Happy Friday! 👻 The 2023 crypto market is back to our regularly scheduled up-only programming. The blockchain ecosystems we track saw median and average 7D price increases of ~12% and ~13%, respectively, despite continued (US) regulatory fud. Let’s jump into it 👇

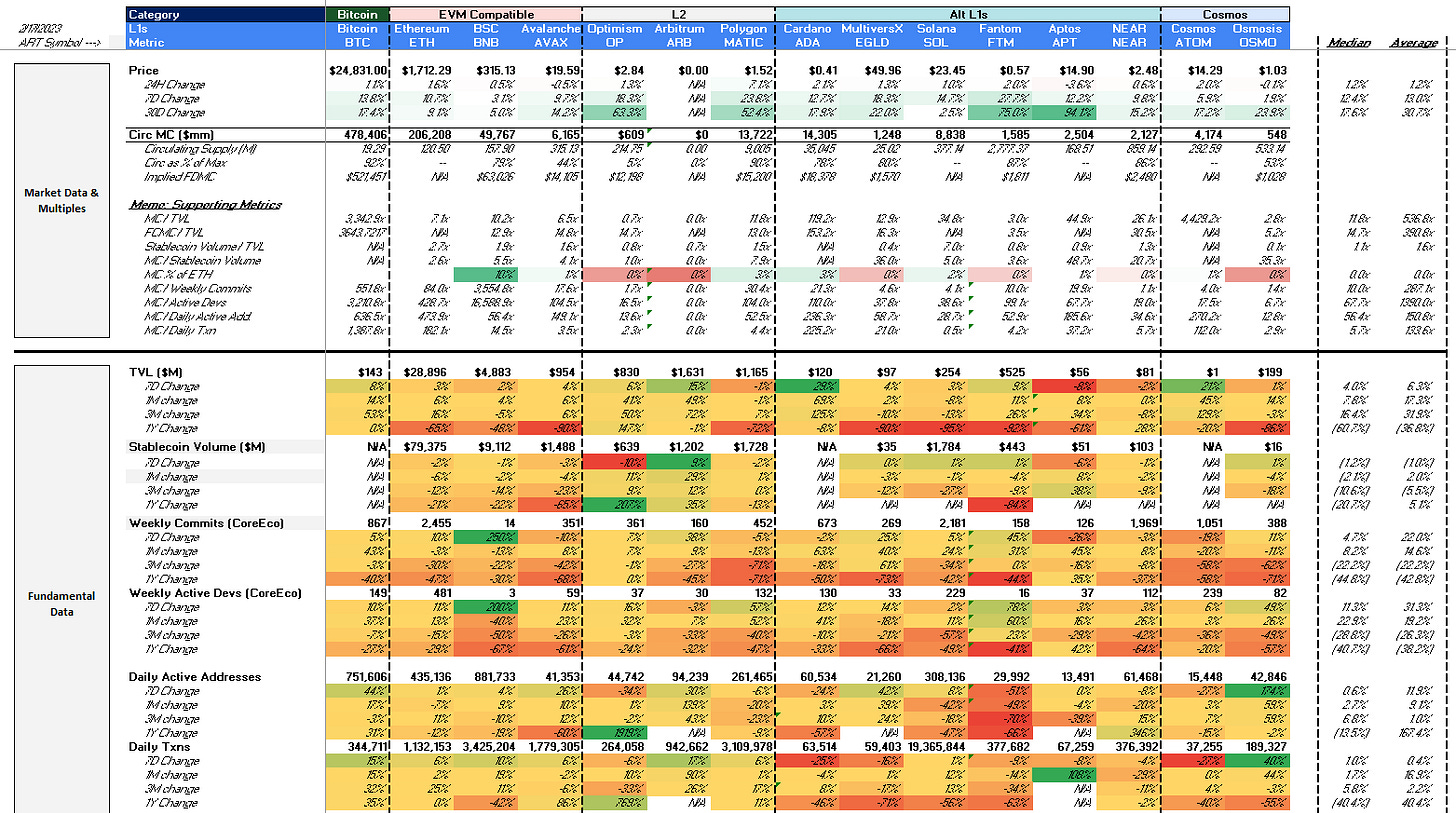

L1 Comps Dashboard

The crypto ecosystem saw a sharp rebound despite increased regulatory scrutiny from the SEC and other government agencies. There were some targeted actions on the Binance ecosystem, with The New York Department of Financial Services (NYDFS) asking Paxos to halt issuing US dollar-denominated stablecoin BUSD and “end its relationship with Binance for the branded stablecoin BUSD.” Going forward, Paxos announced that “new and existing Paxos customers will be able to redeem their funds in US dollars or convert their BUSD tokens to Pax Dollar (USDP), a regulated US dollar-backed stablecoin also issued by Paxos Trust.”

Despite US legal fud, there appears to be regulatory progress being made in others parts of the globe. Hong Kong is leading the charge on creating a path forward for retail investors to trade cryptocurrencies starting June 1st, along with rumors that there would be a HKD-denominated stablecoin alongside that transition.

CEO of Coinbase Brian Armstrong took to Twitter to criticize US policymakers for creating a “hostile environment” for crypto and warned that the US could lose its place as the world’s financial hub if it doesn’t appropriately respond to developments happening in other crypto-friendly geographies.

Elsewhere, Andrew Kang of Mechanism Capital memes about the China coin narrative, but is he really that far off 🤭

Further Elsewhere… the SEC is suing Terraforma Labs and Do Kwon for securities fraud. Mr Gensler been busy!

Price / Activity WoW Change:

The largest price increases came from some of the more heavily traded names (do you see a trend?) that have coincidentally also run up a ton in recent weeks, including MATIC (up ~24% WoW), FTM (up ~28% WoW) and OP (up 18% WoW).

Price action has primarily been attributed to positive regulatory motions coming out of Asia, and has largely drowned out a lot of the FUD associated with US legal actions against the crypto ecosystem.

With that said, BNB was one of the large-caps that saw the smallest WoW gains despite positive regulatory news coming out of HK, likely dampened by the US regulatory backlash associated with Paxos / BUSD. Below, Hal lays out a long case for BNB going into the next leg of the market.

On another note, we have seen an uptick in overall blockchain activity, with the bellwether ETH seeing another week of net deflationary action, largely stemming from heightened NFT trading activity on BLUR after its airdrop occurred on February 14.

Trading Volumes WoW Change:

7D Trading volumes came back up for some up-only action with median 7D volumes of ~$7.6bn (excl. BTC) vs. prior week of ~$7.1bn. MATIC saw yet another heavy week of trading with $6.2bn in nominal volume traded (up from $5.3bn last week), representing ~45% of its market cap. SOL saw a 50% increase in trading volumes ($4.9bn this past week vs. $3.2bn the prior week) while FTM and BNB (all our usual suspects) saw closed out the top five tokens by trading volume (excl. ETH), with $3.8bn and $3.8bn traded over the past 7 days, respectively, representing ~237% and ~8% of current circulating market cap.

Other Ecosystems Highlights

BLUR

Blur was the crypto story of the week, with an airdrop that rewarded both traders and creators for interacting with the platform over the past three months.

Per Artemis Protocol Traction, we saw that both NFT marketplace activity and DEXs spiked in gas usage on the day of the drop, with continued elevated levels of trading continuing for the rest of the week.

Looking a bit closer, we can see that DAUs on Opensea still continue to outpace Blur users (19,297 DAUs for Opeansea’s “Seaport” contract vs. 8,352 for Blur’s “BlurExchange” contract over the past 24 hours) but BlurExchange saw almost the same level of gas usage despite less than half the daily transactions / DAUs. This would indicate that traders are still placing a premium on blockspace utilized for BlurExchange.

that’s all folks

Detailed L1 dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 2/3/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.