This week, Su Zhu and Kyle Davies’ OPNX is shutting down, Sui becomes a top 10 DeFi blockchain with ~$400mm in TVL and a climate-conscious BTC ETF may come to market.

🌞 Tether reports $2.85B in quarterly profit

💫 JUP airdrop elicits some criticism but maintains support from Solana community

The week saw a rebound across major tokens as average and median W/W prices increased by 3.3% and 5.3%, respectively. AVAX saw the largest week over week gain with a increase of ~12.4% after the Avalanche Foundation announced the launch of a feature that allows for interoperability between the C-Chain and subnets. The rest of the ecosystem saw upwards momentum on the back of a rebound in BTC, with other layer 2s and alt l1s including SOL and APT seeing single digit increases of 7.9% and 6.1%, respectively. The S&P 500 and Nasdaq Index grew by 1.3% and 1.0% WoW, respectively, with the S&P continuing to climb amidst hot jobs figures and strong tech earnings.

🌞 Tether reports $2.85B in quarterly profit

In their recent attestation report, Tether, issuers of USDT, the world’s largest stablecoin, announced $2.85b in profit for Q4. They reported ~$1b in operating profits, most of which they say came from interest on US Treasuries, the rest coming from the appreciation of their gold and bitcoin reserves. One X user pointed out how impressive this was for a company of only 12 employees, especially when compared to a TradFi giant like Goldman Sachs who employs 45,000 people and generated profits of only $2b. USDT is the world’s largest stablecoin, and has been for the past several years. It currently commands a 75% share of circulating stablecoin supply, with a notable amount of its supply issued on Justin Sun’s Tron blockchain - 13bn USDT since the start of 2023.

Since the fall of FTX, Tether had been against the ropes as the crypto community speculated as to its lack of solvency, with many predicting a bankruptcy and subsequent further collapse of the industry. Tether had been targeted for not being a US based company, and many people were skeptical about Tether’s reserves, doubts which were furthered by a lack of transparency into the company’s financials. Tether has been the subject of legal and regulatory scrutiny, including inquiries and lawsuits regarding its business practices, reserve disclosures, and the nature of its backing assets. Given Tether's role as a major stablecoin in the cryptocurrency market, fears about its solvency and backing had broader implications for market stability.

Since then, Tether has taken many steps towards improving transparency and trust. The company has emphasized its commitment to removing the risk of secured loans from the token reserves, achieving an excess reserve total of $5.4 billion by the end of the year. The company is allegedly working towards providing real-time reserves data (Coindesk)

💫 JUP airdrop elicits some criticism but maintains support from Solana community

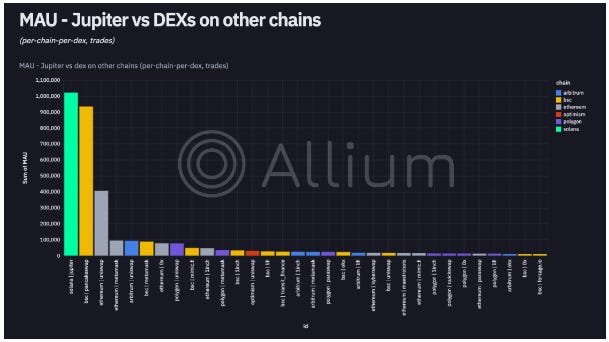

Jupiter, Solana’s biggest DEX aggregator, completed its $JUP token airdrop on Wednesday. Jupiter directs 80% of organic trading volume on Solana, and 65% of all volume. Data by Andrew Hong (@ilemi on Dune) shows Jupiter’s dominance in Solana DeFi. These charts analyze where the trade was sourced, not where it ultimately executed. On Friday Jupiter traded around $0.60, at market cap of about $800mm and an FDV of over $6bn.

Additionally, according to data from Allium, Jupiter is the leading platform as measured by unique wallets. Coingecko shows Jupiter ranked 2nd based on 24hr trading volume, only behind Uniswap V3. It will be interesting to see if these numbers can be maintained through 2024, or if this is just a consequence of the airdrop hype.

According to data from Artemis, Solana network revenue in USD reached all time highs as a result of the airdrop. We can corroborate this data with Solscan, which shows that fees spiked to over 2x their previous all time high, empirical evidence of the excitement surrounding the event.

The controversy

Many Solana community members were outraged by the way the token launch was executed, claiming it was a veiled attempt at raising funds for the team. The initial allocation included 1bn $JUP tokens for the airdrop, with another 250mm $JUP for the team. Some claim this 250mm was sold into the market right away, effectively functioning as a fund raise/IPO. Meow, Jupiter’s founder, agreed in the Jupiter Discord that it was an open market sale. Some believe that this was an obfuscated ICO and an attempt at bypassing securities laws.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 1/20/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

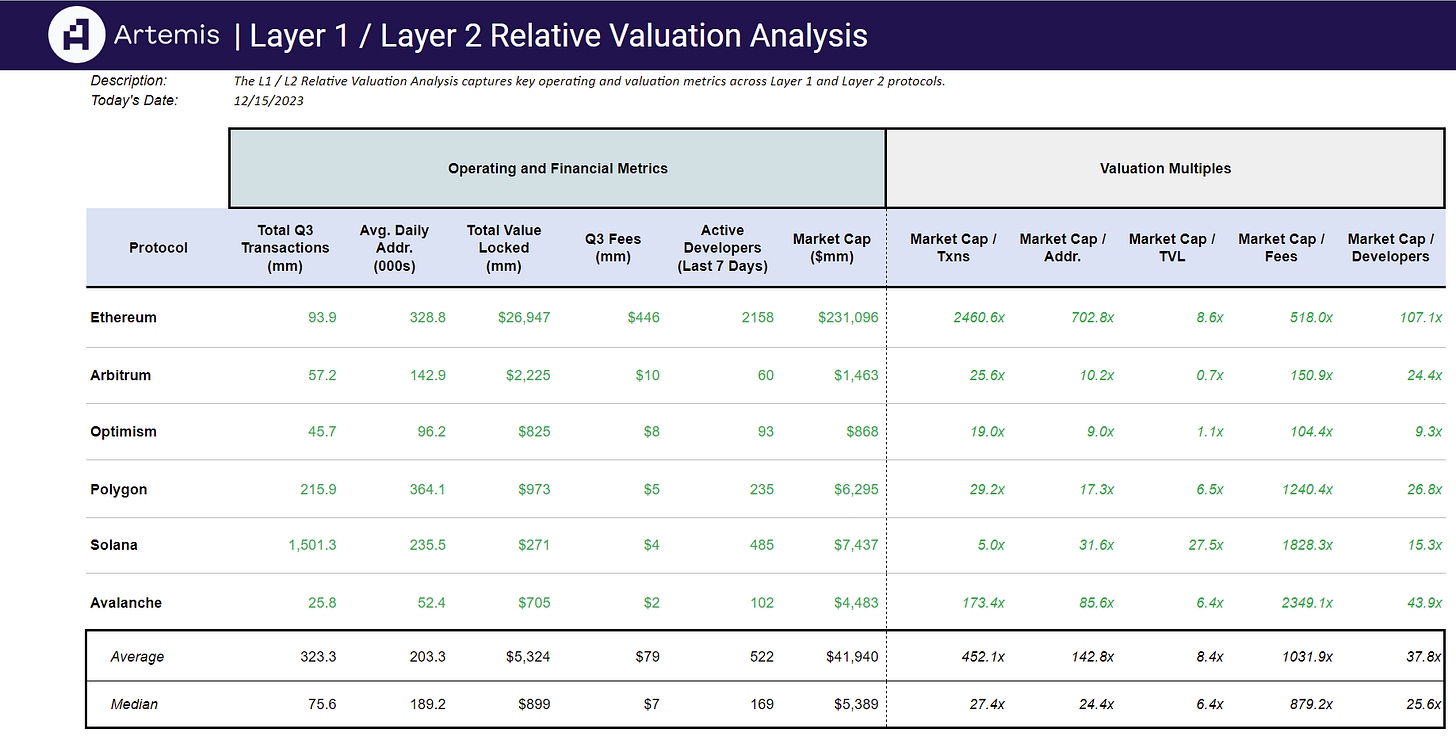

Artemis Sheets

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞