This week, Brazil introduces bill to create a strategic bitcoin reserve (Blockworks); Wisdom Tree files for XRP ETF (CoinTelegraph); Justin Sun invests $30m in Trump’s World Liberty Financial (Bloomberg); and Trump threatens BRICS nations with 100% tariffs if they move off of the dollar (Reuters).

🌞 Flashbots introduces BuilderNet solution to Ethereum’s centralized block building

💫 Hyperliquid’s HYPE airdrop is one of the largest ever

Last week, the market largely maintained its forward momentum with major assets up an average of +7%. The EVM ecosystem saw large gains as ETH was up 7.3%, L2s like ARB and MATIC were up 11.2% each, and AVAX gained 16.5%, making it this week’s winner. Notably, Aptos was up 9.7% as Bitwise’s Aptos Staking ETP was officially launched (X/Bitwise_Europe). Another notable digital asset market development in the past week was the recent proliferation of AI agent tokens like VIRTUALS, and ai16z, each up over 100% last week as speculation around the potential of onchian AI agents mounts. Equities markets have mirrored this rally, with leading indices notching their best month of the year in November.

In a critical ruling this week, a US appeals court overturns sanctions on Tornado Cash imposed by the US Treasury Department back in 2022 (Reuters). This is particularly important as it sets a precedent for how the government can regulate immutable smart contracts. Of note, the court found that the smart contracts at issue, due to their decentralized, and immutable nature, cannot be considered the property of their developers. The court also found that these smart contracts are neither services, nor contracts, making them exempt from classification as property under either. It is important to note that this does not apply to any and all smart contracts deployed on blockchains. Tornado Cash was particular in that the deployment of the contracts involved more than one thousand participants, and the contracts do not have an admin key. That said, this is a massive win for decentralized onchain protocols at large.

🌞 Flashbots introduces BuilderNet solution to Ethereum’s centralized block building

Flashbots, a premier research and development organization in the MEV space, recently launched BuilderNet. For context, Flashbots is dedicated to reducing the negative externalities of maximal extractable value, or MEV. They have built a number of open source products aimed to minimize the negative effects of MEV, including MEV-Boost, mev-geth, and more. MEV refers to the extraction of value from transactions by specialized entities in the Ethereum block production value chain. Examples of MEV are: DEX arbitrage, DeFi liquidations, sandwich attacks, or other, more sophisticated strategies for extracting value from the chain. Some forms of MEV are more harmful to users than others. For instance, sandwich attacks are harmful to users, while DEX arbitrage helps create more efficient markets.

BuilderNet, Flashbots most recent product, is a decentralized block-building network for Ethereum, collaboratively operated by Flashbots, Beaverbuild, and Nethermind. It utilizes Trusted Execution Environments (TEEs) to securely aggregate and process transactions, aiming to distribute block-building responsibilities across multiple operators. This approach seeks to mitigate centralization risks, enhance censorship resistance, and ensure a more neutral and resilient Ethereum ecosystem. By decentralizing block building, BuilderNet aspires to create a more transparent and equitable platform for decentralized applications and users alike.

What is block-building in the Ethereum network?

A transaction sent on the Ethereum network goes through several steps before being finalized within a block in the chain. One key step along this process is the actual formation of a block. This includes selecting which transactions will be in the block, as well as the order in which to sequence these transactions. This step is performed by an entity known as a block builder. They are responsible for monitoring the mempool (the database where pending transactions live), selecting from it transactions to include in the block, and sequencing these transactions. A key objective for a block builder is to maximize MEV, or maximal extractable value, from the block. MEV can come from many different types of transactions, and the ordering of these transactions may affect the amount of MEV that can be extracted. Builders may source transactions from the mempool, from bundles received from MEV searchers (entities running specialized MEV-identifying software - a builder may also be a searcher), or from private orderflow (transactions that don’t appear in the mempool and are sent as part of an offchain agreement between the sender and the block builder).

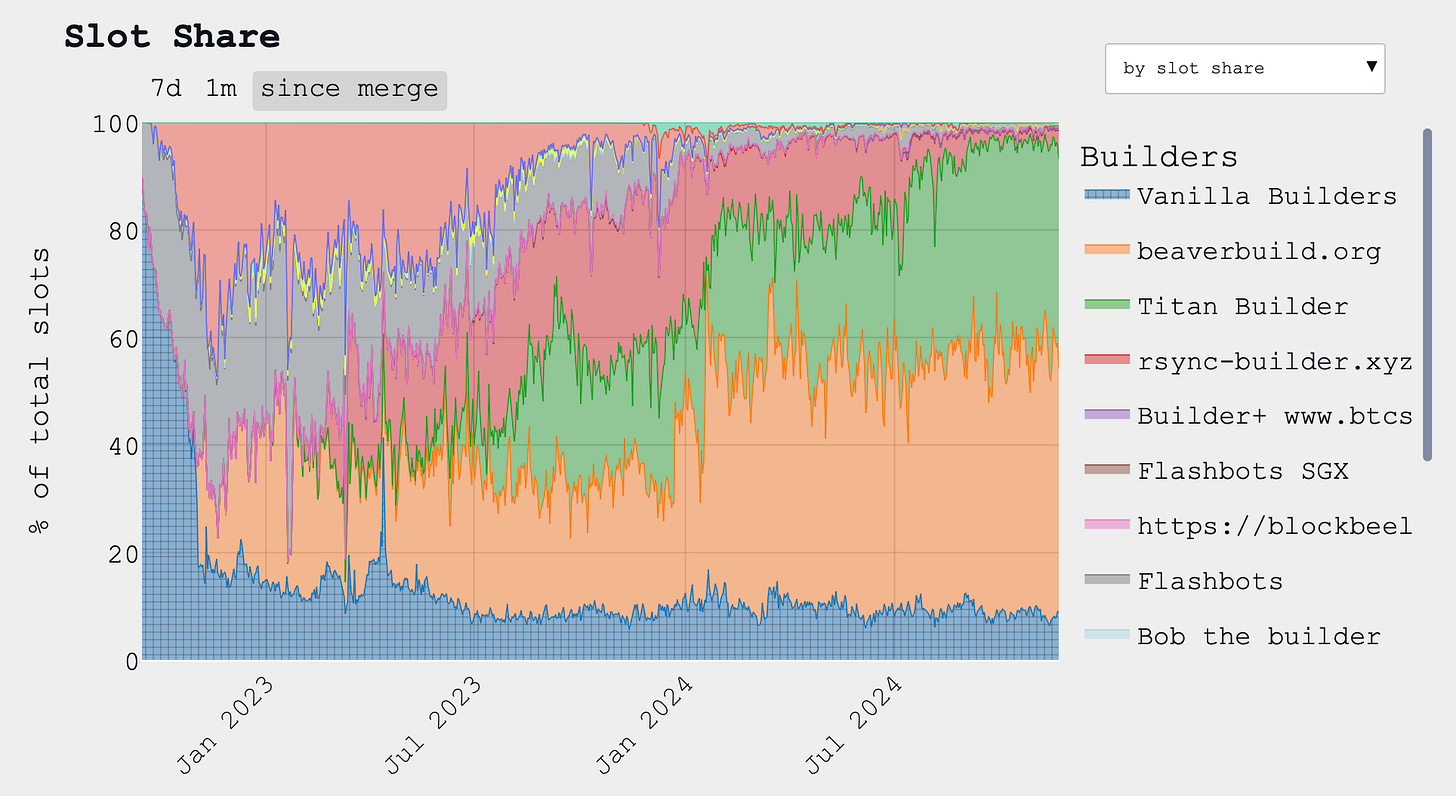

The issue is that today, block building is highly centralized: 2 entities build 90% of blocks, BeaverBuild and Titan Builder.

This concentration of market power has led to major orderflow providers making exclusive orderflow deals with block builders to internalize their MEV by not making it publicly viewable in the mempool. These offchain agreements between orderflow providers and block builders are opaque and create an unequal playing field for users and apps that are not able to get this preferential treatment. This goes against Ethereum’s core principles of censorship resistance, neutrality, and resilience. Data from mevboost.pics shows how this duopoly has grown over time, outcompeting alternatives like rsync-builder, and Flashbots.

BuilderNet aims to tackle this centralization of block building, particularly at the orderflow level, by leveraging recent improvements in the use of trusted execution environments (TEEs) in MEV. The encryption properties of TEE allow for private orderflow to be sent to a decentralized network of block builders. Orderflow remains private but removes the need for opaque offchain agreements as now any BuilderNet participant can process the new orderflow and include its transactions.

The new decentralized block building architecture will also aim to share MEV and gas fees with users (X/SheaKetsdever). Overall, this new architecture promises to radically change a highly centralized aspect of the Ethereum block building value chain, increasing decentralization, network resilience, and censorship resistance. Read the full announcement here.

💫 Hyperliquid’s HYPE airdrop is one of the largest ever

Last week, Hyperliquid executed one of the most highly anticipated airdrops of the year with its $HYPE token. Hyperliquid is a novel decentralized perpetuals exchange that aims to take on centralized exchanges (CEXes) by creating a trading experience on par with CEXes, and vastly superior to existing perps DEXes.

Hyperliquid operates as an L1 that was built from the ground up to serve this specific use case. It implements a custom consensus algorithm called HyperBFT, as well as a custom networking stack built from the ground up.

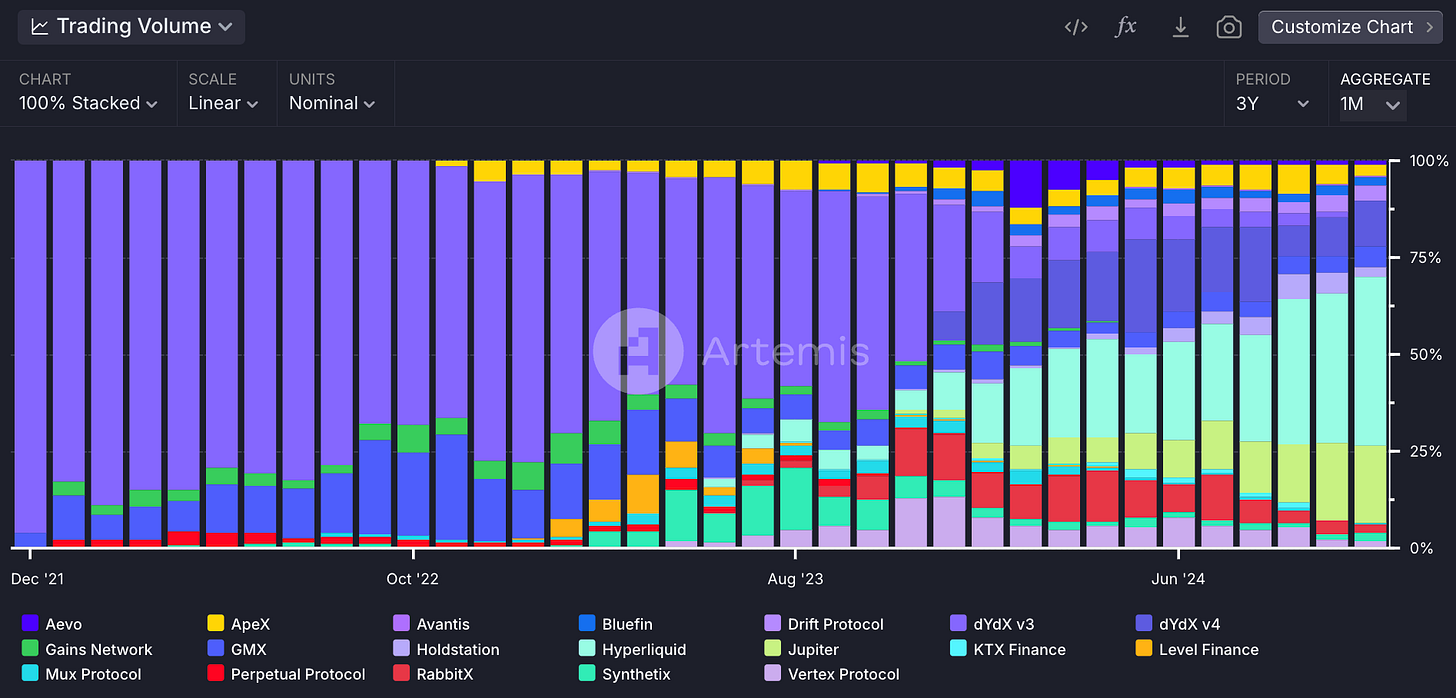

The superior trading experience offered by the Hyperliquid exchange, coupled with expectations of an airdrop, have led Hyperiquid to lead the market in trading volume since March 2024, taking as much as 44% market share in November.

Hyperliquid is especially interesting as it is a rare crypto project that has been completely bootstrapped by the team, taking on no venture capital. Because of this, $HYPE’s genesis allocation does not include the often derided ‘private investor’ allocation. Furthermore, 31% of the initial allocation was given to the community via airdrop last week. The token launched on the market with a market cap of $1.4 billion, before demand pushed the token’s valuation to a market cap of $3.3 billion and a fully diluted valuation of nearly $10 billion. This fully diluted valuation makes the token a top 50 token.

The token will be the native gas token of the Hyperliquid L1 which has great plans for growth in the coming years. For instance, Hyperliquid is developing the HyperEVM, a virtual machine that will allow for arbitrary programmability on top of the L1 (like HyperLend), while the perpetuals and spot DEX will be natively enshrined into the protocol. With protocols like Ethena considering activating the token’s fee switch, Hyperliquid is positioned to consider do the same. Currently, a portion of fees are directed to the Hyperliquidity Provider (HLP) token,

The $HYPE airdrop was largely met with acclaim from the community due to its lack of insider allocation and generous community allocation, but it was not without its critcs. Most of the criticism has been around the protocol’s decentralization. At present, it seems that there are only a small handful of validators ran by the team.

Proponents of Hyperliquid have rebutted this point stating that the team has plans to decentralize the protocol further. They also point out that decentralization is a spectrum in that greater centralization allows them to offer the great onchain trading experience that users have come to love. Hyperliquid is considered one of the most innovative crypto projects of the year, and we are excited to follow where it will go next.

Liquid Token + Crypto VC Roles

See below for job postings from friends of Artemis! Feel free to reach out directly to us if you’re interested in applying / learning more about the roles!

Detailed dashboard for people who love more numbers in smaller font:

Note: Revenue represents fees that go to the protocol’s treasury or are returned to tokenholders via a burn mechanism.

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments.

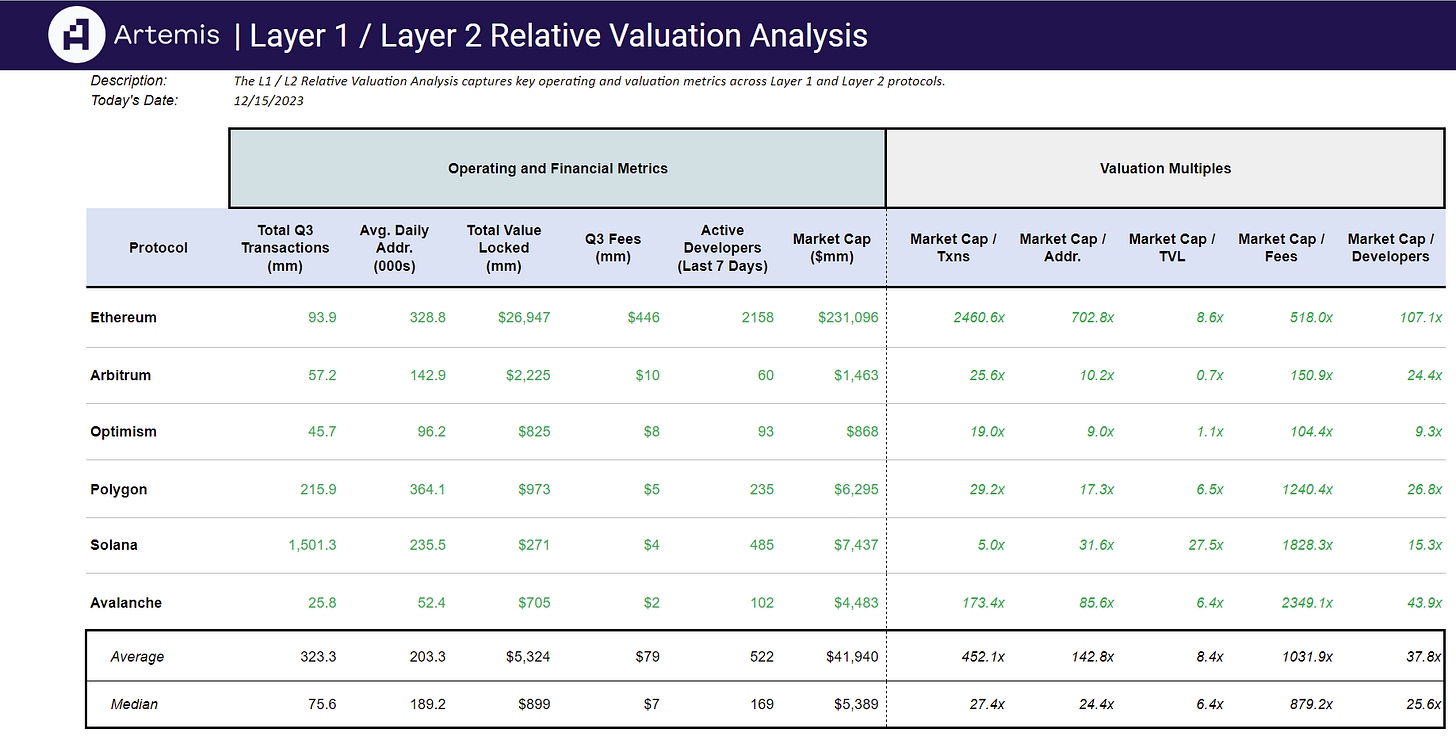

Artemis Sheets

Check out other analyses such as the Artemis Relative Valuation L1 / L2 Analysis in Google Sheets here! Track valuation multiples across key operating metrics for top blockchain including Ethereum, Arbitrum, Optimism and Solana.

Powered by Artemis Sheets 🌞