investors without proper registration and disclosure, violating securities laws. The legal and financial turmoil culminated in Genesis filing for bankruptcy in January 2023, following the suspension of withdrawals and the SEC lawsuit.

NYAG update on the DCG lawsuit

This week, the NYAG tripled the size of the alleged fraud committed by Digital Currency Group (DCG), bringing the alleged fraud scheme to more than $3bn. The NYAG alleges that DCG caused more than $1bn in losses through misleading investors who partook in the Gemini Earn program. Since the original complaint in October 2023, many investors have come forward about their losses as a result of Gemini Earn. Over 230,000 investors allege to have been defrauded by Gemini and Genesis, a DCG subsidiary, now in bankruptcy. The Gemini Earn program was marketed as a low risk investment opportunity, but the NYAG alleges that Gemini’s own internal analyses revealed the financials of Genesis were risky, and that DCG and its executives attempted to conceal losses through various means, including a $1.1 billion promissory note with minimal interest rate.

Meanwhile, A DCG spokesperson told Axios: "This is the same baseless complaint recirculated to generate another round of press headlines. We will fight the claims aggressively and we will win. DCG has always conducted its business lawfully and with integrity.” These developments underscore the importance of having a clear regulatory framework in the cryptocurrency sector that protects investors while fostering innovation.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 1/27/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

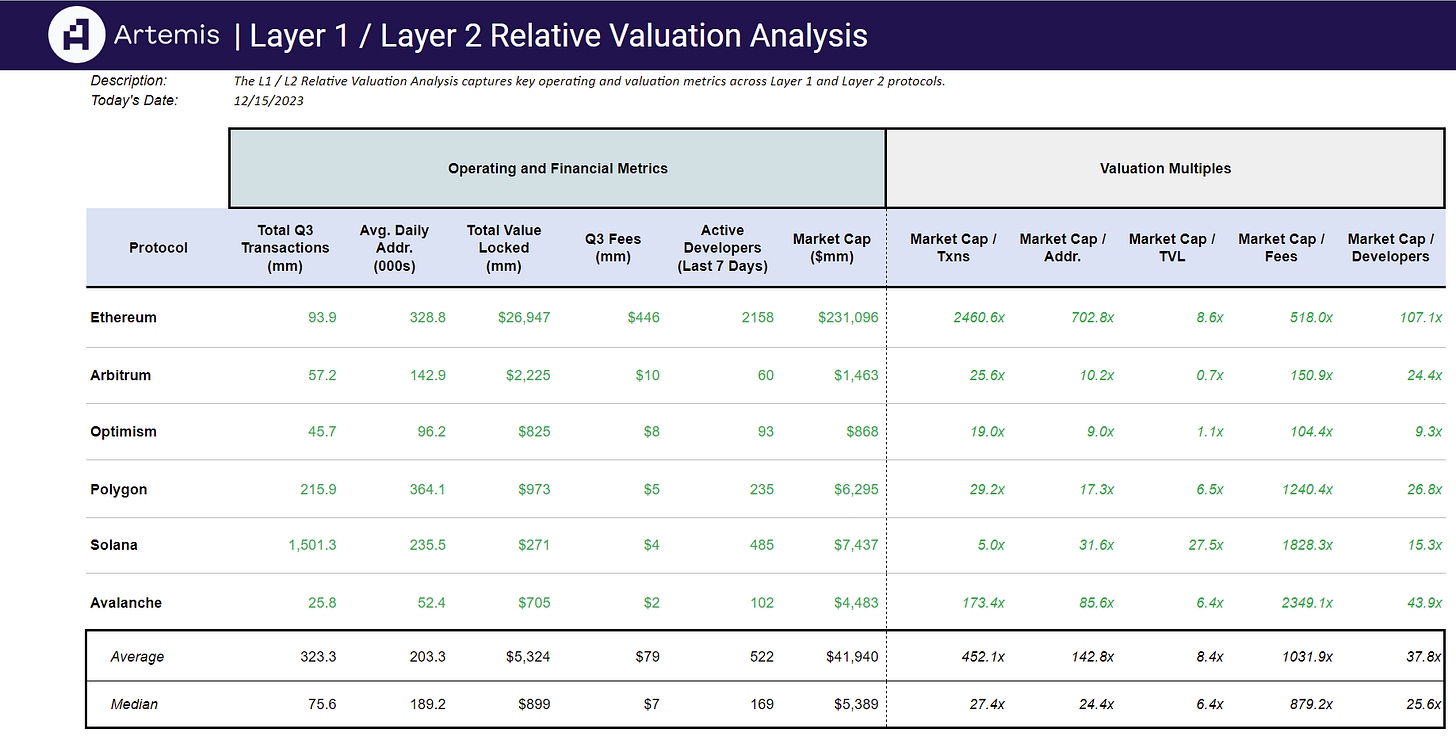

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞