Last week, Pudgy Penguins and Milady Maker NFT collections each introduce a fungible token to their ecosystems (Coingecko); Circle and Binance launch strategic partnership to expand USDC adoption and challenge Tether dominance (Circle); Google announced their latest quantum chip, Willow, and stated that the chip’s power lends credence to the multiverse theory (Google); and Microstrategy (MSTR) will be added to the NASDAQ 100 (Reuters).

🌞 Movement’s Mainnet and MOVE token TGE

💫 Magic Eden Airdrop and NFTs Comback

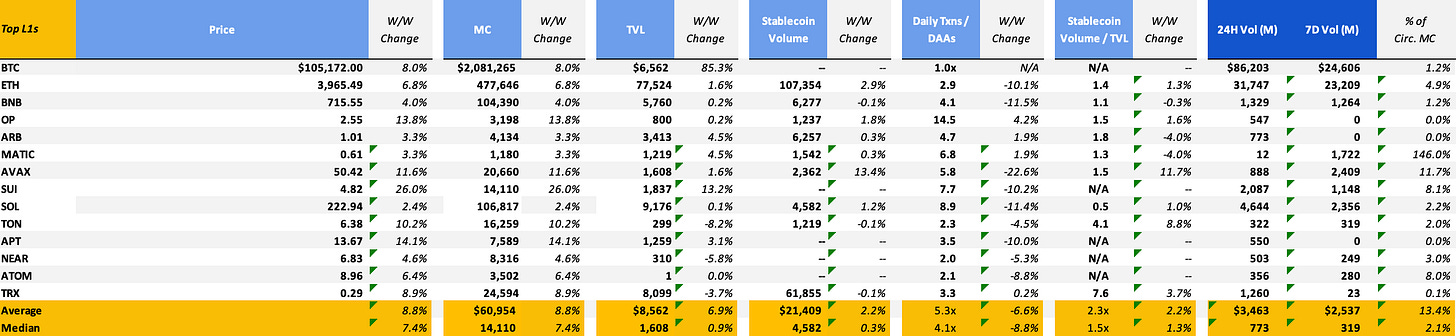

Last week saw major tokens continue their move up, as the total cryptocurrency market cap approaches the $4 trillion mark. SUI has continued to outperform the market, climbing nearly 350% in the last quarter of 2024 alone. This makes SUI the 9th largest cryptocurrency by fully diluted value - note that approximately 30% of the token’s supply is in circulation. BTC has continued in strength, from recovering from $95k midweek lows, to making new all-time highs above $105k by the end of the week.

BlackRock, the world’s largest asset manager with over $11 trillion in AUM , recently published a research report recommending that investors allocate 1-2% of their traditional 60/40 portfolios to digital assets. BlackRock’s recommendation could be a potential boon to BTC and ETH ETF flows, which have seen massive growth to date.

One of the last major macro economic meeting of the year is happening this week as the Federal Open Markets Committee (FOMC) will have its final meeting of the year on Wednesday. Markets estimate a further rate cut decision will be made (FedWatch Tool) making it the Fed’s third rate cut of the year, having brought interest rates down a full percentage point from 5.25-5.50 to 4.25-4.50. While likely priced in, the news may continue to influence risk assets like cryptocurrencies as borrowing costs fall.

🌞 Movement’s Mainnet and MOVE token TGE

Last week marked a significant milestone for Movement Labs as they launched the Movement Network mainnet alongside the debut of the MOVE token. These launches signal the arrival of a new Layer 2 (L2) blockchain ecosystem built on Ethereum, powered by a novel rollup framework that prioritizes flexibility, speed, and interoperability. The Movement Network stands out in an increasingly crowded L2 space, offering a distinct approach that blends the security of Ethereum with the capabilities of MoveVM, a programming environment originally designed by Facebook's Diem/Libra team, and adopted by the popular Sui and Aptos Layer 1 blockchains.

At its core, the Movement Network aims to address two of the most persistent challenges in blockchain: scalability and security. While rollups—such as those developed by Optimism and Arbitrum—have proven effective in reducing congestion on Ethereum, they still contend with trade-offs and are EVM-centric. Movement Labs seeks to offer an alternative with the Move Stack, a modular framework that empowers developers to create application-specific rollups tailored to their needs.

The Move Stack brings several innovations to the table. One of its most notable features is the Move Executor, a dual-execution environment supporting both Ethereum Virtual Machine (EVM) and Move Virtual Machine (MoveVM) transactions. This dual compatibility enables developers to seamlessly integrate existing Ethereum-based applications while exploring the enhanced security and performance offered by the Move language. Known for its resource-oriented programming paradigm, Move reduces common vulnerabilities like reentrancy attacks while supporting parallel transaction execution, which increases throughput and efficiency.

Although Movement Network analytics are currently not available, we can look at the performance of existing Move-based blockchains to glean insights as the demand for this technology. Aptos and Sui are the leading Move-based alternative Layer 1 blockchains. Notably, they are two of the fastest growing blockchains in that category by active addresses and TVL. Sui in particular has managed to attract many consumer applications like RECRD, FanTV, Birds and Wave Wallet which together make up more than half of the network’s active addresses.

The MOVE token launch complemented Movement Network’s mainnet launch by airdropping $830 million to community members (Decrypt). The MOVE token is currently trading at a $6.2 billion fully diluted value, making it the 59th largest token by that metric, and the 108th largest by market cap. The token generation event included an airdrop of 10% of the token’s 10 billion total supply, with an additional 12.5% considered circulating for a total of 22.5% of the supply in circulation today.

Movement Labs has ambitious goals for the MOVE token, aiming to make it the utility token of the ecosystem in the same way that ETH is to Ethereum. Use cases aimed to be developed by Movement Labs for the token include:

Usage as the native staking token for validators in participating in Movement’s fast finality settlement mechanism

Usage as Movement Network’s native gas token, while rollups leveraging the Move Stack will also be expected to use MOVE as the gas token.

The token will also be used to decentralize network governance and as the network’s native asset for DeFi liquidity and collateral.

Movement Network’s mainnet launch and the TGE of the MOVE token are big steps forward for both the Move ecosystem as well as the Ethereum rollup ecosystem. Recently, Eclipse, a Solana Virtual Machine Ethereum rollup launched. These developments illustrate the continued competition between alternative layer 1 blockchain and rollups looking to capture user attention and liquidity. They further Ethereum’s vision to become the settlement layer for thousands of varied rollups, whether they run the EVM, SVM, Move-VM or something else. At the same time, these rollups are yet to prove themselves, and many have not yet progressed sufficiently to be fully considered permissionless rollups. 2025 will be an momentous year as large alternative layer 1 blockchains like Berachain, MegaETH, Monad come to mainnet, and challenge the rollup ecosystem.

💫 Magic Eden Airdrop and NFTs Comback

Magic Eden, one of the leading NFT marketplaces, recently took a significant step forward with the launch of its native token, ME, last week. This marks a notable development in the NFT space, where marketplaces are increasingly adopting tokens to incentivize user participation and enhance platform engagement. The launch of ME coincides with broader shifts in the NFT ecosystem, characterized by increased trading activity, rising royalty fees, and evolving market dynamics.

In parallel with Magic Eden's developments, the broader NFT market has experienced a resurgence. Trading volumes across all marketplaces have seen a significant uptick in recent weeks, accompanied by higher royalty fees. This suggests increased revenue opportunities for both NFT creators and platforms, indicating renewed interest in digital collectibles. Pudgy Penguins has emerged as a leader in the space, witnessing a sharp rise in both trading volume and floor price. The collection recently surpassed Bored Ape Yacht Club in terms of market cap, with CryptoPunks as its next target. The growing prominence of Pudgy Penguins reflects a shift in consumer preferences and the enduring appeal of creative and community-driven projects.

Pudgy Penguins have seen an explosion in trading volume across both the flagship Pudgy Penguins as well as the Little Pudgys collections. The collections are the top two most traded collections in the past 24 hours. This volume may also be incentivized by the recent announcement of the ecosystem’s PENGU token airdrop scheduled for later this month.

Other notable events in the NFT ecosystem include Milady Maker's recent airdrop of its CULT token, which has generated significant buzz among its holders. These airdrops highlight the growing use of tokenomics to foster deeper engagement and reward loyal communities in the NFT ecosystem.

As Magic Eden charts its course with the ME token, and collections like Pudgy Penguins and Milady Maker redefine success in the space, the NFT market demonstrates its resilience and adaptability. The question now is whether this renewed momentum is sustainable or another cycle in the ever-volatile NFT market.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

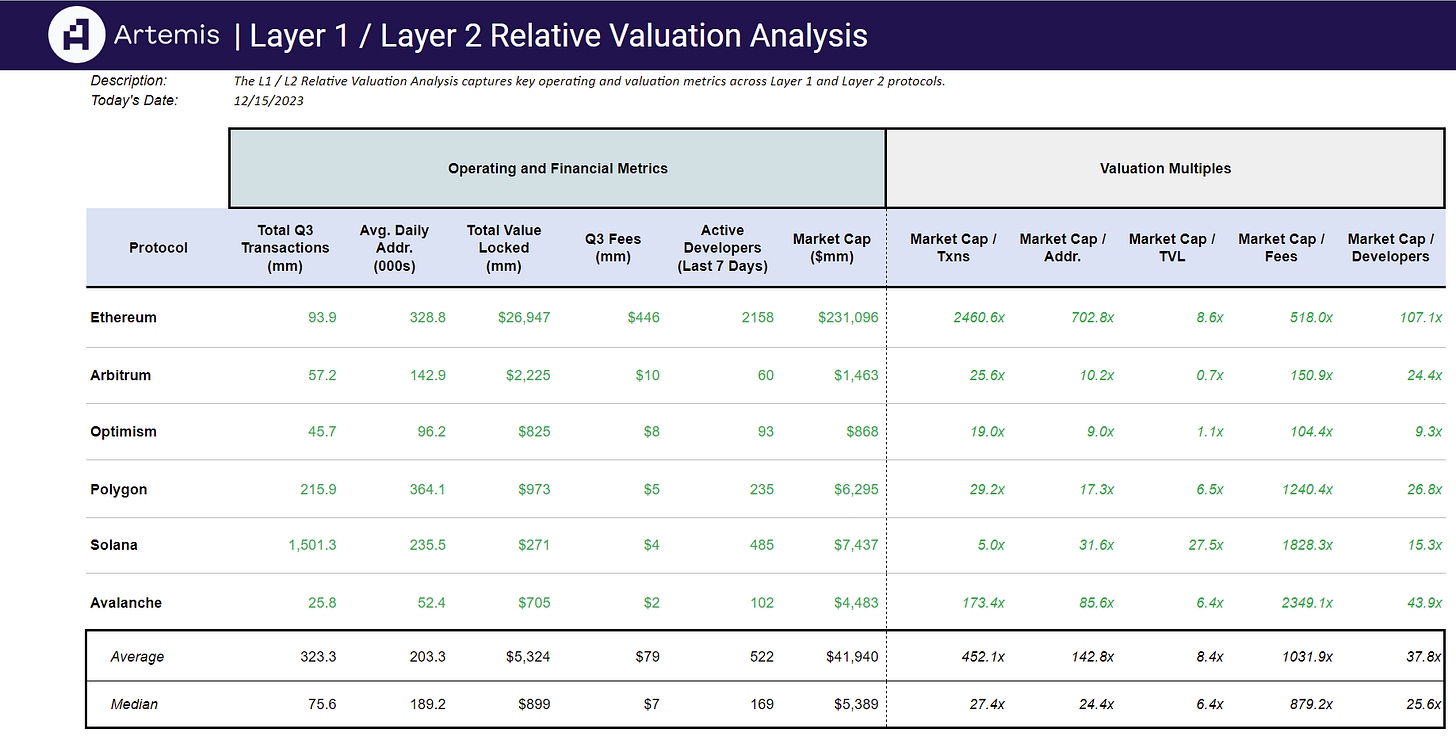

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞