Happy New Year Artemis community!

This week, Bitcoin mining revenues continue to grow, Jim Cramer calls Bitcoin a “technological marvel”, and VanEck’s Matt Sigel states that BlackRock has $2bn of capital lined up in week one for its Bitcoin ETF.

🌞 Visa announces new web3 loyalty rewards partnership

💫 Ex-Citi employees plan launch of Bitcoin Securities that do not require SEC approval

The week saw price drops across the L1 ecosystem from alt L1s and layer 2s as average and median W/W prices declined by 7.1% and 7.9%, respectively. This week saw EVM compatible chains such as OP, ARB MATIC and AVAX drop mid-teens WoW after gaining heavily into year end. Meanwhile, BTC held up vs. the smart contract ecosystem driven by expectations the BTC ETF could be approved by as early as next week. OSMO also showed strengthen vs. its peer group as well as the native ATOM token, gaining ~15% WoW. The S&P 500 and Nasdaq Index started the year in the red led by drops in technology-related equities, declining by 1.8% and 3.8% WoW, respectively.

🌞 Visa announces new web3 loyalty rewards partnership

This week, Visa announced a partnership with SmartMedia Technologies (SMT), an enterprise web3 engagement platform enabling next generation brand-to-consumer relationships. In a press release by Visa, the partnership is described as '“helping brands meet next-generation customers where they increasingly are - in digital and virtual worlds - through immersive programs like gamified giveaways, augmented reality treasure hunts, and new ways to earn and burn loyalty points.”

The press release also notes that consumers have heighted expectations about the value they receive from loyalty programs, and that people want to be rewarded for for online interacts and engagement with a brand. Kathleen Pierce-Gilmore, SVP and Global Head of Issuing Solutions at Visa, states that “our new innovative digital loyalty solution empowers brands to reward customers not only for their transactions but for their active engagement, paving the way for secure, seamless and immersive digital and real-world experiences at their fingertips.

The new product intends to provide brands with an “enterprise platform” that can be customized to create unique experiences and offers for consumer. Brands will be able to engage customers in a digital sphere and directly utilize a Visa digital wallet to apply brand rewards towards virtual, digital and real-world experiences. For reference, some of the key features touted by the SmartMedia x Visa platform include:

Drag & drop platform enabling brands to design, develop & distribute, tokens, digital collectibles & campaigns - all with no coding required

Custom branded wallets with simple 2-click registration

Metaverse & AR world builder

Integrated CRM + real time event triggers including first-party data management

Advanced reporting, analytics, and business intelligence suite

This partnership heralds an exciting new era for Web3 that could take next-generation digital experiences to the mainstream consumer. We will be watching closely to see whether brands and consumers engage with this innovative platform.

💫 Ex-Citi employees plan launch of Bitcoin Securities that do not require SEC approval

As the BTC ETF conversation continues to take center stage among traditional financial institutions vying for market share of future BTC-related offerings, a group of Citi executives have plans to launch BTC securities for qualified buyers that are exempt from registration under the Securities Act of 1933. Members from the founding team previously spent 10 years in the Equity Capital Markets / Depositary Receipts group at Citi before launching the new venture.

The new organization, called Receipts Depositary Corporation (RDC), plans to launch its first product “Bitcoin depositary receipts” which will operate in a manner similar to that of American depositary receipts that track foreign stocks such as Alibaba and PDD. Known as “BTC DRs,” the offering will allow institutions access to Bitcoin securities through regulated market infrastructure and will be cleared through traditional clearance channel Depository Trust Co. As part of the announcement, co-founder and CEO Ankit Mehta stated that “[RDC is] really a conversion tool for asset owners today, whether they are hedge funds, family offices, corporations, large institutional investors, that want to take their Bitcoin and convert it into a DTC-eligible security and enjoy direct ownership in the US clearances.”

Ankit also stated that he expects RDC’s product to be “complimentary” to Bitcoin ETFs. As it stands, it appears that Bitcoin ETFs will be redeemed for cash, while depositary receipts will allow for direct ownership of Bitcoin for qualified institutions. Ankit noted that buying Bitcoin directly is oftentimes not the preferred option for regulated entities as there are security risks and regulatory uncertainties. He drew comparisons between these challenges and the initial stages of American investing in foreign companies, which were eventually mitigated through the creation of the American depositary receipt.

Ultimately, the continued innovation within crypto products for financial institutions shows persistent interest and appetite for crypto-related investment products. We expect that 2024 will see more product launches that will bridge both institutions and consumer further into the digital asset ecosystem.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 12/16/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

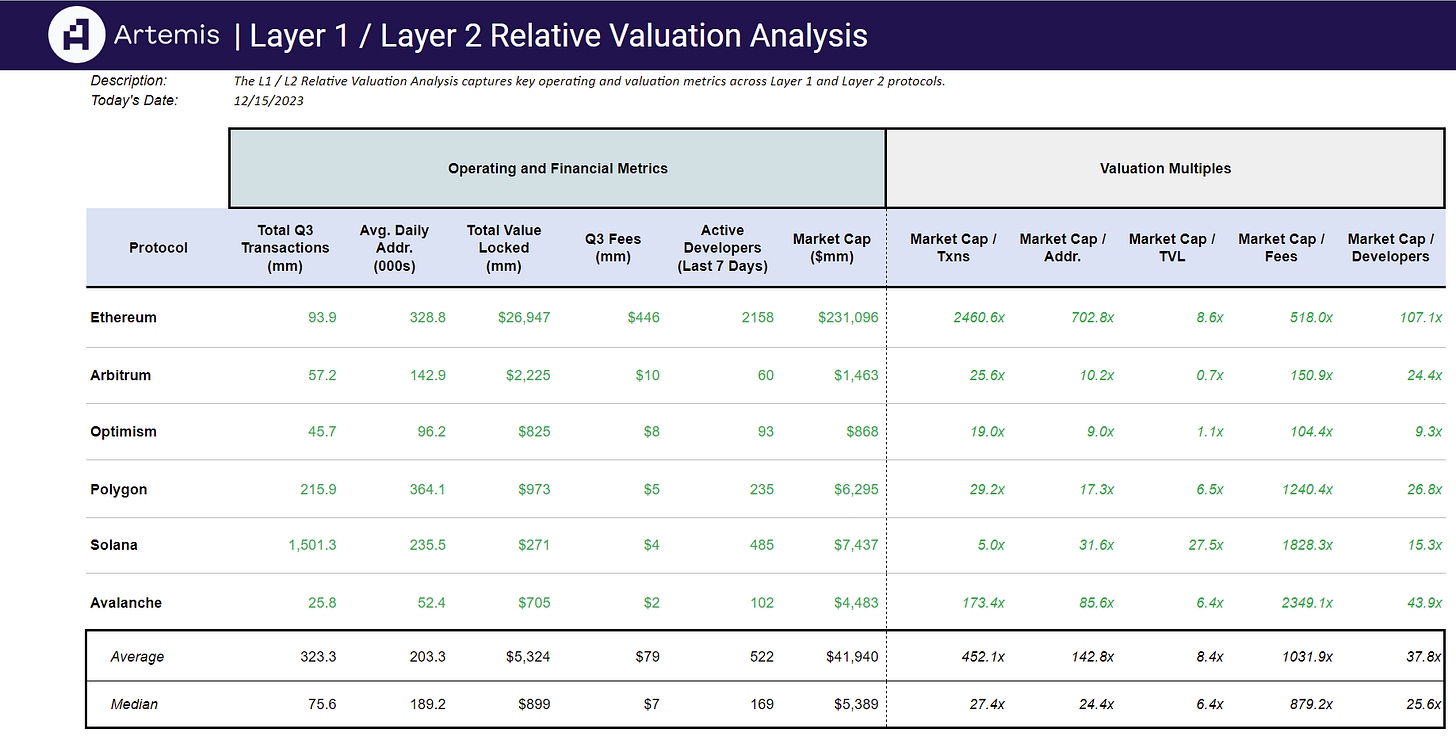

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞