This week, Fidelity held meeting with SEC about spot bitcoin fund, El Salvador encourages Bitcoin and USDT investment via release of “Freedom Visa”, and Worldcoin developer TFH evaluates potential fundraise through WLD sale.

🌞 Sam Altman-backed Investment Vehicle Launches Bitcoin Private Credit Fund and Insurance Vehicle

💫 Artemis Data Insights:

On-chain Trading Volume reaches ~$7bn+ across Perpetual Exchanges and DEXs

Overview of Solana Activity

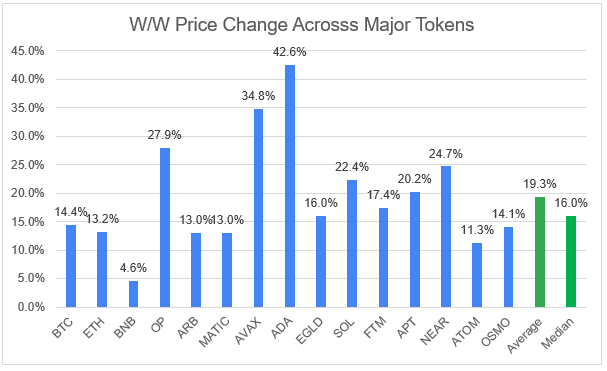

The week saw basically everything surge upwards with average and median WoW increases of 19.3% and 16.0%, respectively. This week saw alt L1s including AVAX and ADA lead the pact with ~35% and ~43% WoW gains, respectively. Majors including BTC and ETH were up double digits on the week as a result of the intersection of lowered inflation, better than expected employment data and ETF anticipation after crypto regulatory headwinds were further mitigated last week with the legal action taken against Binance. Meanwhile, the S&P 500 and Nasdaq Index increased 0.9% and 0.5% WoW, respectively, with the S&P 500 booking the longest weekly win streak in over 4 years.

🌞 Sam Altman-backed Investment Vehicle Launches Bitcoin Private Credit Fund and Insurance Vehicle

Meanewhile Advisors, a crypto startup backed by Sam Altman, launched a bitcoin private credit fund through its investment management subsidiary “Meanwhile Advisors”.

The fund aims to raise $100mm and plans to close at the end of Q1 2024. The fund intends to private institutional investors with access to Bitcoin while providing a 5% yield denominated in Bitcoin. The fund will generate that yield by lending Bitcoin to a set of borrowers. The fund is a closed end vehicle where participating LPs will contribute US dollars into the fund, which Meanwhile Advisors will convert into Bitcoin. The Bitcoin will then be lent out to borrowers to generate the 5% return denominated in Bitcoin.

The fund has a 3 year investment period and a four year harvest period resulting in a seven-year total term, with standard investment fund mechanics: 2% management fee and 20% carried interest with one wrinkle - the fees will be charged in Bitcoin. On this point, Zac Townsend, CEO of Meanwhile, stated that “This is important because it means if Bitcoin goes to the moon, we don’t get to take any carried interest on the price appreciation of Bitcoin. We received carried interest when we turn our LP’s Bitcoin into more Bitcoin”.

Zac also notes that his team is looking out “20, 30, 40 years and [envisioning] a global BTC economy. For that to be trust, there must be robust (debt) capital markets - with BTC operating as a currency, funding projects, getting returns, etc. We’re proud to be working to create that world through this credit fund.”

Meanwhile has already launched an insurance fund that takes in premiums, invests it alongside Meanwhile’s solvency capital and generates returns in BTC. Zac notes that they have experienced “no credit losses to date” and are aiming to launch the credit fund to capitalize on top of that experience.

Meanwhile has also indicated future plans to develop a wider range of financial offerings denominated in crypto, including term life insurance and accidental death coverage in BTC.

💫 Artemis Data Insights: On-chain Trading Volume reaches ~$7bn+ across Perpetual Exchanges and DEXs

As the crypto markets heated up this past week, we saw elevated levels of perpetual exchange and decentralized exchange activity across multiple blockchains.

Perpetual exchange trading volume grew to ~$4bn over the past 4 days, with the vast majority of volume driven by dYdX (~$1.5bn daily volume) and Vertex Protocol (~$800mm+ daily volume). Over the week prior to Monday December 4th, daily perpetual trading volumes ranged from ~$1.6-2.0bn.

Spot trading volumes amongst some of the largest EVM exchanges also grew over the same period, with Uniswap, Sushiswap and Pancakeswap generating ~$2bn of daily trading volume since Monday, versus ~$1.2bn of daily trading volume in the previous week.

💫 Artemis Data Insights: Overview of Solana Activity

As the price of Solana breaks ~$70 and the fully diluted market cap exceeds ~$40bn, we took a look at the fundamental operating metrics underpinning the network.

Solana daily DEX volume grew to YTD highs of ~$700mm as the JTO token was airdropped to ~10k people on December 7th. Solana’s DEX volumes of ~$700mm makes it ~35% of total DEX volumes across the three largest decentralized exchanges (Uniswap, Sushiswap and Pancakeswap).

Solana TVL has been rapidly growing month over month as more capital is attracted to the ecosystem, which could be a sustained trend after the successful launch of the JTO airdrop. The ecosystem could be drawing in additional capital as folks expect various other projects to similarly launch tokens in the near future.

While Solana’ stablecoin marketcap continues to grow alongside renewed capital deployment in the ecosystem, it still falls below where it sat at the beginning of the year. It remains to be seen whether the massive growth in DeFi metrics (TVL, DEX Volumes) will contribute to sustainable growth in Stablecoins on the network.

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism (source: Token Terminal). Weekly commits and weekly dev activity as of 11/20/23.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Check out the analysis in Google Sheets here! Powered by Artemis Sheets