Last week, bitcoin surpassed the $100,000 milestone; Coinbase integrates Apple Pay into Onramp (Coinbase); Tether discontinued support for its euro-backed stablecoin (Cointelegraph); Dogecoin celebrated its 11th anniversary (Binance); and Pudgy Penguins is set to launch its $PENGU token on Solana (Decrypt).

🌞 Ethena’s USDe surpasses DAI, becoming 3rd largest stablecoin by supply

💫 Base: The unstoppable rise continues

This week saw several big milestones hit across the cryptocurrency landscape. The biggest news came by way of bitcoin which breached the $100,000 mark. Also, Ethereum, while continuing to lag all-time highs, finally broke $4,000, a number it had failed to reach since March. Other notable winners include Tron’s TRX, which is up 40% on the week, while SUI continues it’s relentless march, now up 500% over the past year. Generally high market sentiment, coupled with Trump continuing his pro-crypto administration picks have fueled these moves.

In big news about the upcoming presidential administration, Donald Trump has selected Paul Atkins, former SEC Commissioner (2002-2008), as his choice for SEC Chair in his potential upcoming administration. Atkins is known for advocating free-market approaches to regulatory policy, a stance that could prove favorable for digital assets. According to the Wall Street Journal, Trump has also appointed David Sacks as special advisor on AI and cryptocurrency policy. Sacks, who previously expressed support for cryptocurrency, notably stated in 2017 that "bitcoin is fulfilling PayPal's original vision" (CNBC). Additionally, Eric Trump is scheduled to speak at the Bitcoin MENA conference on December 9-10th, sharing the stage with former Binance CEO Changpeng Zhao and Tron founder Justin Sun.

🌞 Ethena’s USDe surpasses DAI, becoming 3rd largest stablecoin by supply

Ethena's USDe stablecoin has recently emerged as the third-largest stablecoin globally, surpassing DAI and breaching a circulating supply of $5 billion. The stablecoin's impressive expansion comes from its market cap soaring 116% above October's low point, reaching approximately $5.4 billion.

The rapid ascent of USDe can be largely attributed to its attractive yield-generating properties. Unlike traditional stablecoins such as USDT and USDC, which are primarily used for transactions, USDe offers stakers an annual percentage yield (APY) of approximately 30% today (Ethena). This high yield is generated through a combination of Ethereum staking rewards and hedged positions against ETH and BTC short funding rates.

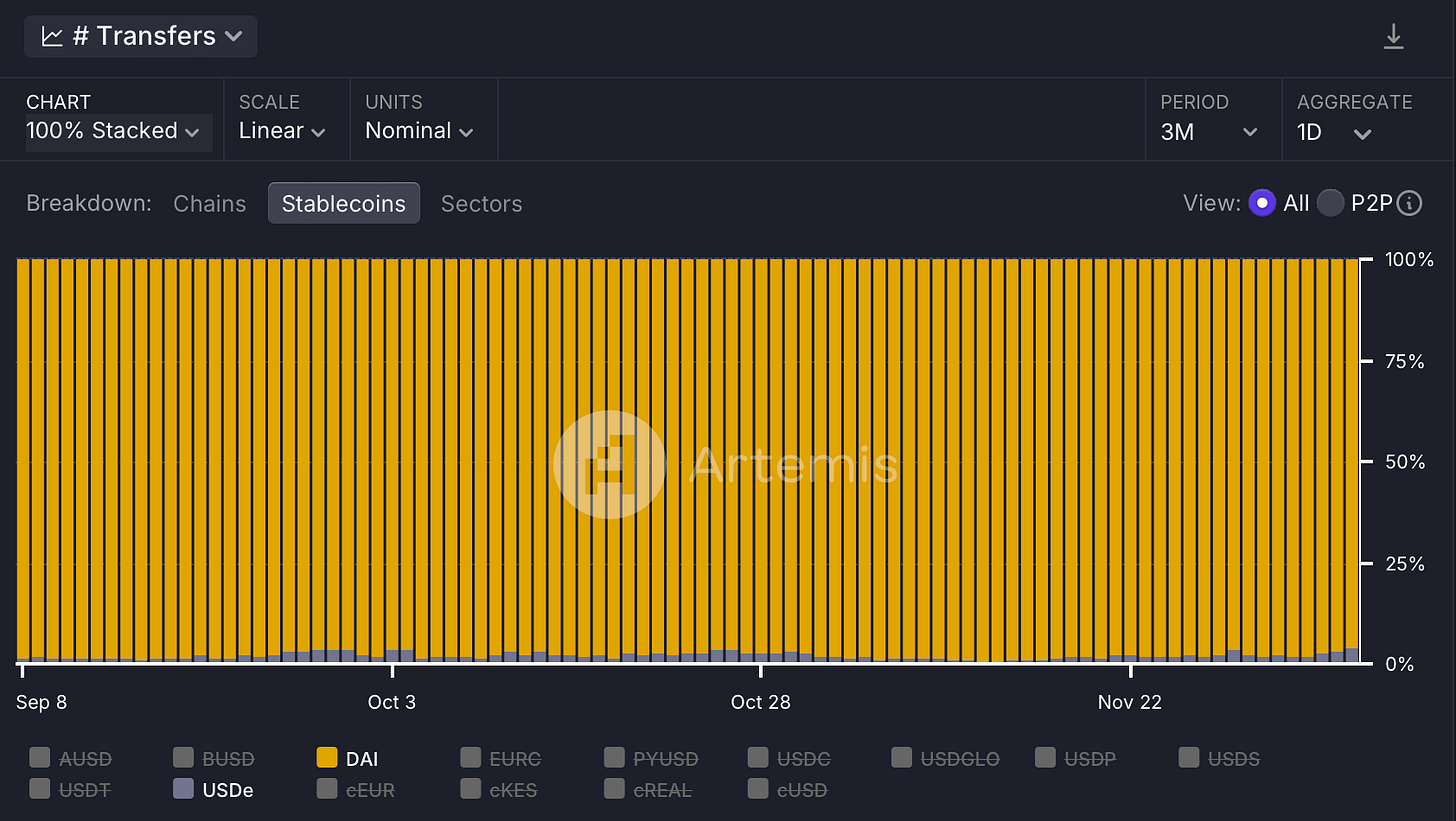

Ethena's CEO, Guy Young, highlighted the protocol's impact on the DeFi ecosystem, stating, "We are beginning to now see the effects as USDe blackholes every stablecoin in DeFi while warping lending markets to a new base rate… The next step for Ethena is plugging directly to $100b-1tn+ asset managers who can provide the capital required". This shift in approach has attracted users looking for higher returns on their digital dollar holdings, with most USDe tokens being held for earning rewards rather than trading. This is evident in the number of USDe transfers: when stacked up against DAI, USDe makes up only 4% of stablecoin transfers. More starkly, when compared with the rest of the stablecoin market, it makes up only 0.02% of all transfers.

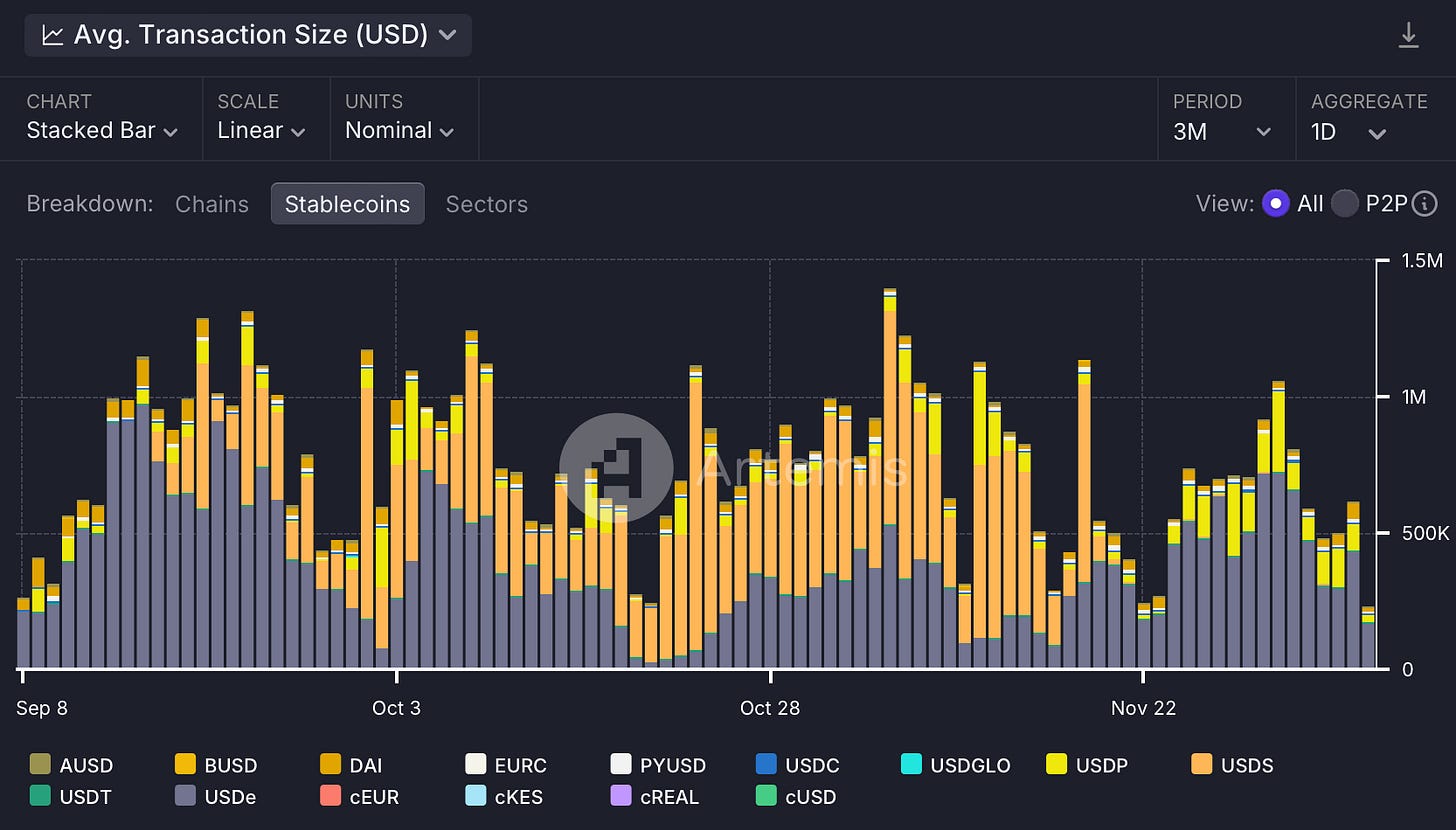

Furthering the point that USDe is seen as more of an investment asset than a trading asset to be used in DeFi, is the fact that USDe has largely had the largest average transaction size of all stablecoins. USDe’s average daily transfer size has frequently hovered around $500k.

The success of USDe has not been without its developments and challenges. Recently, Wintermute's proposal to revamp Ethena's revenue sharing model for sENA (staked ENA) holders was approved by the risk committee. This change aims to better align sENA holders' interests with the protocol's financial success, addressing what Wintermute described as a misalignment between stakeholders and the protocol's revenue-generating success. Additionally, Ethena's governance token, ENA, has seen significant growth, with a 100% price increase over 30 days, bringing its market cap to over $3bn last week.

The protocol is also preparing to launch USDtb, a new stablecoin backed by BlackRock's BUIDL fund, indicating a strategic push to diversify its offerings. However, the rapid growth of USDe has raised concerns among some analysts who draw parallels to past projects like Terra-Luna. Critics caution against potential risks associated with high-yield products and rapid expansion in the crypto space. Looking ahead, Ethena has ambitious plans for 2024. The protocol aims to become a unified currency layer, integrating DeFi, CeFi, and traditional finance (X/ethena_labs). This strategy focuses on leveraging USDe as a fulcrum asset to aggregate liquidity across centralized and decentralized exchanges.

As Ethena continues to evolve and attract more users, its impact on the broader cryptocurrency ecosystem will be closely watched. The success of USDe represents a significant shift in the stablecoin landscape, potentially heralding a new era of yield-bearing stablecoins and reshaping the DeFi market.

💫 Base: The unstoppable rise continues

Last week, Base, the Ethereum Layer 2 scaling solution developed by Coinbase, surpassed $4bn in total value locked, becoming the first Ethreum scaling solution to do so since Polygon PoS last did in early 2022.

Base has, by and large, become the leading Ethereum scaling solution, surpassing its peers on several key metrics. In the latter half of 2024, Base has surpassed Arbitrum in several key metrics, including Total Value Locked (TVL), decentralized exchange trading volume, daily active addresses, and daily transactions.

Notably, Base has captured up to 80% of stablecoin transfer volumes among Ethereum scaling solutions in recent weeks. In fact, Base did $30bn in daily stablecoin transfer volume on Dec 6th, by far the most by an Ethereum scaling solution ever.

This massive rise in stablecoin transfer volume is certainly out of the ordinary. The Artemis team published a deep dive into what drove this surge: X/artemis__xyz.

The summary is that the drive in stablecoin transfer volume is driven by a small handful of market makers trading on the Aerodrome DEX. One address in particular is providing millions of dollars of liquidity to certain pool on Aerodrome for very short periods of time (just a few blocks), at very narrow ticks. What this means for the market maker is that they are able to generate a large return on their position by earning AERO emissions from the protocol gauge for the liquidity they provided. This is great for traders as they get deeper liquidity on their trades within those ticks. However, the losers in this situation are the passive liquidity providers as they provide a smaller portion of the liquidity on those trades, thus earning less rewards. It highlights one of the unique characteristics of the MetaDEX design whereby liquidity providers receive native token emissions (AERO) instead of trading fees. These emissions are preset and can be optimized for through strategic liquidity provision. This differs from traditional DEX design where an LPs revenue stream is variable based on trading volume.

Base's emergence as the leading Ethereum scaling solution, marked by $4bn in TVL and record-breaking stablecoin volumes, reveals the evolving dynamics of Layer 2 ecosystems. The recent surge in activity on Aerodrome DEX demonstrates both the power and complexity of emission-based rewards systems, where sophisticated market makers can optimize for token emissions in ways that benefit active traders while potentially impacting passive liquidity providers. This highlights how protocol design choices can shape unexpected market behaviors in the maturing DeFi landscape.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

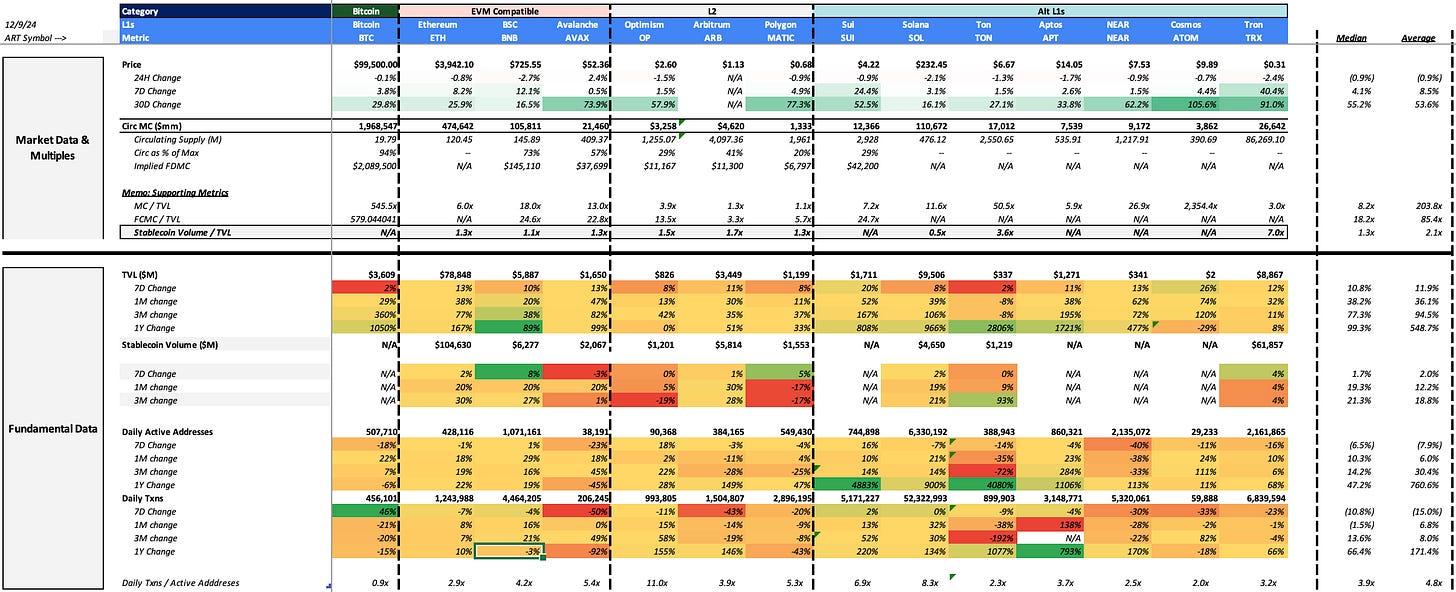

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

Artemis Sheets

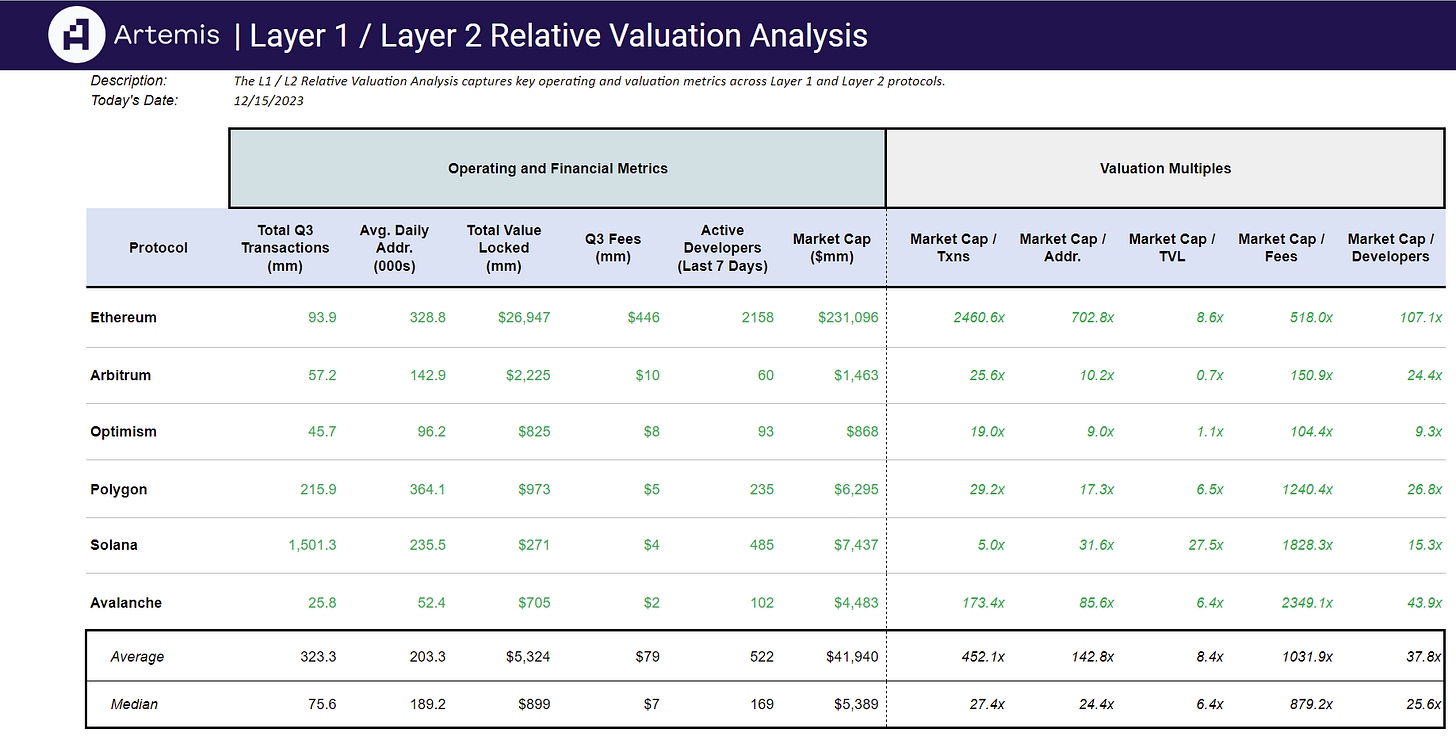

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞

Great Insights. Thanks for sharing